Russia Perfume Market Size, Share, and COVID-19 Impact Analysis, By Perfume Type (Premium, and Mass), By Category (Female Fragrances, Male Fragrances, and Unisex Fragrances), and Russia Perfume Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Perfume Market Insights Forecasts to 2035

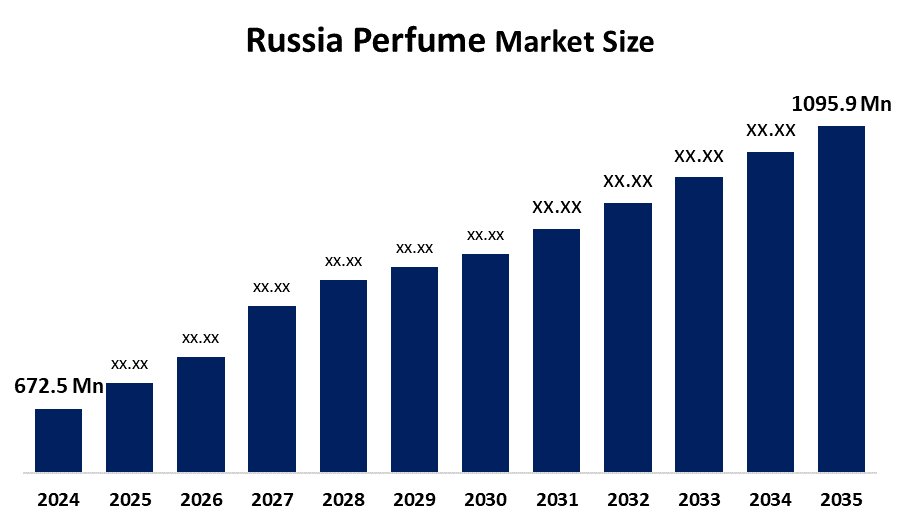

- The Russia Perfume Market Size Was Estimated at USD 672.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.54% from 2025 to 2035

- The Russia Perfume Market Size is Expected to Reach USD 1095.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Perfume Market Size Is Anticipated To Reach USD 1095.9 Million By 2035, Growing At A CAGR Of 4.54% From 2025 to 2035. The perfume market in Russia is driven by increased consumer disposable income, rising demand for high-end and luxury scents, increased knowledge of beauty and personal care, expanding e-commerce and retail distribution, and the growing influence of international brands and perfumes promoted by celebrities.

Market Overview

The market for perfumes in Russia consists of the whole process of creating, distributing, and selling these scents, which comprise eau de parfum, eau de toilette, and body mists. The most common uses of perfumes are personal care, luxury gift-giving, and lifestyle improvement. Retail sites in stores, online shopping platforms, beauty product chains, and duty-free sales are the sources where perfumes are sold for both mass-market and high-end customers. At the same time, trends are focused on brand prestige, scent innovation, and seasonal or celebrity-endorsed collections.

The Russian government is backing the fragrance sector with 285 million in 2024 for the local manufacture of essential materials for the fragrance and cosmetics sectors. In addition, 1 billion was earmarked for support through TV commercials for Russian brands, thus helping eight local firms. The 35% import tariff (20% for French products) acts as a catalyst for local production and market growth.

The perfume market in Russia is enlarging through the growth of local production, increased investments in production facilities, and greater utilization of local raw materials. Polex Beauty is one of the companies increasing its capacity, while local brands hold nearly 68% of the market share, thus opening new avenues for premium fragrances, online sales, and import-substituted perfume products in the future.

Report Coverage

This research report categorizes the market for the Russia Perfume Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia perfume market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia perfume market.

Russia Perfume Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 672.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.54% |

| 2035 Value Projection: | USD 1095.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Perfume Type, By Category |

| Companies covered:: | Faberlic Novaya Zarya Brocard Group Aromoda Unicosmetic Perfume Style Pure Sense Rive Gauche Russian Standard Perfumes Sashera And Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The perfume market in Russia is driven by the increasing disposable income and increased consumer spending on personal care/luxury product purchases. Growing consumer awareness of grooming lifestyles, along with the influences from international brands, is creating additional demand for perfumes. The rapid expansion of retail chains (e.g., major department stores, etc.), as well as e-commerce and duty-free shops, has greatly increased access to these products. Government efforts supporting the growth of the domestic perfume industry include import substitution policies, research for new fragrances, and packaging.

Restraining Factors

The perfume market in Russia is mostly constrained by the dependence on imports of raw materials, and thus the high cost, unstable currency rates, strict regulations, and the presence of well-established international brands competing aggressively, which puts smaller domestic manufacturers at a disadvantage.

Market Segmentation

The Russia perfume market share is classified into perfume type and category.

- The premium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Perfume Market Size is segmented by perfume type into premium, and mass. Among these, the premium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The popularity of worldwide and celebrity-endorsed perfumes, more disposable incomes, growing brand consciousness, and consumer preferences for luxury and high-quality fragrances are all contributing factors to this. The greatest market share is a result of premium items' higher income per unit.

- The female fragrances segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Perfume Market Size is segmented by category into female fragrances, male fragrances, and unisex fragrances. Among these, the female fragrances segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because women are the biggest perfume consumers, which increases demand for a wide range of fragrances and high-end products. Female fragrance sales are further boosted by fashion trends, gift-giving culture, and rising disposable incomes, giving this category the highest revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia perfume market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Faberlic

- Novaya Zarya

- Brocard Group

- Aromoda

- Unicosmetic

- Perfume Style

- Pure Sense

- Rive Gauche

- Russian Standard Perfumes

- Sashera

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In December 2025, Russia's perfume output reached 93 million pieces in 2024, driven by increased domestic production and the imposition of import duties on perfume products.

• In June 2024, the company Faberlic added new fragrances in the form of eau de parfum, produced solely in Russia and aimed at the mid-premium consumer market, to its fragrance portfolio.

• In March 2024, according to the Russian Ministry of Industry and Trade, domestic perfume output grew by more than 20% year-on-year, fueled by import substitution measures and the emergence of new domestic brands.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia perfume market based on the below-mentioned segments:

Russia Perfume Market, By Perfume Type

- Premium

- Mass

Russia Perfume Market, By Category

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Frequently Asked Questions (FAQ)

-

What is the Russia perfume market size?Russia perfume market size is expected to grow from USD 672.5 million in 2024 to USD 1095.9 million by 2035, growing at a CAGR of 4.54% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by increasing disposable income and increased consumer spending on personal care/luxury product purchases. Growing consumer awareness of grooming lifestyles, along with the influences from international brands, is creating additional demand for perfumes

-

What factors restrain the Russia perfume market?Constraints include the dependence on imports of raw materials, and thus the high cost, unstable currency rates, strict regulations, and the presence of well-established international brands competing aggressively, which puts smaller domestic manufacturers at a disadvantage

-

How is the market segmented by perfume type?The market is segmented into premium, and mass.

-

Who are the key players in the Russia perfume market?Key companies include Faberlic, Novaya Zarya, Brocard Group, Aromoda, Unicosmetic, Perfume Style, Pure Sense, Rive Gauche, Russian Standard Perfumes, Sashera, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?