Russia Coated Glass Market Size, Share, and COVID-19 Impact Analysis, By Coating (Soft, and Hard), By Application (Architecture, Optical, Automotive, and Others), and Russia Coated Glass Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsRussia Coated Glass Market Insights Forecasts to 2035

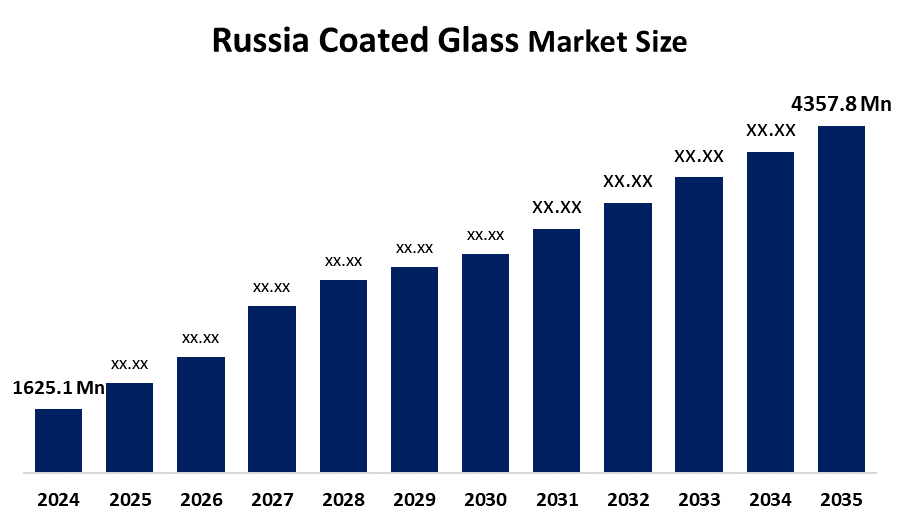

- The Russia Coated Glass Market Size Was Estimated at USD 1625.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.38% from 2025 to 2035

- The Russia Coated Glass Market Size is Expected to Reach USD 4357.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Coated Glass Market Size Is Anticipated To Reach USD 4357.8 Million By 2035, Growing At A CAGR of 9.38% From 2025 To 2035. The coated glass market in Russia is driven by rising construction activity, the adoption of energy-efficient buildings, expanding automobile manufacturing, infrastructure modernization, the need for solar-control glazing, and the growing usage of sophisticated architectural and safety glass.

Market Overview

The Russia Coated Glass Market Size refers to the production and use of glass treated with specialized coatings to enhance properties such as solar control and thermal insulation and anti-reflection and durability. The market serves applications across residential and commercial construction and automotive glazing and solar energy systems and industrial equipment. Coated glass serves as a fundamental material in contemporary Russian construction and vehicle design and renewable energy infrastructure because it enhances energy efficiency and indoor comfort and safety and visual appeal.

The Russian Ministry of Industry and Trade has allocated billions of rubles through low-interest loans and innovation grants to support local glass manufacturers who use the Industrial Development Fund. The funding has enabled local manufacturers to produce more coated glass products which will decrease their need to import materials. The building energy-saving programs together with the construction subsidies for environmentally friendly building projects create an incentive for developers to use advanced window technologies. The construction financing programs have provided development funds which total approximately 2.6 billion RUB to builders that include energy-saving initiatives. The production of energy-efficient glass products in the country now receives more attention as a major priority.

In 2025, a new 8 billion coated glass production facility launched in the Moscow region, boosting sun-protected glazing capacity. The construction projects which developed energy-efficient building standards created increased demand for Low-E and heat-reflective coatings. The company will develop smart coatings Arctic-ready insulating glass and customized thermal solutions which will serve both residential and commercial markets.

Report Coverage

This research report categorizes the market for the Russia coated glass market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia coated glass market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia coated glass market.

Russia Coated Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1625.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 9.38% |

| 2035 Value Projection: | USD 4357.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Coating |

| Companies covered:: | Larta Glass Modern Glass LLC Russian Glass Company Salavatsteklo Saratovstroisteklo STiS Group Shvabe Holding Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Coated Glass Market in Russia is driven by the rising residential and commercial construction, growing adoption of energy-efficient buildings, and increasing demand for solar control and Low-E glazing. Demand increases because infrastructure modernization and automotive production growth and government support for domestic glass manufacturing create new opportunities. The required climate-related thermal insulation together with advanced architectural design implementation and smart sustainable material investments provide new opportunities for coated glass adoption in essential industrial sectors.

Restraining Factors

The Coated Glass Market in Russia is mostly constrained by the high production, energy costs, the need to use imported coating equipment, materials and the difficulties involved in transporting products throughout the country's extensive areas, the construction project delays and developers' preference for budget-friendly solutions, which restrict fast implementation of advanced coated glazing products.

Market Segmentation

The Russia coated glass market share is classified into coating and application.

- The soft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Coated Glass Market Size is segmented by coating into soft, and hard. Among these, the soft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of soft-coated glass is the material of choice for energy-efficient buildings and contemporary architectural projects because it provides exceptional thermal insulation, solar management, and optical clarity. The increased use of soft coatings due to Russia's push for Low-E glass, the expansion of residential construction, and commercial developments leads to higher volumes and average selling prices compared to hard-coated alternatives.

- The architecture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Coated Glass Market Size is segmented by application into architecture, optical, automotive, and others. Among these, the architecture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of architectural applications, which are fueled by the need for solar control and Low-E glazing, energy-efficient building requirements, and residential and commercial construction, account for the biggest consumption volumes. Architecture has the biggest revenue share and sharpest growth velocity because to the substantial usage of coated glass for windows and façades in large-scale housing projects, office complexes, and infrastructure renovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Coated Glass Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Larta Glass

- Modern Glass LLC

- Russian Glass Company

- Salavatsteklo

- Saratovstroisteklo

- STiS Group

- Shvabe Holding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, with an investment of more than 8 billion, a new factory was established in the Moscow region to produce polished glass with sun-protection coatings, increasing the capacity of coated glass for energy-efficient applications.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia coated glass market based on the below-mentioned segments:

Russia Coated Glass Market, By Coating

- Soft

- Hard

Russia Coated Glass Market, By Application

- Architecture

- Optical

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

What is the Russia coated glass market size?Russia coated glass market size is expected to grow from USD 1625.1 million in 2024 to USD 4357.8 million by 2035, growing at a CAGR of 9.38% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising residential and commercial construction, growing adoption of energy-efficient buildings, and increasing demand for solar control and Low-E glazing.

-

What factors restrain the Russia coated glass market?Constraints include the high production, energy costs, the need to use imported coating equipment, materials and the difficulties involved in transporting products throughout the country's extensive areas

-

How is the market segmented by application?The market is segmented into architecture, optical, automotive, and others.

-

Who are the key players in the Russia coated glass market?Key companies include Larta Glass, Modern Glass LLC, Russian Glass Company, Salavatsteklo, Saratovstroisteklo, STiS Group, Shvabe Holding, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?