Russia Hospital Electronic Health Records Market Size, Share, and COVID-19 Impact Analysis, By Type (Acute, Ambulatory, and Post-Acute), By Hospital Size (Small Hospital, Large Hospital, and Medium Hospital), By Application (Cardiology, Neurology, Mental and Behavioural Health, Radiology, Oncology, Nephrology and Urology, Gastroenterology, Pediatrics, General Medicine, Physical Therapy and Rehabilitation, and Others), and Russia Hospital Electronic Health Records Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareRussia Hospital Electronic Health Records Market Insights Forecasts to 2035

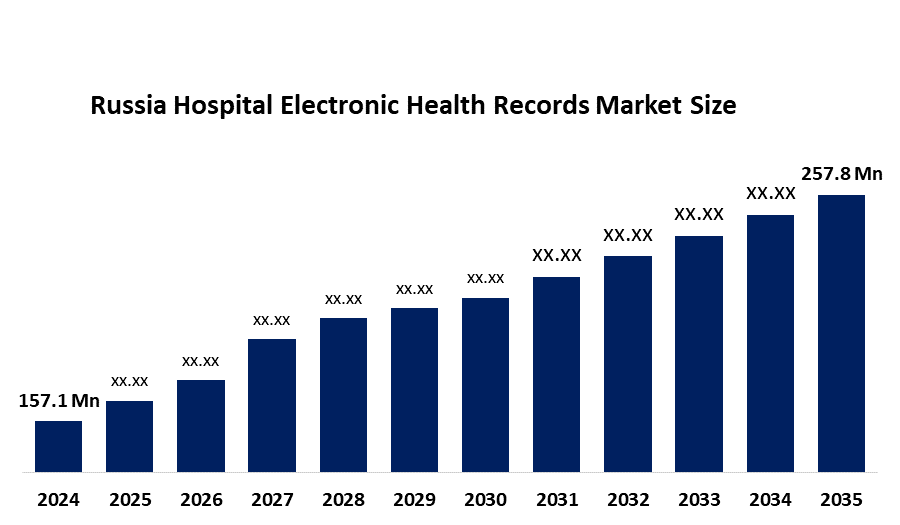

- The Russia Hospital Electronic Health Records Market Size Was Estimated at USD 157.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.61% from 2025 to 2035

- The Russia Hospital Electronic Health Records Market Size is Expected to Reach USD 257.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Hospital Electronic Health Records Market Size is anticipated to reach USD 257.8 Million by 2035, Growing at a CAGR of 4.61% from 2025 to 2035. The hospital electronic health records market in Russia is driven by the government led digital healthcare initiatives, increased hospital IT adoption, the need for effective patient data management, improvements in interoperability, the rising burden of chronic diseases, and investments in health informatics infrastructure.

Market Overview

The Russia hospital electronic health records (EHR) market refers to the deployment and use of digital systems that store, manage, and exchange patient clinical information across hospital settings. The platforms enable patient registration together with diagnostic and treatment documentation and billing and care coordination functions. The applications operate across public and private hospitals and specialty clinics and integrated care networks and enable hospitals to achieve better workflow processes and accurate data management and regulatory compliance and continuous patient healthcare delivery while supporting Russia's healthcare digital transformation objectives.

The Russian Ministry of Health established the federal initiative creating a single digital contour in healthcare to promote digital health record usage which has received more than 200 billion RUB in health IT funding since 2011 until 2024. The Unified State Health Information System (EGISZ) now serves more than 65000 medical facilities which use medical information systems to access its services. Starting in 2025, all medical facilities across the country must maintain their electronic medical records.

Digital health adoption reached new heights when multiple Russian hospitals switched to EHR systems and Moscow residents increased their use of EHR patient portals by two times. Domestic tech firms like Yandex Health and Webiomed are integrating AI analytics and predictive tools into EHRs. The future growth of the industry depends on AI diagnostics and rural digital expansion and cloud-based interoperability.

Report Coverage

This research report categorizes the market for the Russia hospital electronic health records market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia hospital electronic health records market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia hospital electronic health records market.

Russia Hospital Electronic Health Records Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 157.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.61% |

| 2035 Value Projection: | USD 257.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Hospital Size |

| Companies covered:: | Unified Medical Information and Analytical System (EMIAS), Medos, N3. Healthcare, RT MIS, Webiomed, MGERM, Softline, 1C Company, KMIS, Complex Medical Information Systems (C-MIS), Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hospital electronic health records market in Russia is driven by the government implements healthcare digitalization and requires hospitals to use electronic medical records and connect their systems to the Unified State Health Information System (EGISZ). The need to control patient data and the increasing chronic disease burden and higher hospital IT spending drive organizations to adopt new technologies. Public and private hospitals accelerate their EHR implementation because of the expanded telemedicine services and AI-based clinical analysis tools and improved system compatibility standards and need for affordable patient care management solutions.

Restraining Factors

The hospital electronic health records market in Russia is mostly constrained by the high implementation and maintenance costs, existing IT systems, difficulties with system interoperability, threats to cybersecurity, lack of qualified health IT professionals and different levels of digital development found in various regional hospitals.

Market Segmentation

The Russia hospital electronic health records market share is classified into type, hospital size and application.

- The acute segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia hospital electronic health records market is segmented by type into acute, ambulatory, and post-acute. Among these, the acute segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of acute hospitals manage the largest patient volumes and clinical complexity, necessitating the usage of complete EHR systems for billing, diagnosis, treatment, admissions, and EGISZ compliance. Large public hospitals are given priority in government digitalization initiatives, which results in early adoption, larger contracts, and more acute care spending per facility, driving the largest revenue share.

- The large hospital segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia hospital electronic health records market is segmented by hospital size into small hospital, large hospital, and medium hospital. Among these, the large hospital segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large public and private hospitals need full-scale EHR platforms with interoperability, analytics, and connectivity with the national EGISZ system since they handle larger patient volumes and more intricate clinical workflows. In addition, they have larger IT budgets, adopt advanced modules earlier, and receive priority government financing and digitalization support, all of which lead to higher contract values and quicker implementation when compared to medium and small hospitals.

- The general medicine segment has the largest revenue market share in 2024 and is predicted to expand at a significant CAGR over the forecast period.

The Russia hospital electronic health records market is segmented by application into cardiology, neurology, mental and behavioural health, radiology, oncology, nephrology and urology, gastroenterology, pediatrics, general medicine, physical therapy and rehabilitation, and others. Among these, the general medicine segment has the largest revenue market share in 2024 and is predicted to expand at a significant CAGR over the forecast period. This is because of general medicine departments are the main users of EHR systems for regular paperwork, diagnostics, prescriptions, and care coordination because they manage the majority of patient visits and inpatient admissions. EHR deployment usually starts in general medicine since government digitalization projects focus core clinical procedures first.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia hospital electronic health records market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unified Medical Information and Analytical System (EMIAS)

- Medos

- N3. Healthcare

- RT MIS

- Webiomed

- MGERM

- Softline

- 1C Company

- KMIS

- Complex Medical Information Systems (C-MIS)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, Russia's Unified State Health Information System (EGISZ) completely switched to digital format, enhancing the exchange of electronic medical data between clinics and hospitals and doing away with numerous paper processes.

- In August 2025, the use of regional EHRs and patient portals increased, with Moscow's EMR tools enabling users to schedule appointments and view test results online.

- In May 2025, with the integration of billions of medical records across the country, electronic medical record (EMR) and ambulatory EHR systems emerged as key components of Russia's healthcare data infrastructure.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia hospital electronic health records market based on the below-mentioned segments:

Russia Hospital Electronic Health Records Market, By Type

- Acute

- Ambulatory

- Post-Acute

Russia Hospital Electronic Health Records Market, By Hospital Size

- Small Hospital

- Large Hospital

- Medium Hospital

Russia Hospital Electronic Health Records Market, By Application

- Cardiology

- Neurology

- Mental and Behavioral Health

- Radiology

- Oncology

- Nephrology and Urology

- Gastroenterology

- Pediatrics

- General Medicine

- Physical Therapy and Rehabilitation

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia hospital electronic health records market size?A: Russia hospital electronic health records market size is expected to grow from USD 157.1 million in 2024 to USD 257.8 million by 2035, growing at a CAGR of 4.61% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by government implements healthcare digitalization and requires hospitals to use electronic medical records and connect their systems to the Unified State Health Information System (EGISZ).

-

Q: What factors restrain the Russia hospital electronic health records market?A: Constraints include the high implementation and maintenance costs, existing IT systems and difficulties with system interoperability.

-

Q: How is the market segmented by type?A: The market is segmented into acute, ambulatory, and post-acute.

-

Q: Who are the key players in the Russia hospital electronic health records market?A: Key companies include Unified Medical Information and Analytical System (EMIAS), Medos, N3. Healthcare, RT MIS, Webiomed, MGERM, Softline, 1C Company, KMIS, Complex Medical Information Systems (C-MIS), and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?