Russia Diabetes Market Size, Share, and COVID-19 Impact Analysis, By Type (Insulin, Oral Anti-diabetic Drugs, Non-Insulin Injectable Drugs, and Combination Drugs), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), and Russia Diabetes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareRussia Diabetes Market Insights Forecasts to 2035

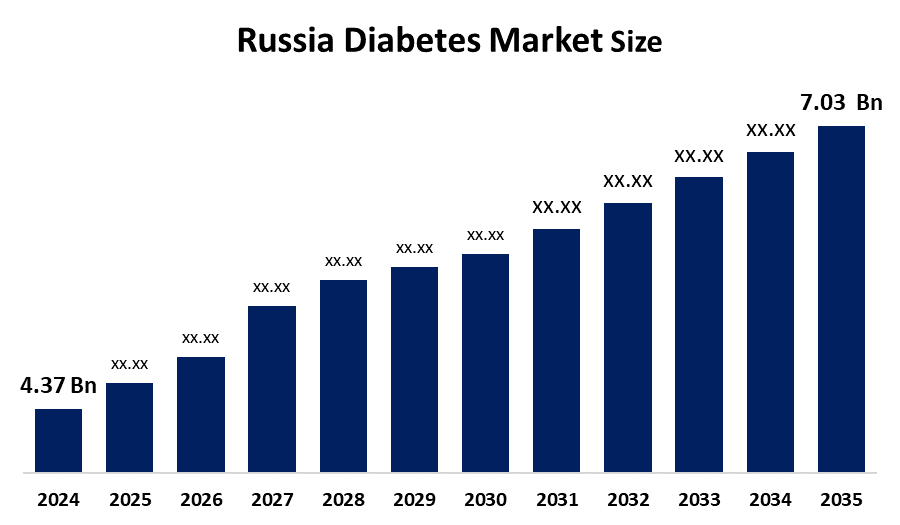

- The Russia Diabetes Market Size Was Estimated at USD 4.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.42% from 2025 to 2035

- The Russia Diabetes Market Size is Expected to Reach USD 7.03 Billion by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Russia Diabetes Market Size Is Anticipated To Reach USD 7.03 Billion By 2035, Growing At A CAGR Of 4.42% From 2025 To 2035. The diabetes market in Russia is driven by increasing occurrence of diabetes, the aging of the population, the rise in obesity rates, better access to diagnosis and treatment, increased government healthcare spending, and the widespread use of insulin therapies, glucose monitoring devices, and diabetes management programs.

Market Overview

The Russian diabetes market includes pharmaceutical medications, insulin therapy, glucose monitoring equipment, and diabetes management solutions used for diabetes diagnosis, treatment, and monitoring. In order to control blood glucose levels, avoid problems, and enhance the quality of life for diabetes patients throughout Russia, these items are extensively used in clinics, hospitals, and home care settings.

The Russian government is committed to supporting diabetes management for the period (2022–2026) through the National Diabetes Control Program. This programme has been allocated funding of approximately RUB 180 billion to provide affordable access to insulin, medicines, diagnostics, and glucose monitoring devices. Along with the national programme, RUB 5.5 billion has recently been budgeted to local governments for improving early diagnosis, increasing the availability of endocrinology services, and developing subsidised treatment strategies for people living with diabetes throughout the country.

The diabetes market in Russia is getting oozing with innovations through the implementation of local insulin production, creation of native GLP-1 and combined treatments, and the introduction of glucose monitoring instruments by companies based in Russia. The possibilities for the future are many, such as AI technology-assisted diabetic treatment, telehealth services combined, widespread use of continuous glucose monitoring technologies, and further adoption by the government support of import substitution in healthcare programs.

Report Coverage

This research report categorizes the market for the Russia diabetes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia diabetes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia diabetes market.

Russia Diabetes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.42% |

| 2035 Value Projection: | USD 7.03 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution |

| Companies covered:: | Geropharm JSC, Pharmstandard (JSC), BIOCAD, R-Pharm, Protek Pharmaceuticals, Akrihin, Katren, Promomed Group, Insulinum, Local glucose monitor producers, Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The diabetes market in Russia is driven by the rise in diabetes cases caused by an aging population, an inactive way of living, and higher obesity rates. Better diagnosis rates, access to insulin and glucose monitoring devices, and disease management awareness contribute to the market's growth. Also, strong government healthcare programs, public health spending, and local manufacturing of diabetes drugs and devices, along with the adoption of digital health and remote monitoring technologies, are in demand in hospitals as well as in homecare settings.

Restraining Factors

The diabetes market in Russia is mostly constrained by the economic problems, uneven access to advanced treatments in remote areas, medicine price controls, reliance on state funding, regulatory challenges, and different accessibility of innovative diabetes drugs and monitoring technologies in various parts of the country.

Market Segmentation

The Russia diabetes market share is classified into type and distribution channel.

- The insulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia diabetes market is segmented by type into insulin, oral anti-diabetic drugs, non-insulin injectable drugs, and combination drugs. Among these, the insulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high incidence of type 1 diabetes and cases of advanced type 2 diabetes that need insulin therapy are the causes of this. Insulin's highest revenue share and ongoing increase are a result of strong government support, extensive reimbursement, growing local insulin production, and steady demand for long-term treatment.

- The hospital pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia diabetes market is segmented by distribution channel into online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the hospital pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because government-funded healthcare programs mainly use hospitals to prescribe and administer insulin and injectable diabetes treatments. Hospital pharmacies are the recommended method of treating diabetes in Russia because they guarantee controlled distribution, payment coverage, and patient monitoring.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia diabetes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Geropharm JSC

- Pharmstandard (JSC)

- BIOCAD

- R-Pharm

- Protek Pharmaceuticals

- Akrihin

- Katren

- Promomed Group

- Insulinum

- Local glucose monitor producers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Promomed's registration of Semaltara marked the introduction of the first Russian tablet semaglutide for type 2 diabetes, thus widening the array of domestic GLP-1 therapy options.

- In June 2025, A team of researchers from Sechenov University invented a biotechnology that would allow the production of GLP-1-based drug substances at a much lower cost, thus making the corresponding diabetes medicines cheaper.

- In April 2025, the health authority in Russia approved the use of the seventh semaglutide-based drug, which increased the diabetes treatments available from local sources.

- In March 2025, Local producers (like Geropharm) managed to increase their insulin sales share in government procurements to around 44%, which put foreign brands under pressure.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia diabetes market based on the below-mentioned segments:

Russia Diabetes Market, By Type

- Insulin

- Oral Anti-diabetic Drugs

- Non-Insulin Injectable Drugs

- Combination Drugs

Russia Diabetes Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Frequently Asked Questions (FAQ)

-

Q: What is the Russia diabetes market size?A: Russia diabetes market size is expected to grow from USD 4.37 billion in 2024 to USD 7.03 billion by 2035, growing at a CAGR of 4.42% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a rise in diabetes cases caused by an aging population, an inactive way of living, and higher obesity rates. Better diagnosis rates, access to insulin and glucose monitoring devices, and disease management awareness contribute to the market's growth.

-

Q: What factors restrain the Russia diabetes market?A: Constraints include the economic problems, uneven access to advanced treatments in remote areas, medicine price controls, reliance on state funding, regulatory challenges, and different accessibility of innovative diabetes drugs and monitoring technologies in various parts of the country.

-

Q: How is the market segmented by type?A: The market is segmented into insulin, oral anti-diabetic drugs, non-insulin injectable drugs, and combination drugs.

-

Q: Who are the key players in the Russia diabetes market?A: Key companies include Geropharm JSC, Pharmstandard (JSC), BIOCAD, R-Pharm, Protek Pharmaceuticals, Akrihin, Katren, Promomed Group, Insulinum, Local glucose monitor producers, and Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?