Singapore Blood Collection Market Size, Share, and COVID-19 Impact Analysis, By Collection Site (Venous and Capillary), By Application (Diagnostics and Treatment), By Method (Manual Blood Collection and Automated Blood Collection), and Singapore Blood Collection Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Blood Collection Market Insights Forecasts to 2035

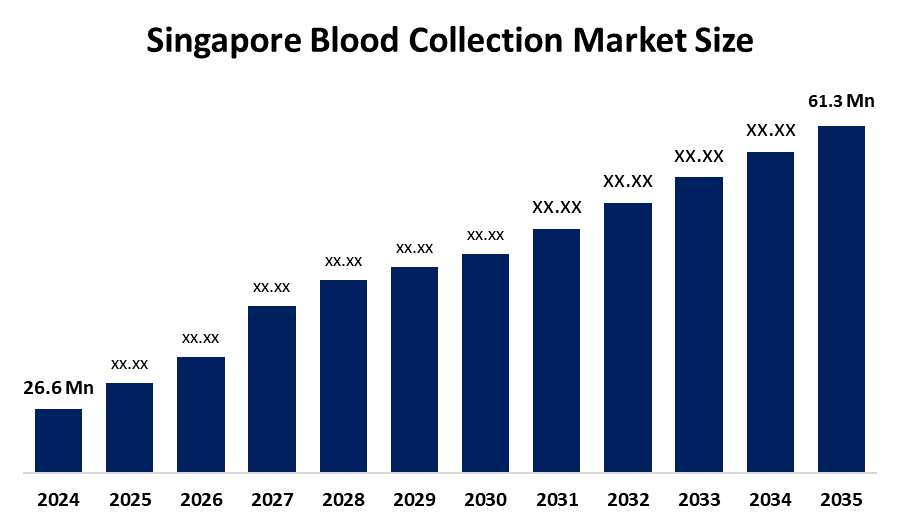

- The Singapore Blood Collection Market Size Was Estimated at USD 26.6 Million in 2024

- The Singapore Blood Collection Market Size is Expected to Grow at a CAGR of Around 7.89% from 2025 to 2035

- The Singapore Blood Collection Market Size is Expected to Reach USD 61.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Singapore Blood Collection Market Size is Anticipated to Reach USD 61.3 Million by 2035, Growing at a CAGR of 7.89% from 2025 to 2035. The Singapore blood collection market is driven by increasing diagnostic tests, rising cases of chronic and infectious diseases, growing health check-ups and preventive care, and well-developed hospital and laboratory facilities, supported by government health programs.

Market Overview

The Singapore Blood Collection Market Size refers to the blood collection, processing, storage, and transportation systems of blood and its components that are used for different medical and research purposes. This sector comprises blood collection from donors in hospitals, blood banks, diagnostic laboratories, and specialized blood collection centers. Blood collection is essential for performing diagnostics, blood transfusions, treatments, and research activities, including detecting infectious diseases, monitoring chronic diseases, and supporting surgeries. The increasing demand is attributed to the rise in chronic diseases, the elderly population, and the necessity for health check-ups and healthcare services. Developments in automated blood collection devices are transforming the market into a major pillar of Singapore's healthcare system.

The Singapore Blood Collection Market Size in Singapore is a vital part of the country's healthcare sector due to increasing healthcare demand and a very low donor participation rate. Currently, the country requires approximately 400 units of blood every day (which is more than 120,000 units annually) to carry out operations and treat trauma cases, cancer, and chronic illness. However, only 12% of the population donates blood. Moreover, the aging population is one of the main factors driving the demand even higher. Patients aged 60 and above account for approximately 60% of the total blood supply, indicating that a reliable and scalable blood collection system is of utmost importance.

The Singapore government is backing up the market very strongly, and this is done by the National Blood Programme, which is a joint effort of the Health Sciences Authority (HSA) and the Singapore Red Cross. Activities to attract donors, awareness campaigns all over the country, partnerships with corporations, and youth programs for engagement are some of the initiatives that help to maintain the supply since voluntary blood donation is one of the ways these initiatives encourage. On the marketing side, a strong government support, evident gaps in demand and supply, along with demographic pressure, make the Singapore blood collection market a highly necessary, extensively policy-backed, and opportunity-driven for innovation and growth.

Report Coverage

This research report categorizes the market for the Singapore Blood Collection Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore blood collection market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore blood collection market.

Singapore Blood Collection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.6 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.89% |

| 2035 Value Projection: | USD 61.3 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Collection Site ,By Method |

| Companies covered:: | BD (Becton, Dickinson and Company), Terumo Corporation, Fresenius Kabi, Grifols, S.A., Sartorius AG, Haemonetics Corporation, Nipro Corporation, Macopharma, Ortho Clinical Diagnostics, Sarstedt AG & Co. KG, Greiner Bio-One International GmbH, Sekisui Diagnostics, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Blood Collection Market Size is driven by the growing need for diagnostic tests. Besides this, the rising number of chronic and infectious diseases, the development of healthcare facilities, government initiatives towards blood donation programs, technological progress in blood collection and storage methods, as well as increasing health consciousness, are some of the factors contributing to the overall market growth.

Restraining Factors

The Singapore Blood Collection Market Size is restrained by a shortage of voluntary donors, high operational and equipment costs, stringent regulatory requirements, and challenges in maintaining blood safety and quality. Also, storage and transportation logistics problems, along with low awareness of regular blood donation, can hamper the market growth.

Market Segmentation

The Singapore Blood Collection Market share is classified into collection site, application, and method.

- The venous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Blood Collection Market Size is segmented by collection site into venous and capillary. Among these, the venous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The venous segment is growing because venous blood collection allows larger sample volumes, is suitable for a wide range of diagnostic tests, and provides more accurate and reliable results. Its widespread use in hospitals, laboratories, and clinical settings in Singapore further drives demand.

- The diagnostics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Blood Collection Market Size is segmented by application into diagnostics and treatment. Among these, the diagnostics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The diagnostics segment is growing because blood samples are essential for detecting, monitoring, and managing a wide range of diseases, including chronic, infectious, and lifestyle-related conditions. Rising demand for early diagnosis, preventive health screenings, and laboratory testing in Singapore drives this segment’s growth.

- The manual blood collection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Blood Collection Market Size is segmented by method into manual blood collection and automated blood collection. Among these, the manual blood collection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The manual blood collection segment is growing because it is simple, cost-effective, widely used in hospitals and diagnostic labs, and suitable for routine blood tests and smaller-scale operations. Its ease of use and reliability make it the preferred method in Singapore.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Blood Collection Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

-

BD (Becton, Dickinson and Company)

-

Terumo Corporation

-

Fresenius Kabi

-

Grifols, S.A.

-

Sartorius AG

-

Haemonetics Corporation

-

Nipro Corporation

-

Macopharma

-

Ortho Clinical Diagnostics

-

Sarstedt AG & Co. KG

-

Greiner Bio-One International GmbH

-

Sekisui Diagnostics

-

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

-

November 2025: The Health Sciences Authority (HSA) and the Singapore Red Cross launched an enhanced “Adopt a Bloodbank” program, introducing a new Blood Partner Award to deepen partnerships with organizations, strengthen the national blood supply, and encourage sustained donor recruitment across Singapore.

-

March 2024: Scientists at Nanyang Technological University (NTU), Singapore, developed ExoArc, a coin-sized device capable of isolating high-purity blood plasma within 30 minutes. This innovation offers a faster and more user-friendly alternative to traditional centrifugation methods for diagnostics and precision medicine.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Blood Collection Market Size based on the below-mentioned segments:

Singapore Blood Collection Market, By Collection Site

- Venous

- Capillary

Singapore Blood Collection Market, By Application

- Diagnostics

- Treatment

Singapore Blood Collection Market, By Method

- Manual Blood Collection

- Automated Blood Collection

Frequently Asked Questions (FAQ)

-

1. What is the Singapore blood collection market size in 2024?The Singapore blood collection market size was estimated at USD 26.6 million in 2024.

-

2. What is the projected market size of the Singapore blood collection market by 2035?The Singapore blood collection market size is expected to reach USD 61.3 million by 2035.

-

3. What is the CAGR of the Singapore blood collection market?The Singapore blood collection market size is expected to grow at a CAGR of around 7.89% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore blood collection market?The Singapore blood collection market is driven by increasing diagnostic tests, rising cases of chronic and infectious diseases, growing health check-ups and preventive care, and well-developed hospital and laboratory facilities, supported by government health programs.

-

5. Which application segment dominated the market in 2024?The diagnostics segment dominated the market in 2024.

-

6. What segments are covered in the Singapore blood collection market report?The Singapore blood collection market is segmented on the basis of collection site, application, and method.

-

7. Who are the key players in the Singapore blood collection market?Key companies include BD (Becton, Dickinson and Company), Terumo Corporation, Fresenius Kabi, Grifols, S.A., Sartorius AG, Haemonetics Corporation, Nipro Corporation, Macopharma, Ortho Clinical Diagnostics, Sarstedt AG & Co. KG, Greiner Bio‑One International GmbH, and Sekisui Diagnostics

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?