Russia Laundry Appliances Market Size, Share, and COVID-19 Impact Analysis, By Loading Type (Front Load and Top Load), By End Use (Residential and Commercial), and Russia Laundry Appliances Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Laundry Appliances Market Insights Forecasts to 2035

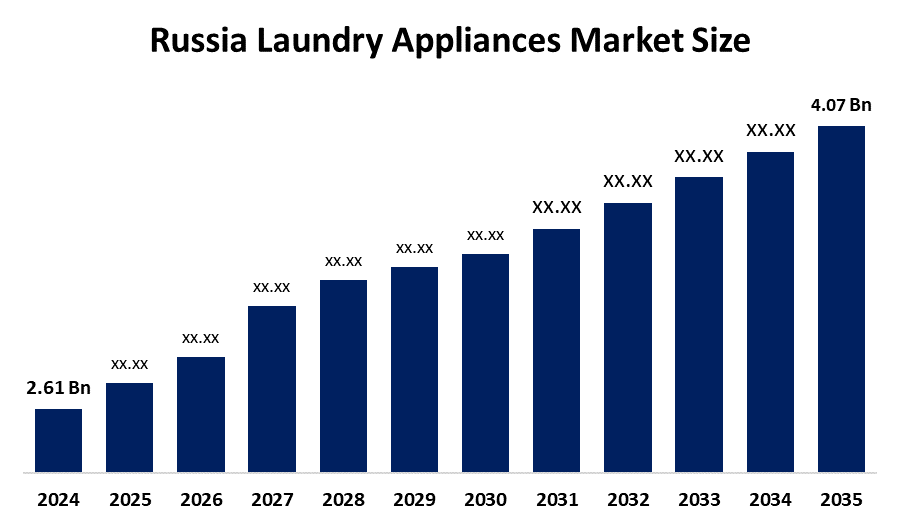

- The Russia Laundry Appliances Market Size Was Estimated at USD 2.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.12% from 2025 to 2035

- The Russia Laundry Appliances Market Size is Expected to Reach USD 4.07 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Russia Laundry Appliances Market Size is Anticipated to Reach USD 4.07 Billion by 2035, Growing at a CAGR of 4.12% from 2025 to 2035. The laundry appliances market in Russia is driven by rising urbanization, the need to replace outdated appliances, rising disposable incomes, energy-efficient technologies, the adoption of smart homes, and the growth of e-commerce distribution channels across the country.

Market Overview

The market for laundry appliances in Russia comprises washing machines, dryers, and washer-dryers that are meant for residential and commercial purposes. These appliances help the fabrics get cleaned, dried, and kept hygienically efficiently. The market applications range from households to laundries, hotels to hospitals, and commercial facilities. The applications have been made possible by urban living, time-saving requirements, energy-efficient appliances, smart features, and a general increase in demand for sophisticated and automated laundry solutions in Russia.

The Russia Laundry Appliances Market Size is supported by the government's industrial statistics that reflect the increasing production of domestic appliances, efficiency regulations, and import-substitution policies. The Ministry of Industry and Trade allocates billions of rubles in the form of subsidies, preferential loans, and grants to promote local production, modernization, R&D, and the manufacturing of energy-efficient household appliances.

The most recent innovations in the Russia Laundry Appliances Market Size consist of smart commercial washers with remote control and energy-saving cycles that are IoT-enabled, and domestic engineering of new washing machine models to mitigate the impact of sanctions. Meanwhile, global players like Samsung and LG are investing in eco-friendly, connected technologies, which in turn generate innovations and future possibilities in the areas of sustainable, smart, and localized laundry solutions.

Report Coverage

This research report categorizes the market for the Russia Laundry Appliances Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia laundry appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia laundry appliances market.

Russia Laundry Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.61 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.12% |

| 2035 Value Projection: | USD 4.07 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Loading Type ,By End Use |

| Companies covered:: | Okean, Biryuza, Vyatka, Feya, Volga, Assol, Slavda / Renova, Snow White, BORK, Gazprom Household Systems, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The laundry appliances market in Russia is driven by urbanization, a rising middle-class population, and the demand for household appliances that are convenient and save time. The replacement of old appliances, the use of energy- and water-efficient technologies, and the integration of smart features are all factors that contribute to the growth of the market. On top of this, government measures that encourage local production, import substitution, and energy efficiency, along with the growing e-commerce and organized retail networks, are pushing the demand even more in both residential and commercial sectors.

Restraining Factors

The Russia Laundry Appliances Market Size in Russia is mostly constrained by the high prices of the products, the rising costs everywhere, the unstable incomes of the households, and the limited availability of imported parts, which is a result of sanctions. All these things together negatively affect the pricing, the supply chains, and therefore also the consumers' purchasing decisions.

Market Segmentation

The Russia Laundry Appliances Market share is classified into loading type and end use.

- The front load segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Laundry Appliances Market Size is segmented by loading type into front load and top load. Among these, the front load segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its improved cleaning capabilities, greater capacity, compatibility with contemporary, space-saving designs, and increased energy and water efficiency. Its leading market share and promising growth prognosis are further supported by growing urban households and consumer desire for high-end, environmentally friendly equipment.

- The residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Laundry Appliances Market Size is segmented by end use into residential and commercial. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The highest market share and strong future growth are supported by factors such as growing urbanization, expanding household appliance penetration, the rise of nuclear families, higher disposable incomes, and a strong desire for automatic and energy-efficient washing machines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Laundry Appliances Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Okean

- Biryuza

- Vyatka

- Feya

- Volga

- Assol

- Slavda / Renova

- Snow White

- BORK

- Gazprom Household Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, A subsidiary of Gazprom plans to restart the production of home appliances at the former Bosch factory in Saint Petersburg, which will include washing machines.

- In March 2025, LG has allowed the production of washing machines and other appliances to be resumed partially at the Russian plant for the domestic market.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia Laundry Appliances Market Size based on the below-mentioned segments:

Russia Laundry Appliances Market, By Loading Type

- Front Load

- Top Load

Russia Laundry Appliances Market, By End Use

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

What is the Russia laundry appliances market size?Russia laundry appliances market size is expected to grow from USD 2.61 billion in 2024 to USD 4.07 billion by 2035, growing at a CAGR of 4.12% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by urbanization, a rising middle-class population, and the demand for household appliances that are convenient and save time. The replacement of old appliances, the use of energy- and water-efficient technologies, and the integration of smart features are all factors that contribute to the growth of the market.

-

What factors restrain the Russia laundry appliances market?Constraints include the high prices of the products, the rising costs everywhere, the unstable incomes of the households, and the limited availability of imported parts, which is a result of sanctions.

-

How is the market segmented by loading type?The market is segmented into front load and top load.

-

Who are the key players in the Russia laundry appliances market?Key companies include Okean, Biryuza, Vyatka, Feya, Volga, Assol, Slavda / Renova, Snow White, BORK, Gazprom Household Systems, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?