Russia Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Pet Type (Dog Food, Cat Food, and Others), By Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Others), and Russia Pet Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Pet Food Market Insights Forecasts to 2035

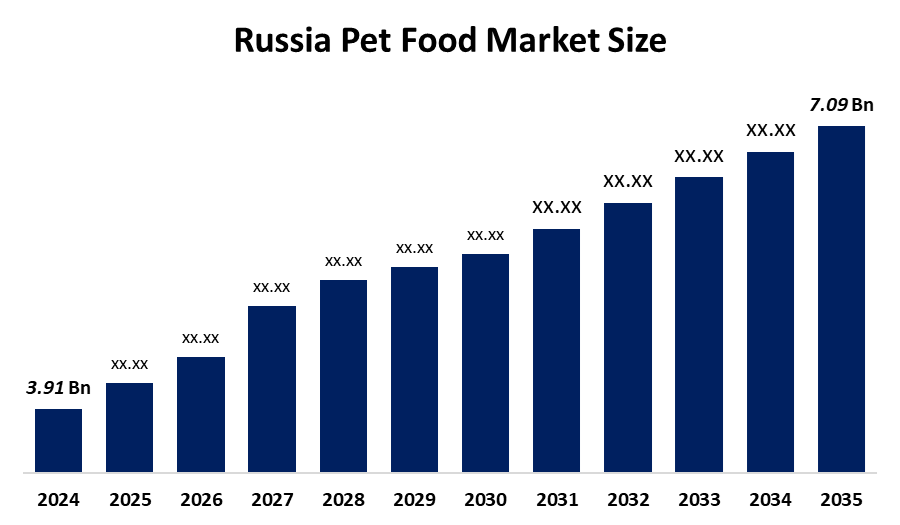

- The Russia Pet Food Market Size Was Estimated at USD 3.91 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.56% from 2025 to 2035

- The Russia Pet Food Market Size is Expected to Reach USD 7.09 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Pet Food Market Size is anticipated to reach USD 7.09 Billion by 2035, Growing at a CAGR of 5.56% from 2025 to 2035. The pet food market in Russia is driven by rising pet ownership, rising disposable incomes, increased pet health and nutrition knowledge, urbanization, and the growth of organized retail and e-commerce channels.

Market Overview

The pet food market in Russia is represented by the whole industry, starting from the manufacturing and continuing through the distribution and sales of food products that are designed for domestic pets like cats, dogs, birds, fish, and small mammals. The applications cover households, veterinary clinics, pet shops, and online stores, all of which respond to the trend of an increasing number of pets and the growing consumer awareness of proper pet nutrition and wellness.

The government support for domestic manufacturing and import substitution initiatives is the backbone of the pet food market in Russia, where 98% of pet food is produced locally (1.4 million tons in 2023). The adoption of mandatory labeling requirements (October 2024 for dry, March 2025 for wet food), along with quality control inspections carried out by the Russian Veterinary and Phytosanitary Inspection Agency (Rosselkhoznadzor) provide safety and transparency, thus increasing consumer trust and aiding the growth of the local industry.

Some of the most recent developments in the pet industry are the January 2025 merger of Balchug Capital and Raduga, which increased the production of high-quality pet food in the country, and the October 2024 decision of the government to require labels for all wet and dry pet food, which has made the market more transparent. The domestic production has also increased, as over 200 new brands went into the market in 2024. The future of the pet industry is in premium-rich nutrition, health-centric compositions, and local production of pet food to meet the demand created by the increase in pet ownership.

Report Coverage

This research report categorizes the market for the Russia pet food market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia pet food market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia pet food market.

Russia Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.91 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.56% |

| 2035 Value Projection: | USD 7.09 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Pet Type |

| Companies covered:: | PetKorm, • R-Trade, • Raduga LLC, • Aller Petfood, • AlphaPet, • Gatchina Feed Mill, • Limkorm, • TACC, • Miratorg, • ProBalance / Veles / Pet-Product LLC, and • Other Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pet food market in Russia is driven by the rising number of pets, bigger pet health and nutrition awareness, and higher disposable incomes, which mainly lead people to choose high-quality and specialty pet food. Besides, the urbanization trend, the opening up of organized retail and e-commerce channels, and the increase in demand for premium, organic, and functional pet food products are the major forces behind market growth. Also, the changing lifestyles and adopting pets’ human traits by the owners, meaning treating them as family members, are the significant factors highly contributing to the market’s growth

Restraining Factors

The pet food market in Russia is mostly constrained by the economic instability, high dependency on imports, raw material costs that go up and down, a lack of knowledge about specialized pet nutrition in small towns, and the strictness of regulatory requirements, which all together hinder the growth and acceptance of the market.

Market Segmentation

The Russia pet food market share is classified into pet type and distribution channel.

- The dog food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia pet food market is segmented by pet type into dog food, cat food, and others. Among these, the dog food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because dogs are the most common pets in Russia, and dog owners are increasingly choosing high-quality, wholesome, and easily accessible dog food options to protect their pets' health and well-being, which is boosting sales and growth in this market.

- The supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia pet food market is segmented by distribution channel into convenience stores, online channel, specialty stores, supermarkets/hypermarkets, and others. Among these, the supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because channels are the most popular option for buying pet food and have the most market share since they provide pet owners with a huge selection of products, competitive pricing, and easy one-stop shopping.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia pet food market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

PetKorm

• R-Trade

• Raduga LLC

• Aller Petfood

• AlphaPet

• Gatchina Feed Mill

• Limkorm

• TACC

• Miratorg

• ProBalance / Veles / Pet-Product LLC

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, it's been a remarkable year for domestic production, which has just been topped by the opening of 267 new brands and the finest output of 1.56 million tonnes in 2024.

- In March 2025, Pet food in Russia was sold for about 510 billion RUB in the past year, which is almost 18% more than the previous year's market size.

- In October 2024, Dry pet food labeling became a requirement in Russia, with the already effective measure aiming at making the tracing of products easier and at cutting the number of counterfeit products.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia pet food market based on the below-mentioned segments:

Russia Pet Food Market, By Pet Type

- Dog Food

- Cat Food

- Others

Russia Pet Food Market, By Distribution Channel

- Convenience Stores

- Online Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Others

Frequently Asked Questions (FAQ)

-

What is the Russia pet food market size?Russia pet food market size is expected to grow from USD 3.91 billion in 2024 to USD 7.09 billion by 2035, growing at a CAGR of 5.56% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by a rising number of pets, bigger pet health and nutrition awareness, and higher disposable incomes, which mainly lead people to choose high-quality and specialty pet food. Besides, the urbanization trend, the opening up of organized retail and e-commerce channels, and the increase in demand for premium, organic, and functional pet food products are the major forces behind market growth.

-

What factors restrain the Russia pet food market?Constraints include the economic instability, high dependency on imports, raw material costs that go up and down, a lack of knowledge about specialized pet nutrition in small towns, and the strictness of regulatory requirements, which all together hinder the growth and acceptance of the market

-

How is the market segmented by pet type?The market is segmented into dog food, cat food, and others

-

Who are the key players in the Russia pet food market?Key companies include PetKorm, R‑Trade, Raduga LLC, Aller Petfood, AlphaPet, Gatchina Feed Mill, Limkorm, TACC, Miratorg, ProBalance / Veles / Pet‑Product LLC, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?