Singapore Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Chocolate Confectionery, Sugar Confectionery, Gum, Cereal Bars, and Other Confectionery), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, E-retailers, and Others), and Singapore Confectionery Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSingapore Confectionery Market Insights Forecasts to 2035

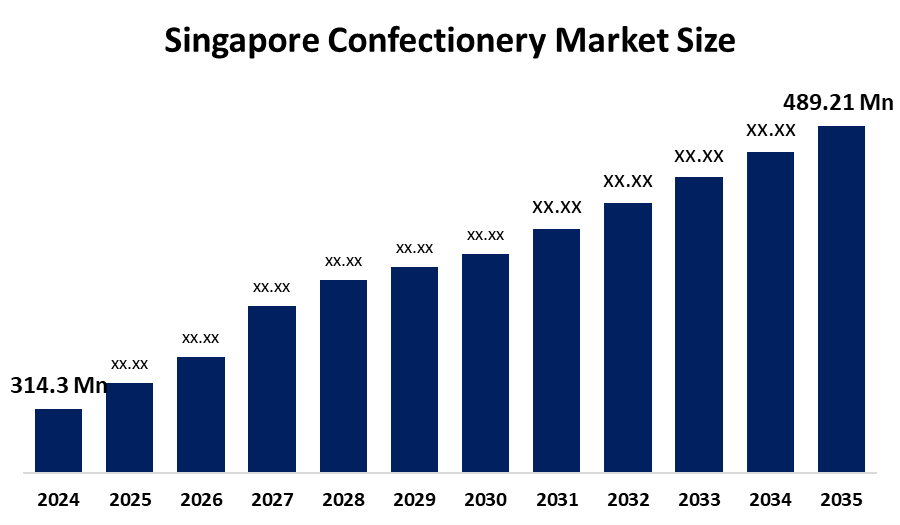

- The Singapore Confectionery Market Size Was Estimated at USD 314.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Singapore Confectionery Market Size is Expected to Reach USD 489.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Confectionery Market Size is anticipated to reach USD 489.21 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The confectionery market in Singapore is driven by the demand from consumers for a wide variety of flavors, rising health consciousness, and a strong economy.

Market Overview

Confectionery sales include the retail sale of chocolate, gum, and sugar confections. Gourmet chocolates continued to gain popularity as more individuals purchased expensive chocolate treats. Belgian chocolates are available in both retail supermarkets and specialty/confectionery stores. Leonidas, Godiva, and Neuhaus are among the luxury chocolates available in confectionery stores, The Cocoa Trees, and the Godiva Specialty Store. For imported candies and snacks, Singapore serves as a separate port. The growth of the sector is facilitated by a strongly ingrained gift-giving culture, digital penetration, and government support for e-commerce.

Report Coverage

This research report categorizes the market for Singapore Confectionery market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore Confectionery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore Confectionery market.

Singapore Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 314.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.1% |

| 2035 Value Projection: | USD 489.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product Type and By Distribution Channel |

| Companies covered:: | Polar Puffs & Cakes, Aalst Chocolate, Pastry Mart, Mr. Bucket Chocolaterie, Yong Wen, Awfully Chocolate, Nasty Cookie, Baker’s Brew Studio, The Bakery Depot, SWEE HENG BAKERY PTE LTD, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The confectionery market in Singapore is driven by premiumization, the growth of e-commerce, and trends toward healthier snack options that improve product accessibility. As consumers' demands for organic, low-sugar, & creative products grow, major firms are adjusting, and sustainability policies are becoming more and more significant

Restraining Factors

The Singaporean confectionery market is constrained by a variety of issues, including escalating worries about consumer health, changes in the cost of raw commodities, which impair market efficiency. Cocoa and sugar yields are impacted by a number of economic factors, including stock ratios, labor availability, crop diseases, and unfavorable weather.

Market Segmentation

The Singapore Confectionery market share is classified into product type and distribution channel.

- The chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Confectionery market is segmented by product type into Chocolate Confectionery, Sugar Confectionery, Gum, Cereal Bars, and Other Confectionery. Among these, the chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by due to its widespread appeal, adaptability, and robust customer demand for both high-end and ordinary indulgences. Its domination over every age category and geographical area is further strengthened by elements like established brand loyalty, seasonal giving, and innovative product formats.

- The supermarket & hypermarket segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Confectionery market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, e-retailers, and others. Among these, the hypermarket & supermarket segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by the store designs that accommodate a variety of customer needs and offer ease of use by bringing a large selection of confectionery goods under one roof. Supermarkets and hypermarkets also frequently use strategic location tactics, setting up shop in busy places to draw customers and profit from impulsive candy purchases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Confectionery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Polar Puffs & Cakes

- Aalst Chocolate

- Pastry Mart

- Mr. Bucket Chocolaterie

- Yong Wen

- Awfully Chocolate

- Nasty Cookie

- Baker’s Brew Studio

- The Bakery Depot

- SWEE HENG BAKERY PTE LTD

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- On 29th May 2024, Polar Puffs & Cakes is thrilled to announce an exciting, exclusive launch with Sanrio to celebrate Hello Kitty’s 50th Anniversary. To mark this special occasion, launching two delightful 3D cakes, the Classic Hello Kitty and the Classic My Melody.

- On April 23, 2024, in Singapore, during this week's Food & Hotel Asia (FHA) in Singapore, Cargill is exhibiting its premium gourmet products and adaptable solutions for chocolate, compounds, fillings & coatings, and decorations that are specifically designed for chefs and food experts in the hospitality industry.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Confectionery market based on the below-mentioned segments:

Singapore Confectionery Market, By Product Type

- Chocolate Confectionery

- Sugar Confectionery

- Gum

- Cereal Bars

- Other Confectionery

Singapore Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- E-retailers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Singapore Confectionery market size?A: The Singapore Confectionery market was estimated at USD 314.3 million in 2024 and is projected to reach USD 489.21 million by 2035, growing at a CAGR of 4.1% during 2025–2035

-

Q: What is confectionery and its primary use?A: The confectionery market is a segment of the food industry that involves the production, distribution, and sale of sweet, high-sugar foods. Its primary use is to provide moments of indulgence, celebration, and joy for consumers, while also serving as a strategic tool for marketing and retail

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising disposable income, increasing awareness of health and wellness, and innovative products. robust e-commerce infrastructure, a variety of cultural influences, and changing consumer preferences for healthier and more upscale options

-

Q: What factors restrain the Singapore Confectionery market?A: Constraints include the number of problems, such as rising consumer health concerns, fierce rivalry, high operational costs, and volatile raw material prices.

-

Q: How is the market segmented by distribution type?A: The market is segmented into Supermarkets/Hypermarkets, Convenience Stores, and E-retailers.

-

Q: Who are the key players in the Singapore Confectionery market?A: Key companies include the Polar Puffs & Cakes, Aalst Chocolate, Pastry Mart, Mr. Bucket Chocolaterie, Yong Wen, Awfully Chocolate, Nasty Cookie, Baker’s Brew Studio, The Bakery Depot, and SWEE HENG BAKERY PTE LTD.

-

Q: Who are the target audiences for this market report?Q: Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?