Global Round Aluminum Slugs Consumption Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cold Forged Slugs, Hot Forged Slugs, and Impact Extruded Slugs), By Alloy Type (1000 Series, 3000 Series, and 5000 Series), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Round Aluminum Slugs Consumption Market Insights Forecasts to 2035

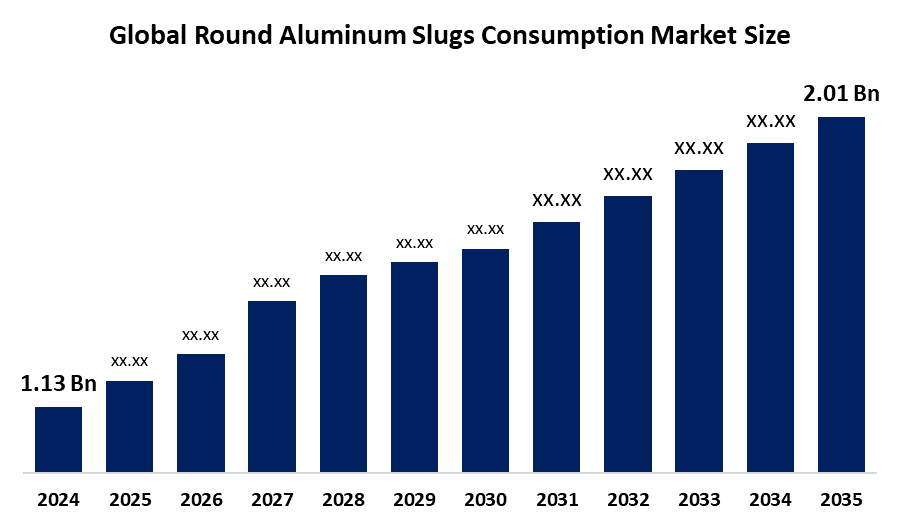

- The Global Round Aluminum Slugs Consumption Market Size Was Estimated at USD 1.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.38% from 2025 to 2035

- The Worldwide Round Aluminum Slugs Consumption Market Size is Expected to Reach USD 2.01 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Round Aluminum Slugs Consumption market size was worth around USD 1.13 Billion in 2024 and is predicted to grow to around USD 2.01 Billion by 2035 with a compound annual growth rate (CAGR) of 5.38% from 2025 and 2035. The market for round aluminum slugs consumption has a number of opportunities to grow because they combine outstanding recyclability, lightweight durability, and high speed production compatibility. These characteristics lower expenses, satisfy sustainability requirements, and increase demand in the electronics, automotive, and packaging industries.

Market Overview

The round aluminum slugs consumption refers to the global industry focused on the production and use of round aluminum slugs, circular discs of high purity aluminum, which are primarily utilized as raw materials in manufacturing processes such as extrusion and deep drawing. The demand for aluminum slugs is mostly driven by the construction, automotive, and beverage packaging industries, with North America and Europe being the two main regions propelling market expansion. The U.S. Geological Survey estimates that 65.2 million metric tons of aluminum were produced worldwide in 2022, with a significant amount going toward making aluminum slugs. Manufacturers are concentrating on creating premium aluminum slugs with reduced carbon footprints as environmental concerns and regulatory demands grow. The market's future is anticipated to be shaped by this tendency.

The Indian government declared the elimination of Basic Customs Duty on lead, zinc, and copper scrap in the Union Budget for FY 2025–2026. This policy seeks to improve India's standing in international markets and lower operating costs for recyclers. Compared to 0.31 million tonnes in CY 2023, India imported 0.32 million tonnes of copper scrap in CY 2024. In previous budgets, the duty was reduced from 5% to 2.5%. In a similar vein, a complete BCD exemption on imports of lead and zinc scrap will increase domestic processing and employment. Strong demand for secondary raw materials is demonstrated by India's imports of 151,107 tonnes of lead scrap and 73,947 tonnes of zinc scrap in CY 2024.

Report Coverage

This research report categorizes the round aluminum slugs consumption market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the round aluminum slugs consumption market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the round aluminum slugs consumption market.

Global Round Aluminum Slugs Consumption Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.13 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.38% |

| 2035 Value Projection: | USD 2.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product Type, By Alloy Type and By Region |

| Companies covered:: | Ball Corporation, Neuman Aluminium Austria, Alucon Public Company Limited, Talum, Aluminium Werke Wutöschingen, Rheinfelden Semis GmbH, Impol Group, Fuchuan Metal Technologies Co. Ltd., Aluman S.A., Envases Group, Haomei Aluminum, Exal Corporation, Novelis Inc., Rusal, Rio Tinto, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The round aluminum slugs consumption market is driven by the increased use of aerosol applications, demand for personal care products, and demand for premium packaging are expected to drive the specialist container industry. Improvements in fuel economy are projected to be driven by weight reduction programs, increased use of aluminum in automotive applications, and components production demands to support specialized applications and integration into the industry. Technological advancements, improvements in forming capability, and advancements in quality control are anticipated to support the greater adoption of precision manufacturing techniques, promoting the use of aluminum slugs and optimizing production.

Restraining Factors

The round aluminum slugs consumption market is restricted by factors like the stability of production costs are expected to stem from supply chain disruptions, increased aluminum prices, and raw material availability affecting prices and processing margins. Some innovations that increase the pressure to remain competitively positioned in the market include innovations in composite materials, yielding costs or specialty application benefits, innovations in possibilities for steel containers, and alternatives for plastic packaging.

Market Segmentation

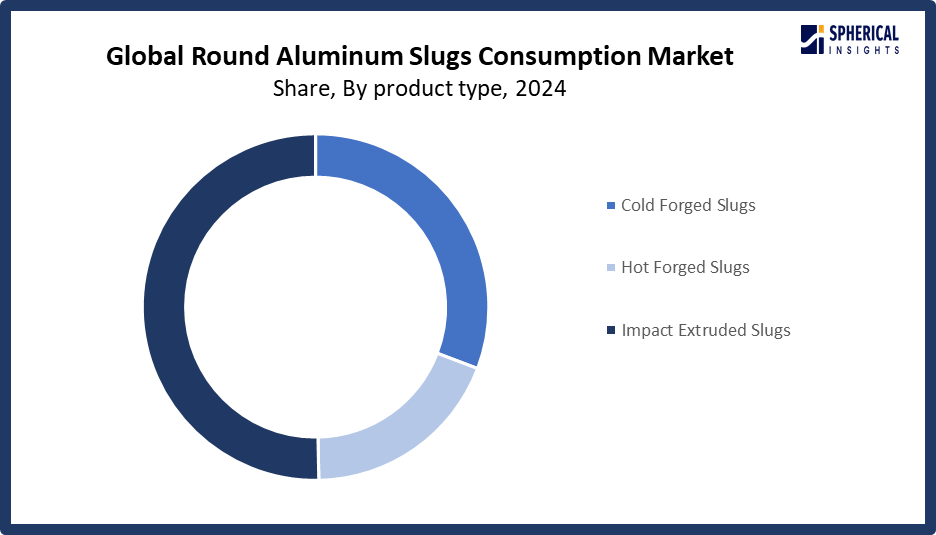

The round aluminum slugs consumption market share is classified into product type and alloy type.

- The impact extruded slugs segment dominated the market in 2024, accounting for approximately 50.5% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the round aluminum slugs consumption market is divided into cold forged slugs, hot forged slugs, and impact extruded slugs. Among these, the impact extruded slugs segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by its smooth container production, thin wall production dimensions, and production efficiencies at high volumes, which meet the needs of the packaging and aerosol container manufacturing industries.

Get more details on this report -

- The 1000 series segment accounted for the largest share in 2024, accounting for approximately 40.3% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the alloy type, the round aluminum slugs consumption market is divided into 1000 series, 3000 series, and 5000 series. Among these, the 1000 series segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to its high purity aluminum content, exceptional corrosion resistance, and excellent formability characteristics that fit both general packaging applications and food contact regulations.

Regional Segment Analysis of the Round Aluminum Slugs Consumption Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 40.5% of the round aluminum slugs consumption market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 40.5% of the round aluminum slugs consumption market over the predicted timeframe. In the Asia Pacific market, the market is rising due to China's rapid growth in the automotive packaging sector, a growing innovation market, increasing disposable incomes that will result in higher market share for recycled packaging products, and robust government policies favoring manufacturing, infrastructure spending, and sustainability.

China's large industrial base, especially in the automotive, packaging, and electronics industries, allows it to dominate the Asia-Pacific market for round aluminum slug consumption. Its dominant position in the market is further supported by the nation's well-established supply chains and large capacity for producing aluminum.

North America is expected to grow at a rapid CAGR, representing nearly 30% in the round aluminum slugs consumption market during the forecast period. The North America area has a thriving market for round aluminum slugs consumption due to large investments made in recycling infrastructure and lightweight materials to promote sustainability, growing consumer interest in recyclable materials, and a healthy demand from beverage packaging and the automotive industry.

The United States leads the North American market for the round aluminum slugs consumption because of its strong beverage can and packaging industry, extensive infrastructure for recycling aluminum, high demand for lightweight materials in consumer and automotive goods, and supportive laws encouraging sustainable materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the round aluminum slugs consumption market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ball Corporation

- Neuman Aluminium Austria

- Alucon Public Company Limited

- Talum

- Aluminium Werke Wutöschingen

- Rheinfelden Semis GmbH

- Impol Group

- Fuchuan Metal Technologies Co. Ltd.

- Aluman S.A.

- Envases Group

- Haomei Aluminum

- Exal Corporation

- Novelis Inc.

- Rusal

- Rio Tinto

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Novelis, a leading sustainable aluminum solutions provider and the world leader in aluminum rolling and recycling, announced that it had entered into a joint development agreement with DRT Holdings, LLC to accelerate the adoption of high-recycled content alloys in aluminum beverage can ends. This collaboration aims to improve the manufacturing process for sustainable can ends, ensuring seamless adoption across the global metal packaging industry.

- In February 2024, Constellium SE partnered with Chanel Fragrance & Beauty and G.Pivaudran to introduce a packaging including recycled aluminium for Chanel's mascara line "Le Volume." The mascara packaging will now incorporate 10 to 20 per cent of post-consumer recycled (PCR), depending on the model.

- In October 2023, Hydro acquired the Polish aluminium recycling company Alumetal S.A. to strengthen its position in aluminium recycling across Europe and to expand its product offering in the low-carbon and scrap-based foundry alloy market. Together, Hydro and Alumetal became the leading integrated aluminium recycler in Europe.

- In August 2021, Alcoa announced a comprehensive Technology Roadmap aimed at transforming the aluminum industry towards a sustainable future. This initiative aligns with Alcoa's commitment to achieving net-zero greenhouse gas emissions by 2050 across its global operations, including Scope 1 and Scope 2 emissions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the round aluminum slugs consumption market based on the below-mentioned segments:

Global Round Aluminum Slugs Consumption Market, By Product Type

- Cold Forged Slugs

- Hot Forged Slugs

- Impact Extruded Slugs

Global Round Aluminum Slugs Consumption Market, By Alloy Type

- 1000 Series

- 3000 Series

- 5000 Series

Global Round Aluminum Slugs Consumption Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the round aluminum slugs consumption market over the forecast period?The global round aluminum slugs consumption market is projected to expand at a CAGR of 5.38% during the forecast period.

-

2. What is the market size of the round aluminum slugs consumption market?The global round aluminum slugs consumption market size is expected to grow from USD 1.13 Billion in 2024 to USD 2.01 Billion by 2035, at a CAGR of 5.38% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the round aluminum slugs consumption market?Asia Pacific is anticipated to hold the largest share of the round aluminum slugs consumption market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global round aluminum slugs consumption market?Ball Corporation, Neuman Aluminium Austria, Alucon Public Company Limited, Talum, Aluminium Werke Wutöschingen, Rheinfelden Semis GmbH, Impol Group, Fuchuan Metal Technologies Co. Ltd., Aluman S.A., Envases Group, Haomei Aluminum, Exal Corporation, Novelis Inc., Rusal, Rio Tinto, and Others.

-

5. What factors are driving the growth of the round aluminum slugs consumption market?The round aluminum slugs consumption market growth is driven by the growing need for recyclable, lightweight materials in the electronics, automotive, and packaging sectors. Further driving market expansion are improvements in manufacturing technologies and growing environmental consciousness.

-

6. What are the market trends in the round aluminum slugs consumption market?The round aluminum slugs consumption market trends include sustainability and recyclability, advancements in manufacturing technologies, customization and product innovation, expansion into emerging markets, and automotive lightweighting.

-

7. What are the main challenges restricting the wider adoption of the round aluminum slugs consumption market?The round aluminum slugs consumption market trends include price fluctuations for raw materials, especially aluminum, can have a big effect on manufacturing costs and profit margins, leaving enterprises in a precarious financial situation.

Need help to buy this report?