Saudi Arabia NDT Market Size, Share, By Component (Equipment, Software, Services, Consumables), By Testing Method (Ultrasonic, Radiographic, Magnetic Particle, Liquid Penetrant, Visual Inspection, Eddy-Current, Acoustic Emission, Thermography/Infrared, Computed Tomography), By Technique (Traditional/Conventional, AI-enabled), By End-user Industry (Oil & Gas, Power Generation, Aerospace, Defense, Automotive & Transportation, Manufacturing & Heavy Engineering, Construction & Infrastructure, Chemical & Petrochemical, Marine & Ship Building, Electronics & Semiconductor, Mining, Medical Devices, Others), Saudi Arabia NDT Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingSaudi Arabia NDT Market Insights Forecasts to 2035

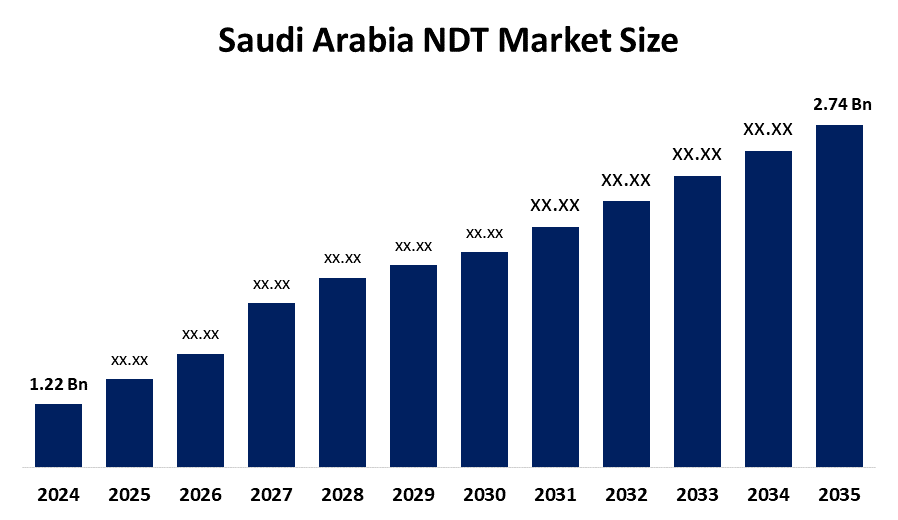

- Saudi Arabia NDT Market Size 2024: USD 1.22 Bn

- Saudi Arabia NDT Market Size 2035: USD 2.74 Bn

- Saudi Arabia NDT Market CAGR 2025-2035: 7.6%

- Saudi Arabia NDT Market Segments: Component, Testing Method, Technique, End-user Industry

Get more details on this report -

Non- destructive testing (NDT) comprises a variety of inspection and testing methods that assess the integrity, quality, and performance of materials, components, and structures without causing any harm or damage. The application of NDT services and solutions is extensive in Saudi Arabia. They are employed in oil and gas facilities, power plants, refineries, petrochemical complexes, construction projects, transportation assets, and manufacturing units to maintain safety, reliability, and compliance with regulations. The market is primarily driven by the Kingdom's focus on asset integrity management, operational safety, and the lifecycle extension of the most important infrastructure. The rise in industrial activity under large, scale energy, industrial, and infrastructure projects keeps the demand for regular inspection and monitoring services high. Additionally, several technological advancements such as digital radiography, automated ultrasonic testing, remote visual inspection, and AI, enabled defect analysis are facilitating accuracy, efficiency, and inspection coverage.

Government led initiatives under Vision 2030 are committed to industrial safety standards, localization of technical services, and quality compliance in the different sectors. This is, therefore, an enabling environment for the role of certified NDT practices. The enforcement of regulations by energy and industrial authorities also acts as a deterrent to any kind of violation and, thus, supports consistent inspection requirements. In the long term, there will be significant openings in smart inspection technologies and the localization of NDT capabilities. The development of a skilled workforce and the rising adoption of advanced testing methods will, moreover, create a substantial demand for Saudi Arabia's existing assets and new projects.

Market Dynamics of the Saudi Arabia NDT Market:

The Saudi Arabia NDT market is primarily driven by the demand for NDT services and products related to oil and gas operations, infrastructure development, power generation, and industrial manufacturing. Non, destructive testing has become a necessity in all stages of production, operation, and maintenance in sectors where safety standards are strictly enforced and asset integrity is a prerequisite. The development of industrial projects under Vision 2030 and the increased need for asset life extension are some of the factors contributing to a sustained market demand for NDT services.

The market is restrained by high equipment costs, skilled technician requirements, and the difficulty of performing complicated inspection techniques. The limited local production of sophisticated NDT devices and complete reliance on imports for technology have escalated operational costs. Some industries have still not fully embraced advanced methods, while gaps in training have resulted in slow market penetration in these sectors.

Some of the future opportunities for the Saudi Arabian NDT market include the implementation of digital NDT, AI, based inspection techniques, and automation of testing processes. The need for continuous inspections in the renewable energy sector, smart infrastructure, and local industrial manufacturing will consequently increase. The government focus on quality compliance, industrial safety, and modernization through the adoption of technologies is expected to create a reservoir of growth opportunities for NDT services in the long run.

Saudi Arabia NDT Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.22 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.6% |

| 2035 Value Projection: | USD 2.74 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Applus+ Velosi Arabia Ltd., SGS Gulf Limited, Intertek Saudi Arabia Ltd., Bureau Veritas Saudi Arabia Co. Ltd., TÜV Rheinland Arabia LLC, TÜV NORD Saudi Arabia LLC, ALS Arabia, Element Materials Technology Saudi Arabia (Exova), MISTRAS Group - Saudi Arabia, GE Inspection Technologies Saudi Arabia, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Saudi Arabia NDT Market share is classified into component, testing method, technique, and end-user industry.

By Component:

The Saudi Arabia NDT market is divided by component into equipment, software, services, and consumables. Among these, the equipment segment dominated the market in 2024 the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth is primarily led by the rising need for highly advanced inspection tools in oil, gas, and infrastructure projects. This demand is further propelled by the necessity for frequent preventive maintenance and the expansion of industrial facilities that require reliable and high, performing testing solutions.

By Testing Method:

The Saudi Arabia NDT market is divided by testing method into ultrasonic, radiographic, magnetic particle, liquid penetrant, visual inspection, eddy-current, acoustic emission, thermography/infrared, and computed tomography. Among these, ultrasonic testing dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Their growth is primarily powered by superior defect detection capabilities that are widely applicable across various industries. Moreover, their ease of integration with automated inspection systems and compatibility with high, volume, critical asset inspections significantly contribute to their growth.

By Technique:

The Saudi Arabia NDT market is divided by technique into traditional/conventional and AI-enabled. Among these, traditional/conventional techniques dominated the share in 2024 but AI-enabled techniques are gaining traction. AI-driven growth can mostly be credited to factors such as improved inspection accuracy, real time data analysis, and predictive maintenance capabilities. Besides, the widespread use of digital and smart industrial solutions in the top sectors is also a big driver for this growth.

By End-user Industry:

The Saudi Arabia NDT market is divided by end-user industry into oil & gas, power generation, aerospace, defense, automotive & transportation, manufacturing & heavy engineering, construction & infrastructure, chemical & petrochemical, marine & ship building, electronics & semiconductor, mining, medical devices, and others. Among these, the oil & gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is largely driven by the essential need for pipeline integrity, imposition of strict safety regulations, and continuation of exploration and production activities. Besides that, the expensive assets that need to be inspected regularly, are playing a major role in this growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Saudi Arabia NDT market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Saudi Arabia NDT market:

- Applus+ Velosi Arabia Ltd.

- SGS Gulf Limited

- Intertek Saudi Arabia Ltd.

- Bureau Veritas Saudi Arabia Co. Ltd.

- TÜV Rheinland Arabia LLC

- TÜV NORD Saudi Arabia LLC

- ALS Arabia

- Element Materials Technology Saudi Arabia (Exova)

- MISTRAS Group - Saudi Arabia

- GE Inspection Technologies Saudi Arabia

Recent Developments in the Saudi Arabia NDT Market:

In October 2024, a new 56-inch ultrasonic inline inspection tool for large-diameter pipelines was developed through a joint effort by NDT Global and Saudi Aramco. This breakthrough enhances pipeline integrity management, improves inspection accuracy, and enables safer and more efficient operational practices across Saudi Arabia’s oil and gas infrastructure.

Key Target Audience

- Market Players

- Investors

- End-user

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Saudi Arabia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Saudi Arabia NDT market based on the below-mentioned segments:

Saudi Arabia NDT Market, By Component

- Equipment

- Software

- Services

- Consumables

Saudi Arabia NDT Market, By Testing Method

- Ultrasonic Testing

- Radiographic Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Visual Inspection Testing

- Eddy-Current Testing

- Acoustic Emission Testing

- Thermography / Infrared Testing

- Computed Tomography Testing

Saudi Arabia NDT Market, By Technique

- Traditional / Conventional

- AI-enabled

Saudi Arabia NDT Market, By End-user Industry

- Oil & Gas

- Power Generation

- Aerospace

- Defense

- Automotive & Transportation

- Manufacturing & Heavy Engineering

- Construction & Infrastructure

- Chemical & Petrochemical

- Marine & Ship Building

- Electronics & Semiconductor

- Mining

- Medical Devices

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the Saudi Arabia NDT market size?A:Saudi Arabia NDT Market is expected to grow from USD 1.22 billion in 2024 to USD 2.74 billion by 2035, growing at a CAGR of 7.6% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by large-scale oil and gas operations, strict asset integrity and safety regulations, rising infrastructure and industrial projects under Vision 2030, and the growing need for preventive maintenance and lifecycle extension of critical assets.

-

Q:What factors restrain the Saudi Arabia NDT market?A:Constraints include high costs of advanced NDT equipment, dependence on imported technologies, shortage of highly skilled certified technicians, and slower adoption of advanced inspection methods across smaller industrial facilities.

-

Q:How is the market segmented?A:The market is segmented by component, testing method, technique, and end-user industry.

-

Q Which end-user industry dominates the market?A:The oil and gas sector dominates due to continuous inspection requirements for pipelines, refineries, and offshore assets, along with strict regulatory compliance and high-value infrastructure needing frequent non-destructive testing.

-

Q:Who are the key players in the Saudi Arabia NDT market?A:Key companies include Applus+ Velosi Arabia Ltd., SGS Gulf Limited, Intertek Saudi Arabia Ltd., Bureau Veritas Saudi Arabia Co. Ltd., TÜV Rheinland Arabia LLC, TÜV NORD Saudi Arabia LLC, ALS Arabia, Element Materials Technology Saudi Arabia, MISTRAS Group Saudi Arabia, and GE Inspection Technologies Saudi Arabia.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?