Singapore Cardiovascular Digital Solutions Market Size, Share, and COVID-19 Impact Analysis, By Service Type (CVD Health Informatics, Cardiac Rehab Programs, Unobtrusive Testing, and Others), By Component (Devices and Software), By Deployment (Cloud-Based and On-Premise), and Singapore Cardiovascular Digital Solutions Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Cardiovascular Digital Solutions Market Insights Forecasts to 2035

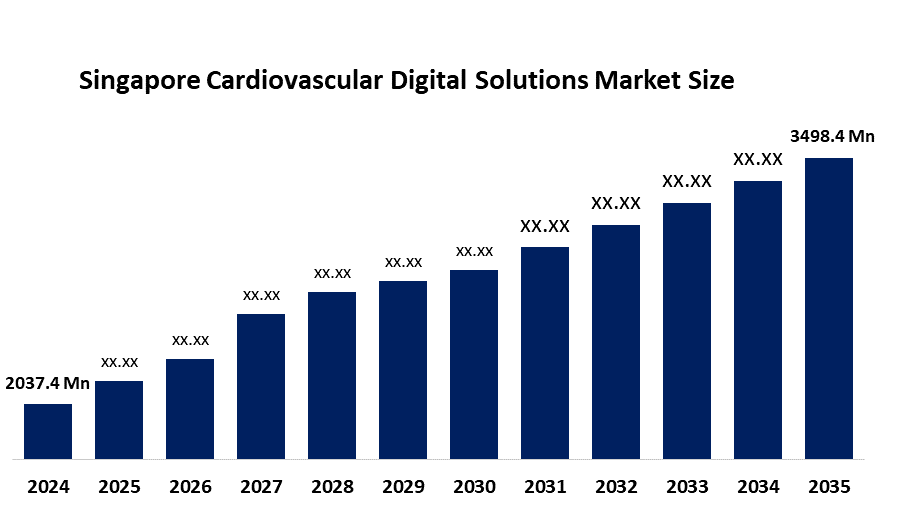

- The Singapore Cardiovascular Digital Solutions Market Size Was Estimated at USD 2,037.4 Million in 2024

- The Singapore Cardiovascular Digital Solutions Market Size is Expected to Grow at a CAGR of Around 5.04% from 2025 to 2035

- The Singapore Cardiovascular Digital Solutions Market Size is Expected to Reach USD 3,498.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Cardiovascular Digital Solutions Market Size is anticipated to reach USD 3,498.4 Million by 2035, Growing at a CAGR of 5.04% from 2025 to 2035. The Singapore cardiovascular digital solutions market is driven by rising cardiovascular disease prevalence, growing adoption of remote monitoring and telecardiology, government support for digital health, and increasing use of AI and wearable devices to improve diagnosis, treatment, and patient outcomes.

Market Overview

The Singapore cardiovascular digital solutions market refers to the sector focused on the production, distribution, and consumption of devices intended for delivering topical drugs, skincare, or cosmetic products in a controlled, sanitary, and handy way. Such dispensers range from creams, gels, ointments, sprays, and lotion applicators, and their various applications can be found in hospitals, clinics, pharmacies, and personal care settings for better dosage accuracy, less contamination, and greater user convenience.

Singapore’s adoption of cardiovascular digital solutions is driven by a significant burden of cardiovascular disease (CVD) and rising risk factors in its population. CVD remains a leading cause of death, accounting for about one in three deaths in Singapore, with an average of 36 heart attacks per day in 2022, highlighting urgent needs for early detection and continuous care management tools. Risk factor prevalence, such as hypertension and high cholesterol, has increased over the past decade, further stressing the importance of digital monitoring and intervention solutions.

Government support and initiatives strongly encourage this market’s growth. Singapore has launched preventive health programs like Healthier SG, focusing on chronic disease management and early risk detection, alongside national collaborative platforms (CADENCE) that leverage data, AI, and digital health technologies to advance cardiovascular research and care delivery. Additionally, substantial funding, such as the SGD 200 million boost to adopt AI and genomics for preventive care, underscores public investment in digital health tools that enhance cardiac diagnostics, remote monitoring, and population health management.

Report Coverage

This research report categorizes the market for the Singapore cardiovascular digital solutions market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore cardiovascular digital solutions market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore cardiovascular digital solutions market.

Singapore Cardiovascular Digital Solutions Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,037.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.04% |

| 2035 Value Projection: | 3,498.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Service Type, By Component |

| Companies covered:: | MedClarity, Siemens Healthineers, iMedrix, Philips, Medtronic, AliveCor, GE HealthCare, Apple Inc., Oracle, Epic Systems, Verily Life Sciences, HeartFlow, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore cardiovascular digital solutions market is driven by rising cardiovascular disease prevalence, growing use of remote monitoring and wearable devices, government initiatives like Healthier SG, and the increasing focus on preventive care, population health management, and data-driven cardiac care.

Restraining Factors

The Singapore cardiovascular digital solutions market is restrained by high implementation and maintenance costs, concerns over data privacy and cybersecurity, limited digital infrastructure in smaller clinics, and resistance to technology adoption among some healthcare providers. Integration challenges with existing hospital systems also slow widespread adoption.

Market Segmentation

The Singapore cardiovascular digital solutions market share is classified into service type, component, and deployment.

- The unobtrusive testing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore cardiovascular digital solutions market is segmented by service type into CVD health informatics, cardiac rehab programs, unobtrusive testing, and others. Among these, the unobtrusive testing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The unobtrusive testing segment is growing because it enables continuous, non-invasive monitoring of cardiac patients using wearable devices, sensors, and remote monitoring systems. This allows early detection of abnormalities, improves patient compliance, reduces hospital visits, and supports real-time data collection for better cardiovascular care.

- The devices segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore cardiovascular digital solutions market is segmented by component into devices and software. Among these, the devices segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The devices segment is growing because of the increasing adoption of wearable cardiac monitors, remote patient monitoring devices, and diagnostic tools that provide real-time tracking of heart health, enable early detection of cardiovascular conditions, and support continuous patient care.

- The cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore cardiovascular digital solutions market is segmented by deployment into cloud-based and on-premise. Among these, the cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cloud-based segment is growing because it offers scalable, cost-effective, and secure storage of cardiovascular patient data. Enables real-time access and analytics for healthcare providers, supports telecardiology and remote monitoring, and facilitates seamless integration with hospital systems and electronic health records.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore cardiovascular digital solutions market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MedClarity

- Siemens Healthineers

- iMedrix

- Philips

- Medtronic

- AliveCor

- GE HealthCare

- Apple Inc.

- Oracle

- Epic Systems

- Verily Life Sciences

- HeartFlow

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, National Heart Centre Singapore unveiled SENSE, an AI-powered system that rapidly interprets cardiac scans to predict coronary artery disease in under 10 minutes, aiming to speed diagnosis and improve cardiovascular care in Singapore’s digital health landscape.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore cardiovascular digital solutions market based on the below-mentioned segments:

Singapore Cardiovascular Digital Solutions Market, By Service Type

- CVD Health Informatics

- Cardiac Rehab Programs

- Unobtrusive Testing

- Others

Singapore Cardiovascular Digital Solutions Market, By Component

- Devices

- Software

Singapore Cardiovascular Digital Solutions Market, By Deployment

- Cloud-Based

- On-premise

Frequently Asked Questions (FAQ)

-

1.What is the Singapore cardiovascular digital solutions market size in 2024?The Singapore cardiovascular digital solutions market size was estimated at USD 2,037.4 million in 2024.

-

2.What is the projected market size of the Singapore cardiovascular digital solutions market by 2035?The Singapore cardiovascular digital solutions market size is expected to reach USD 3,498.4 million by 2035.

-

3.What is the CAGR of the Singapore cardiovascular digital solutions market?The Singapore cardiovascular digital solutions market size is expected to grow at a CAGR of around 5.04% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore cardiovascular digital solutions market?The Singapore cardiovascular digital solutions market is driven by rising cardiovascular disease prevalence, growing adoption of remote monitoring and telecardiology, government support for digital health, and increasing use of AI and wearable devices to improve diagnosis, treatment, and patient outcomes.

-

5.Which component segment dominated the market in 2024?The devices segment dominated the market in 2024.

-

6.What segments are covered in the Singapore cardiovascular digital solutions market report?The Singapore cardiovascular digital solutions market is segmented on the basis of service type, component, and deployment.

-

7.Who are the key players in the Singapore cardiovascular digital solutions market?Key companies include MedClarity, Siemens Healthineers, iMedrix, Philips, Medtronic, AliveCor, GE HealthCare, Apple Inc., Oracle, Epic Systems, Verily Life Sciences, HeartFlow, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?