Russia Refined Cane Sugar Market Size, Share, and COVID-19 Impact Analysis, By Product (Refined White Sugar, Liquid Sugar, and Specialty Sugars), By Application (Beverages, Bakery, and Industrial), and Russia Refined Cane Sugar Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Refined Cane Sugar Market Size Insights Forecasts to 2035

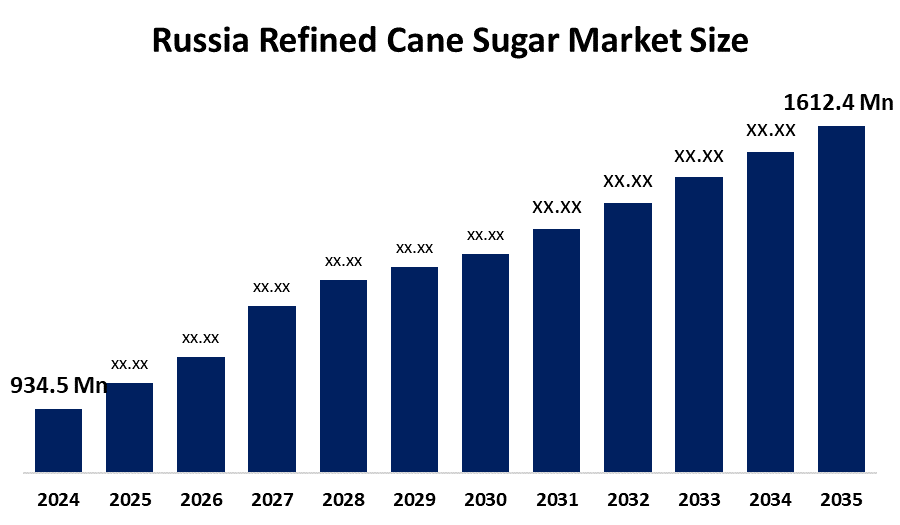

- The Russia Refined Cane Sugar Market Size Was Estimated at USD 934.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.08% from 2025 to 2035

- The Russia Refined Cane Sugar Market Size is Expected to Reach USD 1612.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Russia Refined Cane Sugar Market Size is anticipated to Reach USD 1612.4 Million by 2035, Growing at a CAGR of 5.08% from 2025 to 2035. The refined cane sugar market in Russia is driven by rising food and beverage consumption, expanding bakery and confectionery demand, urbanization, shifting dietary choices, steady imports, and growing food processing businesses across the country.

Market Overview

The market of Russia for the refined cane sugar has to do with the manufacturing, importing, refining, and distributing of sugar that is of high quality and is from sugarcane for local use and industrial purposes. It is a part of the food and drink industry, baking and candy making, dairy goods, and even medicine and home use, where sweetness, quality, and dissolvability are the most important features.

The market for refined cane sugar in Russia is supported by government interventions that are focused on food security and price stability. Among these measures are import quotas for raw sugar, adjustable customs duties, low-interest loans, and financial assistance to producers. To illustrate, about 9 billion rubles were set aside to support sugar and essential food producers through price-stabilization programs.

Among the most recent developments in the refined cane sugar market in Russia are the installation of new packaging lines, for instance, Prodimex's investment of approximately 240 million rubles for the retail sugar output of 1 kg and 5 kg, which has been creating efficiency in supply. The local manufacturers are upgrading their facilities and increasing their output in order to compete with exports. The planned investments in the factory upgrades (about 1.7 billion rubles) will improve the technology used in processing. The future holds potential in diversifying the product range (for example, brown and liquid sugar) and improving automation that would cater to the increasing demand.

Coverage

This research report categorizes the market for the Russia refined cane sugar market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia refined cane sugar market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia refined cane sugar market.

Russia Refined Cane Sugar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 934.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.08% |

| 2035 Value Projection: | USD 1612.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Prodimex Group, Rusagro Group, Dominant Group, Sucden, Agrocomplex, LLC Bekovsky Sugar Plant, LLC Logistic Soft, OAO Balashovsky Sugar Kombinat, Novgorod Grain Enterprise No. 28, Zainsky Sugar Plant, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The refined cane sugar market in Russia is driven by the food and beverage industry's increasing demand, particularly in the bakery, confectionery, and dairy sectors, and the main drivers of the market are consumers' awareness of premium and quality sugar, urbanization, and an increase. They consume more and more. Meanwhile, the consumption of stable imports, growing food processing industries, and changing lifestyles adopting refined sugar is also driving the market growth, thus refined cane sugar has become one of the important ingredients of the Russian food industry.

Restraining Factors

The refined cane sugar market in Russia is mostly constrained by the health concerns regarding sugar consumption, government regulations on sugar intake, competition from alternative sweeteners, price volatility of raw sugar, and fluctuations in import dependency affecting supply stability.

Market Segmentation

The Russia refined cane sugar market share is classified into product and application.

- The refined white sugar segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia refined cane sugar market is segmented by product into refined white sugar, liquid sugar, and specialty sugars. Among these, the refined white sugar segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its widespread use in homes, food processing, baking, confectionery, and beverage industries, the refined white sugar segment leads the Russian refined cane sugar market. It is the best option for industrial applications due to its high purity, constant sweetness, and adaptability.

- The bakery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia refined cane sugar market is segmented by application into beverages, bakery, and industrial. Among these, the bakery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because baked goods' texture, sweetness, and shelf life all depend on premium refined sugar. Urbanization, the growing foodservice sector, and rising consumer demand for packaged bakery goods all contribute to this segment's robust market share and projected expansion over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia refined cane sugar market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Prodimex Group

- Rusagro Group

- Dominant Group

- Sucden

- Agrocomplex

- LLC Bekovsky Sugar Plant

- LLC Logistic Soft

- OAO Balashovsky Sugar Kombinat

- Novgorod Grain Enterprise No. 28

- Zainsky Sugar Plant

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia refined cane sugar market based on the below-mentioned segments:

Russia Refined Cane Sugar Market, By Product

- Refined White Sugar

- Liquid Sugar

- Specialty Sugars

Russia Refined Cane Sugar Market, By Application

- Beverages

- Bakery

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the Russia refined cane sugar market size?A: Russia refined cane sugar market size is expected to grow from USD 934.5 million in 2024 to USD 1612.4 million by 2035, growing at a CAGR of 5.08% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the food and beverage industry's increasing demand, particularly in the bakery, confectionery, and dairy sectors, and the main drivers of the market are consumers' awareness of premium and quality sugar, urbanization, and an increase. They consume more and more.

-

Q: What factors restrain the Russia refined cane sugar market?A: Constraints include the health concerns regarding sugar consumption, government regulations on sugar intake, competition from alternative sweeteners, price volatility of raw sugar, and fluctuations in import dependency affecting supply stability.

-

Q: How is the market segmented by product?A: The market is segmented into refined white sugar, liquid sugar, and specialty sugars.

-

Q: Who are the key players in the Russia refined cane sugar market?A: Key companies include Prodimex Group, Rusagro Group, Dominant Group, Sucden, Agrocomplex, LLC, Bekovsky Sugar Plant, LLC, Logistic Soft, OAO Balashovsky Sugar Kombinat, Novgorod Grain Enterprise No. 28, Zainsky Sugar Plant, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?