Russia Coated Fabrics Market Size, Share, and COVID-19 Impact Analysis, By Coating Type (PVC, PU, PTFE, and Acrylic), By Application (Transportation Upholstery, Protective Clothing, and Industrial), and Russia Coated Fabrics Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Coated Fabrics Market Insights Forecasts to 2035

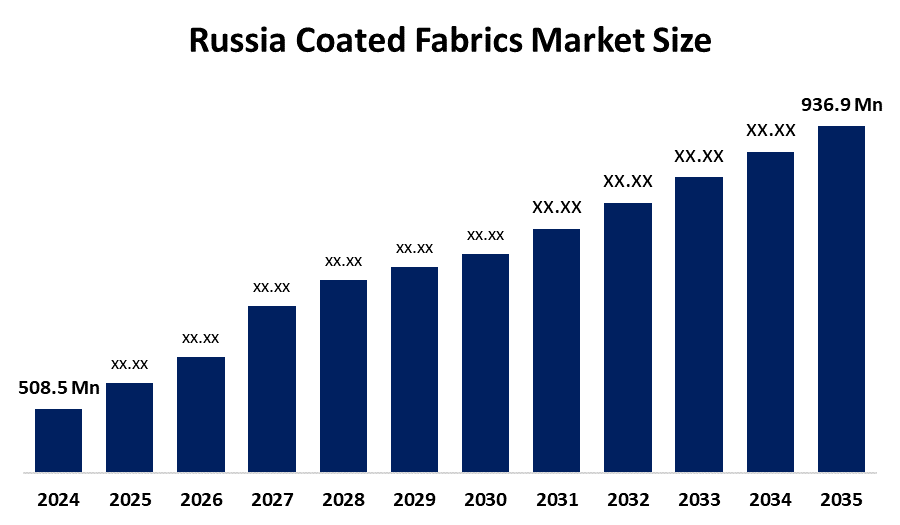

- The Russia Coated Fabrics Market Size Was Estimated at USD 508.5 Million in 2024

- The Russia Coated Fabrics Market Size is Expected to Grow at a CAGR of Around 5.71% from 2025 to 2035

- The Russia Coated Fabrics Market Size is Expected to Reach USD 936.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Russia Coated Fabrics Market Size is Anticipated to Reach USD 936.9 Million by 2035, Growing at a CAGR of 5.71% from 2025 to 2035. The coated fabrics market in Russia is driven by Rising demand from the automotive, construction, industrial protective clothing, and furniture sectors, as well as increased infrastructure development, growing defense applications, and the growing use of high-performance, weather-resistant, and long-lasting coated textile materials.

Market Overview

The Russia Coated Fabrics Market Size refers to the production and sale of textile materials treated with polymers such as PVC, polyurethane, or rubber to enhance durability, water resistance, and strength. The automotive industry, protective clothing, industrial covers and awnings, tarpaulins, furniture upholstery, defence equipment and construction materials all use these fabrics. Coated fabrics provide better protection against chemicals and allow for flexible movement, and protect against various weather conditions, which makes them suitable for outdoor work and heavy industrial tasks.

The Ministry of Industry and Trade provides 22 billion rubles from 2024 until 2026 to sustain Russia Coated Fabrics Market Size through its textile modernization program. Equipment upgrades receive 10 to 15 per cent capital subsidies through import substitution programs. The export financing program provides funding that covers 40 per cent of eligible project expenses, while regional grants range between 5 million and 30 million rubles.

Recent developments in Russia Coated Fabrics Market Size include domestic firms adopting advanced polyurethane and PVC coating technologies for automotive interiors, industrial tarpaulins and speciality textiles. Companies expand their production capacity through their import substitution initiatives. Future opportunities exist in defense contracts, construction textiles, technical protective fabrics and export growth, which will be supported by modernization subsidies and sustainable material innovations.

Report Coverage

This research report categorizes the market for the Russia Coated Fabrics Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia coated fabrics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia coated fabrics market.

Russia Coated Fabrics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 508.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.71% |

| 2035 Value Projection: | USD 936.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Application ,By Coating Type |

| Companies covered:: | BIOFARMA OOO, OOO Amethyst KM, OOO BASIS, LLC SATURN SP, LLC CONTINENT, LLC TRADE HOUSE ANTEKS, LLC OTT, LLC PARITET HIM, JSC TASCOM, Tchaikovsky Textile, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Russia Coated Fabrics Market Size is driven by the automotive industry's need for strong interior materials, increasing construction work, and the rising need for industrial protective clothing and tarpaulins. The market demand receives support from two main sources, which include defense and military applications and the oil and gas industry's need for materials that can withstand extreme weather conditions. The market growth receives major support from both government-backed import substitution policies and the ongoing development of domestic textile manufacturing.

Restraining Factors

The Russia Coated Fabrics Market Size is mostly constrained by the shifting raw material costs, the requirement for imported speciality polymers, the restricted availability of modern coating technologies, and the economic instabilities that affect the market. The combination of international trade barriers and fluctuating currency rates creates higher production expenses while making it harder to compete in export markets.

Market Segmentation

The Russia Coated Fabrics Market share is classified into coating type and application.

- The PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Coated Fabrics Market Size is segmented by coating type into PVC, PU, PTFE, and acrylic. Among these, the PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. PVC-coated textiles are frequently utilized in construction membranes, tarpaulins, truck covers, automobile upholstery, and industrial curtains. They are appropriate for Russia's severe climate due to their great performance in extreme weather conditions. PVC's dominant position in the market is further reinforced by established local production capacity and cheaper processing costs as compared to PU and PTFE coatings.

- The transportation upholstery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Coated Fabrics Market Size is segmented by application into transportation upholstery, protective clothing, and industrial. Among these, the transportation upholstery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Coated fabrics are widely utilized for seat coverings, interior panels, and trimmings in the automotive, rail, and commercial vehicle industries, which is driving this demand. These materials provide weather protection, ease of maintenance, durability, and resistance to abrasion. Furthermore, the segment's leading market share is further supported by an increase in domestic vehicle production and refurbishing activities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Coated Fabrics Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BIOFARMA OOO

- OOO Amethyst KM

- OOO BASIS

- LLC SATURN SP

- LLC CONTINENT

- LLC TRADE HOUSE ANTEKS

- LLC OTT

- LLC PARITET HIM

- JSC TASCOM

- Tchaikovsky Textile

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, Moscow hosted INTERFABRIC-2025 Autumn, where more than 500 businesses showcased textile materials, including coated and technological textiles, emphasizing the industry's focus on innovation and consolidation.

- In April 2025, in response to growing local demand, a significant Russian textile producer announced the extension of its PVC-coating production lines, boosting capacity to supply long-lasting textiles for industrial and car upholstery applications.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia Coated Fabrics Market Size based on the below-mentioned segments:

Russia Coated Fabrics Market, By Coating Type

- PVC

- PU

- PTFE

- Acrylic

Russia Coated Fabrics Market, By Application

- Transportation Upholstery

- Protective Clothing

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the Russia Coated Fabrics market size?A: Russia coated fabrics market size is expected to grow from USD 508.5 million in 2024 to USD 936.9 million by 2035, growing at a CAGR of 5.71% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the automotive industry's need for strong interior materials, increasing construction work, and the rising need for industrial protective clothing and tarpaulins.

-

Q: What factors restrain the Russia coated fabrics market?A: Constraints include the shifting raw material costs and the requirement for imported speciality polymers.

-

Q: How is the market segmented by coating type?A: The market is segmented into PVC, PU, PTFE, and acrylic.

-

Q: Who are the key players in the Russia coated fabrics market?A: Key companies include BIOFARMA OOO, OOO Amethyst KM, OOO BASIS, LLC, SATURN SP, LLC, CONTINENT, LLC, TRADE HOUSE ANTEKS, LLC, OTT, LLC, PARITET HIM, JSC, TASCOM, Tchaikovsky Textile, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?