Russia Pasta & Noodles Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dried Pasta, Fresh and Chilled Pasta, Instant Noodles, and Frozen Pasta and Noodle Meals), By Ingredient (Wheat-Based, Rice and Gluten-Free, and Multigrain and Fortified), and Russia Pasta & Noodles Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Pasta & Noodles Market Insights Forecasts to 2035

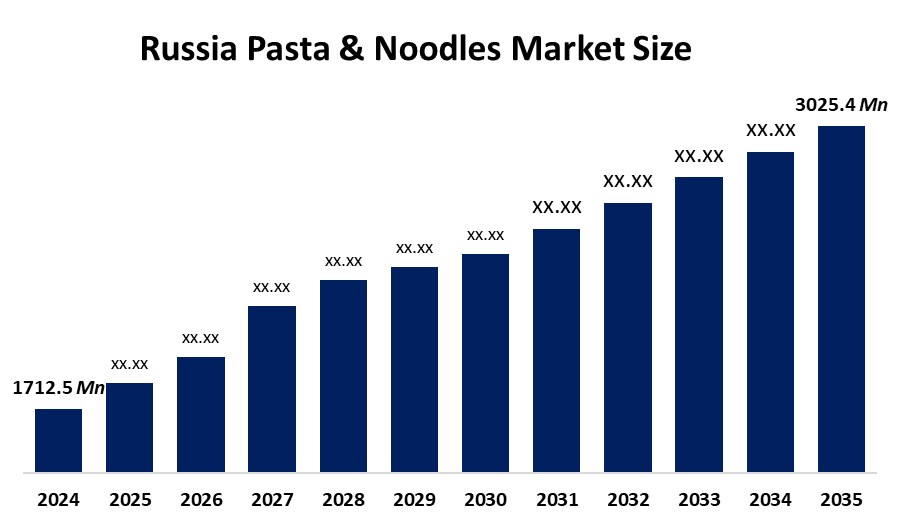

- The Russia Pasta & Noodles Market Size Was Estimated at USD 1712.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.31% from 2025 to 2035

- The Russia Pasta & Noodles Market Size is Expected to Reach USD 3025.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Pasta & Noodles Market Size is anticipated to reach USD 3025.4 Million by 2035, Growing at a CAGR of 5.31% from 2025 to 2035. The pasta & noodles market in Russia is driven by high consumption of staple foods, low prices, long shelf lives, shifting dietary preferences, urbanization, the need for quick meals, the growth of retail chains, and the increasing popularity of foreign cuisines.

Market Overview

The Russia pasta & noodles market refers to the production, distribution, and consumption of wheat- and grain-based dried, fresh, and instant pasta and noodle products. T dola he market includes three different types of pasta products which are traditional pasta instant noodles and specialty pasta products. Applications span household consumption, foodservice outlets, restaurants, cafés, institutional catering, and ready-to-eat meal production. The market demand exists because customers find products affordable and convenient while products maintain their quality and can be used in multiple cooking styles and dietary requirements.

The Russian government supports the pasta and noodles market through agro-industrial programs and industrial modernization schemes. The federal government allocated more than RUB 558 billion to agriculture in 2024 which established stable wheat supply for the country. Pasta producers can access preferential loans via the Industry Development Fund and export transport subsidies of over RUB 7 billion, boosting domestic production and exports.

Russian pasta and noodle manufacturers increased their production capabilities because Makfa and other companies expanded their distribution networks to Asia and the Middle East. The manufacturers are spending money on automated systems and high-quality durum wheat pasta production equipment. Future business opportunities will emerge through the development of healthy food options and instant noodle products and private label brands and international export markets.

Report Coverage

This research report categorizes the market for the Russia pasta & noodles market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia pasta & noodles market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia pasta & noodles market.

Russia Pasta & Noodles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1712.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.31% |

| 2035 Value Projection: | USD 3025.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | Makfa JSC, Rollton, Saransk Pasta Factory, Baisad ZAO, Extra-M, Pasta Palmoni LLC, Soyuzpishcheprom, Barilla Rus, and other key palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pasta & noodles market in Russia is driven by their status as cheap basic foods and their ability to remain fresh for extended periods and their simple cooking methods. The market develops because people in cities need quick and easy meal options which their fast-paced lives require. The market demand in the region increases because local wheat production remains stable while new retail stores open and private label products become more popular and people start to eat international and instant noodle dishes.

Restraining Factors

The pasta & noodles market in Russia is mostly constrained by the raw material price volatility, rising energy and packaging costs, intense price competition, limited product differentiation, and shifting consumer preference toward fresh or low-carbohydrate alternatives.

Market Segmentation

The Russia pasta & noodles market share is classified into product type and ingredient.

- The dried pasta segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia pasta & noodles market is segmented by product type into dried pasta, fresh and chilled pasta, instant noodles, and frozen pasta and noodle meals. Among these, the dried pasta segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Affordability, a long shelf life, ease of storage, and a high consumer dependence on dry pasta as a staple food, all bolstered by a plentiful domestic wheat supply and widespread retail availability, are what propel its leadership.

- The wheat-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia pasta & noodles market is segmented by ingredient into wheat-based, rice and gluten-free, and multigrain and fortified. Among these, the wheat-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Russia's vast wheat output, cheaper production costs, affordability, and strong customer desire for traditional wheat-based pasta and noodles as daily staple meals are the main factors driving this supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia pasta & noodles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Makfa JSC

- Rollton

- Saransk Pasta Factory

- Baisad ZAO

- Extra-M

- Pasta Palmoni LLC

- Soyuzpishcheprom

- Barilla Rus

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Russia's pasta exports increased by around 8% in the first nine months of 2025, reaching over 103,000 tonnes and valued at approximately $154 million.

- In June 2025, over 500,000 tonnes of pasta and noodle products were produced in Russia between January and April 2025, an increase of almost 3% that also supported rising export quantities.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia pasta & noodles market based on the below-mentioned segments:Russia Pasta & Noodles Market, By Product Type

- Dried Pasta

- Fresh and Chilled Pasta

- Instant Noodles

- Frozen Pasta and Noodle Meals

Russia Pasta & Noodles Market, By Ingredient

- Wheat-Based

- Rice and Gluten-Free

- Multigrain and Fortified

Frequently Asked Questions (FAQ)

-

What is the Russia pasta & noodles market size?Russia pasta & noodles market size is expected to grow from USD 1712.5 million in 2024 to USD 3025.4 million by 2035, growing at a CAGR of 5.31% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by their status as cheap basic foods and their ability to remain fresh for extended periods and their simple cooking methods.

-

What factors restrain the Russia pasta & noodles market?Constraints include the raw material price volatility, rising energy and packaging costs.

-

How is the market segmented by product type?The market is segmented into dried pasta, fresh and chilled pasta, instant noodles, and frozen pasta and noodle meals.

-

Who are the key players in the Russia pasta & noodles market?Key companies include Makfa JSC, Rollton, Saransk Pasta Factory, Baisad ZAO, Extra-M, Pasta Palmoni LLC, Soyuzpishcheprom, Barilla Rus, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?