Russia Premium Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product (Still Water, Sparkling Water, Functional & Mineral-enhanced Water, and Flavored Premium Water), By Packaging (Glass Bottles, Plastic Bottles, and Aluminium Cans) and Russia Premium Bottled Water Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Premium Bottled Water Market Insights Forecasts to 2035

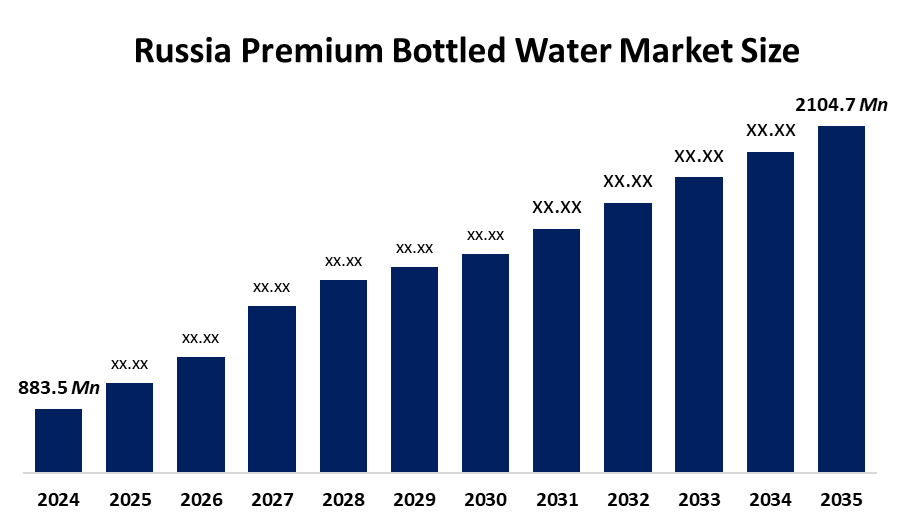

- The Russia Premium Bottled Water Market Size Was Estimated at USD 883.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.21% from 2025 to 2035

- The Russia Premium Bottled Water Market Size is Expected to Reach USD 2104.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia premium Bottled Water Market Size is anticipated to reach USD 2104.7 Million by 2035, Growing at a CAGR of 8.21% from 2025 to 2035. The premium bottled water market in Russia is driven by rising health consciousness, an expanding urban population, rising disposable incomes, a taste for natural and high-end products, changes in lifestyle, and emerging trends in on-the-go consumption, hospitality, and tourism.

Market Overview

The Russia premium bottled water market refers to the production and sale of high-quality bottled water sourced from natural springs, artesian wells, or purified sources, which includes enhanced mineral content. The product markets itself as an essential health product that fits into modern lifestyle needs. The product is used in various settings which include homes, hotels, restaurants, cafés, corporate offices, travel and tourism, fitness centers, healthcare facilities, and premium retail outlets that require safe and pure hydration solutions with added value.

The Russian government supports the premium bottled water market through industry recognition and financial aid programs. The bottled water market generated approximately RUB 663.8 billion in sales during 2024. Small and medium-sized enterprises can obtain special loans which reach RUB 5 million at an interest rate of approximately 5.6% to fund their production expansion and quality improvements and compete with domestic brands.

Russian bottled water production grew strongly in 2024 because the industry achieved its highest output yet while developing new export markets. Domestic brands like Aqua Holding entered new markets by launching premium mineral water products in India. Companies create new business opportunities through their development of sustainable packaging solutions and their production of functional water products which will help them reach international markets.

Report Coverage

This research report categorizes the market for the Russia premium bottled water market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia premium bottled water market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia premium bottled water market.

Russia Premium Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 883.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.21% |

| 2035 Value Projection: | USD 2104.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Aqua Holding Company, Jevea Rus, LLC, Ochakovo, Aqua-Vait UMWBP LLC, JSC Istok, Aqua-Don Limited Company, Mineral Water Factory, Kings Water LLC, Demidov Water, Shishkin Les, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The premium bottled water market in Russia is driven by the increasing health awareness, rising demand for safe mineral-rich drinking water, and growing disposable incomes. Urbanization together with changing lifestyles and consumer preference for natural and functional beverages all contribute to market expansion. The hotel and café and fitness center industries together with premium branding and eco-friendly packaging and tourism growth create rising demand for products in residential and commercial markets.

Restraining Factors

The premium bottled water market in Russia is mostly constrained by the high production costs and logistical expenses and the need to comply with strict regulations and the price sensitivity of customers. Environmental concerns about plastic packaging and the availability of filtered tap water and economic instability all serve as barriers to market growth.

Market Segmentation

The Russia premium bottled water market share is classified into product and packaging.

- The still water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia premium bottled water market is segmented by product into still water, sparkling water, functional & mineral-enhanced water, and flavored premium water. Among these, the still water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its broad availability across retail and hospitality channels, high perception as a healthy and pure hydration alternative, affordability when compared to flavored or functional versions, and widespread daily usage all contribute to its high-volume sales and consistent growth.

- The plastic bottles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia premium bottled water market is segmented by packaging into glass bottles, plastic bottles, and aluminium cans. Among these, the plastic bottles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because they are inexpensive, lightweight, convenient, and widely available through a variety of retail outlets. Its dominant market position and growing momentum are further supported by strong customer preferences for on-the-go consumption and effective distribution logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia premium bottled water market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aqua Holding Company

- Jevea Rus, LLC

- Ochakovo

- Aqua-Vait UMWBP LLC

- JSC Istok

- Aqua-Don Limited Company

- Mineral Water Factory

- Kings Water LLC

- Demidov Water

- Shishkin Les

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Aqua Holding Company created Gorji Vita, which exports premium Russian Caucasus Mountain water to India.

- In January 2025, AFK Sistema invested around RUB 500 million and planned expanded manufacturing capacity to increase production and sales of bottled mineral water.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia premium bottled water market based on the below-mentioned segments:

Russia Premium Bottled Water Market, By Product

- Still Water

- Sparkling Water

- Functional & Mineral-enhanced Water

- Flavored Premium Water

Russia Premium Bottled Water Market, By Packaging

- Glass Bottles

- Plastic Bottles

- Aluminium Cans

Frequently Asked Questions (FAQ)

-

What is the Russia premium bottled water market size?Russia premium bottled water market size is expected to grow from USD 883.5 million in 2024 to USD 2104.7 million by 2035, growing at a CAGR of 8.21% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by increasing health awareness, rising demand for safe mineral-rich drinking water, and growing disposable incomes.

-

What factors restrain the Russia premium bottled water market?Constraints include the high production costs and logistical expenses and the need to comply with strict regulations.

-

How is the market segmented by product?The market is segmented into still water, sparkling water, functional & mineral-enhanced water, and flavored premium water

-

Who are the key players in the Russia premium bottled water market?Key companies include Aqua Holding Company, Jevea Rus, LLC, Ochakovo, Aqua-Vait UMWBP LLC, JSC Istok, Aqua-Don Limited Company, Mineral Water Factory, Kings Water LLC, Demidov Water, Shishkin Les, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?