Russia Luxury Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Clothing and Apparel, Footwear, Eyewear, Leather Goods, Jewelry, Watches, and Beauty and Personal Care), By End User (Men, Women, and Unisex), and Russia Luxury Goods Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Luxury Goods Market Insights Forecasts to 2035

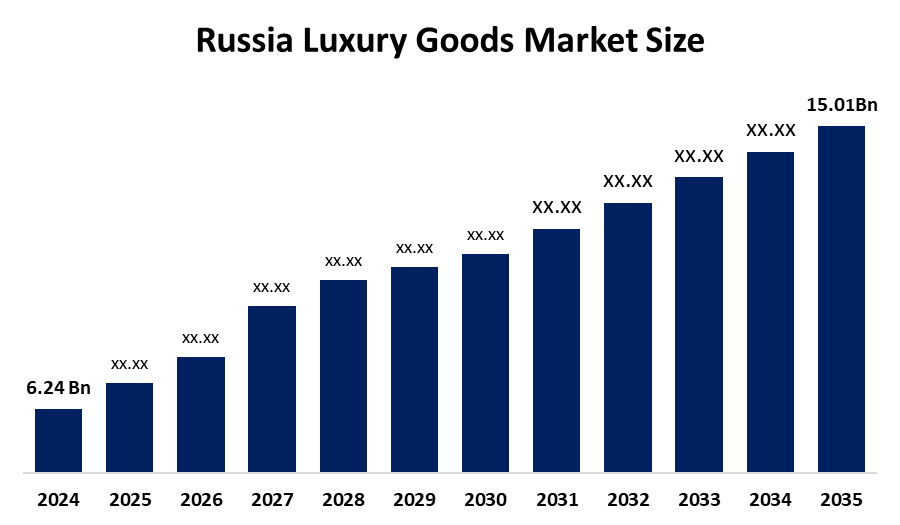

- The Russia Luxury Goods Market Size Was Estimated at USD 6.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.31% from 2025 to 2035

- The Russia Luxury Goods Market Size is Expected to Reach USD 15.01 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Luxury Goods Market Size is anticipated to reach USD 15.01 Billion by 2035, Growing at a CAGR of 8.31% from 2025 to 2035. The luxury goods market in Russia is driven by rising high-net-worth individuals, growing urbanization, a robust demand for high-end clothing and accessories, expanding e-commerce penetration, and customer preferences for exclusivity, quality, and brand prestige.

Market Overview

The market for luxury goods in Russia comprises the selling of expensive products that have the characteristics of being high-quality, exclusive, and possessing a strong brand value. It encompasses different facets of the luxury industry, such as high fashion and apparel, jewelry, horological instruments, cosmetics, perfumes, leather goods, and luxury accessories, among others. The affluent class consumers buy these items for their own use, gifting, and showing off their status; thus, the applications are found in retail outlets, internet platforms, travel retail, and bespoke luxury services.

The Russian government is really behind the luxury goods ecosystem with its support for the legalization of parallel imports, which means that the availability of premium brands is not going to be an issue. Made in Moscow is one of the initiatives that not only increased the turnover in the fashion industry to USD 255 billion, but also attracted the Ministry of Industry to the point of funding RS 50 billion for textile and fashion projects, thereby indirectly fortifying luxury production and retail at home

Among the recent happenings of Russia's luxury goods market, we can find the opening of flagship stores by domestic jewelry brands such as ADAMAS, the advanced technology in high-end watchmaking by Konstantin Chaykin, as well as the increasing usage of digital sales and personalization tools. On the other hand, e-commerce, premium local brands, experiential retail, and city expansion are the future opportunities.

Report Coverage

This research report categorizes the market for the Russia luxury goods market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia luxury goods market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia luxury goods market.

Russia Luxury Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.24 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.31% |

| 2035 Value Projection: | USD 15.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | ADAMAS, Moiseikin Jewellery House, Caviar (Lux Trading Corporation), Konstantin Chaykin, RS 1912 Russian Gems, Russkie Samotsvety Corporation, Nika Jewelry & Watches, Sunlight, Tsum, GUM, and Other kay players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The luxury goods market in Russia is driven by the increasing number of the rich and, on the other hand, the urban consumers who are affluent and have more disposable income. The market's growth is backed by the demand for premium fashion, accessories, watches, jewelry, and cosmetics. The presence of digital platforms, social media, and the online luxury retail channel has made luxury goods accessible to more consumers than ever before. Moreover, the lifestyle changes of consumers to luxury, the preference for rarity and quality, and the catching-up habit of the wealthy all play the largest part in the continuation of market growth.

Restraining Factors

The luxury goods market in Russia is mostly constrained by the economic uncertainties, the geopolitical tensions, the currency volatility, the high import taxes, the limited access to the international brands, and the reduced consumer confidence, all of which together prevent consumers from spending on the luxury items.

Market Segmentation

The Russia luxury goods market share is classified into product type and end user.

- The clothing and apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia luxury goods market is segmented by product type into clothing and apparel, footwear, eyewear, leather goods, jewelry, watches, and beauty and personal care. Among these, the clothing and apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The biggest revenue share is driven by the strong customer desire for high-end fashion labels, seasonal wardrobe updates, and significant expenditure on designer clothes and luxury outerwear, especially among wealthy urban consumers.

- The women segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia luxury goods market is segmented by end user into men, women, and unisex. Among these, the women segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because women spend more on high-end clothing, purses, jewelry, shoes, and cosmetics due to their strong sense of style, predisposition toward high-end, branded personal care and fashion items, and gift-giving patterns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia luxury goods market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADAMAS

- Moiseikin Jewellery House

- Caviar (Lux Trading Corporation)

- Konstantin Chaykin

- RS 1912 Russian Gems

- Russkie Samotsvety Corporation

- Nika Jewelry & Watches

- Sunlight

- Tsum

- GUM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, the Russian jewelry brand ADAMAS made a significant move by opening its primary store in St. Petersburg's Nevsky Center, thus increasing the presence of luxury retail.

- In April 2025, some high-end brands like Dior and Prada, among others, gave up their Russian store leases, which indicated a change in their retail strategies.

- In August 2024, the first store of RS 1912 RUSSIAN GEMS was opened in MEGA Teply Stan, Moscow, signaling the rising trend of luxury consumption in the domestic market.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia luxury goods market based on the below-mentioned segments:

Russia Luxury Goods Market, By Product Type

- Clothing and Apparel

- Footwear

- Eyewear

- Leather Goods

- Jewelry

- Watches

- Beauty and Personal Care

Russia Luxury Goods Market, By End User

- Men

- Women

- Unisex

Frequently Asked Questions (FAQ)

-

What is the Russia luxury goods market size?Russia luxury goods market size is expected to grow from USD 6.24 billion in 2024 to USD 15.01 billion by 2035, growing at a CAGR of 8.31% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing number of the rich and, on the other hand, the urban consumers who are affluent and have more disposable income. The market's growth is backed by the demand for premium fashion, accessories, watches, jewelry, and cosmetics. The presence of digital platforms, social media, and the online luxury retail channel has made luxury goods accessible to more consumers than ever before.

-

What factors restrain the Russia luxury goods market?Constraints include the economic uncertainties, the geopolitical tensions, the currency volatility, the high import taxes, the limited access to the international brands, and the reduced consumer confidence, all of which together prevent consumers from spending on the luxury items

-

How is the market segmented by product type?The market is segmented into clothing and apparel, footwear, eyewear, leather goods, jewelry, watches, and beauty and personal care

-

Who are the key players in the Russia luxury goods market?Key companies include ADAMAS, Moiseikin Jewellery House, Caviar (Lux Trading Corporation), Konstantin Chaykin, RS 1912 Russian Gems, Russkie Samotsvety Corporation, Nika Jewelry & Watches, Sunlight, Tsum, GUM, and Others

-

Who are the target audiences for this market report?Who are the target audiences for this market report?

Need help to buy this report?