Russia Butter Market Size, Share, and COVID-19 Impact Analysis, By Type (Salted butter, Unsalted butter, Clarified and ghee, and Cultured butter), By End Use (Industrial Processing, Retail Channels, and Foodservice), and Russia Butter Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesRussia Butter Market Insights Forecasts to 2035

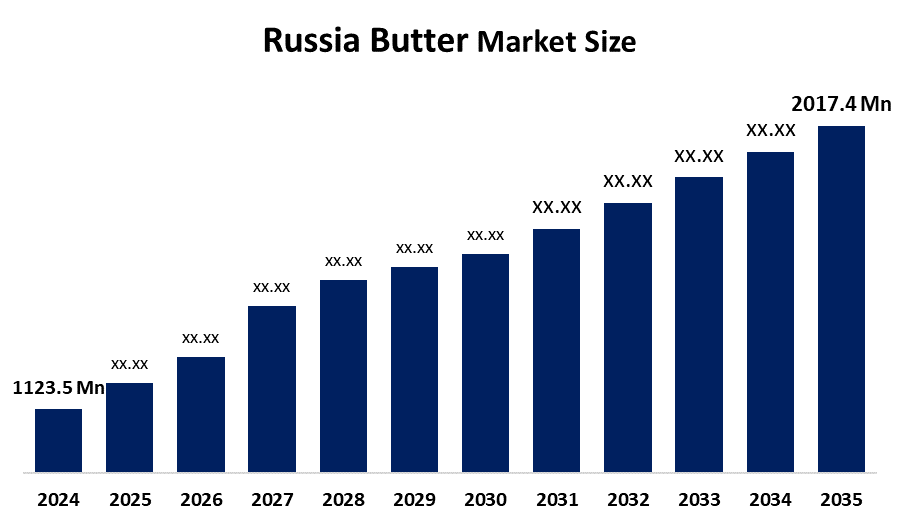

- The Russia Butter Market Size Was Estimated at USD 1123.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.47% from 2025 to 2035

- The Russia Butter Market Size is Expected to Reach USD 2017.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Russia Butter Market Size Is Anticipated To Reach USD 2017.4 Million By 2035, Growing At A CAGR Of 5.47% From 2025 to 2035. The butter market in Russia is driven by rising home consumption, robust bakery and foodservice demand, a desire for natural dairy fats, growing retail distribution, an increase in local dairy output, and a growing usage of butter in processed goods.

Market Overview

The Russia Butter Market Size refers to the production, processing, distribution, and consumption of dairy butter derived mainly from cow’s milk across retail and foodservice channels. The market supplies butter products which customers use for home cooking and baking and spreading purposes while also serving commercial needs in bakeries and confectionery shops and ready-to-eat meal production and food manufacturing operations. Butter serves as a common ingredient in Russian cuisine and packaged food because it enhances flavor and improves texture and provides fat content.

In 2025 Russia allocated over 80 billion RUB to support the dairy industry, which resulted in increased production and discounted loans for butter manufacturers. The government started to provide full 100 percent logistics cost subsidies for milk exports which included butter beginning in January 2024. The measures work to maintain domestic supply stability while enhancing processing capacity and supporting dairy industry development during times of price pressure.

Russia increased its butter imports from the UAE and Turkey because of rising prices and slight domestic production increases. Producers have started to change their prices because supply chain alterations remain in progress. The company plans to create new opportunities by establishing diverse import channels and increasing its local production capacity and developing value-added butter products for foodservice and retail distribution.

Report Coverage

This research report categorizes the market for the Russia Butter Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia butter market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia butter market.

Russia Butter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1123.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.47% |

| 2035 Value Projection: | USD 2017.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | Ecomilk LLC MilkFort Group Kiprino Rusagro Group Agroprom Alev Prostokvashino Selo Zelenoye Krestyanskoye Butter Milkom Irbit Dairy Plant Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Butter Market in Russia is driven by the constant household consumption, bakery, foodservice industries and the demand for natural dairy fats in traditional dishes. The dairy sector receives government support while modern retail networks continue to expand and butter usage in processed foods and packaged products increases which creates favorable conditions for market development. The domestic milk production increase together with product premiumization and HoReCa recovery progress leads to greater butter consumption throughout the country.

Restraining Factors

The butter market in Russia is mostly constrained by the unpredictable raw milk prices, expensive production, logistics expenses, supply chain interruptions, customer affordability issues, competition from margarines, and vegetable fat alternatives. The market experiences consistent demand yet the existing conditions prevent businesses from expanding their operations.

Market Segmentation

The Russia butter market share is classified into type and end use.

- The salted butter segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Butter Market Size is segmented by type into salted butter, unsalted butter, clarified and ghee, and cultured butter. Among these, the salted butter segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mostly due to the fact that salted butter is more popular for regular cooking, baking, and spreading, has a longer shelf life, and is better suited for storage and transportation over Russia's large territory. Additionally, because it is more reasonably priced and regularly supplied in retail establishments, it is the type that households and foodservice operators purchase most frequently, which contributes to its leading revenue share.

- The retail channels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Butter Market Size is segmented by end use into industrial processing, retail channels, and foodservice. Among these, the retail channels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the fact that households buy butter mostly for everyday baking, spreading, and cooking. Russia is the top end-use segment due to its extensive supermarket and convenience store penetration, steady at-home consumption, and robust demand for packaged butter, all of which increase retail sales volumes and income.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia butter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ecomilk LLC

- MilkFort Group

- Kiprino

- Rusagro Group

- Agroprom Alev

- Prostokvashino

- Selo Zelenoye

- Krestyanskoye Butter

- Milkom

- Irbit Dairy Plant

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, Russia's butter production rose 2.3% in 2025, while consumption fell and inventories rose dramatically.

- In April 2025, in an effort to stabilize domestic markets, a tariff exemption for 25,000 tonnes of imported butter has been extended through the end of 2025.

- In January 2025, Russia imported 134.7 thousand tonnes of butter in 2024, a 9.8% increase, with Belarus serving as the primary supplier.

- In November 2024, Russia imports 90 tons of butter from the United Arab Emirates and 20 tons from Turkey in order to combat price spikes. Butter prices climbed ~25.7% in 2024, prompting price-stabilization efforts.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia butter market based on the below-mentioned segments:

Russia Butter Market, By Type

- Salted butter

- Unsalted butter

- Clarified and ghee

- Cultured butter

Russia Butter Market, By End Use

- Industrial Processing

- Retail Channels

- Foodservice

Frequently Asked Questions (FAQ)

-

What is the Russia butter market size?Russia butter market size is expected to grow from USD 1123.5 million in 2024 to USD 2017.4 million by 2035, growing at a CAGR of 5.47% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by constant household consumption and bakery and foodservice industries and the demand for natural dairy fats in traditional dishes. The dairy sector receives government support while modern retail networks continue to expand and butter usage in processed foods.

-

What factors restrain the Russia butter market?Constraints include the unpredictable raw milk prices, expensive production, logistics expenses, supply chain interruptions, customer affordability issues, competition from margarines, and vegetable fat alternatives

-

How is the market segmented by type?The market is segmented into salted butter, unsalted butter, clarified and ghee, and cultured butter.

-

Who are the key players in the Russia butter market?Key companies include Ecomilk LLC, MilkFort Group, Kiprino, Rusagro Group, Agroprom “Alev”, Prostokvashino, Selo Zelenoye, Krestyanskoye Butter, Milkom, Irbit Dairy Plant, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?