Russia Water Treatment System Market Size, Share, and COVID-19 Impact Analysis, By Technology (Reverse Osmosis Systems, Disinfection Methods, Filtration Methods, and Others), By Application (Industrial, Residential), and Russia Water Treatment System Market, Forecasts to 2035

Industry: Machinery & EquipmentRussia Water Treatment System Market Insights Forecasts to 2035

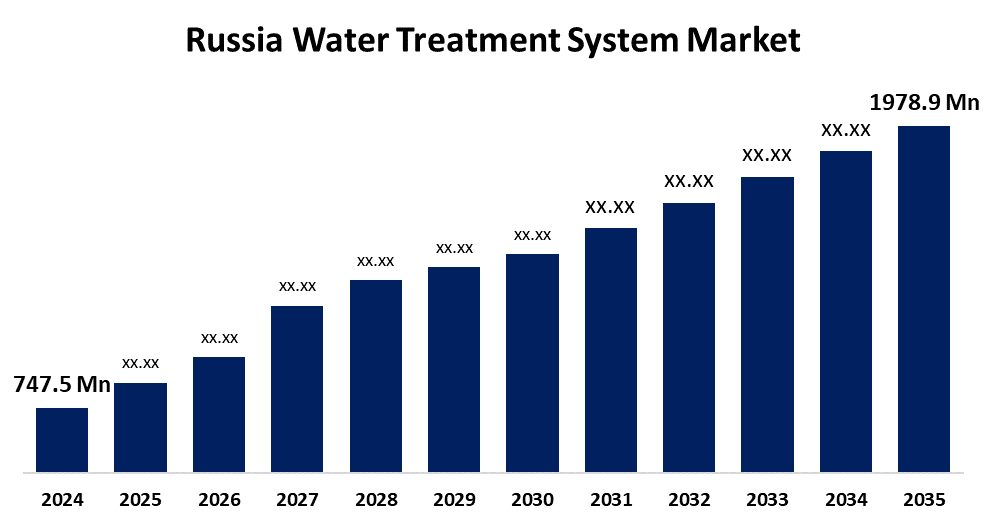

- The Russia Water Treatment System Market Size Was Estimated at USD 747.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.25% from 2025 to 2035

- The Russia Water Treatment System Market Size is Expected to Reach USD 1978.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia water treatment system market size is anticipated to reach USD 1978.9 million by 2035, growing at a CAGR of 9.25% from 2025 to 2035. The water treatment system market in Russia is driven by rising industrial wastewater discharge, ageing municipal water infrastructure, strict environmental regulations, growing urbanization, rising demand for clean drinking water, and investments in cutting-edge filtration, desalination, and wastewater recycling technologies.

Market Overview

The Russia water treatment system market refers to technologies, equipment, and services used to purify and manage water for residential, commercial, and industrial applications. The systems comprise filtration units and reverse osmosis systems, UV disinfection and softeners and wastewater treatment plants. The applications extend to municipal drinking water supply, industrial process water treatment and oil and gas operations, power generation and wastewater recycling to ensure regulatory compliance, environmental protection and safe access to clean water throughout Russia.

The Russian government backs water treatment system development through federal funding initiatives, which include the "Water of Russia" program that provides 70 billion rubles for wastewater treatment plants and treatment system upgrades. In 2025, approximately 815 million rubles were dedicated to water restoration projects throughout the region. The water supply and sanitation system improvements receive funding through a USD 320 million loan from the New Development Bank.

Recent developments show that Russian companies have begun using advanced membrane filtration, ultraviolet disinfection and industrial wastewater recycling technologies. The companies established a partnership to work on upgrading municipal treatment plants and developing smart monitoring systems. The future offers opportunities through the expansion of desalination in coastal areas, the implementation of industrial water reuse systems, and the development of IoT-based treatment optimization and foreign investment in green infrastructure projects throughout Russia’s urban and industrial areas.

Report Coverage

This research report categorizes the market for the Russia water treatment system market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia water treatment system market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia water treatment system market.

Russia Water Treatment System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 747.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.25% |

| 2035 Value Projection: | USD 1978.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 74 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Rosvodokanal, Mosvodokanal, Rusfilter (Komintex Ecology), NEPTUN Filters (RUSTECHNOBISINESS), WATER.RU (Hydra Filter/Gidra Filter), Vodeco-stroy (Aquaflow), Space Aqua / Lemniskata-Filters, Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The water treatment system market in Russia is driven by outdated municipal water systems, growing industrial wastewater discharge, and new environmental regulations that establish stricter effluent treatment standards. The need for drinking water solutions in urban areas drives investments towards modern water filtration and purification systems. The process water treatment and recycling market expands as demand from the oil and gas, power generation, and manufacturing industries increases, supporting growth in both residential and industrial markets.

Restraining Factors

The water treatment system market in Russia is mostly constrained by high installation and maintenance costs, limited municipal funding, economic sanctions that restrict technology imports, difficulties managing outdated infrastructure, and the lengthy nature of project approval processes.

Market Segmentation

The Russia water treatment system market share is classified into technology and application.

- The reverse osmosis systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia water treatment system market is segmented by technology into reverse osmosis systems, distillation systems, disinfection methods, filtration methods, water softeners, and others. Among these, the reverse osmosis systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. They are extensively used in industrial processing, desalination, and municipal water supply applications throughout Russia because of their excellent effectiveness in eliminating dissolved salts, heavy metals, and other pollutants.

- The industrial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia water treatment system market is segmented by application industrial, residential, and commercial. Among these, the industrial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main causes of this are the high-water usage and stringent wastewater discharge laws in sectors including industry, electricity generation, chemicals, and oil and gas. Compared to residential and commercial applications, industrial facilities need more sophisticated treatment systems for process water purification and effluent control, which means greater system capacities and more expenditure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia water treatment system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rosvodokanal

- Mosvodokanal

- Rusfilter (Komintex Ecology)

- NEPTUN Filters (RUSTECHNOBISINESS)

- WATER.RU (Hydra Filter/Gidra Filter)

- Vodeco-stroy (Aquaflow)

- Space Aqua / Lemniskata-Filters

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, Moscow was set to host the Russian International Water Treatment Exhibition (ECWATECH), which promoted industrial cooperation and showcased cutting-edge treatment technologies.

- In July 2025, industrial companies in Moscow created and increased their manufacturing of competitive water treatment equipment, such as UV and ozone systems, for use in public and industrial settings.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia water treatment system market based on the below-mentioned segments:

Russia Water Treatment System Market, By Technology

- Reverse Osmosis Systems

- Distillation Systems

- Disinfection Methods

- Filtration Methods

- Water Softeners

- Others

Russia Water Treatment System Market, By Application

- Industrial

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

What is the Russia water treatment system market size?Russia water treatment system market size is expected to grow from USD 747.5 million in 2024 to USD 1978.9 million by 2035, growing at a CAGR of 9.25% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by outdated municipal water systems, growing industrial wastewater discharge, and new environmental regulations that establish stricter effluent treatment standards.

-

What factors restrain the Russia water treatment system market?Constraints include the high installation and maintenance costs, limited municipal funding, and economic sanctions that restrict technology imports.

-

How is the market segmented by technology?The market is segmented into reverse osmosis systems, distillation systems, disinfection methods, filtration methods, water softeners, and others.

-

Who are the key players in the Russia water treatment system market?Key companies include Rosvodokanal, Mosvodokanal, Rusfilter (Komintex Ecology), NEPTUN Filters (RUSTECHNOBISINESS), WATER.RU (Hydra Filter/Gidra Filter), Vodeco-stroy (Aquaflow), Space Aqua / Lemniskata-Filters, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?