Global Ride Sharing Market Size, Share, and COVID-19 Impact Analysis, By Types (Car Sharing, E-hailing, Car Rental, Station-based Mobility), By Commute (Short Distance, Corporate, Inter City), By Vehicle (Bike/Bicycle, Scooter, Others), By Application (iOS, Android, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Ride Sharing Market Insights Forecasts to 2033

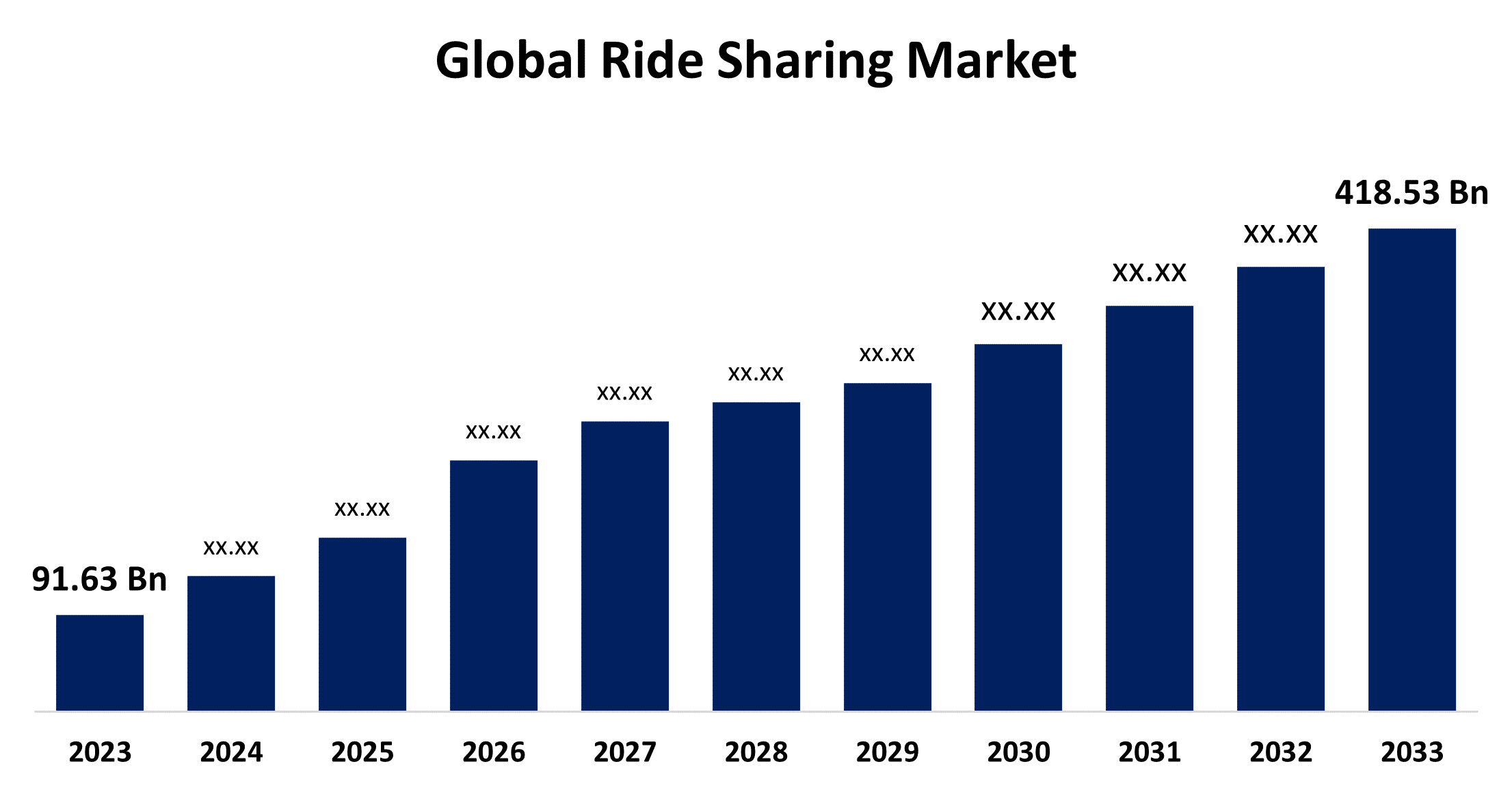

- The Global Ride Sharing Market Size was Valued at USD 91.63 Billion in 2023

- The Market Size is Growing at a CAGR of 16.40% from 2023 to 2033

- The Worldwide Ride Sharing Market Size is Expected to Reach USD 418.53 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ride Sharing Market Size is Anticipated to Exceed USD 418.53 Billion by 2033, Growing at a CAGR of 16.40% from 2023 to 2033.

Market Overview

The ride-sharing service connects customers and drivers by allowing them to arrange rides through online sites or smartphone apps. The Ride Sharing service type provides various benefits, including minimal carbon footprints, convenient booking alternatives, economical door-to-door ride services, and no parking issues. Furthermore, the introduction of big data analytics, IoT, and AI enables smart riding options and the increased availability of cab booking services, which are the key reasons driving worldwide market growth. To help regular commuters save money, certain service providers offer a variety of amenities, special offers, and discounts on their journeys. For example, service providers such as Uber and OLA provide monthly passes at affordable costs to their regular passengers. Furthermore, parking spots are absent. Furthermore, a scarcity of parking places, rising fuel prices, increased road traffic and congestion, and a lack of adequate public transportation systems have fueled demand for carpooling and similar sharing services. The rate of automobile emissions has been steadily growing throughout the years. The automotive industry is a substantial contributor to global greenhouse gas emissions. The government, business organizations, and automakers are making greater efforts to reduce rising CO2 emissions. Various organizations, including the International Institute for Sustainable Development of Canada, the Indian Ministry of Environment and Climate Change, and the European Union Paris Agreement on Climate Change, have set ambitious targets and norms, such as expanding forest cover to reduce carbon footprints in the coming years. As a result, these norms are expected to drive the usage of sharing services over private car ownership.

Report Coverage

This research report categorizes the market for the global ride sharing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ride sharing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ride sharing market.

Ride Sharing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 91.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.40% |

| 2033 Value Projection: | USD 418.53 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Types, By Commute, By Vehicle |

| Companies covered:: | Ola, Grab, Bolt Technology OÜ, Careem, Cabify España S.L.U., Lyft, Inc., Zimride, car2go Group GmbH, Uber Technologies Inc., DiDi Global Inc., Gett, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The fast adoption of smart devices such as smartphones and smart wearables, as well as the increased use of internet data, have opened several prospects for ride-sharing services around the world, accelerating the expansion of the global ride-sharing market. Internet access is the key requirement for using ride-hailing services. To obtain ride information and navigation, consumers must first download ride-providing programs onto their smartphones via the internet. V2V communication, navigation, and telematics all require internet connectivity to function properly. Furthermore, the smartphone apps provide numerous security measures, such as the name, number, and photograph of the driver, vehicle number, route tracing details, and records of previous rides.

Restraining Factors

Stringent restrictions governing vehicle registration and licensing make it difficult for an app-based taxi fleet to conduct ridesharing services. This has hampered the spread of ride-sharing businesses in numerous countries and areas.

Market Segmentation

The global ride sharing market share is classified into type, commute, vehicle, and application.

- The e-hailing segment is expected to hold the largest share of the global ride sharing market during the forecast period.

Based on the type, the global ride sharing market is categorized into car sharing, e-hailing, car rental, and station-based mobility. Among these, the e-hailing segment is expected to hold the largest share of the global ride sharing market during the forecast period. E-hailing ride services transport clients through the use of a personal driver on a contract or job basis. Additionally, the growing demand for e-hailing services is being driven by government measures to raise public awareness about air pollution, passenger comfort, increased traffic congestion, and the simplicity of booking. Rides on e-hailing services are pre-booked and paid for using the transportation network company's smartphone app. Uber, Ola, Lyft, and Gett are major companies in the e-hailing ride-sharing industry.

- The short distance segment is expected to grow at the fastest CAGR during the forecast period.

Based on the commute, the global ride sharing market is categorized into short distance, corporate, and intercity. Among these, the short distance segment is expected to grow at the fastest CAGR during the forecast period. Passengers favor short-distance ride-sharing services such as e-hailing and micro-mobility for getting to public transportation stops like bus and train stations, as well as shopping, celebrations, and visiting friends and family. Many ride-sharing firms concentrate on many ride-sharing alternatives in the 30–40 km range. Lyft and Uber offer carpooling options for shorter distances, whereas Ola offers Ola share to cut commute costs per user and attract more customers who want shorter-distance ride sharing. Thus, using a personal car or public transportation for short trips is problematic in city traffic. Thus, the desire to save money and time on gasoline, along with growing public awareness of air pollution in cities, has fueled a growth in demand for ride-sharing services for short-distance commutes.

- The bike/bicycle segment is expected to hold a significant share of the global ride sharing market during the forecast period.

Based on the vehicle, the global ride sharing market is categorized into bike/bicycle, scooter, and others. Among these, the bike/bicycle segment is expected to hold a significant share of the global ride sharing market during the forecast period. Bike/bicycle sharing is an affordable option that provides acceptable comfort for shorter rides; hence, it is gaining popularity in many countries across regions. Bicycles are environmentally beneficial and take up less time, and because services are widely available, they are appropriate for a single person's ride. Furthermore, electric bikes and bicycles are gaining popularity because they aid the user in hilly circumstances and allow him or her to continue peddling even if the battery dies. As a result, to alleviate traffic congestion, micro-mobility, such as a bike or bicycle, is the most appropriate form of transportation and will remain important in the country.

- The android segment is predicted to dominate the global ride sharing market during the forecast period.

Based on the application, the global ride sharing market is categorized into iOS, android, and others. Among these, the android segment is predicted to dominate the global ride sharing market during the forecast period. Ride-sharing apps are created using cloud computing on mobile devices. Because of their ease of use, the majority of the populace possesses an Android smartphone. As a result, several well-known ride-sharing companies provide apps that are compatible with the Android operating system. For example, Android is the most popular operating system in India, accounting for more than 75% of the market share. Samsung, Xiaomi, Oppo, and Vivo are among the numerous prominent mobile sector players that use the Android operating system.

Regional Segment Analysis of the Global Ride Sharing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

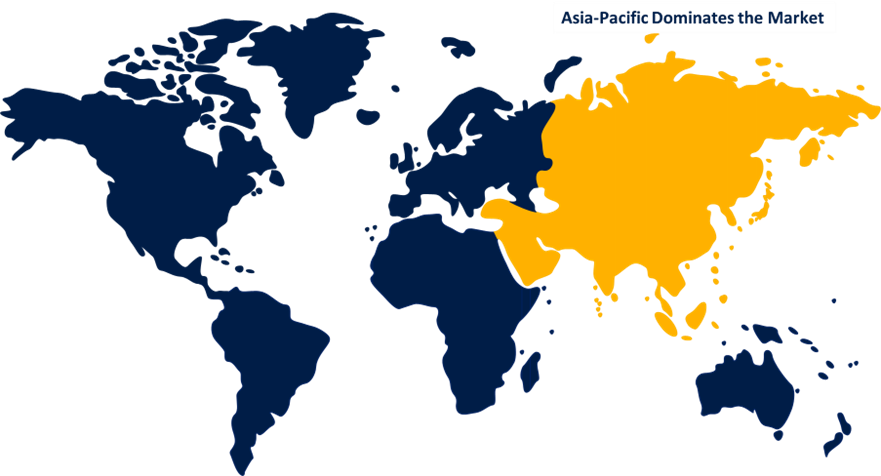

Asia Pacific is projected to hold the largest share of the global ride sharing market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global ride sharing market over the forecast period. In Asia Pacific, ride-sharing services are fast spreading in developing countries such as India, China, and Indonesia, owing to the increasing movement of skilled workers from rural areas to cities. This will be a growth driver for ride-sharing because the passenger does not need a personal vehicle for a short journey, which saves fuel costs and shares mobility while also reducing travel time and congestion owing to fewer vehicles on the road. Ride-sharing can help solve a number of concerns, including traffic congestion, air pollution, and greenhouse gas emissions, all of which have increased as urban populations have grown. Also, the region is home to some of the market's main firms, including Didi, Go-Jek, Grab, and Ola. These factors are boosting market growth in the Asia-Pacific region.

Europe is expected to grow at the fastest CAGR growth of the global ride sharing market during the forecast period. Urbanization has put a strain on urban transportation systems, which in turn affects the population's quality of life. Reduced mobility alternatives, inadequate transportation infrastructure, increased congestion, pollution, and traffic safety issues are just a few of the critical issues that must be addressed systematically. Furthermore, France is a popular tourist destination, with Paris being the most picturesque city, with the Eiffel Tower, the Louvre Museum, and Disneyland. Paris plans to encourage sustainable transportation through electric carsharing and EV purchasing incentives and has developed the world's first fully electric carshare service, Autolib, to instil the sharing culture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ride sharing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ola

- Grab

- Bolt Technology OÜ

- Careem

- Cabify España S.L.U.

- Lyft, Inc.

- Zimride

- car2go Group GmbH

- Uber Technologies Inc.

- DiDi Global Inc.

- Gett

- Others

Key Market Developments

- On January 2023, the Tokyo Hire-Taxi Association declared that its member taxi firms intend to begin ride-sharing services in Tokyo in April 2024. The decision is motivated by the government's desire to partially relax a restriction on ride-sharing platforms. According to recent reports, ride-sharing in the Japanese capital would be restricted to specific areas and hours.

- In June 2022, Uber has launched a new service called UberX Share. The service connects a rider with another traveler going in the same direction, offering a reduction on the total ticket to compensate for the extra time spent on the voyage. The effort seeks to promote shared rides, resulting in a more sustainable use of transportation resources.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global ride sharing market based on the below-mentioned segments:

Global Ride Sharing Market, By Type

- Car Sharing

- E-hailing

- Car Rental

- Station-based Mobility

Global Ride Sharing Market, By Commute

- Short Distance

- Corporate

- Inter City

Global Ride Sharing Market, By Vehicle

- Bike/Bicycle

- Scooter

- Others

Global Ride Sharing Market, By Application

- iOS

- Android

- Others

Global Ride Sharing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global ride sharing market over the forecast period?The Global Ride Sharing Market Size is expected to Grow from USD 91.63 Billion in 2023 to USD 418.53 Billion by 2033, at a CAGR of 16.40% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global ride sharing market?Asia Pacific is projected to hold the largest share of the global ride sharing market over the forecast period.

-

3.Who are the top key players in the ride sharing market?Ola, Grab, Bolt Technology OÜ, Careem, Cabify España S.L.U., Lyft, Inc., Zimride, car2go Group GmbH, Uber Technologies Inc., DiDi Global Inc., Gett, and others.

Need help to buy this report?