Global Shipbuilding Anti-Vibration Market Size, By Product Type (Mounts, Bearing Pads, Bellows), By Function Type (Engine Vibration, HVAC Vibration), By Application (Fishing Boats, Motorboats, Cruise Ships), By Region, And Segment Forecasts, By Geographic Scope and Forecasts to 2032.

Industry: Machinery & EquipmentGlobal Shipbuilding Anti-Vibration Market Insights Forecasts to 2032

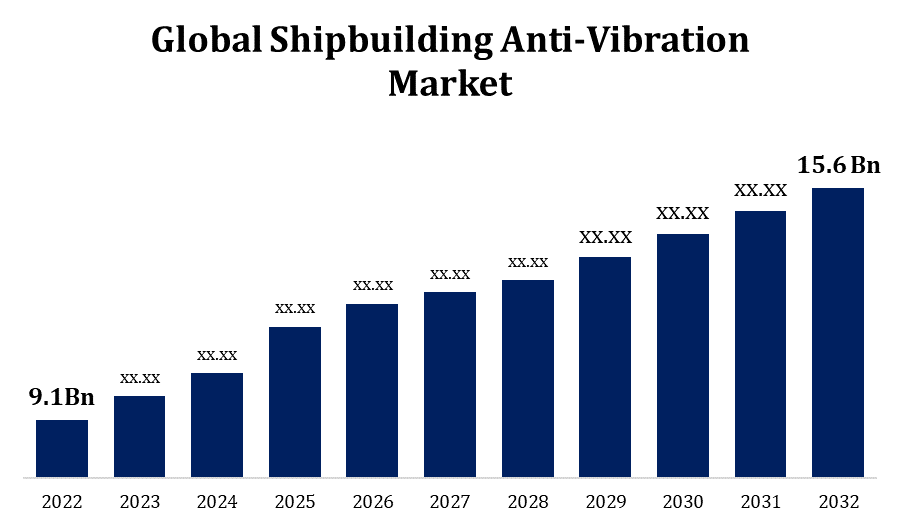

- The Global Shipbuilding Anti-Vibration Market Size was valued at USD 9.1 Billion in 2022.

- The Market is Growing at a CAGR of 6.7% from 2022 to 2032

- The Worldwide Shipbuilding Anti-Vibration Market Size is expected to reach USD 15.6 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Shipbuilding Anti-Vibration Market Size is Expected to reach USD 15.6 Billion by 2032, at a CAGR of 6.7% during the forecast period 2022 to 2032.

The expansion of the anti-vibration market in shipbuilding! It's like witnessing a strong ship sail across the seas of time. Shipbuilding has seen an increase in the demand for anti-vibration technologies. As marine technology progresses and ships grow more sophisticated, there is a greater emphasis on vibration reduction for improved efficiency and safety. The worldwide shipping industry's expansion, the requirement for fuel-efficient boats, and increased knowledge of the impact of vibrations on onboard equipment all contribute to the market's growth. New materials and technologies are almost certainly pushing the limits of what is achievable in anti-vibration solutions.

Shipbuilding Anti-Vibration Market Value Chain Analysis

Raw material providers supply the necessary materials for the production of anti-vibration components, such as specialised metals, polymers, and sophisticated composites. At this step, companies design and manufacture the actual anti-vibration components. This could include mounts, isolators, and damping systems designed specifically for shipbuilding purposes. These professionals combine various components to create full anti-vibration solutions. They tailor solutions to the unique requirements of ship designs. These anti-vibration solutions are incorporated into vessel construction by shipbuilding companies. They make certain that the systems blend in with the overall design and operation of the ships. It's critical to test and confirm that the anti-vibration systems fulfil the highest standards before those ships set sail. Once the anti-vibration systems are complete, they must be delivered to the shipyards. Distribution and logistics businesses are critical in ensuring that everything arrives on schedule and in perfect shape. Some businesses specialise in the installation and maintenance of these systems on ships. They give knowledge during the integration process and continuous assistance to ensure that everything runs well. The shipping corporations who operate the vessels are the ultimate beneficiaries of this value chain.

Shipbuilding Anti-Vibration Market Opportunity Analysis

Because materials and technology are always evolving, there is a chance for companies to innovate and produce more effective and efficient anti-vibration solutions. Consider smart systems that can adapt to changing environments or predictive maintenance solutions. Ships are in high demand throughout the world. With globalisation comes the chance for businesses to broaden their market reach and serve shipbuilders and shipping enterprises all around the world. Many older ships may lack the most recent anti-vibration technologies. Companies can offer retrofitting solutions, such as replacing existing vessels with contemporary anti-vibration technologies to increase their overall performance. Using data analytics to monitor anti-vibration systems in real time can open up potential for predictive maintenance services. Companies that provide solutions that anticipate and prevent possible problems before they emerge can add tremendous value. With the advent of improved anti-vibration technologies, there is an increased requirement for training programmes to educate engineers, shipbuilders, and maintenance crews. Companies who offer complete training services may benefit from this opportunity.

Global Shipbuilding Anti-Vibration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 9.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.7% |

| 2032 Value Projection: | USD 15.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Function Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Trelleborg, Parker LORD, Hutchinson Paulstra, GMT Rubber-Metal-Technic Ltd., Continental AG, AMC, Mecanocaucho, Getzner Werkstoffe GmbH and Other Key Vendors. |

| Growth Drivers: | Increasing consumer disposable income and spending power |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Shipbuilding Anti-Vibration Market Dynamics

Increasing consumer disposable income and spending power

With more money in their purses, customers may choose higher-end ships with powerful anti-vibration equipment. Shipbuilders catering to this rich market may end up including more complex and pricey anti-vibration technologies. Increased consumer buying power may push shipping corporations to invest in new anti-vibration equipment for their fleets. This could result in an increase in demand for innovative technologies that improve comfort and performance. Anti-vibration technologies can make a huge difference in the world of luxury cruises, where client pleasure is paramount. Higher consumer discretionary income may drive the need for vessels with superior anti-vibration features, fueling the growth of the luxury cruise business. Wealthier customers may be more likely to invest in ship maintenance and upgrades.

Restraints & Challenges

Creating and implementing complex anti-vibration technologies can be an expensive endeavour. Shipbuilders and market participants may have difficulties in striking a balance between providing high-quality goods and keeping costs fair. Integrating anti-vibration equipment into the overall ship design can be a difficult task. Shipbuilders must guarantee that these systems do not interfere with other critical functions and can resist the severe marine environment. The shipbuilding industry is extremely vulnerable to global economic conditions. Economic downturns might result in fewer ship orders, reducing demand for anti-vibration measures. Navigating economic uncertainty necessitates agility and smart strategy. The advantages of modern anti-vibration technologies may not be obvious to all stakeholders. Educating shipbuilders, shipping companies, and consumers on the benefits and long-term cost reductions of using a shipyard. As demand for anti-vibration products increases, so does competition. To stand out in a potentially saturated market, businesses must differentiate themselves via innovation, quality, and service.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Shipbuilding Anti-Vibration Market from 2023 to 2032. Given North America's considerable naval presence, modern shipbuilding technology, such as anti-vibration systems, are in high demand. From warships to submarines, naval vessels frequently require cutting-edge equipment to maintain operational performance and crew comfort. North America's commercial shipping business is thriving, carrying commodities across the continent and beyond. Cargo ships outfitted with effective anti-vibration technology can improve fuel efficiency and save maintenance costs, making them appealing to shipping corporations. In North America, the offshore oil and gas industry frequently requires specialised vessels for exploration and extraction tasks. In these boats, anti-vibration technologies are critical to operational stability and safety.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific region is a prominent player in worldwide shipbuilding, with China, South Korea, and Japan leading the way. Because of the sheer amount of ship production in this region, there is a high demand for anti-vibration technologies to improve the performance of diverse boats. Asia-Pacific, as a worldwide trading hub, has a significant need for commercial shipping. Anti-vibration systems enhance fuel efficiency and save wear and tear on cargo ships travelling busy sea routes.

Segmentation Analysis

Insights by Product Type

The bearing pads segment accounted for the largest market share over the forecast period 2023 to 2032. As ships grow in size and transport more cargo or passengers, the demand for strong anti-vibration technologies, such as sophisticated bearing pads, is expected to rise. Larger vessels are subjected to increased stresses, necessitating adequate vibration control. The thriving cruise industry, notably in Asia-Pacific and North America, provides an opportunity for the bearing pads market. Cruise ships, which are famed for their luxury and comfort, require high-quality anti-vibration systems to ensure that guests have a pleasant experience. Bearing pads help to improve crew comfort by reducing vibrations and noise. With a rising emphasis on improving overall working conditions on ships, there may be an increase in demand for high-performance bearing pads.

Insights by Function Type

The HVAC vibration segment accounted for the largest market share over the forecast period 2023 to 2032. HVAC systems are critical for keeping a comfortable climate on board ships. As passenger comfort demands rise, so does the requirement for effective HVAC vibration control solutions. With its opulent liners and attention on passenger comfort, the burgeoning cruise industry is a primary driver for the HVAC vibration category. Smooth sailing is a primary priority, both in terms of ship movement and HVAC system function. In addition to commercial ships, naval ships benefit from HVAC vibration control. Maintaining optimal conditions within the ship is critical for the crew's well-being and performance during military operations.

Insights by Application

The fishing boats segment accounted for the largest market share over the forecast period 2023 to 2032. Fishing boats, particularly commercial fishing boats, benefit from operational efficiency. Anti-vibration technologies help engines run more smoothly, decreasing wear and tear and increasing overall efficiency. Vibrations can harm delicate equipment used in fishing operations, such as sonar systems and navigation instruments. Anti-vibration solutions aid in the protection of these key components, assuring correct and consistent functioning. The fishing industry employs both older and newer vessels. Retrofitting older fishing boats with anti-vibration equipment allows owners to extend the life and performance of their vessels without investing in fully new fleets.

Recent Market Developments

- In October 2022, Trelleborg announced the completion of its acquisition of the German producer MG Silikon.

Major players in the market

- Trelleborg

- Parker LORD

- Hutchinson Paulstra

- GMT Rubber-Metal-Technic Ltd.

- Continental AG

- AMC

- Mecanocaucho

- Getzner Werkstoffe GmbH

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Shipbuilding Anti-Vibration Market, Product Type Analysis

- Mounts

- Bearing Pads

- Bellows

Shipbuilding Anti-Vibration Market, Function Type Analysis

- Engine Vibration

- HVAC Vibration

Shipbuilding Anti-Vibration Market, Application Analysis

- Fishing Boats

- Motorboats

- Cruise Ships

Shipbuilding Anti-Vibration Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Shipbuilding Anti-Vibration Market?The global Shipbuilding Anti-Vibration Market is expected to grow from USD 9.1 Billion in 2023 to USD 15.6 Billion by 2032, at a CAGR of 6.7% during the forecast period 2022-2032.

-

2. Who are the key market players of the Shipbuilding Anti-Vibration Market?Some of the key market players of market are Trelleborg, Parker LORD, Hutchinson Paulstra, GMT Rubber-Metal-Technic Ltd., Continental AG, AMC, Mecanocaucho, Getzner Werkstoffe GmbH.

-

3. Which segment holds the largest market share?The fishing boats segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Shipbuilding Anti-Vibration Market?North America is dominating the Shipbuilding Anti-Vibration Market with the highest market share.

Need help to buy this report?