Russia Fitness Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Cardio, Strength, and Accessories), By End Use (Home, and Gym), and Russia Fitness Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Fitness Equipment Market Insights Forecasts to 2035

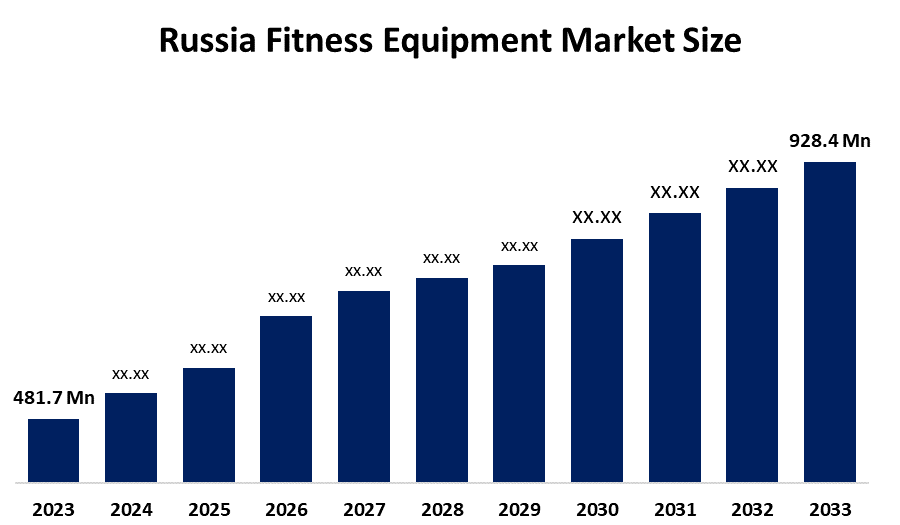

- The Russia Fitness Equipment Market Size Was Estimated at USD 481.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.15% from 2025 to 2035

- The Russia Fitness Equipment Market Size is Expected to Reach USD 928.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia fitness equipment market size is anticipated to reach USD 928.4 million by 2035, growing at a CAGR of 6.15% from 2025 to 2035. The fitness equipment market in Russia is driven by expanding obesity concerns, expanding home fitness usage, the growth of gyms and wellness centers, government fitness efforts, urbanization, and more disposable incomes.

Market Overview

The fitness equipment market in Russia is associated with the production, distribution, and sales of gym equipment used in cardio workouts, strength training, and other physical exercises. The market applications cover home fitness, public gyms, health clubs, sports training centers, rehab clinics, and corporate wellness programs, which all together promote the health, fitness, and active lifestyles of the people living in Russia.

The government activities, like the 55 participation target by 2024 and the 70 participation target by 2030, have contributed a lot to the growth of the Russian fitness equipment market. Federal programs are investing 74.5 billion in 2026 for sports infrastructure, and there will be more money for local equipment manufacture, import substitution, and tax/loan incentives, which will lead to more gyms, home fitness, and overall market growth.

Among the recent advancements in the fitness equipment sector in Russia are the Russian manufacturers like IRONEXT, who are coming up with a variety of strength training machines for instance, Hip Thruster models, along with the creation of new strength training machines and the expansion of local production to lessen the dependence on imported goods. Another manufacturer, FitWorld, has added a variety of training equipment to its local production capacity. As fitness culture is growing, the demand is rising, which in turn, offers future opportunities in the areas of smart and connected fitness devices, home exercise tech, and gym automation solutions.

Report Coverage

This research report categorizes the market for the Russia fitness equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia fitness equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia fitness equipment market.

Russia Fitness Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 481.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.15% |

| 2035 Value Projection: | USD 928.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Equipment, By End Use |

| Companies covered:: | FitWorld Russia,IRONEXT,Bronze Gym,Foreman Fitness,Fitathlon Group,Sportmaster And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The fitness equipment market in Russia is driven by more people becoming aware of their health and wellness, the increase in lifestyle-related diseases previously mentioned, and the increase in people using home fitness routines. The growth of gyms fitness clubscorporate wellness programs continues to drive commercial demand for fitness equipment. The increase in Government initiatives that stimulate sports participation, support for urbanization at a higher level, and disposable income all help to promote the use of cardio, resistance, and other smart fitness equipment in both residential and professional sectors.

Restraining Factors

The fitness equipment market in Russia is mostly constrained by the high costs of equipment, the unstable economy, and the variation in disposable incomes. Additionally, in small towns, there is a lack of consumer awareness, and the market is mainly dependent on imports, which also act as factors hindering the growth of the market.

Market Segmentation

The Russia fitness equipment market share is classified into equipment and end use.

- The cardio segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia fitness equipment market is segmented by equipment into cardio, strength, and accessories. Among these, the cardio segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its widespread appeal for heart health, weight control, and general fitness, the cardio segment leads the Russian fitness equipment industry. Strong demand is driven by rising health consciousness, growing concerns about obesity, and rising use of treadmills, exercise cycles, and ellipticals at home and in the gym. Cardio equipment's dominant revenue share and growth are further supported by its adaptability, usability, and quantifiable fitness outcomes.

- The premium segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia fitness equipment market is segmented by end use into home, and gym. Among these, the premium segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growing urban populations, rising disposable incomes, an increase in the number of commercial gyms, fitness facilities, and wellness clubs, as well as consumers' desire for expert advice and access to a variety of equipment, all contribute to increased demand and revenue for gyms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia fitness equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FitWorld Russia

- IRONEXT

- Bronze Gym

- Foreman Fitness

- Fitathlon Group

- Sportmaster

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, the Moscow Fitness Festival in 2025 was a major event that brought industry growth and equipment trends to the forefront.

- In July 2025, the fitness equipment brand Aerofit (distributed in Russia by SportRus) took a big step, increasing its brand presence at major regional sport events.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia fitness equipment market based on the below-mentioned segments:

Russia Fitness Equipment Market, By Equipment

- Cardio

- Strength

- Accessories

Russia Fitness Equipment Market, By End Use

- Home

- Gym

Frequently Asked Questions (FAQ)

-

Q: What is the Russia fitness equipment market size?A: Russia fitness equipment market size is expected to grow from USD 481.7 million in 2024 to USD 928.4 million by 2035, growing at a CAGR of 6.15% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by more people becoming aware of their health and wellness, the increase in lifestyle-related diseases previously mentioned, and the increase in people using home fitness routines. The growth of gyms/fitness clubs/corporate wellness programs continues to drive commercial demand for fitness equipment.

-

Q: What factors restrain the Russia fitness equipment market?A: Constraints include the high costs of equipment, the unstable economy, and the variation in disposable incomes.

-

Q: How is the market segmented by equipment?A: The market is segmented into cardio, strength, and accessories.

-

Q: Who are the key players in the Russia fitness equipment market?A: Key companies include FitWorld Russia, IRONEXT, Bronze Gym, Foreman Fitness, Fitathlon Group, Sportmaster, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?