Global Security Detectors and Scanners Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (X-ray, Metal Detectors, and Explosive/Other), By End Use (Airports, Commercial Buildings, and Government/Security), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Electronics, ICT & MediaSecurity Detectors and Scanners Market Summary, Size & Emerging Trends

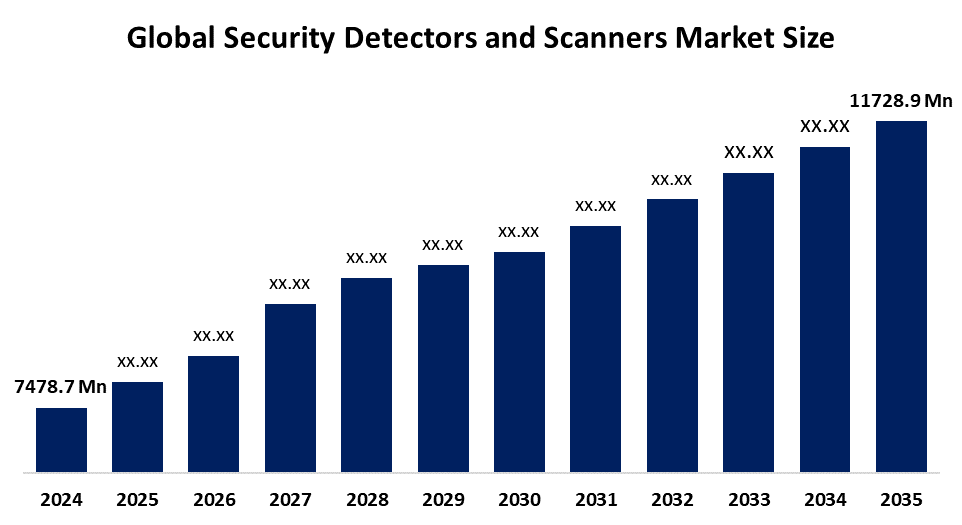

According to Decision Advisor, The Global Security Detectors and Scanners Market Size is Expected to Grow from USD 7478.7 Million in 2024 to USD 11728.9 Million by 2035, at a CAGR of 4.18% during the forecast period 2025-2035. The rising demand for advanced security screening systems in high-risk public spaces such as airports, commercial complexes, and government institutions is a significant driver of this market.

Get more details on this report -

Key Market Insights

- North America is expected to account for the largest share in the security detectors and scanners market during the forecast period.

- In terms of product type, the X-ray segment dominated in revenue during the forecast period.

- In terms of end use, the airport segment accounted for the largest revenue share in the global security detectors and scanners market.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7478.7 Million

- 2035 Projected Market Size: USD 11728.9 Million

- CAGR (2025-2035): 4.18%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Security Detectors and Scanners Market

The Security Detectors and Scanners Market Size centers on the development and deployment of systems that identify concealed threats, such as weapons, explosives, or contraband, in public and restricted-access environments. These technologies play a critical role in maintaining public safety and preventing unauthorized access to sensitive zones. Their use has expanded significantly in response to increased global threats, including terrorism, organized crime, and smuggling. The integration of AI, automation, and data analytics into security systems enhances detection accuracy and operational efficiency. Government mandates, global airport modernization programs, and increased spending on security infrastructure across commercial and government facilities further support market growth. With ongoing technological advancements and rising global security concerns, the market is expected to expand steadily across both developed and emerging economies.

Security Detectors and Scanners Market Trends

- Artificial Intelligence integration is improving real-time threat detection accuracy in scanners.

- Automation in security screening is reducing human error and improving throughput efficiency.

- Miniaturization and portability of scanners are gaining traction in remote and mobile applications.

- Strategic investments and partnerships are expanding capabilities and geographic reach of key manufacturers.

Global Security Detectors and Scanners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7478.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.18% |

| 2035 Value Projection: | USD 11728.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Product Type |

| Companies covered:: | Smiths Detection, OSI Systems, Inc., Garrett Metal Detectors, Leidos Holdings, Inc., Rapiscan Systems, Nuctech Company Limited, CEIA SpA, Adani Systems Inc., Autoclear LLC, Westminster Group PLC, and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Security Detectors and Scanners Market Dynamics

Driving Factors: Increasing security threats and airport modernization projects

The persistent rise in global security threats, including terrorism, organized crime, smuggling of weapons or drugs, and unauthorized access to critical infrastructure, is driving significant demand for advanced security detectors and scanners. As public safety becomes a central concern for both governments and private entities, the need for highly accurate, real-time detection systems has become a strategic priority. A key driver of this demand is the modernization of airport infrastructure, particularly in regions such as Asia-Pacific, the Middle East, and Africa, where governments are heavily investing in airport upgrades and new terminal constructions. These initiatives are designed to handle larger passenger volumes, improve traveler safety, and comply with evolving international security standards.

Restrain Factors: High costs and regulatory complexity

While the market potential is strong, several barriers hinder rapid adoption chief among them being high upfront costs. Advanced security scanners involve expensive hardware, proprietary software, and maintenance-intensive components, which can be financially burdensome for smaller airports, public institutions, and organizations in developing economies. In addition, the complex regulatory environment surrounding security screening systems often involves extensive certification, compliance with data protection laws, and adherence to privacy standards.

Opportunity: Rise in smart city projects and public safety awareness

The global shift toward smart city development presents a significant opportunity for security detector and scanner vendors. Smart cities integrate IoT-enabled surveillance, networked detection systems, and real-time threat analytics across transportation hubs, utility services, and public infrastructure. These deployments require scalable, intelligent scanning solutions that can communicate with centralized security platforms. Additionally, the rising trend of mass public gatherings in arenas, stadiums, schools, and shopping malls has increased the demand for portable and non-intrusive scanners that can provide quick threat detection without compromising user experience. These lightweight and often AI-powered devices are increasingly replacing traditional manual inspections.

Challenges: Data privacy, system integration, and cyber threats

The increasing digitization of security scanners brings a new layer of complexity in the form of cybersecurity risks. As these systems become connected to larger data networks and cloud platforms, they become susceptible to cyberattacks, data breaches, and manipulation. Sensitive passenger or visitor data, especially biometric data collected via facial recognition or body scanning, is a high-value target for hackers. This raises significant ethical and legal questions around data privacy, particularly in regions with stringent privacy regulations such as the European Union, where biometric surveillance is highly scrutinized.

Global Security Detectors and Scanners Market Ecosystem Analysis

The global market ecosystem consists of component suppliers, OEMs, system integrators, and end users. Prominent manufacturers include companies like Smiths Detection, OSI Systems, and Garrett Metal Detectors, who work closely with airport authorities, government security agencies, and commercial contractors. Suppliers of image processing software, radiation sensors, and detection algorithms form the technological foundation. Regulatory bodies such as the TSA, ICAO, and EU Aviation Safety Agency heavily influence equipment standards and certification. The ecosystem thrives on continuous innovation and regulatory alignment to ensure safety, privacy, and detection accuracy.

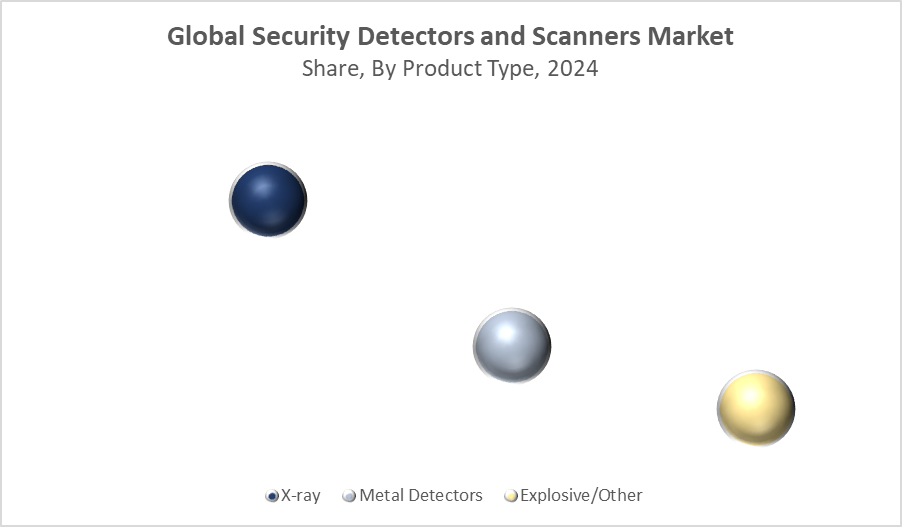

Global Security Detectors and Scanners Market, By Product Type

The X-ray segment accounted for the largest revenue share of approximately 52% in the global security detectors and scanners market during the forecast period. This dominance is attributed to the widespread deployment of X-ray systems in airports, customs checkpoints, government facilities, and courier/logistics screening centers. X-ray scanners are highly effective in detecting a broad range of metallic and non-metallic threats, including weapons, explosives, contraband, and prohibited items, without requiring physical inspection. The latest generation of X-ray technology features dual-view, multi-energy imaging, and 3D volumetric scanning, significantly improving detection accuracy, object differentiation, and image clarity.

Get more details on this report -

The metal detector segment held a significant market share of approximately 29% during the forecast period, driven by its essential role in walk-through and handheld security screening at building entrances, event venues, and transportation terminals. Metal detectors are valued for their cost-effectiveness, portability, and ease of deployment, especially in commercial buildings, schools, shopping malls, and public events. They offer rapid screening with minimal infrastructure requirements and can detect concealed metallic objects such as firearms, knives, or tools on individuals.

Global Security Detectors and Scanners Market, By End Use

The airport segment accounted for the largest revenue share of approximately 48% in the global security detectors and scanners market during the forecast period. This dominant share is driven by the critical role of airports as high-risk infrastructure requiring strict security compliance and advanced screening protocols. International and domestic airports are mandated by regulatory bodies such as the Transportation Security Administration (TSA), International Civil Aviation Organisation (ICAO), and other national aviation authorities to deploy rigorous screening systems for passengers, baggage, and cargo. As a result, airports remain the primary consumers of X-ray scanners, metal detectors, and explosive trace detection systems.

The commercial buildings segment held a significant revenue share of approximately 28% during the forecast period, reflecting the growing emphasis on security in non-government, urban infrastructure. This segment includes office complexes, malls, data centers, banks, hotels, and educational institutions, locations that increasingly face threats such as workplace violence, theft, sabotage, and unauthorised access. Rising awareness about employee safety, coupled with corporate liability concerns, is driving commercial property owners to invest in robust security screening systems.

North America is expected to account for the largest share, holding approximately 40% of the global market revenue during the forecast period. This regional dominance is underpinned by a combination of advanced infrastructure, high security standards, and significant government investments in public safety and counter-terrorism. The United States, in particular, leads in the adoption of cutting-edge detection technologies, with extensive deployment of X-ray scanners, metal detectors, and explosive detection systems across airports, seaports, border checkpoints, and federal buildings. Agencies such as the TSA, DHS, and CBP are actively investing in upgrading scanning systems to meet evolving threat landscapes, including cyber-physical risks and biosecurity concerns.

Asia Pacific is projected to be the fastest-growing region, with a CAGR of approximately 9.1% during the forecast period. The region’s growth is fueled by rapid economic development, urbanization, and large-scale infrastructure investments, particularly in countries like China, India, Indonesia, and Vietnam. A major driver is the aggressive pace of airport construction and upgrades across China and India, supported by government-led civil aviation expansion plans. Additionally, the rise of smart cities and large public infrastructure projects is prompting widespread deployment of advanced security solutions in transportation hubs, public venues, and government complexes.

Europe remains a significant contributor to the global security detectors and scanners market, holding a substantial share driven by its stringent regulatory landscape and emphasis on public safety. The region’s focus on border control, urban transit security, and anti-terrorism measures has led to continued upgrades of scanning technologies across airports, rail stations, and public venues. The European Union’s mandates around passenger screening and data protection (e.g., GDPR) encourage the use of advanced yet privacy-compliant systems, including automated threat detection, biometric scanners, and multi-view X-ray machines. Countries like Germany, the UK, France, and Italy are leading adopters due to their high international traffic and security-sensitive infrastructure.

WORLDWIDE TOP KEY PLAYERS IN THE SECURITY DETECTORS AND SCANNERS MARKET INCLUDE

- Smiths Detection

- OSI Systems, Inc.

- Garrett Metal Detectors

- Leidos Holdings, Inc.

- Rapiscan Systems

- Nuctech Company Limited

- CEIA SpA

- Adani Systems Inc.

- Autoclear LLC

- Westminster Group PLC

- Others

Product Launches in Security Detectors and Scanners Market

- In August 2023, Leidos, a leading technology and defense company, launched its new ClearScan cabin baggage screening system. This system uses advanced computed tomography (CT) technology, which creates detailed 3D images of the contents inside cabin baggage. The use of CT technology significantly improves threat detection capabilities by allowing security personnel to more accurately identify dangerous items such as explosives or weapons, compared to traditional X-ray scanners. This higher precision helps reduce false alarms and the need for manual bag checks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the security detectors and scanners market based on the below-mentioned segments:

Global Security Detectors and Scanners Market, By Product Type

- X-ray

- Metal Detectors

- Explosive/Other

Global Security Detectors and Scanners Market, By End Use

- Airports

- Commercial Buildings

- Government/Security

Global Security Detectors and Scanners Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Global Security Detectors and Scanners Market in 2024?The Global Security Detectors and Scanners Market size was estimated at USD 7,478.7 million in 2024.

-

What is the forecasted CAGR of the Global Security Detectors and Scanners Market from 2025 to 2035?The market is expected to grow at a CAGR of 4.18% during the period 2025–2035.

-

What is the projected market size of the Global Security Detectors and Scanners Market by 2035?The market size is projected to reach USD 11,728.9 million by 2035.

-

Which region holds the largest share in the Global Security Detectors and Scanners Market?North America is expected to account for the largest share, holding approximately 40% of the global market revenue during the forecast period.

-

Which region is expected to grow the fastest in the Global Security Detectors and Scanners Market?Asia Pacific is projected to be the fastest-growing region, with a CAGR of approximately 9.1% during the forecast period.

-

Which product type dominates the Global Security Detectors and Scanners Market?The X-ray segment dominated the market, accounting for approximately 52% of revenue during the forecast period.

-

Which end-use segment holds the largest revenue share in the Global Security Detectors and Scanners Market?The airport segment accounted for the largest revenue share of approximately 48% during the forecast period.

-

Who are the key players operating in the Global Security Detectors and Scanners Market?Key players include Smiths Detection, OSI Systems, Garrett Metal Detectors, Leidos Holdings, Rapiscan Systems, Nuctech Company Limited, CEIA SpA, Adani Systems Inc., Autoclear LLC, and Westminster Group PLC.

Need help to buy this report?