Russia Helicopter Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Light, Medium, and Heavy), By Application (Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, and Others), and Russia Helicopter Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseRussia Helicopter Services Market Size Insights Forecasts to 2035

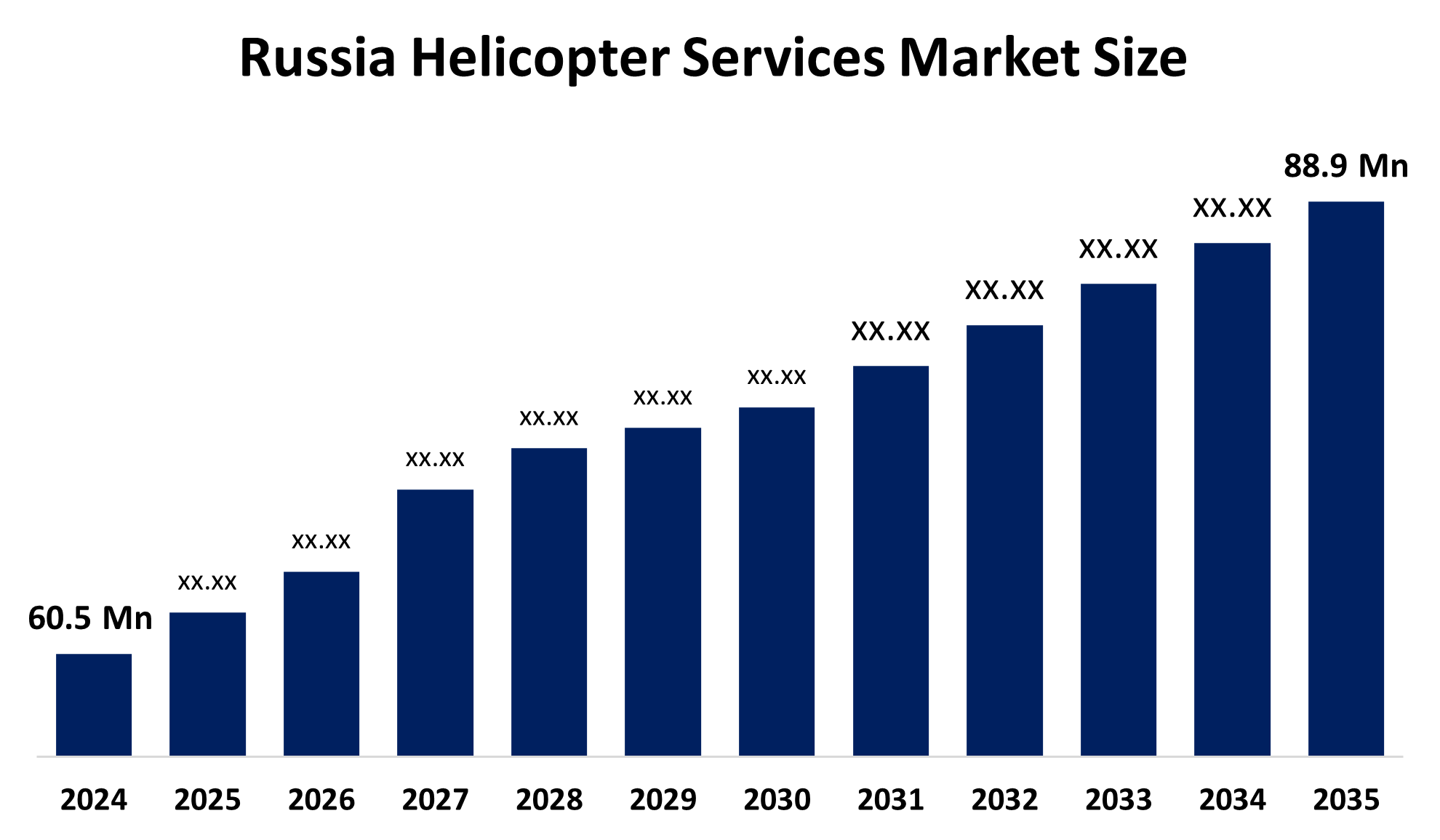

- The Russia Helicopter Services Market Size Was Estimated at USD 60.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.56% from 2025 to 2035

- The Russia Helicopter Services Market Size is Expected to Reach USD 88.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Helicopter Services Market Size is Anticipated to Reach USD 88.9 Million by 2035, Growing at a CAGR of 3.56% from 2025 to 2035. The helicopter services market in Russia is driven by government support for aviation infrastructure and the modernization of regional air transport networks, the growing demand for offshore oil and gas transportation, emergency medical services, search and rescue operations, tourism, and private charter services.

Market Overview

The Russia Helicopter Services Market Size consists of the different types of services that utilize helicopters, including commercial, industrial, medical, and government use. An example of the uses of helicopter services can be found in the offshore oil and gas industry, where helicopters transport crews to offshore oil rigs, as well as provide emergency medical service (EMS) support for patients-in-need and provide flight support for any crew member in need of an EAS.

The supporters of the National Wealth Fund Helicopter project, which is the Russian government, are going to put up about 44.5 billion rubles (2023-2025) to lease Mi-8 helicopters at a very low interest rate of 2.5%, thus boosting the operators’ fleet updating activity. In addition, there has been a draining of billions of troubles in the medevac aviation programmers, and it is mainly for air ambulance helicopters. Other civil aviation subsidies give reimbursements for partial operational costs incurred by regional air services as well.

Report Coverage

This research report categorizes the market for the Russia Helicopter Services Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each sub-market. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia helicopter services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia helicopter services market.

Russia Helicopter Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 60.5 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.56% |

| 2035 Value Projection: | USD 88.9 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Russian Helicopter Systems Aviation Group, CITICOPTER, PANH Helicopters, Helimed Helix Airlines, AeroGeo, Ikar, Uralhelicom, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The helicopter services market in Russia is driven by the demand for offshore oil and gas transportation, better connectivity in remote and hard-to-reach regions, and the rapid growth of emergency medical services and search and rescue operations. The demand from the tourism sector and the advent of VIP charter services and cargo transportation also play a part. On the other hand, the government is stimulating the whole situation by modernizing aviation infrastructure, upgrading the fleet with new helicopters, giving subsidies to regional operators, and so on. This is backed by the fact that they all contribute to the overall improvement of efficiency, safety, and accessibility in various sectors like commercial, industrial, and public.

Restraining Factors

The helicopter services market in Russia is mostly constrained by the high costs of operations plus maintenance, strict regulations and requirements, a narrow availability of qualified pilots, and restrictions due to the season weather that all together create a situation of market suppression, fleet anesthesiology, and technology transfer of the superior helicopter kinds.

Market Segmentation

The Russia Helicopter Services market share is classified into type and application.

- The medium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Helicopter Services Market Size is segmented by type into light, medium, and heavy. Among these, the medium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they provide a balance between payload capacity, range, and operating cost, medium helicopters are more adaptable and cost-effective than light or heavy helicopters and are frequently utilized for offshore oil and gas crew transport, emergency medical services, search and rescue, and regional passenger transport. For medium helicopters, this adaptability increases demand and revenue sharing.

- The business and corporate travel segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Helicopter Services Market Size is segmented by application into offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and others. Among these, the business and corporate travel segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because executives and officials have a high demand for quick, flexible, and high-quality transportation, which is reinforced by industrial and offshore operations that necessitate effective travel to remote places.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Helicopter Services Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Russian Helicopter Systems

- Aviation Group

- CITICOPTER

- PANH Helicopters

- Helimed

- Helix Airlines

- AeroGeo

- Ikar

- Uralhelicom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, the Ministry of Industry of Russia made a statement that more than 50 helicopters had been delivered to Russian airlines in 2025, which shows the modernization of the fleet and the expansion of the service.

- In November 2025, the state company, GTLK, allocated six Mi 8MTV 1 helicopters to the Ut Air Helicopter Services, which was a part of the updated civil operation under the preferential leasing programme.

- In October 2025, Russian Helicopters took part in the China Helicopter Exposition 2025 and brought along its An sat, Ka 32A11M, and Mi to display their aircraft and open up more avenues for international collaboration and export.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia Helicopter Services Market Size based on the below-mentioned segments:

Russia Helicopter Services Market, By Type

- Light

- Medium

- Heavy

Russia Helicopter Services Market, By Application

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia helicopter services market size?A: Russia helicopter services market size is expected to grow from USD 60.5 million in 2024 to USD 88.9 million by 2035, growing at a CAGR of 3.56% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by demand for offshore oil and gas transportation, better connectivity in remote and hard-to-reach regions, and the rapid growth of emergency medical services and search and rescue operations.

-

Q: What factors restrain the Russia helicopter services market?A: Constraints include the high costs of operations plus maintenance, strict regulations and requirements, and a narrow availability of qualified pilots.

-

Q: How is the market segmented by type?A: The market is segmented into light, medium, and heavy.

-

Q: Who are the key players in the Russia helicopter services market?A: Key companies include Russian Helicopter Systems, Heliaviation Group, CITICOPTER, PANH Helicopters, Helimed, Helix Airlines, AeroGeo, Ikar, Uralhelicom, and Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?