Russia Pumps Market Size, Share, and COVID-19 Impact Analysis, By Type (Centrifugal, and Positive Displacement), By End Use (Agriculture, Water & Wastewater, Oil & Gas, Mining, Infrastructure Application (HDD), and Others), and Russia Pumps Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentRussia Pumps Market Insights Forecasts to 2035

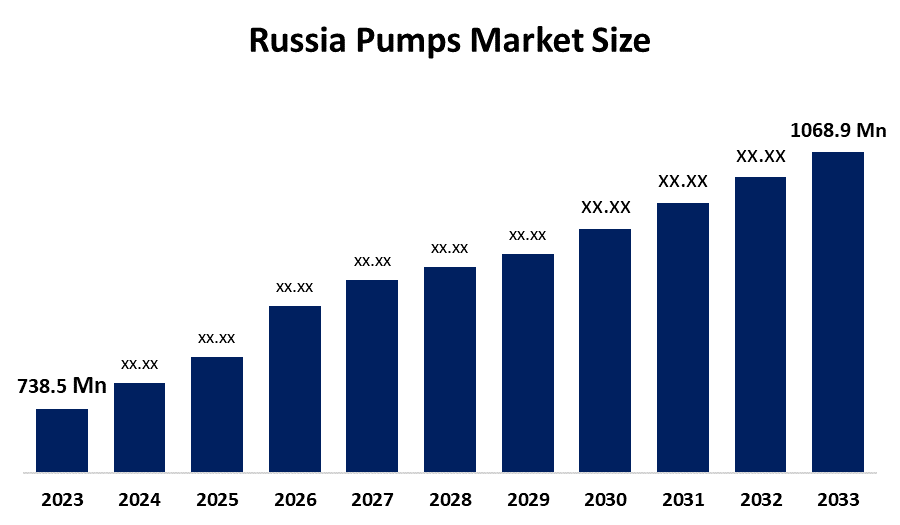

- The Russia Pumps Market Size Was Estimated at USD 738.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.42% from 2025 to 2035

- The Russia Pumps Market Size is Expected to Reach USD 1068.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia Pumps Market Size Is Anticipated To Reach USD 1068.9 Million By 2035, Growing At A CAGR Of 3.42% From 2025 To 2035. The pumps market in Russia is driven by growing oil and gas operations, modernizing industrial infrastructure, increasing need for water and wastewater treatment, expansion of power generation projects, and rising investments in the manufacturing and construction sectors.

Market Overview

The Russia Pumps Market Size refers to the production, distribution and installation of mechanical devices which move fluids through industrial, commercial and residential environments. The pumps used in this system include centrifugal and positive displacement, and submersible types. The system supports fluid transfer and pressure management needs in various sectors, which include oil and gas operations, water and wastewater treatment, power generation, chemical processing, mining, construction, agriculture, irrigation and municipal infrastructure.

Russia supports the pumps market through industrial modernization and import substitution programs. The National Industrial Development Program (2024–2030) allocates over 1 trillion rubles for equipment upgrades. Manufacturers may receive subsidies covering 15–20% of costs. The "Water of Russia" program allocates about 70 billion rubles for infrastructure development, which results in increased demand for pumps.

The Russian Pump Market has experienced recent advancements through industrial and municipal customers who now use energy-efficient smart pump technologies. Domestic manufacturers are upgrading production lines to meet import substitution goals. The future brings opportunities through oil and gas expansion projects, water treatment facility upgrades, HVAC system improvements and rising needs for IoT-based predictive maintenance systems across multiple industries.

Report Coverage

This research report categorizes the market for the Russia pumps market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia pumps market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia pumps market.

Russia Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 738.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.42% |

| 2035 Value Projection: | USD 1068.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | HMS Group UNIPUMP Dzhileks Belamos LGM Livnynasos Jeteks ENA TulaHydroMash Agrovodcom Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pumps market in Russia is driven by the because oil and gas exploration activities, water infrastructure development and industrial plant upgrades all require pump systems. The need for dependable fluid transfer systems increases because power plants, mining operations and chemical production facilities all require these systems. The industrial and municipal markets continue to grow because the government supports import substitution programs, and organizations adopt energy-efficient smart pump technology.

Restraining Factors

The pumps market in Russia is mostly constrained by access to foreign technologies, high capital expenses, supply chain problems, currency fluctuations, and prolonged industrial project approval processes, all of which combine to prevent modernization efforts and large infrastructure projects in Russia.

Market Segmentation

The Russia pumps market share is classified into type and end use.

- The centrifugal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Pumps Market Size is segmented by type into centrifugal, and positive displacement. Among these, the centrifugal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because they are widely used in industrial processing, electricity generation, water and wastewater treatment, and oil and gas. Because they are more reliable and require less maintenance, centrifugal pumps are the recommended option for handling high volumes of fluids. Compared to positive displacement pumps, their adaptability across a variety of high-demand industries generates better revenue.

- The oil & gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Pumps Market Size is segmented by end use into agriculture, water & wastewater, oil & gas, mining, infrastructure application (HDD), and others. Among these, the oil & gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is mostly because Russia engages in a wide range of upstream and midstream industries, such as refinery operations, pipeline transportation, and crude extraction, all of which call for powerful pumping systems. When compared to other end-use sectors, this one has the biggest revenue share due to the substantial demand created by high fluid handling volumes, ongoing operations, and infrastructure expansion projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia pumps market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HMS Group

- UNIPUMP

- Dzhileks

- Belamos

- LGM

- Livnynasos

- Jeteks

- ENA

- TulaHydroMash

- Agrovodcom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, with more than 190 exhibitors and 5,000+ participants, the PCV Expo 2025 industrial event showcased the newest pump technologies and solutions in Moscow from October 21–23.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia pumps market based on the below-mentioned segments:

Russia Pumps Market, By Type

- Centrifugal

- Positive Displacement

Russia Pumps Market, By End Use

- Agriculture

- Water & Wastewater

- Oil & Gas

- Mining

- Infrastructure Application (HDD)

- Others

Frequently Asked Questions (FAQ)

-

What is the Russia pumps market size?Russia pumps market size is expected to grow from USD 738.5 million in 2024 to USD 1068.9 million by 2035, growing at a CAGR of 3.42% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by oil and gas exploration activities, water infrastructure development and industrial plant upgrades, all of which require pump systems. The need for dependable fluid transfer systems increases because power plants, mining operations and chemical production facilities all require these systems.

-

What factors restrain the Russia pumps market?Constraints include access to foreign technologies, high capital expenses, supply chain problems, currency fluctuations, and prolonged industrial project approval processes

-

How is the market segmented by type?The market is segmented into centrifugal, and positive displacement.

-

Who are the key players in the Russia pumps market?Key companies include HMS Group, UNIPUMP, Dzhileks, Belamos, LGM, Livnynasos, Jeteks, ENA, TulaHydroMash, Agrovodcom, and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?