Russia Smart TV Market Size, Share, and COVID-19 Impact Analysis, By Resolution Type (4K UHD TV, HDTV, Full HD TV, and 8K TV), By Distribution Channel (Online and Offline), and Russia Smart TV Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Smart TV Market Size Insights Forecasts to 2035

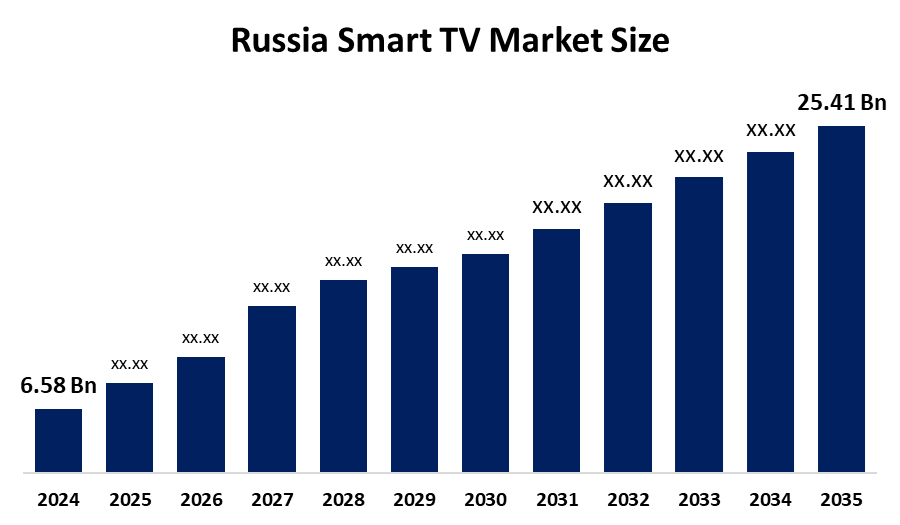

- The Russia Smart TV Market Size Was Estimated at USD 6.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.07% from 2025 to 2035

- The Russia Smart TV Market Size is Expected to Reach USD 25.41 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Russia Smart TV Market Size is anticipated to reach USD 4.34 billion by 2035, growing at a CAGR of 13.07% from 2025 to 2035. The smart TV market in Russia is driven by rising demand for high-definition content, growing internet penetration, the expansion of over-the-top (OTT) streaming platforms, the affordability of smart devices, and the quick uptake of linked home entertainment technologies.

Market Overview

The market for Russia's smart TV gadgets comprises televisions with internet connectivity and inamed operating systems along with the sale and adoption of those. Smart TVs are commonly utilized in streaming OTT content, online gaming, video calls, business presentations, digital advertising, and smart home integration. Their use is widespread across a variety of sectors such as residential, hospitality, corporate, and commercial, where better entertainment, interactive services, and personalized viewing experiences are provided.

The Russian smart TV market is backed by government initiatives that not only encourage the local production of electronics but also substitute imports. Among the measures implemented are grants that can cover as much as 30% of the equipment cost, preferential loans via industrial funds, easy import conditions until 2026, and the long-term programs aimed at 70% of the electronics being locally produced that are indirectly supporting Smart TV manufacturing and distribution.

Developments in the Russia Smart TV Market Size that took place recently, about domestic brands taking 40% of the sales by using AI and local services integration (May 2025), and the share of Smart TV going beyond 90% of total TV sales (H1 2025), have emphasized the growth of technology and the ecosystem. Opportunities in the future will be found in AI features, better displays, and smart home integration as the consumer demand for sophisticated connected entertainment is on the rise.

Report Coverage

This research report categorizes the market for the Russia Smart TV Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia Smart TV Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia Smart TV Market Size.

Russia Smart TV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 6.58 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.07% |

| 2035 Value Projection: | 25.41 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Resolution Type, By Distribution |

| Companies covered:: | Dexp, Sber, Yandex, Hartens, Novex, RAZZ, VITYAZ, ROLS, Erisson, General Satellite / GS Group, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The smart TV market in Russia is driven by the growing interest in digital entertainment, the spread of high-speed internet, and the increasing use of OTT streaming services. On the other hand, the Government's backing of the domestic electronics sector, the import substitution strategy, and the promotion of local smart TV brands are the factors that have made the market even bigger. Besides, the trends of urbanization, the rise of people's incomes, and the fact that consumers are preferring larger screens with advanced features such as 4K, voice control, and smart connectivity are all factors that are contributing to the fast adoption of smart TVs in households.

Restraining Factors

The smart TV market in Russia is mostly constrained by the high cost of products, supply chain disruptions caused by sanctions, the shortage of sophisticated components, currency instability, and the decline of buying power among the so-called price-sensitive consumers, which, in turn, has resulted in slow overall market adoption.

Market Segmentation

The Russia Smart TV Market Size share is classified into resolution type and distribution channel.

- The 4K UHD TV segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Smart TV Market Size is segmented by resolution type into 4K UHD TV, HDTV, Full HD TV, and 8K TV. Among these, the 4K UHD TV segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Larger screens with higher resolution are becoming more and more popular among consumers for home entertainment, gaming, and streaming. 4K UHD TVs are becoming the most popular option among Russian families due to increased availability of 4K content on OTT platforms, falling 4K panel prices, and robust choices from both domestic and foreign companies.

- The offline segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Smart TV Market Size is segmented by distribution channel into online and offline. Among these, the offline segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Consumer preferences for in-store product demonstrations, brand trust, post-purchase assistance, simple financing choices, and the widespread availability of high-end smart TV models through major electronics retail chains are the main factors driving this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Smart TV Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dexp

- Sber

- Yandex

- Hartens

- Novex

- RAZZ

- VITYAZ

- ROLS

- Erisson

- General Satellite / GS Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Rostelecom transferred the production of its Wink Box Mini TV set-top boxes to Russia, thus increasing the output of localized smart TV hardware to a certain extent.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia Smart TV Market Size based on the below-mentioned segments:

Russia Smart TV Market Size, By Resolution Type

- 4K UHD TV

- HDTV

- Full HD TV

- 8K TV

Russia Smart TV Market Size, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

What is the Russia Smart TV Market Size?Russia Smart TV Market Size is expected to grow from USD 6.58 billion in 2024 to USD 25.41 billion by 2035, growing at a CAGR of 13.07% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by growing interest in digital entertainment, the spread of high-speed internet, and the increasing use of OTT streaming services. On the other hand, the government's backing of the domestic electronics sector, the import substitution strategy, and the promotion of local smart TV brands are the factors that have made the market even bigger.

-

What factors restrain the Russia Smart TV Market Size?Constraints include the high cost of products, supply chain disruptions caused by sanctions, the shortage of sophisticated components, currency instability, and the decline of buying power among the so-called price-sensitive consumers, which, in turn, has resulted in slow overall market adoption.

-

How is the market segmented by resolution type?The market is segmented into 4K UHD TV, HDTV, Full HD TV, and 8K TV.

-

Who are the key players in the Russia Smart TV Market Size?Key companies include Dexp, Sber, Yandex, Hartens, Novex, RAZZ, VITYAZ, ROLS, Erisson, General Satellite / GS Group, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?