Russia Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Green Hydrogen, Grey Hydrogen, Blue Hydrogen, Turquoise Hydrogen, and Yellow Hydrogen), By End Use (Ammonia, Refining, Methanol, Fuel, and Others), and Russia Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsRussia Hydrogen Market Insights Forecasts to 2035

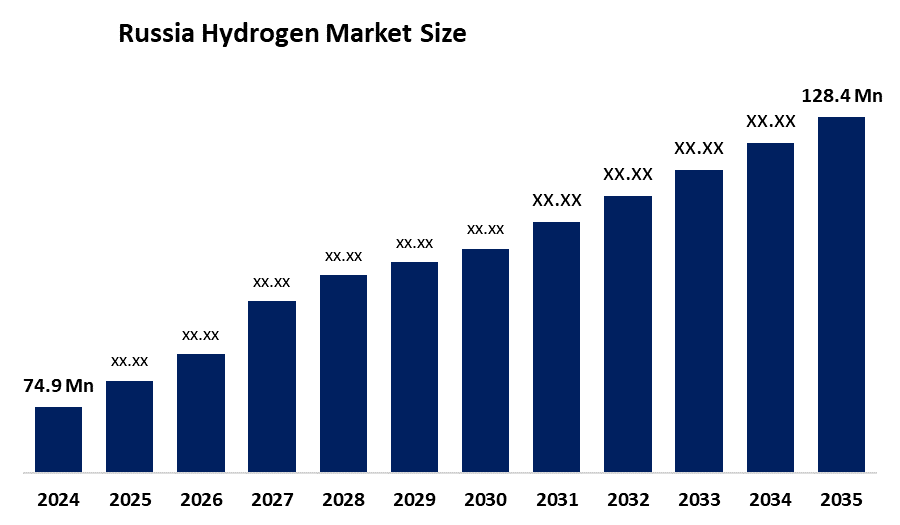

- The Russia Hydrogen Market Size Was Estimated at USD 74.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.02% from 2025 to 2035

- The Russia Hydrogen Market Size is Expected to Reach USD 128.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia hydrogen market size is anticipated to reach USD 128.4 million by 2035, growing at a CAGR of 5.02% from 2025 to 2035. The hydrogen market in Russia is driven by growing demand for clean energy, industry decarbonization objectives, an increase in hydrogen exports, the availability of natural gas supplies, technological advancements, and government programs promoting low-carbon hydrogen production.

Market Overview

The Russia hydrogen market refers to the production, storage, distribution, and utilization of hydrogen across energy and industrial sectors. Hydrogen is used in oil refining, chemical production, metallurgy, power generation, and emerging clean energy applications. Russia focuses on blue and low-carbon hydrogen production through its natural gas reserves, which will support energy exports and transportation, ammonia production, and industrial decarbonization and transition to a low-emission energy economy.

Government initiatives support the Russian hydrogen market through funding programs, which include the National Hydrogen Strategy that aims for 2 Mt of hydrogen exports by 2035. The funding program provides subsidies that cover up to 70% of hydrogen technology expenses, while it supports the development of production facilities, storage systems, and refueling stations. The combination of regional hydrogen clusters, clean energy initiatives, and federal programs drives innovation and infrastructure construction and boosts national economic power on the global stage.

Russia is developing hydrogen projects through its Sakhalin low-carbon hydrogen plant project, which it operates with Rosatom and Gazprom Neft (2023), and its hydrogen infrastructure projects, which it establishes in various areas. Companies such as Novatek are creating hydrogen-powered turbines (2025). The future business opportunities will focus on developing export-oriented hydrogen production systems, green hydrogen technology, and improved hydrogen storage and transportation methods.

Report Coverage

This research report categorizes the market for the Russia hydrogen market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia hydrogen market.

Russia Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 74.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.02% |

| 2035 Value Projection: | USD 128.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Gazprom, Rosatom, Rusal, H2 Invest, Lukoil, NLMK, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen market in Russia is driven by the country's natural gas reserves, government financial support, and rising interest in low-carbon energy and industrial decarbonization initiatives. Russia's hydrogen market expands through three main drivers, which include new hydrogen export facilities, better green and blue hydrogen production technologies, and the development of regional hydrogen production centers.

Restraining Factors

The hydrogen market in Russia is mostly constrained by the expensive green hydrogen production costs, insufficient domestic infrastructure, difficulties with large-scale hydrogen storage and transportation, and the industry's need for natural gas as a primary raw material.

Market Segmentation

The Russia Hydrogen market share is classified into product type and end use.

- The grey hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia hydrogen market is segmented by product type into green hydrogen, grey hydrogen, blue hydrogen, turquoise hydrogen, and yellow hydrogen. Among these, the grey hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to Russia's plentiful natural gas resources, well-established steam methane reforming infrastructure, cheaper production costs than green hydrogen, and extensive use in industrial applications, the grey hydrogen segment is the main source of hydrogen revenue.

- The ammonia segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia hydrogen market is segmented by end use into ammonia, refining, methanol, fuel, and others. Among these, the ammonia segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the widespread use of hydrogen in the production of ammonia for industrial chemicals and fertilizers, the ammonia segment dominates the Russian hydrogen market. Ammonia is in high demand both domestically and internationally, and its manufacturing infrastructure is well-established, which generates substantial revenue and market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gazprom

- Rosatom

- Rusal

- H2 Invest

- Lukoil

- NLMK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, Russia to Launch First Hydrogen Train for Sakhalin in 2026 as Suburban Rail Modernization Gains Momentum.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia hydrogen market based on the below-mentioned segments:

Russia Hydrogen Market, By Product Type

- Green Hydrogen

- Grey Hydrogen

- Blue Hydrogen

- Turquoise Hydrogen

- Yellow Hydrogen

Russia Hydrogen Market, By End Use

- Ammonia

- Refining

- Methanol

- Fuel

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia hydrogen market size?A: Russia hydrogen market size is expected to grow from USD 74.9 million in 2024 to USD 128.4 million by 2035, growing at a CAGR of 5.02% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a country's natural gas reserves, government financial support, and rising interest in low-carbon energy and industrial decarbonization initiatives.

-

Q: What factors restrain the Russia hydrogen market?A: Constraints include the expensive green hydrogen production costs, insufficient domestic infrastructure, and difficulties with large-scale hydrogen storage and transportation.

-

Q: How is the market segmented by product type?A: The market is segmented into green hydrogen, grey hydrogen, blue hydrogen, turquoise hydrogen, and yellow hydrogen.

-

Q: Who are the key players in the Russia hydrogen market?A: Key companies include Gazprom, Rosatom, Rusal, H2 Invest, Lukoil, NLMK, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?