Global Seed Testing Services Market Size, Share, Test Type, Service Provider, Application, Demand & Supply, End-User Industries, Sales Channel, Regional Demand, Company Share, 2025-2035

Industry: AgricultureGlobal Seed Testing Services Market Size Insights Forecasts to 2035

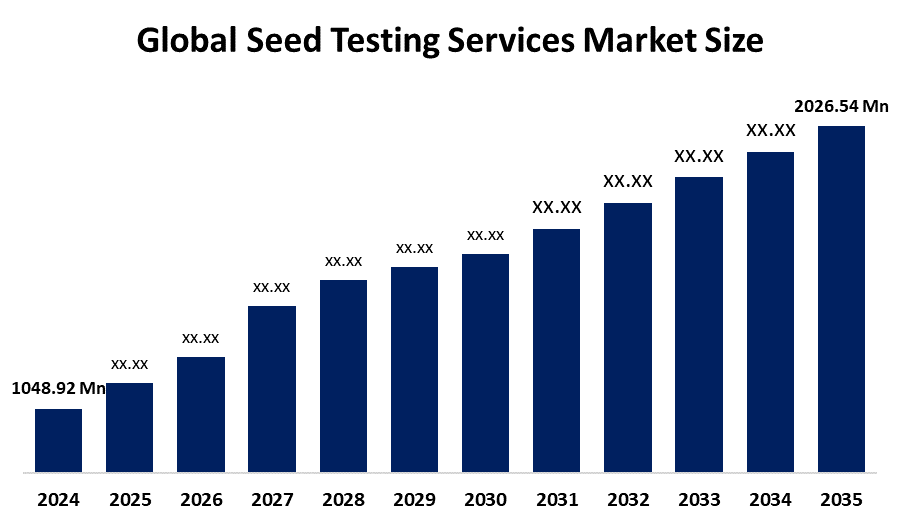

- The Global Seed Testing Services Market Size Was Estimated at USD 1048.92 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.17% from 2025 to 2035

- The Worldwide Seed Testing Services Market Size is Expected to Reach USD 2026.54 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Seed Testing Services Market Size was worth around USD 1048.92 Million in 2024 and is predicted to Grow to around USD 2026.54 Million by 2035 with a compound annual Growth rate (CAGR) of 6.17% from 2025 to 2035. The market for seed testing services is growing due to the increasing demand for high-quality, certified seeds and stricter regulations for seed quality and trade. This is supported by technological advancements and rising awareness of seed quality on crop yield.

Market Overview

The global seed testing services market refers to the industry that provides scientific testing and analysis of seeds to determine their quality, viability, purity, germination rate, and health. These services are crucial in agriculture to ensure high crop yields, reduce losses, and meet regulatory standards. Seed testing is widely used by seed producers, farmers, agricultural research institutes, and regulatory bodies to maintain seed quality and support sustainable agriculture. The market is primarily driven by increasing demand for high-quality seeds due to rising global food needs, expanding commercial agriculture, and growing awareness about the benefits of certified seeds. Technological advancements in seed testing methods, such as genetic purity testing and molecular diagnostics, are further propelling market growth.

Opportunities lie in emerging economies where agricultural modernization is increasing, along with the growing need for organic and hybrid seed verification. Key players in this market include SGS SA, Eurofins Scientific, Bureau Veritas, Intertek Group, and ALS Limited, offering a range of laboratory-based and field-based testing services. Innovations in global seed testing include molecular diagnostics, AI-based seed quality analysis, rapid pathogen detection, and digital traceability systems. Furthermore, government initiatives such as seed certification programs, subsidies for quality seed usage, and investment in agricultural infrastructure are supporting market expansion. The National Seed Health System (NSHS) has launched its 2025 seed health proficiency testing program to ensure laboratory accuracy in detecting seed-borne pathogens. This vital initiative upholds high seed health testing standards, playing a crucial role in protecting agricultural productivity and enhancing global food security.

Report Coverage

This research report categorizes the seed testing services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the seed testing services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the seed testing services market.

Global Seed Testing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1048.92 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.17% |

| 2035 Value Projection: | USD 2026.54 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | Service Provider, Application and COVID-19 Impact Analysis |

| Companies covered:: | Eurofins Scientific, Intertek Group, SGS S.A., Bureau Veritas, ALS Limited, SCS Global Services, TUV Nord Group, AsureQuality, Merieux, Agrifood Technology, RJ Hill Laboratories Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The seed testing services market is propelled by the rising global demand for quality seeds to ensure higher crop yields and food security amid a growing population. Advances in testing technologies, including molecular diagnostics and AI-based analysis, enhance precision and speed. Strict government regulations and certification requirements mandate seed testing, while increasing awareness among farmers about seed health benefits further drives adoption. Expansion in commercial farming and organic agriculture also fuels market growth.

Restraining Factors

The seed testing services market faces restraints from high testing costs, limited access to advanced technologies in developing regions, a lack of standardized global regulations, and inadequate infrastructure, which hinder widespread adoption and slow market growth in some areas.

Market Segmentation

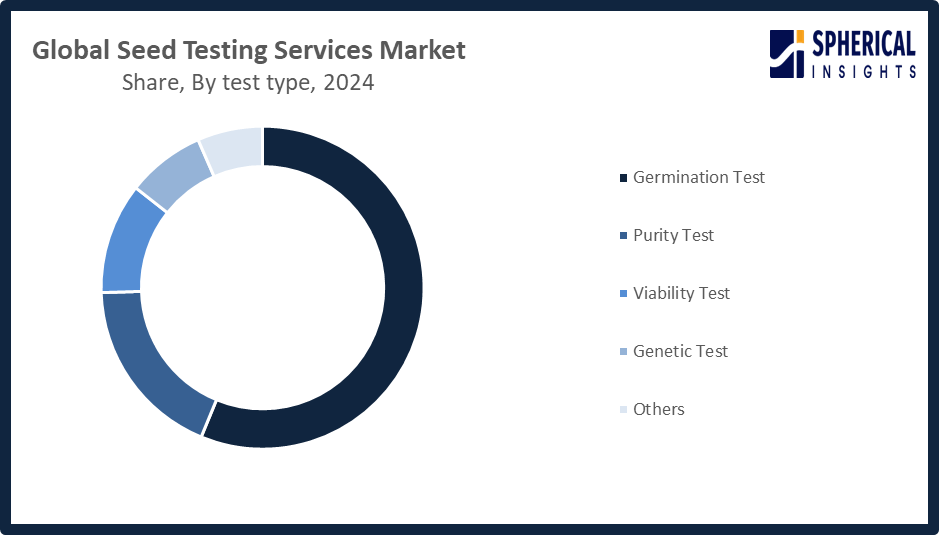

The seed testing services market share is classified into test type, service provider, and application.

- The germination test segment dominated the market in 2024, approximately 56% and is projected to grow at a substantial CAGR during the forecast period.

Based on the test type, the seed testing services market is divided into germination test, purity test, viability test, genetic test, and others. Among these, the germination test segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The germination test segment dominated the seed testing market due to its fundamental role in assessing seed viability and quality for agricultural production. Its substantial projected growth is driven by the rising demand for high-yield, disease-resistant crops, increasingly stringent seed quality regulations, and expanding global food demand. Germination testing remains crucial for compliance and optimizing crop performance.

Get more details on this report -

- The private laboratories segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the service provider, the seed testing services market is divided into government laboratories, private laboratories, and others. Among these, the private laboratories segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment growth is due to increasing diagnostic test volumes for various diseases, a preference for outsourcing specialized testing to these labs for cost-effectiveness and advanced capabilities, the adoption of automated systems for efficiency, and expanding healthcare infrastructure in emerging markets. Furthermore, technological advancements, a rising number of chronic diseases requiring diagnosis, and investments in research accelerate the demand for private laboratory services.

- The seed companies segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the seed testing services market is divided into agriculture, research institutions, seed companies, and others. Among these, the seed companies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment is growing due to the rising global population, which increases demand for food, and advancements in agricultural technology. Key drivers include the adoption of high-yield hybrid and genetically modified (GM) seeds, which offer traits such as pest resistance and improved productivity, and a growing focus on climate-resilient and sustainable crops.

Regional Segment Analysis of the Seed Testing Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the seed testing services market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the seed testing services market over the predicted timeframe. North America is leading the seed testing services market over the predicted timeframe due to its advanced agricultural practices, strong regulatory frameworks, and widespread adoption of certified seeds. The United States, being the leading contributor, invests heavily in agricultural biotechnology and seed quality assurance. Stringent USDA and APHIS regulations mandate rigorous seed testing, boosting demand. Additionally, the presence of major seed companies and accredited laboratories drives innovation, while Canada’s growing focus on sustainable agriculture further supports market expansion in the region.

Asia Pacific is expected to grow at a rapid CAGR in the seed testing services market during the forecast period. Asia Pacific is rapidly growing in the seed testing services market during the forecast period due to rising food demand, expanding agricultural activities, and increasing awareness about seed quality. Countries such as India and China are leading this growth, driven by government initiatives promoting certified seeds, improved testing infrastructure, and digital traceability systems. In India, programs such as SATHI aim to combat counterfeit seeds, while China's focus on agricultural modernization and food security is fueling demand for advanced seed testing. Rapid urbanization and population growth also drive agricultural innovation in the region.

In January 2024, the Federation of Seed Industry of India (FSII) advocated restoring a 200% income tax deduction under Section 35(2AB) for in-house seed R&D and reducing customs duties on essential scientific equipment. These initiatives aim to stimulate innovation and drive growth within India’s seed industry.

Europe’s seed testing services market is growing steadily due to stringent regulatory frameworks and increasing emphasis on sustainable and organic farming. Key countries such as Germany, France, and the Netherlands drive this growth with advanced seed industries and the adoption of innovative testing technologies. The European Union’s strict seed certification and quality standards ensure a high-quality seed supply, while rising environmental concerns and demand for biodiversity conservation further boost the market throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the seed testing services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eurofins Scientific

- Intertek Group

- SGS S.A.

- Bureau Veritas

- ALS Limited

- SCS Global Services

- TUV Nord Group

- AsureQuality

- Merieux

- Agrifood Technology

- RJ Hill Laboratories Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Merieux NutriSciences and AsureQuality launched their joint venture, Merieux NutriSciences AQ (MNAQ), following Merieux’s acquisition of Bureau Veritas’ global food testing operations, including its shares in BVAQ joint ventures across Southeast Asia and Australia, enhancing their global footprint in food safety and quality services.

- In October 2024, Merieux NutriSciences announced an agreement to acquire Bureau Veritas' food testing business for EUR 360 million. Supported by parent company Institut Merieux, this strategic move strengthens Merieux’s global commitment to safer, healthier, and more sustainable food systems.

- In March 2024, Syngenta Vegetable Seeds inaugurated India’s first dedicated Seed Health Lab in Hyderabad, an advanced facility enhancing quality control. This advanced lab will serve growers across India, the Asia Pacific region, and beyond, reinforcing Syngenta’s commitment to seed health.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the seed testing services market based on the below-mentioned segments:

Global Seed Testing Services Market, By Test Type

- Germination Test

- Purity Test

- Viability Test

- Genetic Test

- Others

Global Seed Testing Services Market, By Service Provider

- Government Laboratories

- Private Laboratories

- Others

Global Seed Testing Services Market, By Application

- Agriculture

- Research Institutions

- Seed Companies

- Others

Global Seed Testing Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the seed testing services market over the forecast period?The global seed testing services market is projected to expand at a CAGR of 6.17% during the forecast period.

-

2. What is the market size of the seed testing services market?The global seed testing services market size is expected to grow from USD 1048.92 million in 2024 to USD 2026.54 million by 2035, at a CAGR of 6.17% during the forecast period 2025-2035.

-

3. What is the seed testing services market?The seed testing services market involves companies that analyze and evaluate seed quality to determine attributes such as germination, purity, moisture content, and other vital factors, ensuring that farmers receive high-quality seeds and that the seeds meet regulatory standards for planting.

-

4. Which region holds the largest share of the seed testing services market?North America is anticipated to hold the largest share of the seed testing services market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global seed testing services market?The major players operating in the seed testing services market are Eurofins Scientific, Intertek Group, SGS S.A., Bureau Veritas, ALS Limited, SCS Global Services, TUV Nord Group, AsureQuality, Merieux, Agrifood Technology, RJ Hill Laboratories Limited, and Others.

-

6. What factors are driving the growth of the seed testing services market?The growth of the seed testing services market is driven by the need to increase crop production and food security, stringent government regulations, and the increasing demand for high-quality organic and non-GMO seeds.

-

7. What are the market trends in the seed testing services market?Market trends in seed testing services include the adoption of advanced molecular marker-based methods for greater accuracy, a focus on sustainability and precision agriculture, and increasing demand due to stringent international trade regulations and the need for high-yield, disease-resistant crops.

-

8. What are the main challenges restricting the wider adoption of the seed testing services market?The wider adoption of the seed testing services market is restricted by a combination of high costs, fragmented regulations, and a lack of awareness, especially among smallholder farmers.

Need help to buy this report?