Russia Body Wash Market Size, Share, and COVID-19 Impact Analysis, By Positioning (Mass-market, Premium, Natural/Organic, and Medicated/Dermatological), By Product (Liquid Body Wash, Shower Gels, and Bar Alternatives), and Russia Body Wash Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Body Wash Market Insights Forecasts to 2035

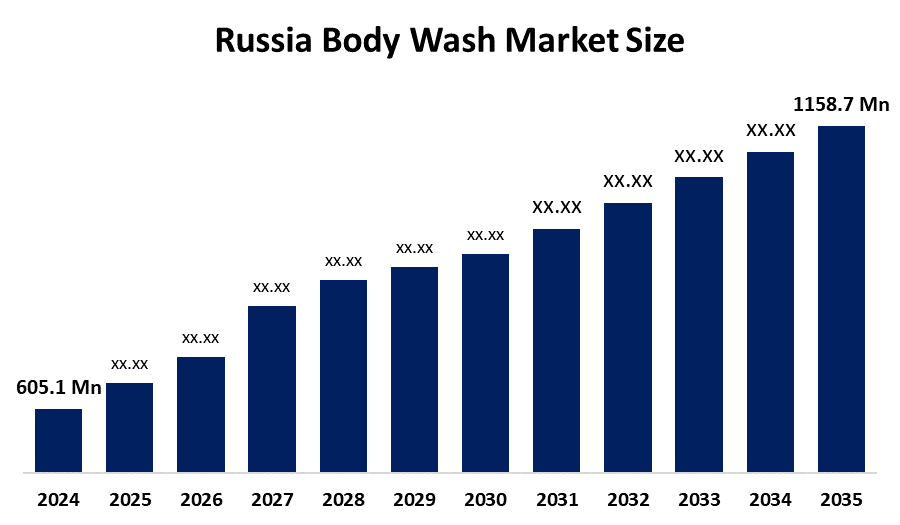

- The Russia Body Wash Market Size Was Estimated at USD 605.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.08% from 2025 to 2035

- The Russia Body Wash Market Size is Expected to Reach USD 1158.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Body Wash Market Size Is Anticipated To Reach USD 1158.7 Million By 2035, Growing At A CAGR Of 6.08% From 2025 To 2035. The body wash market in Russia is driven by rising awareness of personal hygiene, urbanization, middle-class income growth, the desire for convenient liquid cleansers, product premiumization, developing retail and e-commerce channels, and the need for natural and skin-friendly formulations.

Market Overview

The Russia Body Wash Market Size refers to the production, distribution, and consumption of liquid cleansing products which are designed to provide full-body hygiene across both mass and premium market segments. The market provides daily personal care products which people use in their homes and hotels and gyms and healthcare facilities. People use body washes because of their convenient features and skin-conditioning benefits and product scents while the demand for moisturizing products, sensitive skin solutions and natural products drives their use in daily bathing and wellness-oriented routines.

The government has made domestic cosmetics production and import substitution their main focus since 2022, which resulted in domestic brands achieving approximately 68% market share of the cosmetics industry by 2024. The Ministry of Industry and Trade plans budget support and transport subsidies to help local beauty and personal care manufacturers expand their production capacity and enter new markets.

body wash (shower gel) sales rose between 11 percent and 32 percent because consumers changed their preferences from bar soap to liquid formats, which created higher demand for these products. Domestic manufacturers increased their production capacity because of import substitution, while natural and eco-friendly products experienced growing popularity. The company plans to develop its business through two main areas, which include premium organic products and e-commerce distribution expansion throughout Russia.

Report Coverage

This research report categorizes the market for the Russia Body Wash Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia body wash market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia body wash market.

Russia Body Wash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 605.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.08% |

| 2035 Value Projection: | USD 1158.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Positioning |

| Companies covered:: | SPLAT Global Natura Siberica Faberlic OAO Nevskaya Kosmetika OAO Pervoe Reshenie OOO Floresan OOO Russkaya Kosmetika OOO Vestar Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The body wash market in Russia is driven by the people become more aware of personal hygiene and people start to favor liquid body wash products that provide easy-to-use solutions. The market expansion occurs because modern retail and e-commerce platforms continue to grow and consumers prefer skin-friendly products that offer moisturizing benefits and premium product options. Domestic production has increased because import substitution policies drive local manufacturers to produce their products while body wash products with natural ingredients and pleasing scents and wellness benefits experience rising demand from younger consumers across both mass and premium market segments.

Restraining Factors

The body wash market in Russia is mostly constrained by the consumers show high price sensitivity and inflation causes cost increases and there is limited access to premium imported brands and supply chain issues and strong competition from traditional bar soaps and lower-cost local alternatives prevent quick growth of the premium market segment.

Market Segmentation

The Russia body wash market share is classified into positioning and product.

- The mass-market segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia Body Wash Market Size is segmented by positioning into mass-market, premium, natural/organic, and medicated/dermatological. Among these, the mass-market segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mostly due to the fact that mass-market goods are more accessible and reasonably priced, making them appealing to Russia's budget-conscious customers in supermarkets, convenience stores, and online. In comparison to luxury or niche natural and medicated niches, mass-market brands have better sales penetration and income due to strong domestic production, frequent promotions, and everyday household usage.

- The shower gels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia Body Wash Market Size is segmented by product into liquid body wash, shower gels, and bar alternatives. Among these, the shower gels segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the fact that shower gels are popular for everyday bathing, come in a wide variety of scents and skin-benefit varieties, and are heavily marketed by both domestic and foreign manufacturers. Shower gels are the market leader due to their simple accessibility in mass retail and online, competitive price, and consumer preference for convenient liquid versions over bar alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia Body Wash Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SPLAT Global

- Natura Siberica

- Faberlic OAO

- Nevskaya Kosmetika OAO

- Pervoe Reshenie OOO

- Floresan OOO

- Russkaya Kosmetika OOO

- Vestar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, the demand for shower gels (body wash) increased by 11% in Russia in 2024, a sign that consumers are becoming more accustomed to using liquid body cleansers. Fragrances of fruit and berries were particularly well-liked by consumers.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia body wash market based on the below-mentioned segments:

Russia Body Wash Market, By Positioning

- Mass-market

- Premium

- Natural/Organic

- Medicated/Dermatological

Russia Body Wash Market, By Product

- Liquid Body Wash

- Shower Gels

- Bar Alternatives

Frequently Asked Questions (FAQ)

-

What is the Russia body wash market size?Russia body wash market size is expected to grow from USD 605.1 million in 2024 to USD 1158.7 million by 2035, growing at a CAGR of 6.08% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by people become more aware of personal hygiene and people start to favor liquid body wash products that provide easy-to-use solutions. The market expansion occurs because modern retail and e-commerce platforms continue to grow and consumers prefer skin-friendly products that offer moisturizing benefits and premium product options

-

What factors restrain the Russia body wash market?Constraints include the consumers show high price sensitivity and inflation causes cost increases and there is limited access to premium imported brands and supply chain issues.

-

How is the market segmented by product?The market is segmented into liquid body wash, shower gels, and bar alternatives.

-

Who are the key players in the Russia body wash market?Key companies include SPLAT Global, Natura Siberica, Faberlic OAO, Nevskaya Kosmetika OAO, Pervoe Reshenie OOO, Floresan OOO, Russkaya Kosmetika OOO, Vestar, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?