Global Rooibos Tea Market Size, Share, and COVID-19 Impact Analysis, By Type (Red Rooibos Tea, Green Rooibos Tea, and Flavored Rooibos Tea), By Form (Bag, Loose Leaf and Ready-to-Drink Beverage) By Distribution channel (Supermarket/Hypermarket, Specialty Stores and Online Retail), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Rooibos Tea Market Insights Forecasts to 2035

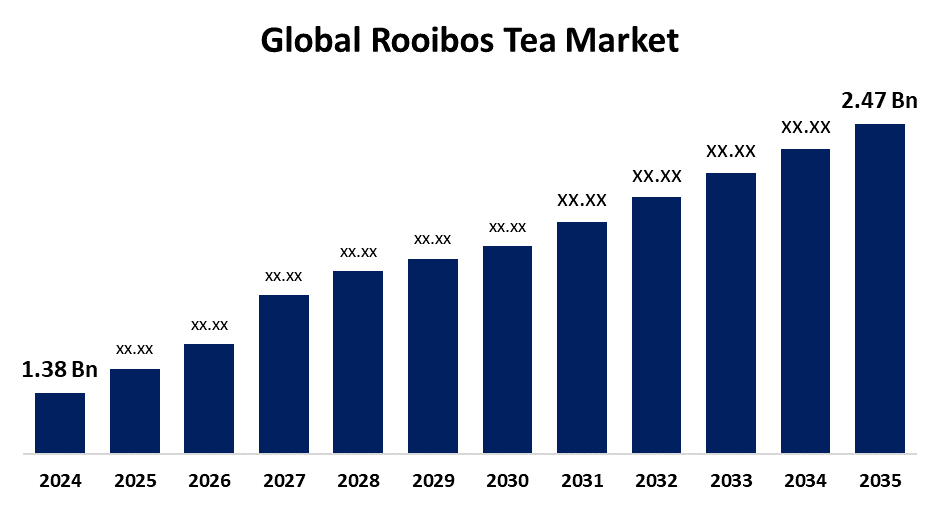

- The Global Rooibos Tea Market Size Was Estimated at USD 1.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.43% from 2025 to 2035

- The Worldwide Rooibos Tea Market Size is Expected to Reach USD 2.47 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Rooibos Tea Market Size was worth around USD 1.38 Billion in 2024 and is predicted to Grow to around USD 2.47 Billion by 2035 with a compound annual growth rate (CAGR) of 5.43% from 2025 and 2035. Increasing health consciousness, increased demand for functional and herbal beverages, the growth of ready-to-drink products, greater affinity for organic and sustainable products, and increasing disposable income coupled with urbanization are some major drivers for the growth of the global rooibos tea market.

Market Overview

The rooibos tea industry is the global business engaged in the production, processing, distribution, and marketing of rooibos tea, a caffeine-free herbal beverage extracted from the Aspalathus linearis plant found only in South Africa. In contrast to other teas, rooibos is caffeine-free by nature and rich in antioxidants, which has made it a favorite among consumers who care about their well-being. As the world turns its attention more towards health and lifestyle, rooibos tea is gaining advantages like antioxidant protection, anti-inflammatory characteristics, digestive benefits, and cardiovascular health. These qualities have taken rooibos tea from the niche of a regional drink to a worldwide-known health beverage. More health-consciousness and the growing demand for herbal and functional drinks persuade consumers to opt for rooibos instead of traditional teas. The growth of ready-to-drink (RTD) rooibos products offers convenient solutions for on-the-go lifestyles, another driver of consumption. Also, the popularity of organic and sustainably produced products supports consumer values of sustainability. Further, with the introduction of flavored rooibos mixes, CBD-infused options, and rooibos skincare products. Online shops and subscription services still extend convenience and consumer interaction. These trends set the rooibos tea market for long-term international expansion as the demand for healthier, tasty, and convenient drinks keeps increasing.

Report Coverage

This research report categorizes the rooibos tea market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rooibos tea market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the rooibos tea market.

Global Rooibos Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.43% |

| 2035 Value Projection: | USD 2.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Form, By Distribution channel, and By Region |

| Companies covered:: | Joekels Tea, The Republic of Tea, Haey & Sons, Twinings, Numi, Stash Tea, Tazo, Tiesta Tea, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers all over the world are becoming increasingly health-aware, looking for natural, caffeine-free, and antioxidant-boosted drinks. Rooibos tea has several health advantages including digestion assistance, anti-inflammation, and stress relief that fuels growing demand as individuals pursue healthier lifestyles. Additionally, flavored rooibos blends like vanilla, citrus, and chai attract consumers with different palates. Secondly, the use of rooibos in skincare products and food supplements broadens its appeal beyond conventional tea consumers. The innovations appeal to a wider group, including younger consumers and consumers looking for multifunctional products.

Restraining Factors

Rooibos tea tends to be more expensive than regular black or green teas because of its specialized cultivation and processing. This can discourage price-conscious consumers, thus constraining its usage, particularly in developing markets. Additionally, rooibos tea possesses a strong earthy, and slightly sweet taste that may not be suitable for all consumers, particularly traditional tea users. Taste can constrain its mass acceptance in some markets.

Market Segmentation

The rooibos tea market share is classified into type, form, and distribution channel.

- The red roobies tea segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the rooibos tea market is divided into red rooibos tea, green rooibos tea, and flavored rooibos tea. Among these, the red roobies tea segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to red rooibos having a sweet, earthy taste that is appealing to many. Its balanced flavor appeals to both ordinary tea drinkers and experts alike, which helps it continue to enjoy widespread appeal.

- The tea bag segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the rooibos tea market is divided into bag, loose leaf, and ready-to-drink beverages. Among these, the tea bag segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by tea bags offering an easy and convenient brewing process without the hassle of measuring or the use of special appliances. The ease is attractive to time-pressed consumers who desire an effortless means to access rooibos tea at any time, fueling the segment's leading market share.

- The food and beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the rooibos tea market is divided into supermarket/hypermarket, specialty stores, and online retail. Among these, the food and beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to rooibos tea is predominantly taken as a caffeine-free, natural herbal tea. Its healthy flavor and therapeutic benefits make it well sought after by consumers looking for alternatives to conventional teas and coffees, generating enormous demand in the food and beverage industry.

Regional Segment Analysis of the Rooibos Tea Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

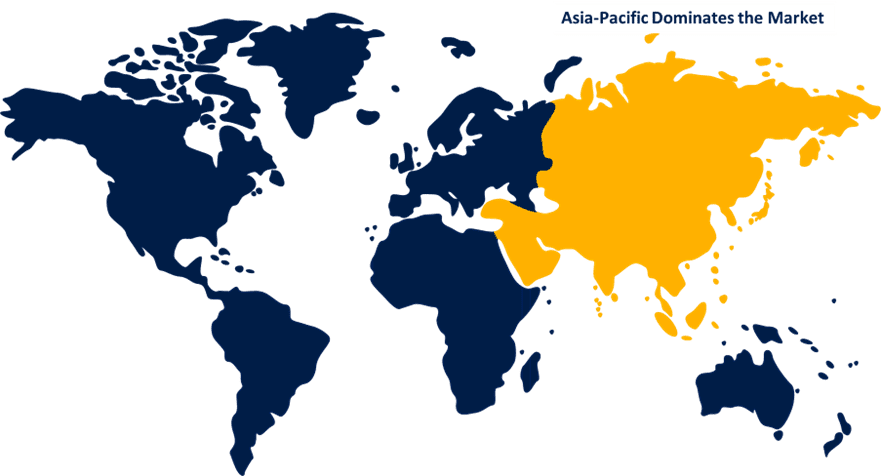

Asia Pacific is anticipated to hold the largest share of the rooibos tea market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the rooibos tea market over the predicted timeframe. Other Asia-Pacific nations such as China, India, and Japan share a long culture of using herbal and medicinal teas for health. Rooibos tea is easily compatible with these cultural practices because it is seen as a natural, medicinal drink. This prevalent taste for herbal infusions would help facilitate increased acceptability of rooibos tea as an everyday health beverage, playing a major role in the region taking the top spot in the international rooibos market.

North America is expected to grow at a rapid CAGR in the rooibos tea market during the forecast period. The North American market prefers specialty, organic, and premium brands. Rooibos tea's organic, natural appeal and high antioxidant content appeal to consumers seeking clean-label and sustainable products. This has pushed brands to innovate and grow rooibos products, propelling rapid market penetration with organic certifications and proprietary blends designed for health-conscious consumers.

Europe is predicted to hold a significant share of the rooibos tea market throughout the estimated period. Europe boasts a rich tradition of tea drinking with a growing interest in herbal and specialty teas. Rooibos perfectly fills the gap as a substitute for conventional black and green teas because of its rich flavor and health attributes. The intrigue for increasingly varied, caffeine-free brews has contributed to rooibos's widespread popularity in the European marketplace.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the rooibos tea market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Joekels Tea

- The Republic of Tea

- Haey & Sons

- Twinings

- Numi

- Stash Tea

- Tazo

- Tiesta Tea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, The Boston Beer Company extended its cannabis-infused iced tea brand, TeaPot, with a new Blackberry Rooibos flavor. The non-caffeinated, low-sugar option is formulated to induce relaxation and tranquility, removing any cannabis flavor or scent. Similar to all TeaPot offerings, Blackberry Rooibos is not carbonated and features 5mg of THC per 355 mL can, providing a smooth, calming drink choice.

- In May 2024, Laager, a tea brand owned by Joekels, recently introduced the Laager Plus CBD Rooibos range, which brings together the caffeine-free, antioxidant-packed benefits of rooibos and the relaxing, sleep-promoting qualities of CBD. The range has two versions: Laager Plus CBD Relax to assist consumers in coping with everyday stress, and Laager Plus CBD Sleep to enhance the quality of sleep. The move is part of a trend towards functional wellness teas that are geared towards relaxation and improved sleep.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the rooibos tea market based on the below-mentioned segments:

Global Rooibos Tea Market, By Type

- Red Rooibos Tea

- Green Rooibos Tea

- Flavored Rooibos Tea

Global Rooibos Tea Market, By Form

- Bag

- Loose Leaf

- Ready-to-Drink Beverage

Global Rooibos Tea Market, By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Retail

Global Rooibos Tea Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the rooibos tea market over the forecast period?The global rooibos tea market is projected to expand at a CAGR of 5.43% during the forecast period.

-

2. What is the market size of the rooibos tea market?The global rooibos tea market size is expected to grow from USD 1.38 Billion in 2024 to USD 2.47 Billion by 2035, at a CAGR of 5.43% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the rooibos tea market?Asia Pacific is anticipated to hold the largest share of the rooibos tea market over the predicted timeframe.

Need help to buy this report?