Russia Industrial Batteries Market Size, Share, and COVID 19 Impact Analysis, By Type (Lithium Based, Lead Acid, and Others), By Application (Grid Level Energy Storage, Motive Power, Telecom and Data Communication, and Uninterruptible Power Supply UPS Backup), and Russia Industrial Batteries Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerRussia Industrial Batteries Market Insights Forecasts to 2035

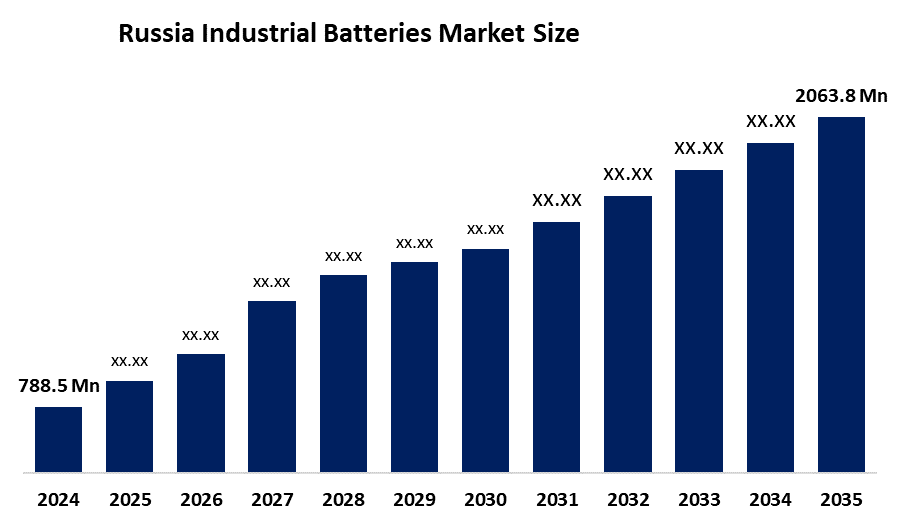

- The Russia Industrial Batteries Market Size was estimated at USD 788.5 Million in 2024

- The Market Size is expected to grow at a CAGR of around 9.14 percent from 2025 to 2035

- The Russia Industrial Batteries Market Size is expected to reach USD 2063.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the Russia industrial batteries market size is anticipated to reach USD 2063.8 million by 2035, growing at a CAGR of 9.14 percent from 2025 to 2035. The industrial batteries market in Russia is driven by rapid industrialization, the development of renewable energy storage, the construction of data centers, increased demand from the manufacturing and telecom sectors, and government support for the upgrade of energy infrastructure.

Market Overview

The market for industrial batteries in Russia includes rechargeable and non rechargeable battery systems that are used in a wide range of industrial applications where a reliable power supply and energy storage are required. These batteries are widely used in telecom, data centers, renewable energy storage, oil and gas, and mining operations, as well as in railway systems, forklifts, and uninterruptible power supply applications. They help facilitate uninterrupted operations, grid stability, and automation across various end use sectors in Russia.

Government efforts to support energy storage and import substitution are strengthening the Russia industrial batteries market. Key initiatives include a battery development roadmap with a budget of approximately RUB 127 billion, low interest loans from the Industrial Development Fund, production subsidies, and localization incentives for telecom, energy storage, and industrial battery manufacturing. These measures aim to increase domestic production capacity and reduce reliance on imports.

Moscow increased the supply of batteries in 2025 by 28.8 percent through the introduction of new technologies in lithium and traction batteries. In the same year, Rossel began mass production of Oxide industrial batteries, reducing dependence on imports and producing more than 2,000 units locally. In addition, future opportunities include expansion of gigafactories, localization of advanced battery chemistries, and increased deployment of energy storage systems for renewable energy sources and electric vehicles.

Report Coverage

This research report categorizes the market for the Russia industrial batteries market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the Russia industrial batteries market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to illustrate the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub segment of the Russia industrial batteries market.

Driving Factors

The industrial batteries market in Russia is driven by rapid industrialization, the need for a constant power supply in telecom, data centers, and manufacturing, and the growing adoption of electric vehicles. The gradual phasing out of coal power plants, increased government support for energy storage, and import substitution initiatives are among the key factors supporting the transition toward a cleaner energy economy. In addition, continued investments in mining and heavy industries, along with advancements in lithium ion and high capacity battery technologies, are contributing to market growth.

Restraining Factors

The industrial batteries market in Russia is constrained by high production and raw material costs, reliance on imports for advanced battery components, limited local production capabilities, strict regulations, and challenges related to the recycling and disposal of used industrial batteries.

Russia Industrial Batteries Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 788.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.14% |

| 2035 Value Projection: | USD 2063.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Tyumenskii Akkumulyatornyi Zavod AO, JSC AKOM, Akku Vertrieb, DELTA Battery, Yellow Battery, AkTeh, ZAKB LLC, Novgorodskaya Akkumulyatornaya Kompaniya, Velikoluksky Battery Plant Impuls, Oxide (Novosibirsk Radio Parts Plant), and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Russia industrial batteries market share is classified into type and application.

- The lead acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia industrial batteries market is segmented by type into lithium based, lead acid, and others. Among these, the lead acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its low cost, dependability, and proven effectiveness in industrial applications, including telecom, UPS systems, and heavy machinery, the lead acid segment leads the Russia industrial batteries market. Despite the emergence of lithium based alternatives, it continues to hold the highest market share and sustained growth across many industries due to its easy availability, established recycling infrastructure, and suitability for high discharge applications.

- The telecom and data communication segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia industrial batteries market is segmented by application into grid level energy storage, motive power, telecom and data communication, and uninterruptible power supply UPS backup. Among these, the telecom and data communication segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by the growing need for dependable and continuous power in data centers and telecom networks, rapid development of digital infrastructure, rising mobile connectivity, and increased demand for backup power solutions in both urban and rural areas.

Competitive Analysis:

The report offers an appropriate analysis of the key organizations and companies involved in the Russia industrial batteries market, along with a comparative evaluation primarily based on product offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides a detailed analysis of current news and developments of the companies, including product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and other activities. This allows for an evaluation of the overall competitive landscape of the market.

List of Key Companies

- Tyumenskii Akkumulyatornyi Zavod AO

- JSC AKOM

- Akku Vertrieb

- DELTA Battery

- Yellow Battery

- AkTeh

- ZAKB LLC

- Novgorodskaya Akkumulyatornaya Kompaniya

- Velikoluksky Battery Plant Impuls

- Oxide (Novosibirsk Radio Parts Plant)

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value Added Resellers (VARs)

Recent Developments

- In December 2025, the first gigafactory for lithium ion batteries in Russia, built in Kaliningrad by JSC TVEL (Rosatom), was officially launched with an annual capacity of 4 GWh. This facility covers the full battery production cycle.

- In November 2025, modernization of the Saratov Battery Plant was announced, with an investment of RUB 550 million planned from 2026 to 2028 to upgrade production of industrial nickel cadmium batteries.

- In July 2025, a mobile fleet of high capacity lithium ion battery storage systems developed by Rosatoms RENERA was presented at INNOPROM 2025 as a new company asset.

Market Segment

This study forecasts res Market, By Typeevenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia industrial batteries market based on the following segments.

Russia Industrial Batteries Market, By Type

- Lithium Based

- Lead Acid

- Others

Russia Industrial Batteries Market, By Application

- Grid Level Energy Storage

- Motive Power

- Telecom and Data Communication

- Uninterruptible Power Supply UPS Backup

Frequently Asked Questions (FAQ)

-

Q: What is the Russia industrial batteries market size?A: Russia industrial batteries market size is expected to grow from USD 788.5 million in 2024 to USD 2063.8 million by 2035, growing at a CAGR of 9.14% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rapid industrialization, the need for constant power supply in telecom, data centers, and manufacturing, and the growing use of electric cars. The gradual phasing out of coal power plants, increased government support for storage, and import substitution are just a few of the ways Russia is transitioning towards a cleaner energy economy.

-

Q: What factors restrain the Russia industrial batteries market?A: Constraints include the high production and raw materials costs, reliance on imports for cutting-edge battery parts, limited local production capabilities, tough regulations, and problems with the recycling and disposal of used industrial batteries.

-

Q: How is the market segmented by type?A: The market is segmented into lithium-based, lead-acid, and others.

-

Q: Who are the key players in the Russia industrial batteries market?A: Key companies include Tyumenskii Akkumulyatornyi Zavod AO, JSC AKOM, Akku‑Vertrieb, DELTA Battery, Yellow Battery, AkTех, ZAKB LLC, Novgorodskaya Akkumulyatornaya Kompaniya, Velikoluksky Battery Plant Impuls, Oxide (Novosibirsk Radio Parts Plant), and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?