Russia Cold Chain Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Software), By Application (Food & Beverages, Pharmaceuticals, and Others), and Russia Cold Chain Monitoring Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationRussia Cold Chain Monitoring Market Insights Forecasts to 2035

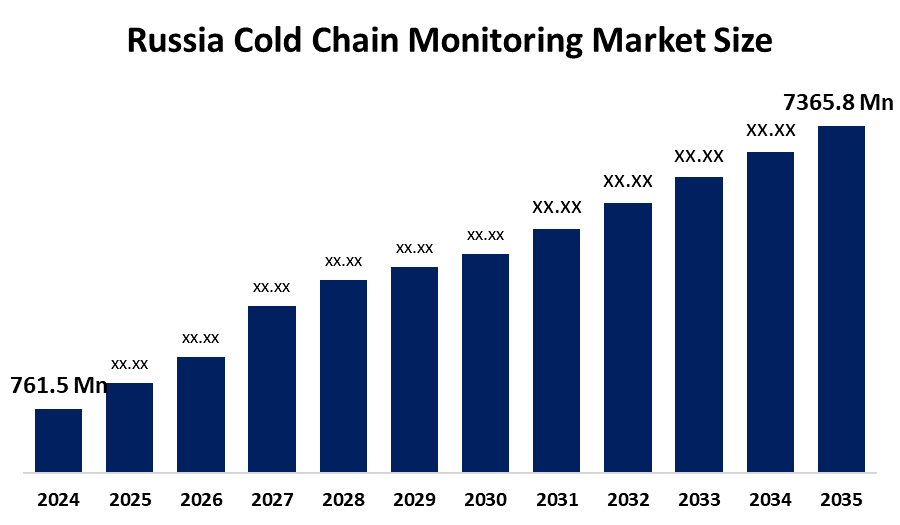

- The Russia Cold Chain Monitoring Market Size Was Estimated at USD 761.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 22.91% from 2025 to 2035

- The Russia Cold Chain Monitoring Market Size is Expected to Reach USD 7365.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia cold chain monitoring market size is anticipated to reach USD 7365.8 million by 2035, growing at a CAGR of 22.91% from 2025 to 2035. The cold chain monitoring market in Russia is driven by expanding pharmaceutical logistics, increasing vaccine distribution, rising food export demand, stringent regulatory compliance, IoT sensor usage, and rising investments in temperature-sensitive supply chains.

Market Overview

The Russia cold chain monitoring market refers to systems and technologies that track, control and maintain temperature-sensitive products during their storage and transportation process. The system consists of sensors, data loggers, RFID devices, and GPS tracking and cloud-based monitoring platforms. The applications cover pharmaceutical products, which include vaccines and biologics, and food and beverage products, which include meat, dairy, seafood and chemical products and healthcare logistics operations. The solutions provide safety protection for products while enabling businesses to meet regulatory standards, decreasing product waste, increasing product tracking capabilities and boosting operational performance through supply chain management across the entire Russian territory.

The Russian government supports cold chain development through the National Agro-Industrial Complex Program, which provides financial support up cent of capital expenses for refrigerated storage initiatives. The budget for cold logistics system improvements exceeds $500 million. The implementation of Technical Regulation TR CU requires businesses to monitor their temperature conditions, which has resulted in increased use of digital cold chain monitoring systems throughout the country.

Recent advancements in Russia’s cold chain monitoring market include IoT sensor integration, AI-based predictive analytics and blockchain traceability, which local logistics firms have implemented. Sovcomflot and other companies are enhancing their real-time monitoring systems. The upcoming market possibilities for the business sector will arise from the development of pharmaceutical cold chains, smart refrigerated transport systems and digital compliance platforms, which enable nationwide vaccine and perishable food distribution.

Report Coverage

This research report categorizes the market for the Russia cold chain monitoring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia cold chain monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia cold chain monitoring market.

Russia Cold Chain Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 761.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.91% |

| 2035 Value Projection: | USD 7365.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Component,By Application |

| Companies covered:: | X Logistics,RZD Logistics,Global Cold Chain,VkusVill,Miratorg,And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cold chain monitoring market in Russia is driven by the growing pharmaceutical production, increasing vaccine distribution needs, and rising demand for temperature-sensitive biologics and frozen processed food products. The market experiences rapid expansion because of strict food safety and pharmaceutical regulations, which drive the adoption of IoT-based tracking systems and the increase in refrigerated warehousing and transport infrastructure investments. Russia needs advanced monitoring systems because its extensive geography requires solutions that can protect product quality during extended supply chain routes.

Restraining Factors

The cold chain monitoring market in Russia is mostly constrained because advanced monitoring systems require expensive implementation and maintenance costs, remote areas lack proper infrastructure, there are insufficient technical workers, and economic conditions create barriers for companies to spend money on digital cold chain systems and modernisation initiatives.

Market Segmentation

The Russia cold chain monitoring market share is classified into component and application.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia cold chain monitoring market is segmented by component into hardware and software. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because real-time monitoring and regulatory compliance depend on hardware elements like temperature sensors, data recorders, RFID devices, and GPS trackers. The demand for physical monitoring devices is rising due to expanding pharmaceutical distribution and food logistics throughout Russia's large territory, which generates more money than digital solutions.

- The pharmaceuticals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia cold chain monitoring market is segmented by application into food & beverages, pharmaceuticals, and others. Among these, the pharmaceuticals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growing manufacturing and distribution of vaccines, biologics, and temperature-sensitive medications, which necessitate stringent regulatory compliance and ongoing temperature monitoring, are the main drivers of this dominance. The need for sophisticated cold chain monitoring systems in this market is further bolstered by growing pharmaceutical logistics throughout Russia and rising healthcare expenditure

.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia cold chain monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- X5 Logistics

- RZD Logistics

- Magnit Logistics

- Global Cold Chain

- Ozon Holdings

- DPDgroup Russia

- VkusVill

- Miratorg

- Sovtransavto

- Termo Kont MK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, the adoption of digital monitoring in e-commerce and grocery delivery is highlighted by the release of industry analysis and strategic papers on cold chain market trends and investment prospects.

- In December 2025, Russian logistics and pharmaceutical forums addressed new regulations and transparent cold chain practices, highlighting the industry's focus on digital monitoring.

- In September 2025, at the World Food exhibition in Moscow, industry professionals conducted workshops on methods for dependable cold chain logistics and integrity, with an emphasis on improving temperature-controlled transit procedures.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia cold chain monitoring market based on the below-mentioned segments:

Russia Cold Chain Monitoring Market, By Component

- Hardware

- Software

Russia Cold Chain Monitoring Market, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia cold chain monitoring market size?A: Russia cold chain monitoring market size is expected to grow from USD 761.5 million in 2024 to USD 7365.8 million by 2035, growing at a CAGR of 22.91% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing pharmaceutical production, increasing vaccine distribution needs, and rising demand for temperature-sensitive biologics and frozen processed food products.

-

Q: What factors restrain the Russia cold chain monitoring market?A: Constraints include that advanced monitoring systems require expensive implementation and maintenance costs, and remote areas lack proper infrastructure.

-

Q: How is the market segmented by component?A: The market is segmented into hardware and software.

-

Q: Who are the key players in the Russia cold chain monitoring market?A: Key companies include X5 Logistics, RZD Logistics, Magnit Logistics, Global Cold Chain, Ozon Holdings, DPDgroup Russia, VkusVill, Miratorg, Sovtransavto, Termo-Kont MK, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?