Global Shell Furnace Market Size, Share, and COVID-19 Impact Analysis, By Type (Below 1t Steel Shell Furnace and 1-30t Steel Shell Furnace), By Application (Metallurgy, Mechanics, Building Material, Automobile Manufacturing, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Shell Furnace Market Insights Forecasts to 2035

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The Worldwide Shell Furnace Market Size is Expected to hold a significant share by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Shell Furnace Market Size is predicted to hold a significant share by 2035 with a compound annual growth rate (CAGR) of 5.7% from 2025 and 2035. The market for shell furnace has a number of opportunities to grow due to the inclination towards more efficient and sustainable industrial processes, along with the integration of Industry 4.0 and IoT-driven predictive maintenance tools.

Market Overview

The global industry of shell furnace refers to the markets for steel shell melting furnaces, which are critical industrial heating devices used in metal processing. Shell furnaces are a type of industrial furnace commonly used in the melting and smelting of various metals, commonly in applications like steel making, casting, and forging, where high temperature and heavy loads are required. They are typically made with a steel structure to provide durability and resistance to extreme temperatures and thermal stress. For instance, ARMS systems are a patented technology from Inductotherm Group, specifically developed for the needs of the foundry, used for tasks such as complete melting process control, earth fault and temperature measuring, sample removal, addition of additives, and control of temperature measuring devices. Further, there is a growing inclination towards decarbonization of the critical petrochemical manufacturing process, supporting the shell furnace market. For instance, in June 2022, Shell and Dow started up an experimental unit to electrically heat stream cracker furnaces at the Energy Transition Campus Amsterdam, which represents a key milestone in the companies’ joint technology programme to electrify steam cracking furnaces, bringing the companies one step closer to decarbonising one of the most carbon-intensive aspects of petrochemical manufacturing.

Innovation and market expansion are anticipated as a result of major players' growing investment in upgrading metallurgical equipment with energy-efficient solutions, retrofitting services, automation integration, and IoT-enabled furnace systems. For instance, in December 2024, SMS Group and SSAB are advancing together in the green steel revolution, which is one of the world’s most powerful electric arc furnaces is SSAB’s strategic unit for green steel production.

Report Coverage

This research report categorizes the shell furnace market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the shell furnace market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the shell furnace market.

Global Shell Furnace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | Inductotherm Group, Induction Technology Corporation (ITC), APS Induction Technology, Cooldo, FOCO induction, Luoyang Hongteng Induction, Luoyang shennai Power Equipment, SuperbMelt, Weifang Jinhuaxin Electric Furnace Manufacturing, Shandong Huaxin Electric Furnace, Abhay Induction Tech, Zhengzhou lanshuo electronics, Luoyang Dinghong Electric Technology, Aichelin Unitherm, Meta Therm Furnace Pvt. Ltd., Fluidtherm Technology, HighTemp Furnaces Ltd., Thermochem Furnaces Pvt Ltd., Shree Mayur Engineering Co., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The shell furnace market is primarily driven by the increased adoption of furnaces in steel production and metal recycling applications. For instance, the Steel Shell IGBT medium frequency melting furnace provides a good method for selecting steel shell IGBT medium frequency melting furnaces for melting steel, alloy steel, special steel, cast iron, stainless steel, and other non-ferrous metal materials. Further, the use of electric induction melting furnaces in scrap metal recycling, which involve recovery, sorting and processing of scrap metal, is propelling the market demand.

Restraining Factors

The shell furnace market is restricted by the fluctuating raw material prices, environmental regulations, and economic fluctuations. The increased raw material costs affect the initial installation expenses for heat exchanger setups, which is a challenging factor in the shell furnace market.

Market Segmentation

The shell furnace market share is classified into type and application.

- The 1-30 t steel shell furnace segment dominated the market with the largest share of about 65% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the shell furnace market is divided into below 1t steel shell furnace and 1-30 t steel shell furnace. Among these, the 1-30 t steel shell furnace segment dominated the market with the largest share of about 65% in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 30-ton induction furnace is a relatively large piece of equipment that can meet most melting needs, mainly used for smelting various scrap metals, iron, steel, copper, and aluminium. The growing demand for 1-30 t steel furnaces in meeting the industry’s evolving requirements is propelling the market demand.

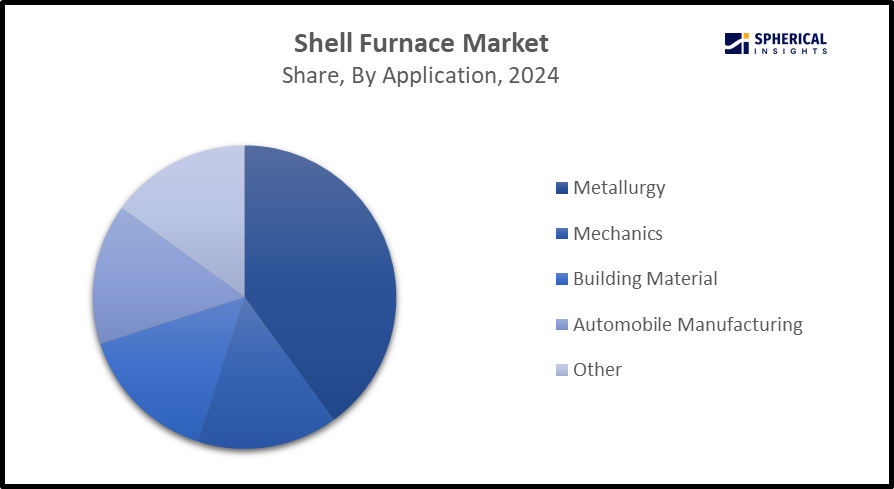

- The metallurgy segment accounted for the largest share of nearly 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the shell furnace market is divided into metallurgy, mechanics, building material, automobile manufacturing, and other. Among these, the metallurgy segment accounted for the largest share of about 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Steel shell furnaces are commonly used in heavy-duty applications like steel making, casting, and forging, where high temperature and heavy loads are required, providing durability and resistance to thermal stability. The high production efficiency of the heating furnace aids in enhancing its application in the metallurgy segment.

Get more details on this report -

Regional Segment Analysis of the Shell Furnace Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Shell Furnace market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of over 20% in the shell furnace market over the predicted timeframe. The market ecosystem in North America is strong, with the presence of major industrial heavyweights well-represented. For instance, in march 2017, Constellium N.V., a Netherlands-based aluminum company has completed the installation of a recycling furnace at its Muscle Shoals, Alabama, aluminium facility. The market for shell furnace has been driven by the region's advanced manufacturing capabilities, demand for high-quality steel products, along with an increasing focus on modernization, sustainability, and energy efficiency. The U.S. is leading the North America’s shell furnace market, with a significant share of nearly 25%, driven by the innovations in refractory materials and thermal insulation, which make furnaces the preferred choice for integrated steel plants.

Asia Pacific is expected to grow at a rapid CAGR of nearly 4-7% in the shell furnace market during the forecast period. The Asia Pacific area has a thriving market for shell furnace due to its rapid industrial growth and need for energy-efficient solutions. Due to their governments' initiatives and policies aiming to reduce carbon emissions and promote energy efficiency, which contributes to propelling the shell furnace market. China is dominating the Asia Pacific shell furnace market, holding roughly 34% revenue share, owing to the surging need for more advanced melting technologies. For instance, in November 2020, the International technology group ANDRITZ received an order from Zouping Hongfa Aluminium Science Technology Co., Ltd., part of Weiqiao Aluminium Group, to supply one melting and holding furnace cell for its plant in Shangdong Province, China.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Shell Furnace market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Inductotherm Group

- Induction Technology Corporation (ITC)

- APS Induction Technology

- Cooldo

- FOCO induction

- Luoyang Hongteng Induction

- Luoyang shennai Power Equipment

- SuperbMelt

- Weifang Jinhuaxin Electric Furnace Manufacturing

- Shandong Huaxin Electric Furnace

- Abhay Induction Tech

- Zhengzhou lanshuo electronics

- Luoyang Dinghong Electric Technology

- Aichelin Unitherm

- Meta Therm Furnace Pvt. Ltd.

- Fluidtherm Technology

- HighTemp Furnaces Ltd.

- Thermochem Furnaces Pvt Ltd.

- Shree Mayur Engineering Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, PTC Industries gained as Aerolloy commissions an advanced titanium casting furnace. PTC Industries rose 2.41% to Rs 15300.75 after its wholly owned subsidiary, Aerolloy Technologies, announced the commissioning of a Vacuum Arc Remelting (VAR) 400 furnace.

- In September 2025, Monolithisch India Ltd, a manufacturer of premixed ramming mass, is aiming for up to 30% share of the market in the next couple of years.

- In April 2025, Tata Steel UK confirmed its decision to proceed with the closure of two old blast furnaces as part of a GBP 1.25 billion investment to transition to a state-of-the-art Electric Arc Furnace at its Port Talbot steelworks in south Wales.

- In February 2023, the All India Induction Furnaces Association (AIIFA), along with regional industry associations from across the country, requested the government to rationalize the GST structure on metal scraps. AIIFA said that the induction furnace sector contributes around 35% to the total steel production in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the shell furnace market based on the below-mentioned segments:

Global Shell Furnace Market, By Type

- Below 1t Steel Shell Furnace

- 1-30t Steel Shell Furnace

Global Shell Furnace Market, By Application

- Metallurgy

- Mechanics

- Building Material

- Automobile Manufacturing

- Other

Global Shell Furnace Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the shell furnace market?North America is anticipated to hold the largest share of the shell furnace market over the predicted timeframe.

-

2. What is the forecasted CAGR of the Global Shell furnace Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.7% during the period 2024–2035.

-

3. Who are the top companies operating in the Global Shell furnace Market?Key players include Inductotherm Group, Induction Technology Corporation (ITC), APS Induction Technology, Cooldo, FOCO induction, Luoyang Hongteng Induction, Luoyang shennai Power Equipment, SuperbMelt, Weifang Jinhuaxin Electric Furnace Manufacturing, Shandong Huaxin Electric Furnace, Abhay Induction Tech, Zhengzhou lanshuo electronics, Luoyang Dinghong Electric Technology, Aichelin Unitherm, Meta Therm Furnace Pvt. Ltd., Fluidtherm Technology, HighTemp Furnaces Ltd., Thermochem Furnaces Pvt Ltd., and Shree Mayur Engineering Co.

-

4. Can you provide company profiles for the leading shell furnace manufacturers?Yes. For example, Inductotherm Group leads the industry in the development and manufacturing of advanced technologies, products and systems for the heat-driven transformation of metals and specialty materials. Induction Technology Corporation (ITC) is an international company specialising in the design and manufacture of complete induction melting and heating systems.

-

5. What are the main drivers of growth in the shell furnace market?An increased adoption of furnaces in steel production and metal recycling applications, and the use of electric induction melting furnaces in scrap metal recycling, are major market growth drivers of the shell furnace market.

-

6. What challenges are limiting the shell furnace market?Fluctuating raw material prices, environmental regulations, and economic fluctuations remain key restraints in the shell furnace market.

Need help to buy this report?