Russia Ice Cream Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Vanilla, Chocolate, Fruit, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, and Others), and Russia Ice Cream Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Ice Cream Market Insights Forecasts to 2035

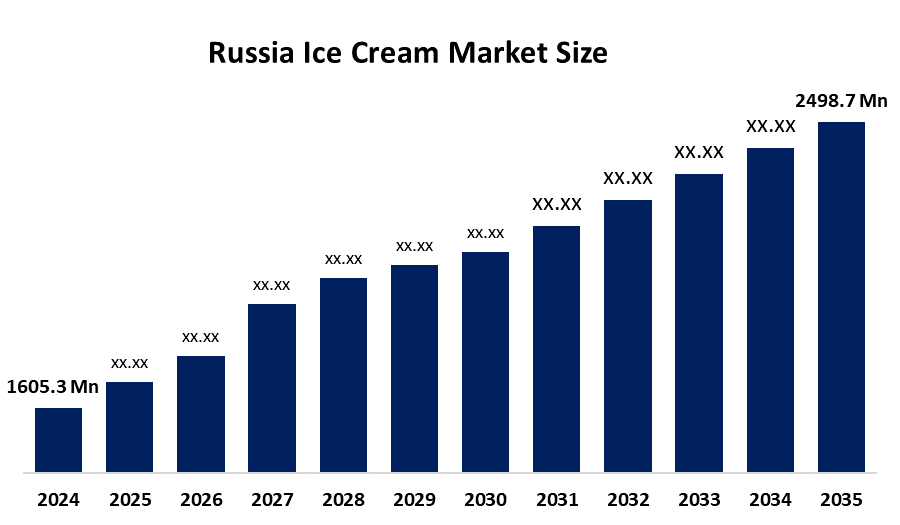

- The Russia Ice Cream Market Size Was Estimated at USD 1605.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Russia Ice Cream Market Size is Expected to Reach USD 2498.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia ice cream market size is anticipated to reach USD 2498.7 million by 2035, growing at a CAGR of 4.1% from 2025 to 2035. The ice cream market in Russia is driven by growing disposable incomes, urbanization, the growth of retail chains, innovation in flavors and forms, premiumization, impulse buying, summertime demand, better cold-chain logistics, marketing campaigns, and an increase in Russia's youth population.

Market Overview

The Russia ice cream market is made up of the entire value chain of frozen dessert production and sale, in which Russia is a large market for both dairy and non-dairy ice creams, sorbets, and frozen novelties. Household consumption, impulse buying, desserts served in restaurants, cafés, and fast-food places, and seasonal and holiday consumption are just some of the applications. Nationwide, the market caters to different consumer tastes through various retail channels such as supermarkets, convenience stores, kiosks, and foodservice.

The ice cream market of Russia is, in a way, supported by the dairy sector, which is wider in scope. Government data indicates that domestic production is considerably strong. Measures taken are dairy subsidies of approximately RUB 80 billion per year, 30-40% capitalization cost paybacks, soft loans, policies for reducing imports, and exporting with government aid for the development of processing, cold-chain infrastructure, and modernization of dairy and ice-cream making units.

The Russia ice cream market has seen a lot of activity recently, such as an increase in production capacity, the introduction of new flavors, the creation of premium and functional products, and an increase in exports to Asia, Africa, and the Middle East. It is worth mentioning the Smart automated ice-cream machines and energy-efficient processing technology, which have also surfaced. The future opportunities are in plant-based options, health-oriented varieties, regional sales growth, and untapped per-capita consumption potential.

Report Coverage

This research report categorizes the market for the Russia ice cream market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia ice cream market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia ice cream market.

Russia Ice Cream Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1605.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | USD 2498.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Flavor, By Distribution Channel |

| Companies covered:: | Iceberry Group, Renna Group of Companies, Unilever Russia,Froneri, Slavitsa Ice Cream Factory LLC, Chistaya Liniya, Russian Cold Group, Chelny Kholod, Novosibholod, Russkoe Moloko, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ice cream market in Russia is driven by the increase in disposable income, more summertime demand, a greater presence of retail stores and convenience stores, as well as a growing preference for more luxurious dessert options. The continual introduction of new flavours, the availability of high-quality products with added benefits, effective advertising, and the increase in population density, as well as advancements in cold chain logistics, have all contributed to the steady growth of ice cream markets throughout the different regions of Russia.

Restraining Factors

The ice cream market in Russia is mostly constrained by the seasonal demand variations, the continuous increase of raw material and energy costs, difficulties in cold-chain logistics in remote areas, health worries regarding sugar intake, the price sensitivity of customers, and the restriction of rural consumption growth.

Market Segmentation

The Russia ice cream market share is classified into flavor and distribution channel.

- The vanilla segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia ice cream market is segmented by flavor into vanilla, chocolate, fruit, and others. Among these, the vanilla segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its widespread market acceptance, affordability, and adaptability, vanilla continues to be the most popular flavor. Its widespread use as a stand-alone flavor and as a foundation for mixes, desserts, and premium versions results in increased sales volumes and steady demand throughout foodservice and retail channels.

- The supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia ice cream market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others. Among these, the supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These channels provide a large selection of products, affordable prices, opportunities for bulk purchases, and robust cold-chain infrastructure. They are the consumer's first option due to their high foot traffic, widespread presence, and regular promotions, which result in the highest revenue share and steady growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia ice cream market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Iceberry Group

- Renna Group of Companies

- Unilever Russia

- Froneri

- Slavitsa Ice Cream Factory LLC

- Chistaya Liniya

- Russian Cold Group

- Chelny Kholod

- Novosibholod

- Russkoe Moloko

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Revenue from Russia's ice cream exports jumped almost 30% when compared to the previous year, and reached nearly $70 million (January-October 2025), mainly due to strong demand from Kazakhstan, Belarus, and Uzbekistan.

- In November 2025, Online sales of ice cream in Russia increased by approximately 22%, although this was indicative of the new channel’s consumers shifting to, an overall sales decline was still in effect.

- In June 2025, the exports of Russian ice cream experienced a remarkable increase of about 40% in the first six months of 2025, which was a result of the larger growth in exports.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia ice cream market based on the below-mentioned segments:

Russia Ice Cream Market, By Flavor

- Vanilla

- Chocolate

- Fruit

- Others

Russia Ice Cream Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia ice cream market size?A: Russia ice cream market size is expected to grow from USD 1605.3 million in 2024 to USD 2498.7 million by 2035, growing at a CAGR of 4.1% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increase in disposable income, more summertime demand, a greater presence of retail stores and convenience stores, as well as a growing preference for more luxurious dessert options.

-

Q: What factors restrain the Russia ice cream market?A: Constraints include the seasonal demand variations, the continuous increase of raw material and energy costs, difficulties in cold-chain logistics in remote areas, and health worries regarding sugar intake.

-

Q: How is the market segmented by flavor?A: The market is segmented into vanilla, chocolate, fruit, and others.

-

Q: Who are the key players in the Russia ice cream market?A: Key companies include Iceberry Group, Renna Group of Companies, Unilever Russia, Froneri, Slavitsa Ice Cream Factory LLC, Chistaya Liniya, Russian Cold Group, Chelny Kholod, Novosibholod, Russkoe Moloko, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?