Russia Polyvinyl Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Grade (Partially Hydrolyzed, Fully Hydrolyzed, Low Foaming Grades, Sub-Partially Hydrolyzed, and Others), By End Use (Paper, Food Packaging, Construction, Electronics, and Others), and Russia Polyvinyl Alcohol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsRussia Polyvinyl Alcohol Market Insights Forecasts to 2035

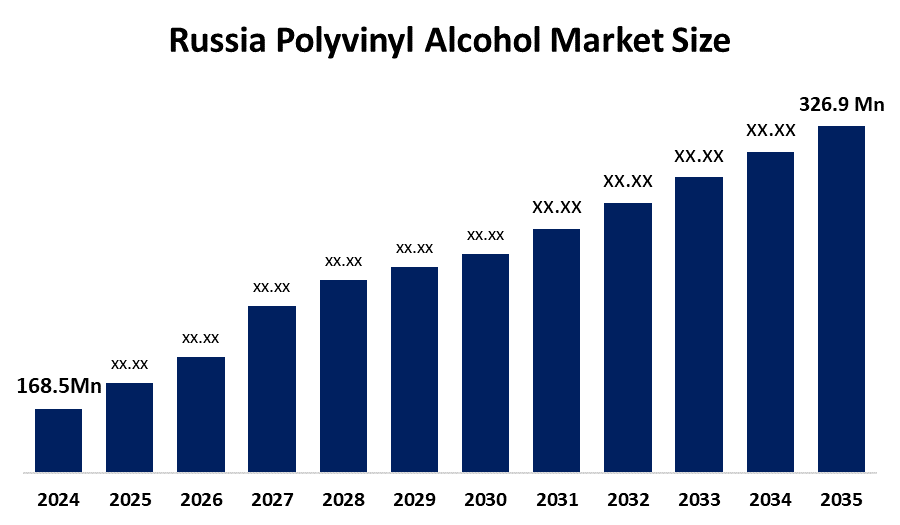

- The Russia Polyvinyl Alcohol Market Size Was Estimated at USD 168.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.21% from 2025 to 2035

- The Russia Polyvinyl Alcohol Market Size is Expected to Reach USD 326.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Polyvinyl Alcohol Market Size is anticipated to reach USD 326.9 million by 2035, growing at a CAGR of 6.21% from 2025 to 2035. The polyvinyl alcohol market in Russia is driven by the packaging, construction, textile, paper, and adhesives sectors, with increased demand, as well as its growing use in water-soluble films, domestic production expansion, and expanding uses in sustainable and biodegradable materials.

Market Overview

The Russia Polyvinyl Alcohol [PVA] Market Size refers to the production, distribution, and consumption of Polyvinyl alcohol, a water-soluble synthetic polymer that people use throughout different industrial applications. In Russia, PVA is applied in adhesives, paper coating, textile sizing, construction additives, packaging films, and emulsion polymerization. The material serves as a binding agent and film-forming agent for use in pharmaceutical and cosmetic products, which enables business expansion in manufacturing and packaging and infrastructure development.

The Russia Polyvinyl Alcohol Market Size in its current state receives advantages from government support through the national project New Materials and Chemistry, which will continue until 2030 to promote import replacement and local manufacturing. The plastic processing sector received more than RUB 9 billion in financial support through special loan programs and grant funding in 2024. Chemical manufacturers receive three types of incentives, which include low-interest financing, tax benefits and partial reimbursement of modernization costs.

Recent developments in the Russia Polyvinyl Alcohol Market Size include local manufacturers expanding production capacity and introducing higher-grade PVA grades for packaging and textile applications. Companies develop better production methods through established partnerships with end-users who require specialized solutions. The upcoming market potential exists through water-soluble films and biodegradable products, together with construction additives and speciality industrial applications, which sustainability trends drive.

Report Coverage

This research report categorizes the market for the Russia Polyvinyl Alcohol Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia polyvinyl alcohol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia polyvinyl alcohol market.

Russia Polyvinyl Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 168.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.21% |

| 2035 Value Projection: | USD 326.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Grade , By End Use |

| Companies covered:: | PVSKhIM, NefteKhim-Innovatsii, TransChem Ltd., Chemistry and Textiles LLC, First Ural Chemical Company, RusChemicals Group, SIBUR, Nizhnekamskneftekhim, Gazprom Neftekhim Salavat, OOO Irksnabservice, and other key players. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The Russia Polyvinyl Alcohol Market Size is driven by the rising demand for water-soluble and biodegradable films. The market growth results from higher construction sector demand for cement and mortar additives and the growing use of polyvinyl alcohol in textile and paper processing applications. The domestic manufacturing sector benefits from import substitution policies, which create additional market opportunities. The market continues to grow because of demand from adhesives and detergents, pharmaceuticals and speciality industrial applications.

Restraining Factors

The Russia Polyvinyl Alcohol Market Size is mostly constrained by the stem from its need to rely on imported raw materials, the unpredictable nature of feedstock prices, its restricted domestic production capabilities and the impact of currency value changes.

Market Segmentation

The Russia Polyvinyl Alcohol Market share is classified into grade and end use.

- The partially hydrolyzed segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Polyvinyl Alcohol Market Size is segmented by grade into partially hydrolyzed, fully hydrolyzed, low foaming grades, sub-partially hydrolyzed, and others. Among these, the partially hydrolyzed segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its strong adhesive performance, outstanding film-forming qualities, and great solubility in cold water are the reasons for its domination. It is highly favoured in Russia's packaging, construction, and textile industries due to its extensive use in packaging films, textile sizing, paper coating, and emulsion polymerization applications.

- The construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Polyvinyl Alcohol Market Size is segmented by end use into paper, food packaging, construction, electronics, and others. Among these, the construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The existing construction activities throughout Russia result in the country being dominated by its current infrastructure development projects and residential building efforts. The construction materials industry depends on polyvinyl alcohol because it serves as a fundamental component for cement additives, tile adhesives, mortars and coatings due to its superior binding capacity, film development properties and water resistance ability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Polyvinyl Alcohol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PVSKhIM

- Neftekhim-Innovatsii

- TransChem Ltd.

- Chemistry and Textiles LLC

- First Ural Chemical Company

- RusChemicals Group

- SIBUR

- Nizhnekamskneftekhim

- Gazprom Neftekhim Salavat

- OOO Irksnabservice

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2026, as a result of increased regional demand, trade publications reported an increase in export inquiries for Russian-made polyvinyl alcohol grades in CIS markets.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia Polyvinyl Alcohol Market Size based on the below-mentioned segments:

Russia Polyvinyl Alcohol Market, By Grade

- Partially Hydrolyzed

- Fully Hydrolyzed

- Low Foaming Grades

- Sub-Partially Hydrolyzed

- Others

Russia Polyvinyl Alcohol Market, By End Use

- Paper

- Food Packaging

- Construction

- Electronics

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia polyvinyl alcohol market size?A: Russia polyvinyl alcohol market size is expected to grow from USD 168.5 million in 2024 to USD 326.9 million by 2035, growing at a CAGR of 6.21% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising demand for water-soluble and biodegradable films. The market growth results from higher construction sector demand for cement and mortar additives and the growing use of polyvinyl alcohol in textile and paper processing applications.

-

Q: What factors restrain the Russia polyvinyl alcohol market?A: Constraints include the stem from its need to rely on imported raw materials, the unpredictable nature of feedstock prices, its restricted domestic production capabilities and the impact of currency value changes.

-

Q: How is the market segmented by end use?A: The market is segmented into paper, food packaging, construction, electronics, and others.

-

Q: Who are the key players in the Russia polyvinyl alcohol market?A: Key companies include PVSKhIM, NefteKhim‑Innovatsii, TransChem Ltd., Chemistry and Textiles LLC, First Ural Chemical Company, Ruschemicals Group, Sibur, Nizhnekamskneftekhim, Gazprom Neftekhim Salavat, OOO Irksnabservice, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?