Singapore Construction Market Size, Share, and COVID-19 Impact Analysis, By Sector (Residential, Commercial, Infrastructure, and Others), By Construction Type (New Construction and Renovation/Retrofit), By Construction Method (Conventional On-Site and Modern Methods of Construction), By Investment Source (Public, Private, Public-Private Partnership, and Others), and Singapore Construction Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingSingapore Construction Market Insights Forecasts to 2035

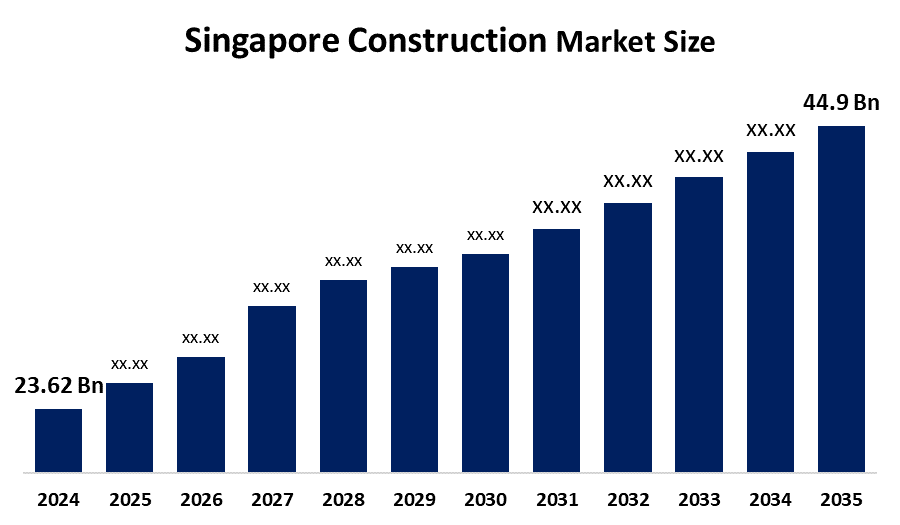

- The Singapore Construction Market Size Was Estimated at USD 23.62 Billion in 2024

- The Singapore Construction Market Size is Expected to Grow at a CAGR of Around 6.01% from 2025 to 2035

- The Singapore Construction Market Size is Expected to Reach USD 44.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore construction Market Size Is Anticipated To Reach USD 44.9 Billion By 2035, Growing At A CAGR Of 6.01% from 2025 to 2035. The Singapore construction market is driven by strong government infrastructure spending, ongoing public housing development, urban redevelopment projects, population growth, and rising demand for sustainable and smart building solutions.

Market Overview

The Singapore Construction Market Size is the industry ecosystem that provides the services of planning, design, development, and maintenance for residential, commercial, industrial, and infrastructure projects throughout Singapore. These activities include the public and private sectors, such as housing developments, transport infrastructure, commercial buildings, and industrial facilities, which are supported by contractors, developers, engineers, and material suppliers and driven by urbanization, government infrastructure spending, and sustainable building initiatives.

Singapore's construction industry is expanding positively, with public infrastructure and urban redevelopment projects on a large scale serving as the main drivers. Developments of a significant scale, such as Changi Airport Terminal 5, Tuas Mega Port, Greater Southern Waterfront, and the expansion of the MRT network, are energizing construction demand. The sector had a value of over USD 23 billion in 2024 and is anticipated to go beyond USD 44 billion by 2035, thus indicating its strong long-term growth potential.

Government backing is instrumental in this regard through measures such as the Singapore Green Plan 2030 and Green Mark Certification Scheme that encourage sustainable and energy-efficient buildings. Investments in green infrastructure, smart construction technologies, and productivity enhancements, coupled with green bond financing of up to S$35 billion, are opening up possibilities for developers, investors, and suppliers throughout Singapore's construction market.

Report Coverage

This research report categorizes the market for the Singapore Construction Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore construction market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore construction market.

Singapore Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.62 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.01% |

| 2035 Value Projection: | USD 44.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sector, By Construction Type |

| Companies covered:: | Tata Projects Singapore Edgenta UEMS Pte Ltd Gammon Construction Ltd Sembcorp Design and Construction Pte Ltd Dragages Singapore Pte Ltd Woh Hup (Private) Limited Lum Chang Building Contractors Pte Ltd McConnell Dowell South East Asia Pte Ltd Obayashi Singapore Pte Ltd China Construction Development Co. Pte Ltd Shimizu Corporation Hock Lian Seng Holdings Ltd And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Construction Market Size is driven by a strong government infrastructure expenditure, a steady demand for public housing through HDB programs, and major transport and utility projects. The expansion is also anchored by urban redevelopment, increasing green and smart building investments, population growth, and the extension of industrial and data center facilities.

Restraining Factors

The Singapore Construction Market Size is restrained by the high construction and labor costs. Manpower shortage is another issue, which is caused by the dependence on foreign workers. Additionally, the price of materials continues to increase. On top of that, the market is affected by strict regulations, longer approval timelines, and economic uncertainty, all of which can cause delays or limit new construction projects.

Market Segmentation

The Singapore construction market share is classified into sector, construction type, construction method, and investment source.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Construction Market is segmented by sector into residential, commercial, infrastructure, and others. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The residential segmental growth is due to strong government support for public housing, continuous HDB launches, and sustained demand from population growth and household formation. Urban redevelopment and upgrading of aging housing estates further contribute to the segment’s dominance.

- The new construction segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Construction Market is segmented by construction type into new construction and renovation/retrofit. Among these, the new construction segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The new construction segmental growth is due to the ongoing government-led infrastructure projects, large-scale public housing developments, and rising investments in commercial, industrial, and data center projects. Continued urban expansion and redevelopment initiatives in Singapore further support strong demand for new construction activities.

- The conventional on-site segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Construction Market is segmented by construction method into conventional on-site and modern methods of construction. Among these, the conventional on-site segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The conventional on-site segmental growth is due to its widespread adoption, design flexibility, and suitability for complex and customized projects. Established contractor expertise, familiarity with traditional practices, and the large number of ongoing residential and commercial developments in Singapore support its continued dominance.

- The private segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Construction Market is segmented by investment source into public, private, public-private partnership, and others. Among these, the private segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The private segmental growth is due to high investment in homes, offices, data centers, and industrial buildings. Strong interest from real estate developers and foreign investors also supports private construction projects in Singapore.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore construction market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tata Projects Singapore

- Edgenta UEMS Pte Ltd

- Gammon Construction Ltd

- Sembcorp Design and Construction Pte Ltd

- Dragages Singapore Pte Ltd

- Woh Hup (Private) Limited

- Lum Chang Building Contractors Pte Ltd

- McConnell Dowell South East Asia Pte Ltd

- Obayashi Singapore Pte Ltd

- China Construction Development Co. Pte Ltd

- Shimizu Corporation

- Hock Lian Seng Holdings Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2025, Sika opened a new state-of-the-art manufacturing plant in Singapore to produce mortars and other construction materials, boosting local supply for building projects and supporting demand for innovative, sustainable construction solutions as the market grows.

- In April 2025, Saint-Gobain marked its 360th anniversary in Singapore by reinforcing sustainability leadership and launching partnerships with local startups through its NOVA innovation arm, supporting green construction materials, decarbonization solutions, and smart building technologies.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore construction market based on the below-mentioned segments:

Singapore Construction Market, By Sector

- Residential

- Commercial

- Infrastructure

- Others

Singapore Construction Market, By Construction Type

- New Construction

- Renovation/Retrofit

Singapore Construction Market, By Construction Method

- conventional On-Site

- Modern Methods of Construction

Singapore Construction Market, By Investment Source

- Public

- Private

- Public-Private Partnership

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore construction market size in 2024?The Singapore construction market size was estimated at USD 23.62 billion in 2024.

-

2. What is the projected market size of the Singapore construction market by 2035?The Singapore construction market size is expected to reach USD 44.9 billion by 2035

-

3. What is the CAGR of the Singapore construction market?The Singapore construction market size is expected to grow at a CAGR of around 6.01% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore construction market?The Singapore construction market size is expected to grow at a CAGR of around 6.01% from 2024 to 2035.

-

5. Which construction type segment dominated the market in 2024?The new construction segment dominated the market in 2024.

-

6. What segments are covered in the Singapore construction market report?The Singapore construction market is segmented on the basis of sector, construction type, construction method, and investment source.

-

7. Who are the key players in the Singapore construction market?Key companies include Tata Projects Singapore, Edgenta UEMS Pte Ltd, Gammon Construction Ltd, Sembcorp Design and Construction Pte Ltd, Dragages Singapore Pte Ltd, Woh Hup (Private) Limited, Lum Chang Building Contractors Pte Ltd, McConnell Dowell South East Asia Pte Ltd, Obayashi Singapore Pte Ltd, China Construction Development Co. Pte Ltd, Shimizu Corporation, Hock Lian Seng Holdings Ltd, and others

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?