Russia Nutraceuticals Market Size, Share, and COVID-19 Impact Analysis, By Product (Vitamins & Minerals, Functional Foods, Sports Nutrition, and Herbal Supplements), By Distribution Channel (OTC Retailers, and Online Pharmacies), and Russia Nutraceuticals Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Nutraceuticals Market Insights Forecasts to 2035

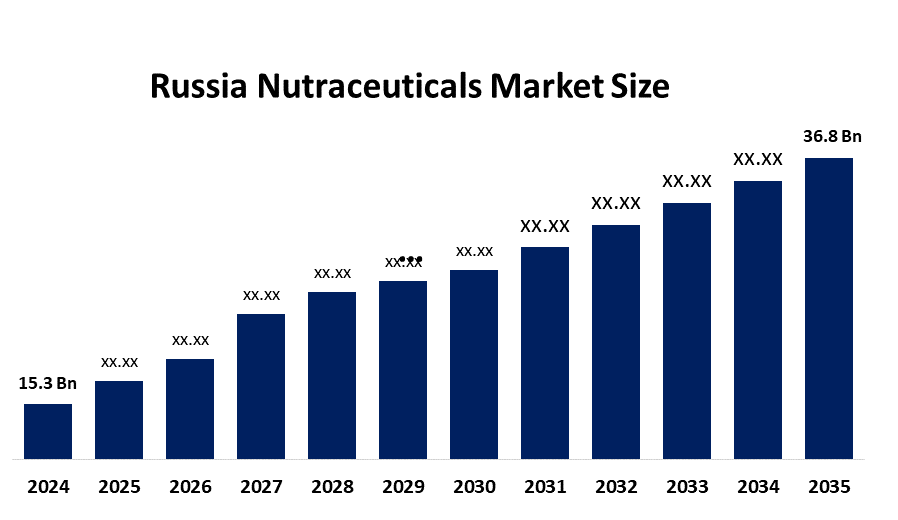

- The Russia Nutraceuticals Market Size Was Estimated at USD 15.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.31% from 2025 to 2035

- The Russia Nutraceuticals Market Size is Expected to Reach USD 36.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia Nutraceuticals Market Size is anticipated to reach USD 36.8 Billion by 2035, Growing at a CAGR of 8.31% from 2025 to 2035. The nutraceuticals market in Russia is driven by growing health consciousness, an aging population, a focus on preventative healthcare, rising disposable incomes, an increase in the prevalence of chronic diseases, expanding pharmacy and online sales channels, product innovation, and encouraging government wellness programs.

Market Overview

Nutraceuticals in Russia include the manufacturing, distributing, and selling of food-based products that offer additional health and medical benefits over and above just basic nutrition. The categories of these products include dietary supplements, functional food, and functional beverage application categories for preventative healthcare, boosting immunity, improving digestion, helping with weight management, sports nutrition, and reducing the risk of disease. Most of these products are sold through pharmacies, supermarkets, speciality health stores, and online, supporting total wellness and healthy living in every part of Russia.

Regulation and health policies are the pillars of the Russian nutraceuticals market. The market for dietary supplements was projected to reach about RUB 130 billion in 2025. Federal Law No. 150-FZ made it possible to prescribe supplements by doctors, safety labeling became obligatory, and different federal programs were promoting functional foods, preventive healthcare, and quality control, which, in turn, supported the domestic nutraceuticals production and market expansion indirectly.

From 2024 to 2025, the market of nutraceuticals in Russia increased by approximately 12%, with the acceptance of high-end dietary supplements and the attraction of clean-label products to consumers. Home-based companies are moving towards the production of such non-traditional forms as gummies and powders, and exhibitions like NUTRICON.RU contribute to the communication within the industry. The horizons ahead are personalized nutrition, herbal supplements, and health tech integration, among others.

Report Coverage

This research report categorizes the market for the Russia nutraceuticals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia nutraceuticals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia nutraceuticals market.

Russia Nutraceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.31% |

| 2035 Value Projection: | USD 36.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Evalar, Nooteria Labs, Omega-3 PRO, Complivit, Akvi-on, Mirrolla, RealCaps, Siberian Wellness, Artlife, BioRevol / NutrIMix LLC, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nutraceuticals market in Russia is driven by health consciousness, attaining older age population, an increasingly active lifestyle, and chronic diseases. Besides these, market growth is supported by many factors such as higher income levels, the trend of preventive health care, innovations in functional foods and dietary supplements, and the expansion of pharmacies and online sales channels, as well as the establishment of stronger regulatory frameworks that not only ensure product safety but also trust among consumers.

Restraining Factors

The nutraceuticals market in Russia is mostly constrained by the strict regulatory requirements, long product registration processes, consumer sensitivity to prices, and little awareness in countryside areas, along with risks of counterfeit products and dependence on imported raw materials, which might lead to higher costs and disrupt supply.

Market Segmentation

The Russia nutraceuticals market share is classified into product and distribution channel.

- The vitamins & minerals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia nutraceuticals market is segmented by product into vitamins & minerals, functional foods, sports nutrition, and herbal supplements. Among these, the vitamins & minerals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of widespread everyday consumption, considerable consumer trust, and substantial medical support. These products are mostly prescribed for immunity, bone health, and deficiency management, especially for older patients. Preventive healthcare awareness, regular reordering, convenient procurement through pharmacies, and affordable prices all contribute to the income growth and high sales volumes that have been the standard in this category.

- The OTC retailers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia nutraceuticals market is segmented by distribution channel into OTC retailers, and online pharmacies. Among these, the OTC retailers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. In Russia, pharmacies and over-the-counter stores are the most reliable places to buy nutraceuticals. Higher sales volumes are driven by strong pharmacist recommendations, broad product availability, instant access, and consumer preference for expert advice. This segment's dominant market share is further supported by extensive national pharmacy networks and well-established purchasing habits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia nutraceuticals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Evalar

• Nooteria Labs

• Omega-3 PRO

• Complivit

• Akvi-on

• Mirrolla

• RealCaps

• Siberian Wellness

• Artlife

• BioRevol / NutrIMix LLC

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Significant regulatory reforms, such as Federal Law No. 150-FZ, which permits physician prescriptions for supplements, were examined, indicating more stringent market regulation.

- In August 2025, with robust offline and expanding online demand, Russian sales of male fertility nutritional supplements surpassed RUB 957.6 million in H1 2025.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia nutraceuticals market based on the below-mentioned segments:

Russia Nutraceuticals Market, By Product

- Vitamins & Minerals

- Functional Foods

- Sports Nutrition

- Herbal Supplements

Russia Nutraceuticals Market, By Distribution Channel

- OTC Retailers

- Online Pharmacies

Frequently Asked Questions (FAQ)

-

Q:What is the Russia nutraceuticals market size?A:Russia nutraceuticals market size is expected to grow from USD 15.3 billion in 2024 to USD 36.8 billion by 2035, growing at a CAGR of 8.31% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by health consciousness, attaining older age population, an increasingly active lifestyle, and chronic diseases. Besides these, market growth is supported by many factors such as higher income levels, the trend of preventive health care, innovations in functional foods and dietary supplements, and the expansion of pharmacies and online sales channels.

-

Q:What factors restrain the Russia nutraceuticals market?A:Constraints include the strict regulatory requirements, long product registration processes, consumer sensitivity to prices, and little awareness in countryside areas, along with risks of counterfeit products and dependence on imported raw materials.

-

Q:How is the market segmented by product?A:The market is segmented into vitamins & minerals, functional foods, sports nutrition, and herbal supplements.

-

Q:Who are the key players in the Russia nutraceuticals market?A:Key companies include Evalar, Nooteria Labs, Oмега-3 PRO, Complivit, Akvion, Mirrolla, RealCaps, Siberian Wellness, Artlife, BioRevol / NutrIMix LLC, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?