Russia Blood Collection Market Size, Share, and COVID-19 Impact Analysis, By Method (Manual Blood Collection, and Automated Blood Collection), By Application (Diagnostics, and Treatment), and Russia Blood Collection Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareRussia Blood Collection Market Size Insights Forecasts To 2035

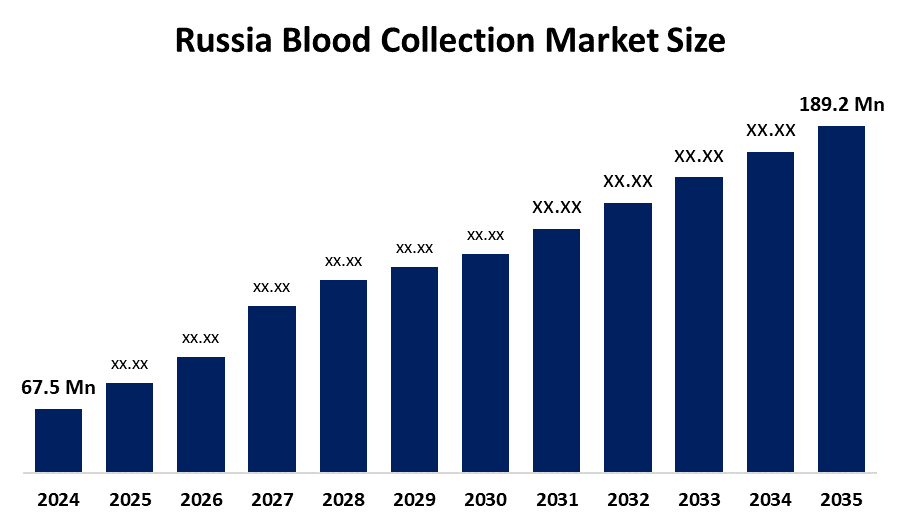

- The Russia Blood Collection Market Size Was Estimated At USD 67.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 9.82% From 2025 To 2035

- The Russia Blood Collection Market Size Is Expected To Reach USD 189.2 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Blood Collection Market Size Is Anticipated To Reach USD 189.2 Million By 2035, Growing At A CAGR Of 9.82% From 2025 To 2035. The blood collection market in Russia is driven by more blood donation programs, increasing rates of chronic diseases, the development of new hospital facilities, technological progress in collection devices, and government programs that enhance transfusion and diagnostic service capabilities.

Market Overview

The Russia blood collection market size refers to products and systems used for safe, sterile, and efficient collection, storage, and transport of blood samples and donations. The market includes blood bags, collection tubes, needles, and automated systems. The products find extensive use in hospitals and blood banks, diagnostic laboratories, transfusion centers, and research institutes for disease diagnosis, blood transfusions, surgeries, and medical research.

Russia's blood collection market size receives its primary support through extensive government involvement. The national blood service, which handles approximately 3.3 million annual donations, operates under the supervision of the Ministry of Health. The Federal Bone Marrow Donor Registry, which receives complete state funding, surpassed 500000 registered donors by the year 2025. Federal budgets finance blood banks, plasma procurement, donor awareness campaigns, and free voluntary donation programs throughout the country.

Russia's blood collection market size has introduced new mobile collection units through Rostec's RosElectronics, which can gather 40 liters of blood from remote areas. The DonorConnect digital platform provides automated donor management through its digital services. The future research agenda will investigate automated collection systems, advanced cold-chain technologies, and digital donor tracking systems, which will improve operational efficiency, safety, and accessibility for all hospitals and blood banks across the country.

Report Coverage

This research report categorizes the market size for the Russia blood collection market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia blood collection market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia blood collection market.

Russia Blood Collection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 67.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 9.82% |

| 2023 Value Projection: | USD 189.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Method, By Application |

| Companies covered:: | Eiliton LLC, Elatomsky Instrument Plant, Granat Bio Tech, Delrus, Unilab, Zavod Meditsinskikh Tekhnologiy, Sanamedical, Medplús brands, Microgen, Binnopharm Group, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The blood collection market size in Russia is driven by the fact that people need safe blood and plasma supplies, as chronic and surgical conditions become more common, and hospitals and diagnostic facilities grow, and government programs promote voluntary blood donation. The market growth for healthcare and blood transfusion services receives support from technological advancements, which improve collection devices and automated systems and digital donor management platforms to deliver enhanced operational efficiency and safety, and better donor access.

Restraining Factors

The blood collection market size in Russia is mostly constrained by the insufficient number of voluntary donors and the high costs of operations and equipment, the strict rules through which organizations must operate, the difficulties associated with delivering services to remote areas, and the system of centralized blood banks, which results in delayed business growth and decreased market productivity.

Market Segmentation

The Russia blood collection market share is classified into method and application.

- The manual blood collection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia blood collection market size is segmented by method into manual blood collection, and automated blood collection. Among these, the manual blood collection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is the method of choice for routine blood collection and small-scale transfusion services because it is widely used in hospitals, clinics, and blood donation centers, requires less equipment than automated systems, is simple to use in distant locations, and has established workflows.

- The diagnostics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia blood collection market size is segmented by application into diagnostics, and treatment. Among these, the diagnostics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is fueled by a number of factors, including the growing need for precise disease detection, the rising incidence of infectious and chronic illnesses, the development of laboratory infrastructure, and the expanding use of blood samples in medical testing, research, and early diagnosis. These factors all work together to increase the use of blood collection products for diagnostic purposes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia blood collection market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eiliton LLC

- Elatomsky Instrument Plant

- Granat Bio Tech

- Delrus

- Unilab

- Zavod Meditsinskikh Tekhnologiy

- Sanamedical

- Medplús brands

- Microgen

- Binnopharm Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In November 2025, modern storage hubs, increased strategic blood stores, and improved blood service technology were considered during the 17th All-Russian Blood Service Forum. Lyophilized plasma procurement targets were raised to at least 12,000 units for 2026, and new regulations for blood collection, storage, and transportation were implemented.

• In June 2025, Rostec commenced serial manufacture of mobile blood collection terminals, expanding outreach and collection capacity in different settings.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia blood collection market based on the below-mentioned segments:

Russia Blood Collection Market, By Method

- Manual Blood Collection

- Automated Blood Collection

Russia Blood Collection Market, By Application

- Diagnostics

- Treatment

Frequently Asked Questions (FAQ)

-

What is the Russia blood collection market size?Russia blood collection market size is expected to grow from USD 67.5 million in 2024 to USD 189.2 million by 2035, growing at a CAGR of 9.82% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the fact that people need safe blood and plasma supplies, as chronic and surgical conditions become more common, and hospitals and diagnostic facilities grow, and government programs promote voluntary blood donation.

-

What factors restrain the Russia blood collection market?Constraints include the insufficient number of voluntary donors, the high costs of operations and equipment, and the strict rules through which organizations must operate.

-

How is the market segmented by method?The market is segmented into manual blood collection, and automated blood collection.

-

Who are the key players in the Russia blood collection market?Key companies include Eiliton LLC, Elatomsky Instrument Plant, Granat Bio Tech, Delrus, Unilab, Zavod Meditsinskikh Tekhnologiy, Sanamedical, Medplús brands, Microgen, Binnopharm Group, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?