Russia Power Transmission & Distribution Market Size, Share, and COVID-19 Impact Analysis, By Asset Type (Transmission Line, and Distribution Line), By End Use (Renewables, Electric Utility, and Industrial), and Russia Power Transmission & Distribution Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerRussia Power Transmission & Distribution Market Insights Forecasts to 2035

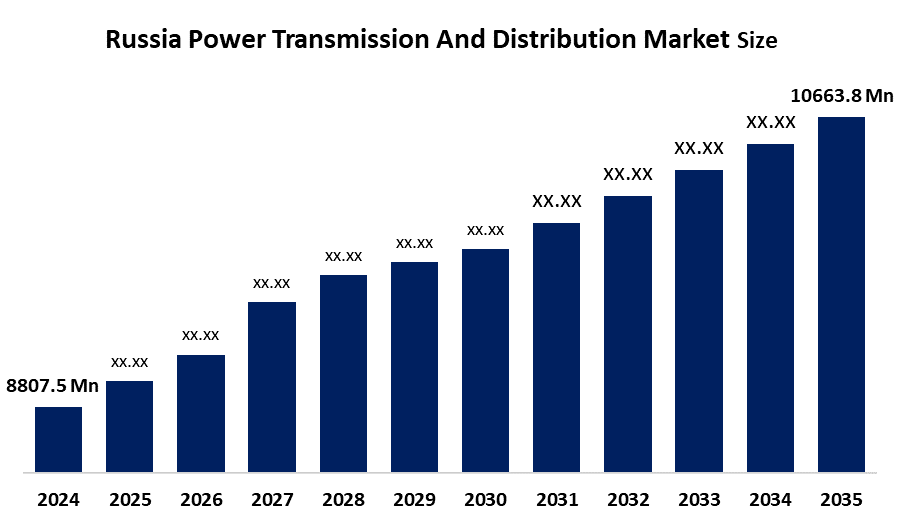

- The Russia Power Transmission & Distribution Market Size Was Estimated at USD 8807.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.75% from 2025 to 2035

- The Russia Power Transmission & Distribution Market Size is Expected to Reach USD 10663.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia power transmission & distribution market size is anticipated to reach USD 10663.8 Million by 2035, Growing at a CAGR of 1.75% from 2025 to 2035. The power transmission & distribution market in Russia is driven by increased demand for electricity, grid modernization programs, the integration of renewable energy sources, government infrastructure investments, the implementation of smart grids, and the nation's growing industrial and urban electrification.

Market Overview

The Russia power transmission and distribution market and it includes the infrastructure, equipment, and technologies for reliable and efficient electricity transmission from generation plants to the final consumers. The market consists of the high-voltage transmission network, substations, transformers, and distribution systems. The applications cover rural and urban electrification, the supply of power to industries, integration of renewable energies, the deployment of smart grids, and the carrying out of utility operations, which in turn, ensure stable energy delivery, minimize losses, and support the overall electricity demand growth that has already taken place in various sectors throughout the country.

The government has initiated grid modernization programs, which have a great impact on the Russia electric power transmission and distribution market. These programs have a budget of more than USD 25 billion that will be used to improve the power lines and substations. Dividends from state utility companies will be reinvested, smart grid projects will be implemented, renewable energy sources will be connected to the grid, and pro-investment in the long-term infrastructure reforms for reliability and efficiency will be the policy of the day.

The digitalization of the power grid, along with the integration of renewables, has become the new target of investments. Russian firms, including Rosseti, are pursuing digital substations, smart grid monitoring, and automated distribution systems in an attempt to enhance reliability and efficiency. Among the possibilities for the future are the extensive renewal of deteriorating networks, the enlargement of smart metering, and the deployment of advanced technologies for managing power systems in both industrial and regional applications.

Report Coverage

This research report categorizes the market for the Russia power transmission & distribution market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia power transmission & distribution market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia power transmission & distribution market.

Russia Power Transmission & Distribution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8807.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 1.75% |

| 2035 Value Projection: | USD 10663.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | PAO Rosseti, Federal Grid Company of Unified Energy System, JSC IDGC Holding / Interregional Distribution Grid Companies, Rosseti Centre and Volga Region, Rosseti North-West, Rosseti Tyumen, Rosseti Siberia, Rosseti Lenenergo, JSC Inter RAO UES, RusHydro PJSC, Others, and Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The power transmission & distribution market in Russia is driven by the electricity requirements from industries and cities, government funds for power projects, and the replacement of outdated power lines with modern ones. The continuous growth of the market and the upgrading of the transmission systems are also due to the increasing use of renewable energy sources, the adoption of the smart grid and digital technologies, the reliability standards for the grids, and the need to minimize the losses through transmission in the large and diverse geographical areas.

Restraining Factors

The power transmission & distribution market in Russia is mostly constrained by the high costs of investment and maintenance, the large size of the area, making the projects more complicated, the government regulations, the lengthy process of gaining approvals, and the very little participation of private investors in the large-scale modernization of the grid.

Market Segmentation

The Russia power transmission & distribution market share is classified into asset type and end use.

- The transmission line segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia power transmission & distribution market is segmented by asset type into transmission line, and distribution line. Among these, the transmission line segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of Russia's large geographic size and the requirement for long-distance power transfer between generation sites and consumption centers, the transmission line segment dominates the country's power transmission and distribution industry. Higher capital spending is driven by major investments in high-voltage and ultra-high-voltage lines, grid expansion projects, renewable integration, and cross-regional connectivity.

- The electric utility segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia power transmission & distribution market is segmented by end use into renewables, electric utility, and industrial. Among these, the electric utility segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. In order to fulfill the growing demand for electricity in the country, state-owned utilities have made significant investments in grid modernization, transmission and distribution network extension, reliability enhancements, and the integration of new power generation capacity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia power transmission & distribution market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PAO Rosseti

- Federal Grid Company of Unified Energy System

- JSC IDGC Holding / Interregional Distribution Grid Companies

- Rosseti Centre and Volga Region

- Rosseti North-West

- Rosseti Tyumen

- Rosseti Siberia

- Rosseti Lenenergo

- JSC Inter RAO UES

- RusHydro PJSC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, the Russian government plans to allocate dividends from the state-operated electricity firms, such as Rosseti and RusHydro, to the supporting industry funds for grid upgrades and infrastructure investment.

- In October 2025, during the Russian Energy Week, Rosseti introduced the provision of an easier grid connection process and new digital client services for access to the power network.

- In February 2025, Rosseti Lenenergo renovated its 110 kV Annino substation, thus making the Lomonosov district's supply more reliable; at the same time, Rosseti expanded the power lines and substations for the mining companies' energy demands.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia power transmission & distribution market based on the below-mentioned segments:

Russia Power Transmission & Distribution Market, By Asset Type

- Transmission Line

- Distribution Line

Russia Power Transmission & Distribution Market, By End Use

- Renewables

- Electric Utility

- Industrial

Frequently Asked Questions (FAQ)

-

Q:What is the Russia power transmission & distribution market size?A:Russia power transmission & distribution market size is expected to grow from USD 8807.5 million in 2024 to USD 10663.8 million by 2035, growing at a CAGR of 1.75% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by electricity requirements from industries and cities, government funds for power projects, and the replacement of outdated power lines with modern ones.

-

Q:What factors restrain the Russia power transmission & distribution market?A:Constraints include the high costs of investment and maintenance, the large size of the area, making the projects more complicated, and the government regulations.

-

Q:How is the market segmented by asset type?A:The market is segmented into transmission line, and distribution line.

-

Q:Who are the key players in the Russia power transmission & distribution market?A:Key companies include PAO Rosseti, Federal Grid Company of Unified Energy System, JSC IDGC Holding / Interregional Distribution Grid Companies, Rosseti Centre and Volga Region, Rosseti North-West, Rosseti Tyumen, Rosseti Siberia, Rosseti Lenenergo, JSC Inter RAO UES, RusHydro PJSC, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?