Russia Aluminum Foil Market Size, Share, and COVID-19 Impact Analysis, By Product (Wrapper Foils, Pouches, Blister Packs, Container Foils, Foil Lids, and Others), By End Use (Industrial, and Packaging), and Russia Aluminum Foil Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsRussia Aluminum Foil Market Size Insights Forecasts To 2035

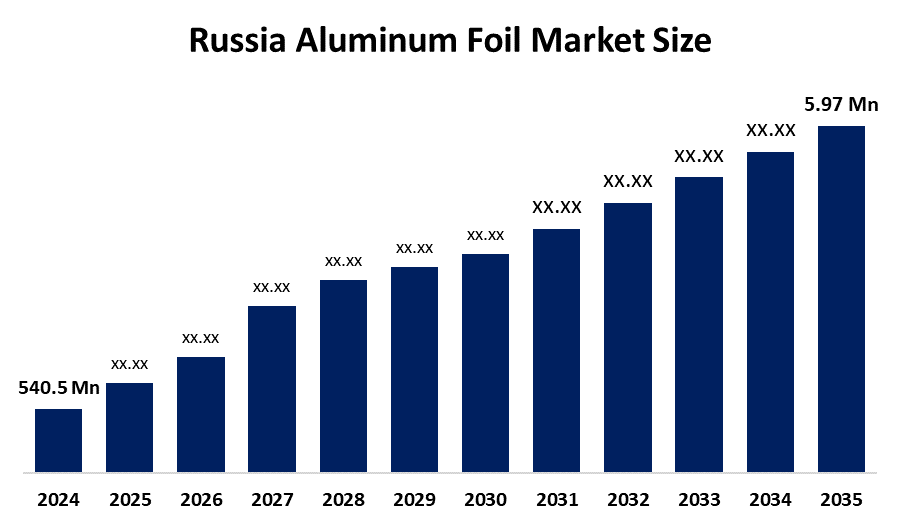

- The Russia Aluminum Foil Market Size Was Estimated At USD 540.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.97% From 2025 To 2035

- The Russia Aluminum Foil Market Size Is Expected To Reach USD 1023.3 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia Aluminum Foil Market Size Is Anticipated To Reach USD 1023.3 Million By 2035, Growing At A CAGR Of 5.97% From 2025 To 2035. The Aluminum Foil market in Russia is driven by rising demand from consumer products, medicines, food packaging, and construction insulation. This demand is bolstered by urbanization, the need for longer shelf lives, the advantages of recycling, and the growth of domestic manufacturing.

Market Overview

The Russia aluminum foil market size refers to the production and consumption of thin aluminum sheets used for packaging, insulation, and industrial purposes. The material has various applications, which include food and beverage packaging, pharmaceutical blister packs, household wrapping, construction insulation, automotive heat shielding, and electrical applications. The market provides product protection, extended shelf life, thermal resistance, and sustainable environmental solutions through aluminum's lightweight recyclability.

The Russian government supports aluminum production growth through its 2030 demand development plan, which aims to increase domestic aluminum consumption and establish industry standards while reducing import dependencies. The strategic value of aluminum permits tax deductions through the Aluminium Valley special economic zones. RUSAL establishes sustainable foil production through its low-carbon packaging program, which benefits from the growing use of domestic containers that increased by 40 percent since 2022 and the company’s 20-million-dollar investment in new casting equipment.

RUSAL introduced its environmentally friendly Sayana foil product, which uses their low-carbon ALLOW INERTA aluminum material, in October 2025 at Magnit Extra stores. The company announced plans to boost foil production at Sayana facilities by approximately 12 percent in May 2025. RUSAL started its domestic production of aluminum food containers in July 2025. The company has two growth opportunities through its sustainable packaging expansion and import-substitution development.

Report Coverage

This research report categorizes the market size for the Russia aluminum foil market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia Aluminum Foil market. Recent market size developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia aluminum foil market.

Russia Aluminum Foil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 540.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.97% |

| 2023 Value Projection: | USD 1023.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End Use |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aluminum foil market size in Russia is driven by the demand for food and beverage packaging, pharmaceutical products, and construction insulation materials, which continues to rise according to urbanization trends and changing consumption patterns. Government initiatives that promote domestic aluminum usage, together with import substitution efforts and recycling programs, create additional growth drivers for the industry. The market expansion results from companies opening new manufacturing facilities and making investments in sustainable, low-carbon aluminum production, and increasing demand for aluminum containers used in ready-to-eat meals.

Restraining Factors

The aluminum foil market size in Russia is mostly constrained by unstable aluminum prices and expensive energy and production expenses, the need to import equipment, economic instability, and the competition from packaging alternatives, which include plastics and paper-based materials.

Market Segmentation

The Russia aluminum foil market share is classified into product and end use.

- The wrapper foils segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia aluminum foil market size is segmented by product into wrapper foils, pouches, blister packs, container foils, foil lids, and others. Among these, the wrapper foils segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Widespread household use, foodservice demand, affordability, high consumption volumes, convenience, and robust demand from food packaging and ready-to-eat applications all contribute to the wrapper aluminum foil segment's dominance.

- The packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia aluminum foil market size is segmented by end use into industrial, and packaging. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong demand from food & beverage packaging, pharmaceuticals, ready-to-eat meals, and domestic applications, coupled with longer shelf-life needs, hygiene standards, and increased aluminum container usage, drives higher quantities and consistent consumption compared to industrial uses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia aluminum foil market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RUSAL

- Sayana Foil

- FoilRus

- Olimpiya Folga

- LLC PETRO

- IEC, LLC

- TVANBA NARSOU YURIEVICH

- Biosfera Polymer

- ARM-Group

- Introplastica

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, to increase foil production capacity, RUSAL invested USD 20 million to launch a new continuous casting line at the Ural Foil facility.

- In July 2025, RUSAL expanded downstream foil uses for packaging by starting to produce aluminum food containers in the Moscow area.

- In May 2025, RUSAL upgraded the finishing foil mill at its SAYANAL plant to increase thin-gauge foil capacity. This resulted in a 10–12% increase in advanced food packaging foil output.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia aluminum foil market based on the below-mentioned segments:

Russia Aluminum Foil Market, By Product

- Wrapper Foils

- Pouches

- Blister Packs

- Container Foils

- Foil Lids

- Others

Russia Aluminum Foil Market, By End Use

- Industrial

- Packaging

Frequently Asked Questions (FAQ)

-

What is the Russia aluminum foil market size?Russia aluminum foil market size is expected to grow from USD 540.5 million in 2024 to USD 1023.3 million by 2035, growing at a CAGR of 5.97% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by demand for food and beverage packaging, pharmaceutical products, and construction insulation materials, which continue to rise according to urbanization trends and changing consumption patterns.

-

What factors restrain the Russia aluminum foil market?Constraints include the unstable aluminum prices, expensive energy and production expenses, the need to import equipment, and economic instability.

-

How is the market segmented by product?The market is segmented into wrapper foils, pouches, blister packs, container foils, foil lids, and others.

-

Who are the key players in the Russia aluminum foil market?Key companies include RUSAL, Sayana Foil, FoilRus, Olimpiya Folga, LLC, PETRO, IEC, LLC, TVANBA NARSOU YURIEVICH, Biosfera Polymer, ARM-Group, Introplastica, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?