Global Shelf-Stable Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Canned Foods, Dry Foods and Packaged Meals), By Nutritional Profile (Organic Shelf-Stable Foods, Gluten-Free Options, High-Protein Products, Low-Sodium Variants and Diet-Specific Products), By Distribution Channel (Online Retail and Offline Retail) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Shelf-Stable Food Market Insights Forecasts to 2035

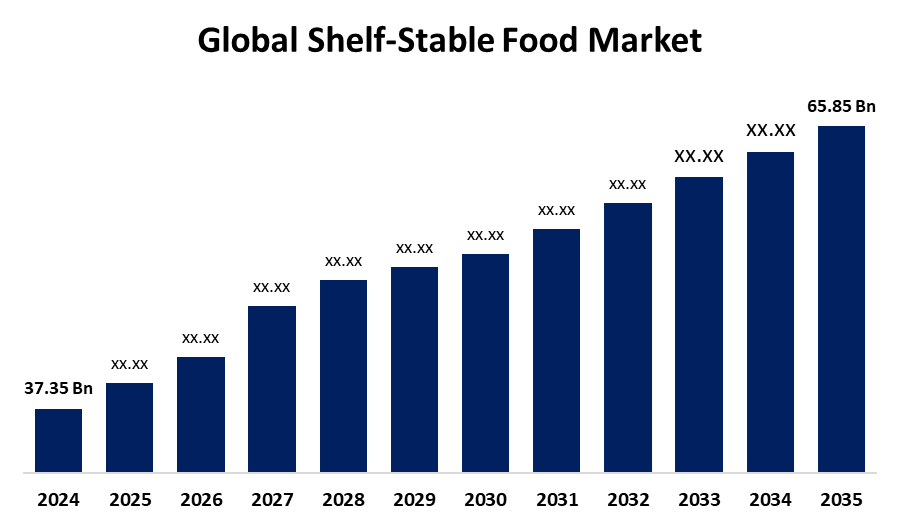

- The Global Shelf-Stable Food Market Size Was Estimated at USD 37.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.29% from 2025 to 2035

- The Worldwide Shelf-Stable Food Market Size is Expected to Reach USD 65.85 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Shelf-Stable Food Market Size Was Worth Around USD 37.35 Billion in 2024 and is predicted to grow to around USD 65.85 Billion by 2035 with a compound annual growth rate (CAGR) of 5.29% from 2025 and 2035. The shelf-stable food industry is spurred on by increasing demand for ready-to-eat, long-shelf-life foods, urbanization, technological advancements in preservation, increased retail and online sales, and heightened consumer interest in food security and emergency preparedness, which drives global market expansion.

Market Overview

The shelf-stable foods market is the business that deals with food processing, distribution, and retailing of foods that are stable at room temperature for long durations without getting spoiled. These foods are preserved by processes such as canning, drying, and vacuum packaging to provide long shelf life and convenience to consumers, retailers, and food service establishments. Shelf-stable foods provide the capacity to minimize food loss by increasing product shelf life, allowing consumers and businesses to keep food on the shelf for extended periods. This positions them to play a crucial role in emergency readiness, disaster response, and areas with limited refrigeration facilities. Shelf-stable foods also provide convenience through fast meal preparation and convenience of storage, which is well in line with the rising demand for ready-to-consume and on-the-go foods. In addition, innovation in environmentally friendly and recyclable packaging materials, aseptic and retort technologies that preserve taste and nutrients, and organic, gluten-free, and other health-focused shelf-stable innovations. Intelligent packaging solutions with freshness indicators and better sealing techniques are also building consumer trust and convenience. Overall, the shelf-stable food industry is transforming at a fast pace, fueled by shifting consumer demands, technology advancements, and sustainability patterns, and thus it is a critical sector in the global food industry.

Report Coverage

This research report categorizes the shelf-stable food market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the shelf-stable food market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the shelf-stable food market.

Global Shelf-Stable Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.29% |

| 2035 Value Projection: | USD 65.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Nutritional Profile, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Vanee Foods, Bolton Group, ConAgra Foods, Del Monte, Kraft Heinz, General Mills, Bumble Bee Foods, Thai Union Group, Bonduelle group.and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Modern consumers lead busy lifestyles, increasing the need for quick, easy-to-prepare meals. Shelf-stable foods require no refrigeration and have a long shelf life, making them ideal for on-the-go consumption, emergency food supplies, and quick meal preparation. This convenience factor significantly boosts market demand globally. Moreover, advancements in preservation methods, such as retort processing, aseptic packaging, and vacuum sealing, have enhanced the safety, taste, and nutritional quality of shelf-stable foods. These innovations have increased consumer confidence and expanded product variety, driving higher adoption rates.

Restraining Factors

Most consumers equate shelf-stable foods as having reduced taste and texture quality than fresh foods. Even with the development of preservation technologies, canned or packaged foods are still viewed by some as less flavorful or healthier, thus restricting wider acceptance and consumption, particularly from consumers looking for quality. In addition, shelf-stable foods tend to be supplemented with additives, preservatives, and high levels of sodium to preserve them longer. Increased consumer awareness regarding possible health hazards of these ingredients, like hypertension or allergy, can deter consumers from making the purchase. This fear leads certain consumers to choose fresh or less processed products

.

Market Segmentation

The shelf-stable food market share is classified into product type, nutritional profile, and distribution channel.

- The canned foods segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the shelf-stable food market is divided into canned foods, dry foods, and packaged meals. Among these, the canned foods segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to canning, which keeps food fresh by sealing it in closed vessels and sterilizing it, which ensures it cannot spoil or get contaminated. This process greatly increases shelf life and makes canned foods a sure bet for long storage. The safety and strength of canned foods make them extremely popular among consumers and vendors across the globe.

- The organic shelf-stable foods segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the nutritional profile, the shelf-stable food market is divided into organic shelf-stable foods, gluten-free options, high-protein products, low-sodium variants, and diet-specific products. Among these, the organic shelf-stable foods segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by consumers globally placing greater emphasis on health and wellness, creating demand for organic foods. Organic shelf-stable foods are seen as safer and healthier options, untainted by synthetic pesticides, fertilizers, and GMOs. This thinking stimulates buying, particularly among millennials and Gen Z, propelling the organic segment's growth and its leading market position.

- The offline retail segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the shelf-stable food market is divided into online retail and offline retail. Among these, the offline retail segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to offline retail benefits from an extensive network of supermarkets, grocery stores, and hypermarkets. These physical stores are widely accessible and trusted by consumers for everyday food purchases. Their presence in both urban and rural areas allows consistent product availability, making them the preferred choice for buying shelf-stable foods in bulk during routine shopping trips.

Regional Segment Analysis of the Shelf-Stable Food Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the shelf-stable food market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the shelf-stable food market over the predicted timeframe. North America’s fast-paced lifestyle fuels demand for ready-to-eat, long-lasting food products. Busy work schedules and dual-income households have led to a strong preference for shelf-stable meals that require minimal preparation. This demand has encouraged continuous product innovation and expansion in canned goods, instant meals, and packaged snacks, securing North America’s lead in market share. Consumers increasingly value portability, ease of storage, and long shelf-life traits that align perfectly with shelf-stable food offerings.

Asia Pacific is expected to grow at a rapid CAGR in the shelf-stable food market during the forecast period. The rapid expansion of the middle class in countries like India, China, Vietnam, and Indonesia has led to increased purchasing power and demand for packaged and processed foods. Shelf-stable products are viewed as affordable, hygienic, and reliable, particularly in regions where cold chain infrastructure is still developing. As consumers seek better quality and more varied food options, shelf-stable goods offer both convenience and value, making them a preferred choice in fast-growing urban and semi-urban markets.

Europe is predicted to hold a significant share of the shelf-stable food market throughout the estimated period. Europe has a long-standing culture of consuming preserved foods, such as canned vegetables, cured meats, and jarred sauces. This historical preference supports the high demand for shelf-stable products. Consumers trust and frequently purchase long-lasting, high-quality packaged goods for convenience, meal preparation, and pantry stockings. The cultural familiarity with shelf-stable items gives brands in Europe a loyal customer base and contributes to sustained demand, making the region a major player in the global shelf-stable food market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the shelf-stable food market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vanee Foods

- Bolton Group

- ConAgra Foods

- Del Monte

- Kraft Heinz

- General Mills

- Bumble Bee Foods

- Thai Union Group

- Bonduelle group.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Stouffer's, once famous for frozen meals, introduced its first ever shelf stable offering: Supreme Shells and Cheese in Cheddar and Three Cheese flavors. It's ready in 10 minutes and contains 10 percent more cheese sauce than the competition representing a huge expansion of the brand into new ground.

- In August 2023, Nestle launched a shelf stable, vegetarian minced meat under its Maggi Veg brand in Chile that delivers vegan meat alternatives and soup kits with no refrigeration required. It reaches areas with limited cold chain access and meets sustainability objectives.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the shelf-stable food market based on the below-mentioned segments:

Global Shelf-Stable Food Market, By Product Type

- Canned Foods

- Dry Foods

- Packaged Meals

Global Shelf-Stable Food Market, By Nutritional Profile

- Organic Shelf-Stable Foods

- Gluten-Free Options

- High-Protein Products

- Low-Sodium Variants

- Diet-Specific Products

Global Shelf-Stable Food Market, By Distribution Chanel

- Online Retail

- Offline Retail

Global Shelf-Stable Food Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the shelf-stable food market over the forecast period?The global shelf-stable food market is projected to expand at a CAGR of 5.29% during the forecast period.

-

2. What is the market size of the shelf-stable food market?The global shelf-stable food market size is expected to grow from USD 37.35 Billion in 2024 to USD 65.85 Billion by 2035, at a CAGR of 5.29% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the shelf-stable food market?North America is anticipated to hold the largest share of the shelf-stable food market over the predicted timeframe.

Need help to buy this report?