Russia Ammonia Market Size, Share, By Form (Anhydrous Ammonia, Aqueous Ammonia, And Ammonium Nitrate), By Manufacturing Process (Haber-Bosch Process, Electrochemical Process, And Others), And Russia Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsRussia Ammonia Market Insights Forecasts to 2035

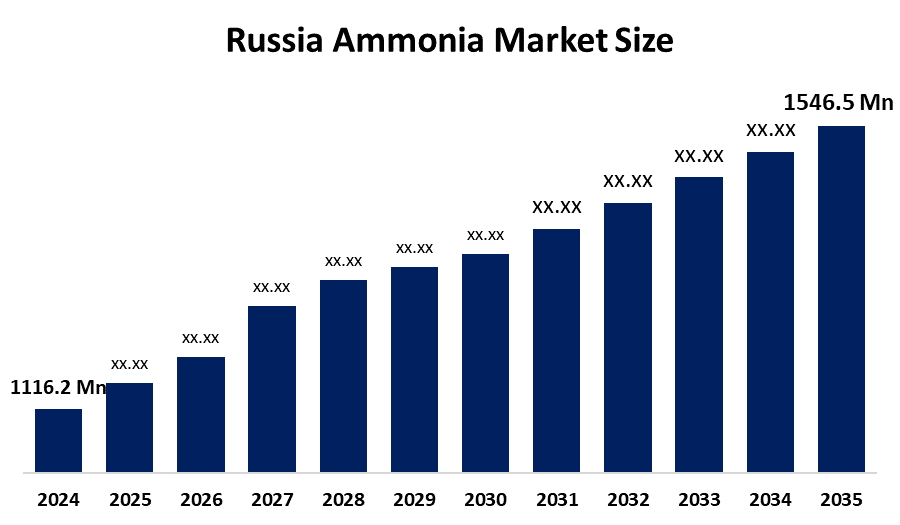

- Russia Ammonia Market Size 2024: USD 1116.2 Mn

- Russia Ammonia Market Size 2035: USD 1546.5 Mn

- Russia Ammonia Market CAGR 2024: 3.01%

- Russia Ammonia Market Segments: Form and Manufacturing Process

Get more details on this report -

The Russia ammonia market is comprised of the production, sales as well as the exports & imports of ammonium products mainly nitrogen fertilizers. Ammonium products are essential in supporting agricultural production by providing nitrogen fertilizers which constitute the basis of all agricultural systems. The vast reserves of natural gas available in Russia make it one of the largest producers of ammonia, since natural gas is used to produce ammonia through the conventional methodology of the Haber Bosch synthesis process.

The ammonia in Russia are backed by government support, including the Roadmap for the Development of Mineral Fertilizer Production, approved by the Government of the Russian Federation, which sets out strategic actions to strengthen domestic fertilizer and associated chemical industries including ammonia through 2025. As per Rosstat, Ammonia output in Russia rose by approximately 6 to 12 million tonnes in the January August 2024 period, supporting broader growth in the fertilizer sector and reflecting the effects of domestic industrial activity on ammonia demand and supply.

As technology advances, Russia’s ammonia providers are now using digitalizing industrial technologies leading to the implementation of more highly efficient production methods and the use of automated technologies and digital integration for improved process control and efficiency. The synthesis process for producing ammonia via renewable energy powered hydrogen, and subsequent low-carbon and green ammonia technologies, may represent a new opportunity for the Russian industry as it continues its development, with growing interest in different carbon capture and carbon utilization techniques and carbon-free alternatives to the production of ammonia.

Market Dynamics of the Russia Ammonia Market:

The Russia ammonia market is driven by the countrys dominant role in fertilizer production and export, comparatively low cost natural gas reserves, strong demand from key industries particularly from agricultural sectors, technological advancements, strong government support, and expanded applications in industrial chemicals and global trade linkages.

The Russia ammonia market is restrained by the energy intensive nature of ammonia production, associated environmental challenges, requires significant energy inputs, increasing regulatory scrutiny and potential carbon pricing pressures.

The future of Russia ammonia market is bright and promising, with versatile opportunities emerging from the transition toward sustainable and low carbon ammonia production. The growing global emphasis on reducing emissions and developing green ammonia produced via renewable energy sources opens avenues for innovation, export diversification, and value added product segments. As international markets expand their demand for environmentally friendly fertilizers and industrial chemicals, Russian producers with advanced technologies and strategic partnerships could capitalize on these trends, enhancing competitiveness and opening new revenue streams.

Russia Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1116.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.01% |

| 2035 Value Projection: | USD 1116.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Form, By Manufacturing Process |

| Companies covered:: | Uralchem,Acron Group,EuroChem Group,Togliattiazot,PhosAgro,KuibyshevAzot, Minudobreniya,Shchekinoazot,Rossosh Mineral Fertilizers And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Russia Ammonia Market share is classified into form and manufacturing process.

By Form:

The Russia ammonia market is divided by form into anhydrous ammonia, aqueous ammonia, and ammonium nitrate. Among these, the anhydrous ammonia segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High agricultural demand, effective source of nitrogen for fertilisers, easily applicable, essential feedstock for various industrial chemicals, and versatility in nature all contribute to the anhydrous ammonia segment's largest share and higher spending on ammonia when compared to other form.

By Manufacturing Process:

The Russia ammonia market is divided by manufacturing process into haber bosch process, electrochemical process, and others. Among these, the haber bosch process segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The haber-bosch process segment dominates because of its established and cost effective method for producing ammonia, essential for fertilizers to support global food security, high energy use, and massive scale production with efficiency in producing nitrogen-rich fertilizers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Russia ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Russia Ammonia Market:

- Uralchem

- Acron Group

- EuroChem Group

- Togliattiazot

- PhosAgro

- KuibyshevAzot

- Minudobreniya

- Shchekinoazot

- Rossosh Mineral Fertilizers

- Others

Recent Developments in Russia Ammonia Market:

In May 2025, Port Favor/Ust-Luga Terminal Expansion, a new railway link was scheduled for completion, designed to increase export capacity for ammonia and other fertilizers at the Port Favour terminal in Ust Luga.

In September 2024, the Russian Far East and Arctic Development Corporation announced a RUB 200 billion project to build a new ammonia and urea plant in the Arctic region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia ammonia market based on the below mentioned segments:

Russia Ammonia Market, By Form

- Anhydrous Ammonia

- Aqueous Ammonia

- Ammonium Nitrate

Russia Ammonia Market, By Manufacturing Process

- Haber-Bosch Process

- Electrochemical Process

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Russia ammonia market size?A: Russia ammonia market is expected to grow from USD 1116.2 million in 2024 to USD 1546.5 million by 2035, growing at a CAGR of 3.01% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the country’s dominant role in fertilizer production and export, comparatively low-cost natural gas reserves, strong demand from key industries particularly from agricultural sectors, technological advancements, strong government support, and expanded applications in industrial chemicals and global trade linkages.

-

Q: What factors restrain the Russia ammonia market?A: Constraints include the energy-intensive nature of ammonia production, associated environmental challenges, requires significant energy inputs, increasing regulatory scrutiny and potential carbon pricing pressures.

-

Q: How is the market segmented by Form?A: The market is segmented into anhydrous ammonia, aqueous ammonia, and ammonium nitrate.

-

Q: Who are the key players in the Russia ammonia market?A: Key companies include Uralchem, Acron Group, EuroChem Group, Togliattiazot, PhosAgro, KuibyshevAzot, Minudobreniya, Shchekinoazot, Rossosh Mineral Fertilizers, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?