Russia Canned Meat Market Size, Share, and COVID-19 Impact Analysis, By Meat Type (Pork, Beef, Seafood, Poultry, and Others), By Distribution Channel (Speciality Stores, Supermarket, Retail Store, and Others), and Russia Canned Meat Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Canned Meat Market Insights Forecasts to 2035

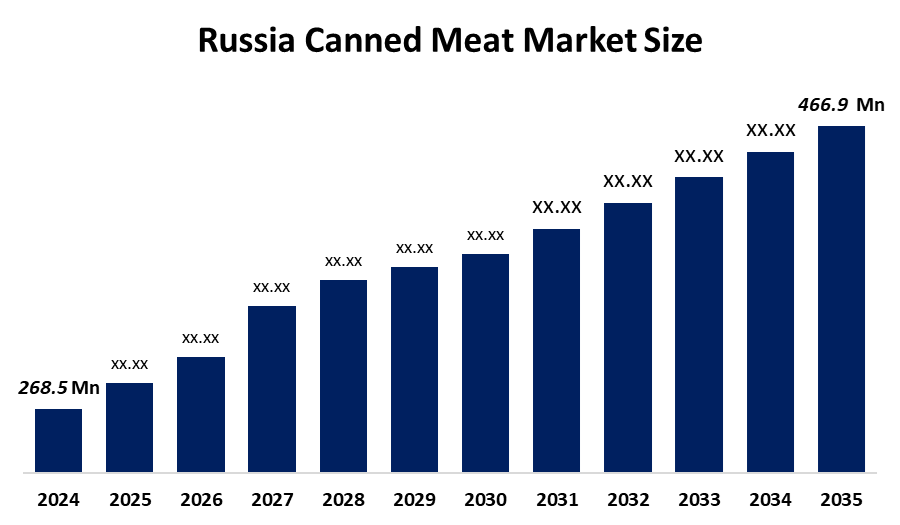

- The Russia Canned Meat Market Size Was Estimated at USD 268.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.16% from 2025 to 2035

- The Russia Canned Meat Market Size is Expected to Reach USD 466.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Canned Meat Market Size is anticipated to reach USD 466.9 Million by 2035, Growing at a CAGR of 5.16% from 2025 to 2035. The canned meat market in Russia is driven by increased urbanization, growing retail distribution networks, military and emergency stockpiling needs, growing domestic meat processing sector capacity, and growing demand for convenient, long-shelf-life food goods.

Market Overview

The Russia canned meat market refers to the production, processing, distribution, and sale of preserved meat products packed in airtight containers to extend their shelf life. The product line includes beef, pork, poultry, and mixed meat variants, which undergo processing through sterilization and sealing. Canned meat serves multiple purposes because it offers convenience, long storage stability and remote area suitability, which makes it ideal for home use and military rations, emergency food reserves and foodservice applications.

Government support through national agro-industrial development programs, which extend until 2030, provides Russia's canned meat market with strong backing. The production volume reached about 833000 tonnes during the period from January to November 2024. The meat processing modernization projects received more than RUB 40 billion in funding during 2025. The government offers businesses preferential loans and subsidies, together with R&D reimbursement programs, to enhance their food self-sufficiency and processing capabilities.

Recent developments in the Russia canned meat market include product diversification with premium, ready-to-eat, and ethnic meat options by major brands like OAO Russkaya. Companies enhance their operations by upgrading facilities, which leads to better product quality and extended shelf life. The company can develop new business prospects through online retail expansion and export growth to CIS countries, and increased market demand for high-protein convenience foods. The company can develop new business prospects through online retail expansion and export growth to CIS countries, and increased market demand for high-protein convenience foods.

Report Coverage

This research report categorizes the market for the Russia canned meat market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia canned meat market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia canned meat market.

Russia Canned Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 268.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.16% |

| 2035 Value Projection: | USD 466.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Meat Type |

| Companies covered:: | The Glavproduct Company, Agrocomplex named after N. I. Tkachev, Saransky Cannery JSC, RUS, LLC, Lesnaya Dikovinka, MonSam, Troitsky Canning Plant, Prodo, Cherkizovo Group, Miratorg Agribusiness Holding, and Other key players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The canned meat market in Russia is driven by the demand for long-shelf-life food products, which provide convenience to consumers. Government agencies increasing their efforts to protect food supplies through domestic agricultural production programs, which the Russian Agriculture Ministry administers, are helping the economy grow. The market maintains strong growth because military procurement processes and emergency stockpiling activities, and meat production capacity develop continuously.

Restraining Factors

The canned meat market in Russia is mostly constrained by the changing raw material costs, increasing expenses for packaging and transportation and economic conditions that decrease consumer spending ability. The market growth is restricted by fresh and frozen meat products and rising consumer health concerns about processed food products.

Market Segmentation

The Russia canned meat market share is classified into meat type and distribution channel.

- The poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia canned meat market is segmented by meat type into pork, beef, seafood, poultry, and others. Among these, the poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its low cost, robust local production, and widespread consumer acceptance, the chicken market leads. Stable supply is guaranteed by government backing for poultry farming, and increased demand for canned meat products throughout Russia is fueled by the industry's assessment of chicken as a more cost-effective and healthful source of protein.

- The supermarket segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia canned meat market is segmented by distribution channel into speciality stores, supermarket, retail store, and others. Among these, the supermarket segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of its extensive product selection, competitive pricing, robust distribution networks, and significant customer traffic, the supermarket segment leads the Russian canned meat market. Sales and market expansion are further fueled by the availability of private-label goods and the expansion of organized retail chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia canned meat market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Glavproduct Company

- Agrocomplex named after N. I. Tkachev

- Saransky Cannery JSC

- RUS, LLC

- Lesnaya Dikovinka

- MonSam

- Troitsky Canning Plant

- Prodo

- Cherkizovo Group

- Miratorg Agribusiness Holding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2026, Russia's record export of canned and prepared poultry goods to Saudi Arabia exceeded $19 million, demonstrating the country's rise in exports.

- In April 2025, Russia announced intentions to supply the army with the seized assets of Glavprodukt, a large canned food manufacturer, underscoring key measures to ensure food security.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia canned meat market based on the below-mentioned segments:

Russia Canned Meat Market, By Meat Type

- Pork

- Beef

- Seafood

- Poultry

- Others

Russia Canned Meat Market, By Distribution Channel

- Speciality Stores

- Supermarket

- Retail Store

- Others

Frequently Asked Questions (FAQ)

-

What is the Russia canned meat market size?Russia canned meat market size is expected to grow from USD 268.5 million in 2024 to USD 466.9 million by 2035, growing at a CAGR of 5.16% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by demand for long-shelf-life food products, which provide convenience to consumers. Government agencies increasing their efforts to protect food supplies through domestic agricultural production programs, which the Russian Agriculture Ministry administers, are helping the economy grow.

-

What factors restrain the Russia canned meat market?Constraints include the changing raw material costs, increasing expenses for packaging and transportation and economic conditions that decrease consumer spending ability.

-

How is the market segmented by meat type?The market is segmented into pork, beef, seafood, poultry, and others.

-

Who are the key players in the Russia canned meat market?Key companies include The Glavproduct Company, Agrocomplex named after N. I. Tkachev, Saransky Cannery JSC, RUS, LLC, Lesnaya Dikovinka, MonSam, Troitsky Canning Plant, Prodo, Cherkizovo Group, Miratorg Agribusiness Holding, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?