Russia Food Colors Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Colors, and Synthetic Colors), By Application (Beverages, Bakery, Dairy, and Confectionery), and Russia Food Colors Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Food Colors Market Insights Forecasts to 2035

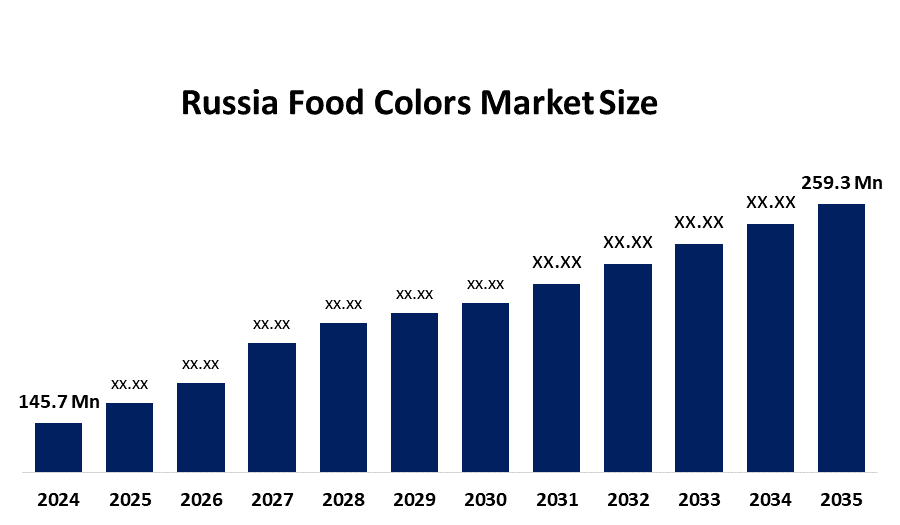

- The Russia Food Colors Market Size Was Estimated at USD 145.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.38% from 2025 to 2035

- The Russia Food Colors Market Size is Expected to Reach USD 259.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Food Colors Market Size is anticipated to reach USD 259.3 Million by 2035, Growing at a CAGR of 5.38% from 2025 to 2035. The food colors market in Russia is driven by growing demand for packaged and processed foods, the manufacturing of more baked goods and confections, consumers' inclination for aesthetically pleasing items, the expansion of foodservice establishments, and the slow transition to natural and clean-label food coloring ingredients.

Market Overview

The Russia food colors market consists of natural and synthetic color additives which food and beverage products use to improve their visual appearance and consumer appeal. These colors are used in bakery products, confectionery items, dairy products, beverages, processed foods, and snack foods. Food colors help products keep their visual appearance throughout processing while providing a solution to color loss and making products easier to identify. The increasing need for visually appealing packaged foods together with the growing demand for natural food colors is leading to expanded usage of these colors throughout Russia's food processing sector.

The Russian food processing industry which includes food colors shows growth through complex food additive sales which increased from 80 to 165 thousand tons between 2019 and 2023. Government support for agro-industrial modernization and import substitution through subsidized loans and industrial development funds helps domestic food ingredient production which supplies the food colors sector while reducing import dependency.

Recent Russian developments include expanded production of natural food colorants by local suppliers like EcoColor LLC to meet growing demand for clean-label products. Manufacturers are developing heat-stable pigments which will improve products used in bakery and dairy applications. The future market opportunities will be found through natural plant-based colorants and advanced stabilization technologies which enable manufacturers to produce processed foods and beverages.

Report Coverage

This research report categorizes the market for the Russia food colors market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia food colors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia food colors market.

Russia Food Colors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 145.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.38% |

| 2035 Value Projection: | USD 259.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | EcoColor LLC, Russian Ingredients, PTI Group of Companies LLC, Yarprodsnabservice LTD, Neos Ingredients, DENA-TRADE, Mona Ingredients, LLC, K-K Trading LLC, Ingredia LLC, Fruit Master Russia, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The food colors market in Russia is driven by the increasing demand for processed packaged and convenience foods which are particularly popular in bakery and confectionery and dairy and beverage sectors. The demand for color additives has grown because consumers prefer food products that have visually appealing appearance and reliable quality. The market experiences growth because foodservice outlets continue to expand their operations and local food manufacturers increase their production capacity while developing new flavoring products and visual elements. The market expansion throughout Russia receives support from people who now prefer natural and clean-label food colors because the government promotes domestic ingredient manufacturing and food import substitution.

Restraining Factors

The food colors market in Russia is mostly constrained by the strict food safety regulations and the lack of high-quality natural color sources and the elevated costs of producing clean-label alternatives and the restrictions on importing raw materials and the price sensitivity that exists among small and mid-scale food manufacturers.

Market Segmentation

The Russia food colors market share is classified into type and application.

- The synthetic colors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia food colors market is segmented by type into natural colors, and synthetic colors. Among these, the synthetic colors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its reduced prices, great color stability, extended shelf life, good heat resistance, and extensive use in mass-produced processed foods, confections, and bakeries, the synthetic color segment leads the Russian food coloring market.

- The confectionery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia food colors market is segmented by application into beverages, bakery, dairy, and confectionery. Among these, the confectionery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The high consumption of candies, chocolates, gummies, and coated sweets, all of which mainly rely on vivid, consistent colors for visual appeal, is the cause of this. Its dominant market position and expansion are bolstered by ongoing product innovation and robust consumer demand for enticing confections.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia food colors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EcoColor LLC

- Russian Ingredients

- PTI Group of Companies LLC

- Yarprodsnabservice LTD

- Neos Ingredients

- DENA-TRADE

- Mona Ingredients, LLC

- K-K Trading LLC

- Ingredia LLC

- Fruit Master Russia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, health concerns about unreported synthetic food colors (azorubine) in sweets prompted regulatory investigation, affecting industry compliance and labeling policies.

- In June 2025, ingredient industry shows such as Agroprodmash-2025 highlighted increasing demand for functional, natural extracts, and colorants used in food processing, boosting innovation in natural food color solutions.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia food colors market based on the below-mentioned segments:

Russia Food Colors Market, By Type

- Natural Colors

- Synthetic Colors

Russia Food Colors Market, By Application

- Beverages

- Bakery

- Dairy

- Confectionery

Frequently Asked Questions (FAQ)

-

Q: What is the Russia food colors market size?A: Russia food colors market size is expected to grow from USD 145.7 million in 2024 to USD 259.3 million by 2035, growing at a CAGR of 5.38% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by increasing demand for processed packaged and convenience foods which are particularly popular in bakery and confectionery and dairy and beverage sectors. The demand for color additives has grown because consumers prefer food products that have visually appealing appearance and reliable quality.

-

Q: What factors restrain the Russia food colors market?A: Constraints include the strict food safety regulations and the lack of high-quality natural color sources and the elevated costs of producing clean-label alternatives.

-

Q: How is the market segmented by type?A: The market is segmented into natural colors, and synthetic colors.

-

Q: Who are the key players in the Russia food colors market?A: Key companies include EcoColor LLC, Russian Ingredients, PTI Group of Companies LLC, Yarprodsnabservice LTD, Neos Ingredients, DENA-TRADE, Mona Ingredients, LLC, K-K Trading LLC, Ingredia LLC, Fruit Master Russia, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?