Russia Sealants Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Epoxy, Polyurethane, and Silicone), By End Use (Aerospace, Automotive, Building and Construction, and Healthcare), and Russia Sealants Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsRussia Sealants Market Insights Forecasts to 2035

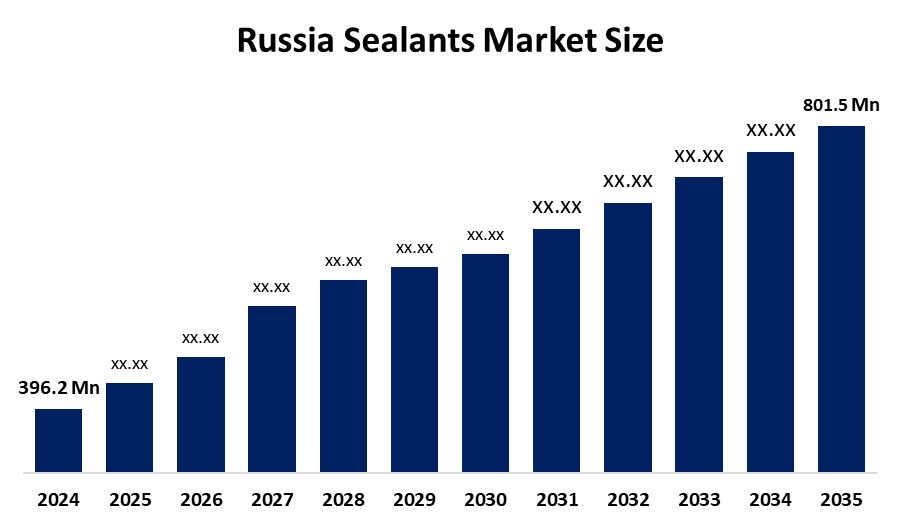

- The Russia Sealants Market Size Was Estimated at USD 396.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.61% from 2025 to 2035

- The Russia Sealants Market Size is Expected to Reach USD 801.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Sealants Market Size is anticipated to reach USD 801.5 Million by 2035, Growing at a CAGR of 6.61% from 2025 to 2035. The sealants market in Russia is driven by the growing building and infrastructure projects, an increase in automobile and industrial manufacturing, an increase in restoration activities, and a growing need for long-lasting, weather-resistant, and high-performing sealing solutions

Market Overview

The Russia sealants market covers the whole range from production to the very end of application of sealing materials, which are to block the passage of air, water, chemicals, and dust in the joints and gaps. The use of sealants is very common in construction, infrastructure, automotive, oil & gas, and industrial manufacturing sectors. Major applications consist of building facades, glazing, pipelines, machinery, and vehicle assembly; all these applications are fueled by infrastructure development, industrial activity, and the need for long-lasting, weather-resistant sealing solutions.

Government initiatives like large-scale infrastructure and housing investments indirectly support the Russia sealants market, as more than RUB 2 trillion have been allocated for construction projects in the country's main regions. The federal energy-efficiency building regulations alongside digital labeling schemes for construction materials not only help improve quality control but also promote the use of high-performance sealants in residential, commercial, and industrial applications

In the first quarter of the year 2025, TechnoNICOL introduced the import-substituting silicone-acrylic sealants master, which are produced domestically using 85% Russian raw materials, and they provide better UV resistance and are less expensive. Russian manufacturers such as Germet. Pro is increasing its production capabilities. Prospects involve eco-friendly formulations, low-VOC sealants, and specific industrial and automotive applications adapted to local climatic conditions.

Report Coverage

This research report categorizes the market for the Russia sealants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia sealants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia sealants market.

Russia Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 396.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.61% |

| 2035 Value Projection: | USD 801.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Resin |

| Companies covered:: | RUSTA LLC, Scientific-Production Firm “Adhesiv.”, Temonten Group of Companies, Mastersil (Hermetik Center), Sealing Materials Plant LLC, Hermetex, Germoizol, Aquatron Plant, LLC “Zavod Promyshlennykh Germetikov.”, SANZ Russia, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sealants market in Russia is driven by the construction and infrastructure projects getting bigger and multiplying, the involvement of renovation and remodeling activities going up, and the automotive and industrial sectors increasing their demand for sealants. Furthermore, the harshness of Russia's climate makes the need for long-lasting, weather-resistant, and energy-efficient sealing solutions more pressing, and it is the main factor of the market growth. On top of that, the major shift towards the green, high-performance, and specialty sealants is made possible by the technological breakthroughs that have taken place hence the adoption across residential, commercial, and industrial applications is being accelerated too.

Restraining Factors

The sealants market in Russia is mostly constrained by the uncertainty in the Russian economy, fluctuating prices of raw materials, dependency upon imports for advanced formulas and finished goods being disrupted by the supply chain, and strict environmental and regulatory standards resulting in increased production and compliance costs

Market Segmentation

The Russia sealants market share is classified into resin and end use.

- The silicone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia sealants market is segmented by resin into acrylic, epoxy, polyurethane, and silicone. Among these, the silicone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its exceptional flexibility, robust adhesion, resilience to weather and temperature, and durability, it is extensively utilized in industrial, automotive, and construction applications, particularly in Russia's severe climate.

- The building and construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia sealants market is segmented by end use into aerospace, automotive, building and construction, and healthcare. Among these, the building and construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the continuous building of homes and businesses, renovations, and infrastructure improvements, as well as the strong need for long-lasting sealants that are appropriate for Russia's harsh climate.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia sealants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RUSTA LLC

- Scientific-Production Firm “Adhesiv.”

- Temonten Group of Companies

- Mastersil (Hermetik Center)

- Sealing Materials Plant LLC

- Hermetex

- Germoizol

- Aquatron Plant

- LLC “Zavod Promyshlennykh Germetikov.”

- SANZ Russia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In December 2025, the enforcement of mandatory marking for sealants, putties, and similar materials was expanded to include all manufacturers and distributors. The ban on unmarked products is scheduled to take effect in May 2026.

• In October 2025, Russia introduced the Honest Sign system, mandating digital marking for sealants and related construction materials. This regulation requires full traceability and compliance monitoring for all sealants sold in the country.

• In December 2024, new digital marking regulations for building materials, including sealants, began affecting supply chains and pricing structures.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia sealants market based on the below-mentioned segments:

Russia Sealants Market, By Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

Russia Sealants Market, By End Use

- Aerospace

- Automotive

- Building and Construction

- Healthcare

Frequently Asked Questions (FAQ)

-

What is the Russia sealants market size?Russia sealants market size is expected to grow from USD 396.2 million in 2024 to USD 801.5 million by 2035, growing at a CAGR of 6.61% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by construction and infrastructure projects getting bigger and multiplying, the involvement of renovation and remodeling activities going up, and the automotive and industrial sectors increasing their demand for sealants. Furthermore, the harshness of Russia's climate makes the need for long-lasting, weather-resistant, and energy-efficient sealing solutions more pressing, and it is the main factor of the market growth.

-

What factors restrain the Russia sealants market?Constraints include the uncertainty in the Russian economy, fluctuating prices of raw materials, dependency upon imports for advanced formulas and finished goods being disrupted by the supply chain, and strict environmental and regulatory standards resulting in increased production and compliance costs

-

How is the market segmented by end use?The market is segmented into aerospace, automotive, building and construction, and healthcare.

-

Who are the key players in the Russia sealants market?Key companies include RUSTA LLC, Scientific-Production Firm “Adhesiv”, Temonten Group of Companies, Mastersil (Hermetik Center), Sealing Materials Plant LLC, Hermetex, Germoizol, Aquatron Plant, LLC “Zavod Promyshlennykh Germetikov”, SANZ Russia, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?