Russia Insulin Drugs & Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Drug (Basal or Long-Acting Insulins, Bolus or Fast-Acting Insulins, Traditional Human Insulins, Combination Insulins, and Biosimilar Insulins) and By Device (Insulin Pumps, Insulin Pens, Insulin Syringes, and Insulin Jet Injectors), and Russia Insulin Drugs & Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareRussia Insulin Drugs & Delivery Devices Market Insights Forecasts to 2035

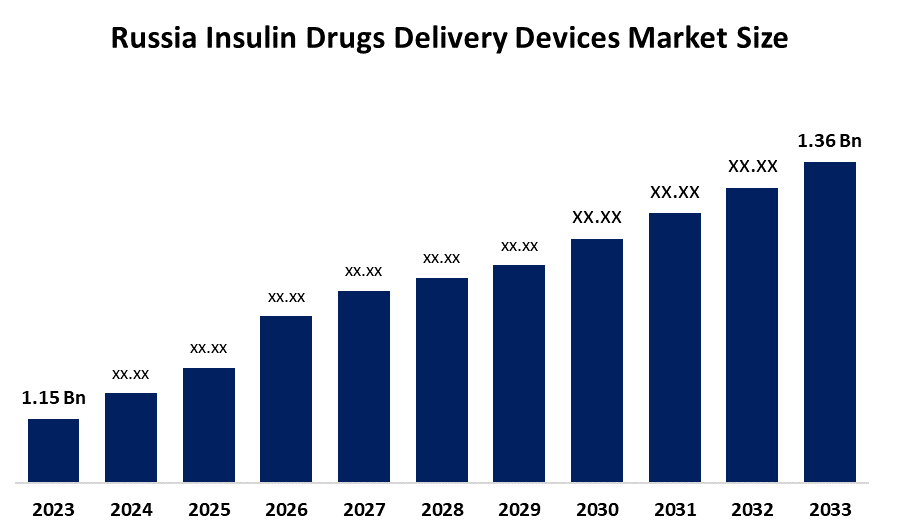

- The Russia Insulin Drugs & Delivery Devices Market Size Was Estimated at USD 1.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.54% from 2025 to 2035

- The Russia Insulin Drugs & Delivery Devices Market Size is Expected to Reach USD 1.36 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia insulin drugs delivery devices market size is anticipated to reach USD 1.36 billion by 2035, growing at a CAGR of 1.54 from 2025 to 2035. The insulin drugs & delivery devices market in Russia is driven by rising diabetes prevalence, an older population, better diagnosis rates, government healthcare initiatives, increased access to insulin, and the widespread adoption of cutting-edge delivery technology.

Market Overview

The market for insulin medications and delivery devices in Russia encompasses various insulin formulations along with products such as syringes, pens, pumps, and injectors that are utilized for the treatment of diabetes. These goods assist in maintaining blood sugar levels and in avoiding health issues that arise due to diabetes. Main venues are hospitals, clinics, pharmacies, and home care, which are backed by the governments reimbursement schemes, rising diabetes cases, better diagnosis, and wider acceptance of easy-to use, patient-friendly insulin delivery technologies throughout Russia.

The Russian market for insulin pharmaceuticals and delivery devices is being reinforced by state sponsored measures like the National Diabetes Control Program, which will use approximately RUB 180 billion for the combined needs of insulin access, diagnostic services, and treatment. Besides, more than RUB 5 billion of extra subsidies is devoted to the support of regional programs, preferential loans, and import support, thus enhancing the nationwide availability, affordability, and distribution of insulin and delivery devices.

The market of insulin drugs and delivery devices in Russia has seen a few new developments, which include smart insulin pens and pumps equipped with Bluetooth connectivity and data tracking launched in January 2024, and lower-cost biosimilar insulins by Sanofi and GEROPHARM introduced in February 2024 to increase the availability of insulins to the large population. The domestic manufacturers are taking a larger production share and are also getting involved in government procurement. Future opportunities can be seen in digital health integration, telemedicine, rural outreach, and local production expansion.

Report Coverage

This research report categorizes the market for the Russia insulin drugs & delivery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia insulin drugs delivery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia insulin drugs delivery devices market.

Russia Insulin Drugs & Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 1.54% |

| 2035 Value Projection: | USD 1.36 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Drug, By Device |

| Companies covered:: | Geropharm,Nanolek Pharmasintez,Biocad Pharmaceuticals,R Pharm,NovaMedica,SamsonMed,Pharmstandard,MedSintez,Protek Pharmaceuticals And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The insulin drugs & delivery devices market in Russia is driven by the growing number of diabetes patients, escalating awareness and early diagnosis, and a rising need for comfortable and user-friendly delivery systems. In addition, the implementation of supportive government healthcare programs, the provision of subsidies for insulin access, and technological innovation in smart insulin pens and pumps are also among the factors that are promoting market growth. Furthermore, the distribution of insulin throughout both urban and rural areas is being enhanced by pharmacies and hospitals.

Restraining Factors

The insulin drugs delivery devices market in Russia is mostly constrained by the high cost of treatment, small local production, the complexity of getting regulatory approvals, difficulties in getting reimbursement, and disruptions in the supply chain. These factors combined make it hard for patients in certain areas to access and afford the treatment.

Market Segmentation

The Russia insulin drugs delivery devices market share is classified into drug and device.

- The basal or long acting insulins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia insulin drugs delivery devices market is segmented by drug into basal or long-acting insulins, bolus or fast-acting insulins, traditional human insulins, combination insulins, and biosimilar insulins. Among these, the basal or long-acting insulins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because both doctors and patients prefer long-acting insulins since they offer consistent, 24-hour blood glucose control, lower the risk of complications, need fewer daily injections, and are frequently prescribed for both type 1 and type 2 diabetes.

- The insulin pens segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia insulin drugs & delivery devices market is segmented by device into insulin pumps, insulin pens, insulin syringes, and insulin jet injectors. Among these, the insulin pens segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. For both type 1 and type 2 diabetic patients, they are favored over syringes and pumps because of their mobility, ease of use, accurate dose, and convenience for daily self-administration. Adoption is further fueled by their price and compatibility with contemporary insulin formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia insulin drugs delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Geropharm

- Nanolek

- Pharmasintez

- Biocad Pharmaceuticals

- R Pharm

- NovaMedica

- Samson Med

- Pharmstandard

- MedSintez

- Protek Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Recent Developments:

- In October 2025, Pharmasyntez talked about its intention to export insulin produced in Russia to the Middle East, Southeast Asia, and CIS countries, thus broadening the market.

- In March 2025, the share of Russian producers in the purchase of insulin by the government increased to approximately 44, thus enhancing the significance of domestic products.

- In February 2024, GEROPHARM launched a biosimilar insulin as part product in the Russian market at a price that was around 25 lower.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia insulin drugs & delivery devices market based on the below mentioned segments:

Russia Insulin Drugs & Delivery Devices Market, By Drug

- Basal or Long Acting Insulins

- Bolus or Fast Acting Insulins

- Traditional Human Insulins

- Combination Insulins

- Biosimilar Insulins

Russia Insulin Drugs & Delivery Devices Market, By Device

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

- Insulin Jet Injectors

Frequently Asked Questions (FAQ)

-

Q: What is the Russia insulin drugs & delivery devices market size?A: Russia insulin drugs & delivery devices market size is expected to grow from USD 1.15 billion in 2024 to USD 1.36 billion by 2035, growing at a CAGR of 1.54% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing number of diabetes patients, escalating awareness and early diagnosis, and a rising need for comfortable and user-friendly delivery systems. In addition, the implementation of supportive government healthcare programs, the provision of subsidies for insulin access, and technological innovation in smart insulin pens and pumps are also among the factors that are promoting market growth.

-

Q: What factors restrain the Russia insulin drugs & delivery devices market?A: Constraints include the high cost of treatment, small local production, the complexity of getting regulatory approvals, difficulties in getting reimbursement, and disruptions in the supply chain.

-

Q: How is the market segmented by drug?A: The market is segmented into basal or long-acting insulins, bolus or fast-acting insulins, traditional human insulins, combination insulins, and biosimilar insulins.

-

Q: Who are the key players in the Russia insulin drugs & delivery devices market?A: Key companies include Geropharm, Nanolek, Pharmasintez, Biocad Pharmaceuticals, R‑Pharm, NovaMedica, Samson‑Med, Pharmstandard, MedSintez, Protek Pharmaceuticals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?