Global Running Apparel Market Size, Share, and COVID-19 Impact Analysis, By Product Types (Tops, Bottoms, Outerwear, Socks and Accessories), By Fabric Material (Synthetic, and Others), By End User (Men, Women, Kids), By Distribution Channels (Offline Stores, Online Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Consumer GoodsGlobal Running Apparel Market Insights Forecasts to 2035

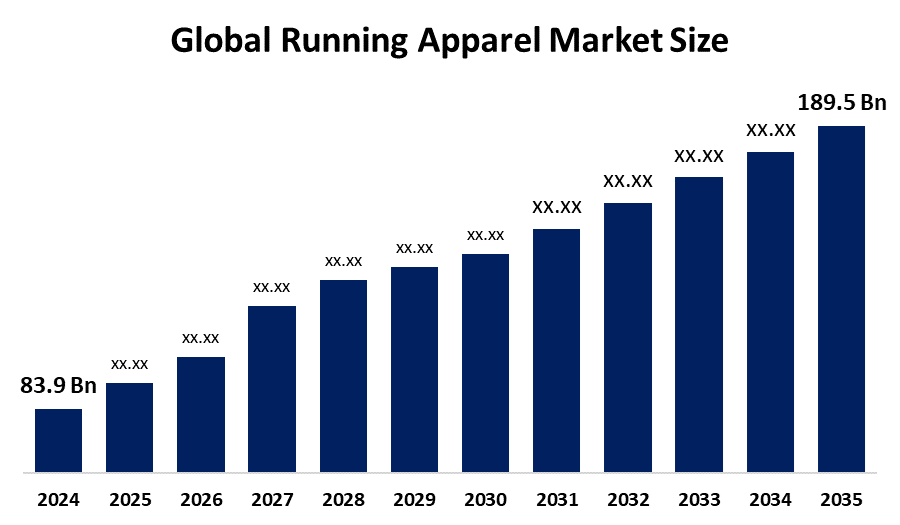

- The Global Running Apparel Market Size Was Estimated at USD 83.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.69% from 2025 to 2035

- The Worldwide Running Apparel Market Size is Expected to Reach USD 189.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Running Apparel Market size was worth Around USD 83.9 Billion in 2024 and is predicted to Grow to Around USD 189.5 Billion by 2035 with a compound annual growth Rate (CAGR) of 7.69% from 2025 and 2035. The market for running apparel has a number of opportunities to grow due to increasing emphasis on women’s fit and digital-first distribution strategies.

Market Overview

The global running apparel industry focuses on the clothing and accessories specifically designed for running, including items such as shorts, tights, jackets, and socks. Running apparel is crucially used for any runner, whether a seasoned marathoner or a casual jogger, and significantly impacts performance, comfort, and overall running experience. Running apparel aids in enhancing performance through moisture management, temperature regulation, and supporting muscle function. Advanced textiles, like biodegradable synthetics and graphene-enhanced fabrics, are designed for comfort, durability, and sustainability. Fabric materials used in running apparel, like polyester, nylon, and merino wool, possess the best moisture-wicking properties. Workout wear, including skintight leggings, crop tops and unitards, has long been the workout uniform, expanding women’s active wear trends.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and expanding partnerships. For instance, Lululemon Athletica Inc. has consistently blended function, style and science from redefining athleisure with technical fabrics to launching performance-first product lines. The use of AI for personalized shopping experiences and AR for virtual try-ons aids in enhancing the convenience and engagement of running apparel. Further, there is a surging trend towards high-tech sportswear, including advancements in moisture-wicking fabrics and other technical apparel.

Report Coverage

This research report categorizes the running apparel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the running apparel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the running apparel market.

Running Apparel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 83.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.69% |

| 2035 Value Projection: | USD 189.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Types, By Fabric Material, By End User, By Distribution Channels, By Region |

| Companies covered:: | Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, ASICS Corporation, New Balance Athletics Inc., Columbia Sportswear Co., Authentic Brands Group, Mizuno Corporation, Wolverine World Wide Inc., Amer Sports |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The upsurging urban fitness trends are promoting the running apparel market due to increasing prioritization towards breathable, lightweight materials among city runners. The increasing innovation in fabric & design by the integration of AI-powered design tools and 3D printing is propelling the market growth of running apparel. Increased female participation in running, significantly driven the market demand for running apparel. As per statistics, it was estimated that 45% of marathon runners are women, and studies have shown that women are better at holding a consistent pace throughout running a marathon. Additionally, an increasing emphasis on sustainability with eco-friendly materials like recycled fabrics and Merino wool is contributing to promoting the running apparel market. Athleisure makes up almost 20% of online apparel shopping, which is a thriving e-commerce sector, responsible for supporting the running apparel market.

Restraining Factors

The running apparel market is restricted by the availability of counterfeit products, emerging microplastic regulations on synthetics, seasonal demand fluctuations, and volatility in raw material costs for advanced fabrics. Further, the growing demand for sustainable practices, intense competition, and changing consumer preferences are challenging the market growth.

Market Segmentation

The running apparel market share is classified into product types, fabric material, end user, and distribution channels.

- The tops segment dominated the running apparel market in 2024, accounting for about 42% share and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the running apparel market is divided into tops, bottoms, outerwear, and socks & accessories. Among these, the tops segment dominated the running apparel market in 2024, accounting for about 42% share and is projected to grow at a substantial CAGR during the forecast period. Running apparel tops used among women aid in keeping cool, dry, comfortable, and stylish. The launch of regular-fit T-shirt tops for everyday wear by companies like Adidas AG is contributing to propel the segmental market growth.

- The synthetic segment accounted for the largest share of nearly 67% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the fabric material, the running apparel market is divided into synthetic and others. Among these, the synthetic segment accounted for the largest share of nearly 67% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Synthetic materials, which are produced using synthetic materials, are breathable and also quickly absorb sweat to keep cool during exercise. Its easy maintenance, durability, higher strength, wrinkle resistance, quick drying, versatility, and elasticity are propelling the segmental market.

- The men segment accounted for the largest revenue share of about 49.2% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the running apparel market is divided into men, women, and kids. Among these, the men segment accounted for the largest revenue share of about 49.2% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Men's apparel extends across various industries like fitness, leisure, and even in corporate settings. An increased sports participation among men, along with the upsurging advancements in moisture-wicking textiles and temperature-regulating materials, is contributing to propel the market.

- The offline stores segment accounted for the largest share of nearly 61.1% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channels, the running apparel market is divided into offline stores and online stores. Among these, the offline stores segment accounted for the largest share of nearly 61.1% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. An increase in sports and fitness participation across cities and towns is driving the market in the offline stores segment. For instance, in October 2025, D2C men’s fashion brand Snitch announced a bold step into quick commerce with the launch of its 60-minute apparel delivery service.

Regional Segment Analysis of the Running Apparel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the running apparel market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 41.65% in the running apparel market over the predicted timeframe. The market ecosystem in North America is strong, with both cutting-edge startups and major industries. For instance, Nike has reported a slight uplift in its first-quarter sales, which an analyst described as a “strong lap” in its ongoing reinvention race. The market for running apparel has been driven by the region's increased disposable incomes and dense network of speciality stores. Due to their innovative running apparel products and partnerships with other industry players, they have played a significant role in propelling the market's expansion. For instance, in January 2022, NC State and Under Armour's partnership takes innovation, aiming to drive textiles innovation, improve sustainability. The U.S. is leading the North America running apparel market, holding the largest market share of about 72%, driven by increasing obesity & related issues, along with the growing need for athletic wear.

Asia Pacific is expected to grow at a rapid CAGR of about 8.32% in the running apparel market during the forecast period. The Asia Pacific area has a thriving market for running apparel due to its increasing health awareness, urbanization, and influence of global sports culture. The increasing inclination towards running club stores is contributing to propel the running apparel market. For instance, in September 2025, Chinese sportswear brand Xtep launched its first Asian running club store at Singapore’s Kallang Wave Mall, combining retail offerings with a dedicated community space for runners. China is dominating the Asia Pacific running apparel market in terms of revenue, accounting for 20-30% share. This is attributed to the growing need for high-quality, sustainable and domestically made products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Running Apparel market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Puma SE

- ASICS Corporation

- New Balance Athletics Inc.

- Columbia Sportswear Co.

- Authentic Brands Group

- Mizuno Corporation

- Wolverine World Wide Inc.

- Amer Sports

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Recover Brands, the pioneering sustainable apparel company, would sponsor the Expo Lounge and participate in the Innovation Showcase at the 2026 Running USA Industry Conference presented by haku, taking place February 1–3 in St. Louis, Missouri.

- In June 2025, Manhattan University, an NCAA Division I member institution with 21 men’s and women’s sports teams, announced a pioneering, long-term alliance with the U.S.-based sportswear brand, Capelli Sport.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the running apparel market based on the below-mentioned segments:

Global Running Apparel Market, By Product Types

- Tops

- Bottoms

- Outerwear

- Socks and Accessories

Global Running Apparel Market, By Fabric Material

- Synthetic

- Others

Global Running Apparel Market, By End User

- Men

- Women

- Kids

Global Running Apparel Market, By Distribution Channels

- Offline Stores

- Online Stores

Global Running Apparel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the running apparel market?The global running apparel market size is expected to grow from USD 83.9 Billion in 2024 to USD 189.5 Billion by 2035, at a CAGR of 7.69% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the running apparel market?North America is anticipated to hold the largest share of the running apparel market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Running Apparel Market from 2024 to 2035?The market is expected to grow at a CAGR of around 7.69% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Running Apparel Market?Key players include Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, ASICS Corporation, New Balance Athletics Inc., Columbia Sportswear Co., Authentic Brands Group, Mizuno Corporation, Wolverine World Wide Inc., and Amer Sports.

-

5. Can you provide company profiles for the leading running apparel manufacturers?Yes. For example, Nike, Inc. is an American athletic footwear and apparel corporation headquartered near Beaverton, Oregon, and is the world's largest supplier of athletic shoes and apparel and a major manufacturer of sports equipment, with revenue in excess of US$46 billion in its fiscal year 2022. Adidas AG is a German multinational athletic apparel and footwear corporation and is the largest sportswear manufacturer in Europe, and also the second largest in the world, after Nike.

-

6. What are the main drivers of growth in the running apparel market?Upsurging urban fitness trends, innovation in fabric design, increased female participation in running, and emphasis on sustainability are major market growth drivers of the running apparel market.

-

7. What challenges are limiting the running apparel market?Availability of counterfeit products, emerging microplastic regulations on synthetics, seasonal demand fluctuations, and volatility in raw material costs for advanced fabrics remain key restraints in the running apparel market.

Need help to buy this report?