Global Reusable Water Bottle Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Glass, Metal, Polymer, and Silicone), By Primary Usage (Everyday, Sports, Travel, and Others), By Distribution Channel (Hyper/Supermarkets, Independent Stores, Online Sales, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Reusable Water Bottle Market Size Insights Forecasts to 2035

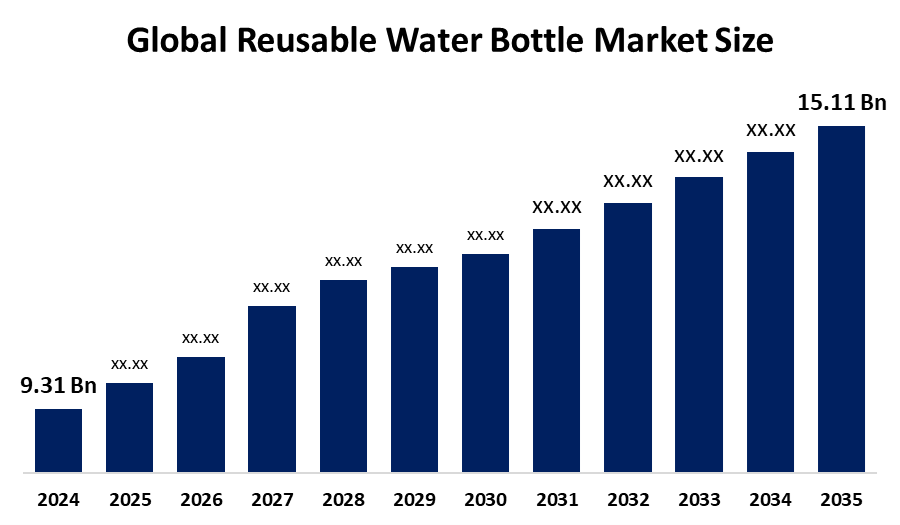

- The Global Reusable Water Bottle Market Size Was Valued at USD 9.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.5% from 2025 to 2035

- The Worldwide Reusable Water Bottle Market Size is Expected to Reach USD 15.11 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The global Reusable Water Bottle Market Size was worth around USD 9.31 Billion in 2024 and is predicted to grow to around USD 15.11 Billion by 2035 with a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035. The market is growing owing to the rise in environmental awareness, which is restricting single-use plastic, government bans, and health issues due to the presence of BPA in single-use plastics. Demand for insulated/smart bottles, growing urbanization, and the increasing trend of a healthy lifestyle in developing countries contribute to the growing market.

Market Overview

The international market for reusable bottles is defined as the business related to the manufacture and distribution of bottles intended to serve multiple purposes and are mostly made from materials such as stainless-steel, plastic, glass, and silicone. They are mostly used for drinking and are applicable daily across households, offices, and institutions, along with use during outdoor and sport-related events and expeditions. The usable bottle market is largely driven by the following factors associated with the increasing awareness, along with the health concerns in different parts of the world, associated with the use and disposal of plastic bottles.

The opportunities emerging include product innovation, such as insulated, intelligent, collapsible, and customized bottles, apart from the increasing use in emerging countries. The drivers, apart from the above, would be the sustainability programs in corporations. The key players in the usable bottle market would be Thermos LLC, CamelBak Products LLC, Tupperware Brands Corporation, SIGG Switzerland AG, Klean Kanteen, Hydro Flask, and S’well, each pursuing innovation in product designs, safety in the use of the materials, and proper distribution of the product across the world. From the 3rd of February 2025, Bali is set to begin the banned use of plastic water bottles in educational institutions, followed by government offices. By Circular Letter Number 2 of 2025, government employees and students are meanwhile obliged to bring their respective containers to carry food and beverages, while no suppliers are allowed to pack food and beverages with plastic materials for government events.

Report Coverage

This research report categorizes the Reusable Water Bottle Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Reusable Water Bottle Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Reusable Water Bottle Market Size.

Reusable Water Bottle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 9.31 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.5% |

| 2035 Value Projection: | 15.11 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Type, By Primary Usage |

| Companies covered:: | Hydro Flask & Stanley, Thermos LLC, CamelBak Products LLC, Klean Kanteen, Tupperware Brands Corporation, Brita GmbH, A.O. Smith Corporation, Newell Brands, Contigo, Hydaway, Nalge Nunc International Corp., Bulletin Brands LLC, Aquasana Inc., SIGG Switzerland AG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the reusable water bottle is fueled by the increase in environmental awareness and concerns about disposing of plastic waste. Environmental and government initiatives to restrict the use of plastic work in favor of the market for the portable water bottle. An increase in health-related concerns about materials like BPA and stainless steel and glass materials is leading consumers towards environmentally friendly products. Corporate sustainability projects and branding efforts involving the use of reusable bottles act as a driving force in the market's growth. Moreover, innovations in the product line, including the use of insulated, intelligent, and designed bottles, have been attracting a whole lot of people to the market.

In January 2026, Dubai announced a ban on single-use plastic water bottles under 500ml, effective January 1. Following the 2024 plastic bag ban, the move promotes reusable and refillable alternatives in homes, offices, and hospitality to reduce waste.

Restraining Factors

The market may face challenges in terms of higher initial investments as compared to disposable bottles, thus hindering the market. Cheap single-use plastic bags may pose challenges to the market, as the inconvenience of cleaning, carrying, and durability, as well as the lack of awareness among the public in developing countries, may restrict the growth of the market due to fluctuations in the cost of raw materials.

Market Segmentation

The Reusable Water Bottle Market Size share is classified into material type, primary usage, and distribution channel.

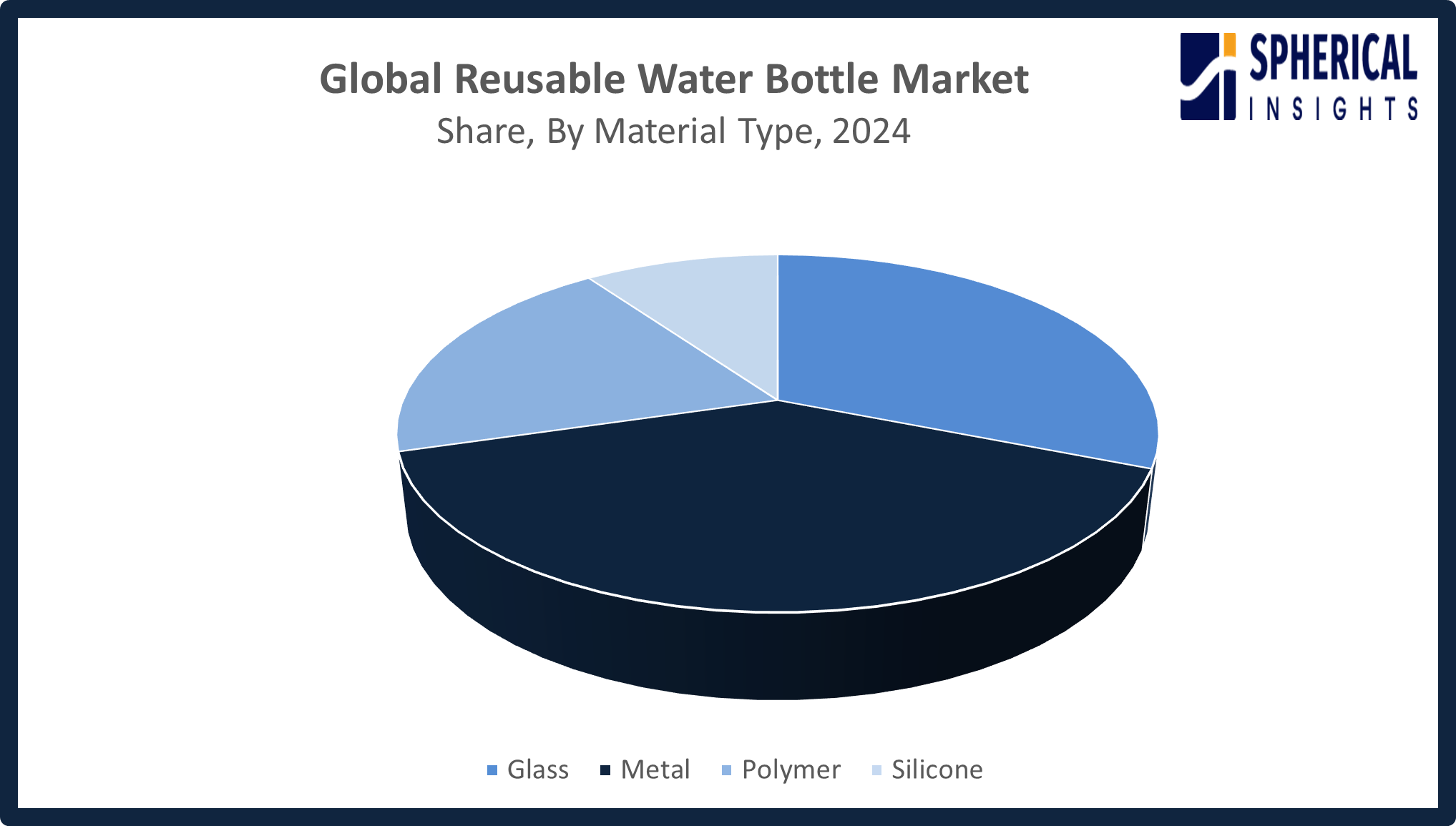

- The metal segment dominated the market in 2024, approximately 39% and is projected to grow at a substantial CAGR during the forecast period.

Based on the material type, the Reusable Water Bottle Market Size is divided into glass, metal, polymer, and silicone. Among these, the metal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The metal part dominated the market in terms of growth due to the durability, temperature retention properties, and health and environmental concerns associated with the use of the material. The stainless steel and aluminium materials used in the manufacture of the bottles do not have the odor or corrosive nature associated with other materials, and the advanced processing increases the insulation properties as well as reduces the weight.

Get more details on this report -

- The everyday segment accounted for the largest share in 2024, approximately 44% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the primary usage, the Reusable Water Bottle Market Size is divided into everyday, sports, travel, and others. Among these, the everyday segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The everyday use segment leads the market in reusable water bottles. This is driven by the usage from home, office, or while travelling. Reusable bottles are preferred by consumers because of convenience, savings, and eco-friendliness. With the trend of sustainable consumption, the market is set to retain its leadership position in the global market.

- The hyper/supermarkets segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Reusable Water Bottle Market Size is divided into hyper/supermarkets, independent stores, online sales, and others. Among these, the hyper/supermarkets segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hyper/supermarkets market accounts for the leading share in the market for reusable water bottles due to their wide penetration, product diversification, and convenience. Retailing gives visibility, shelf space, and helps create consumer engagement campaigns. Urbanization, sustainability-based categories, as well as comparisons for products, increase sales, while continuous efforts in infrastructure development are likely to maintain the leading market share in this form.

Regional Segment Analysis of the Reusable Water Bottle Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Reusable Water Bottle Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Reusable Water Bottle Market Size over the predicted timeframe. The reusable water bottles market in North America is anticipated to have the 38% market share owing to the heightened awareness about the environment, government regulations against the use of single-use plastic, and increasing demand for environment-friendly, BPA-free, and long-lasting water bottles. The United States is majorly driving the market in the region owing to healthy living habits, organization sustainability programs, and the popularity of high-quality products, while the Canadian market is driven by government campaigns, adoption in the workplace, educational institutions, and fitness clubs, in addition to advanced retail systems. In July 2025, Louisville, U.S., launched Plastic Free July, a global initiative encouraging residents and businesses to reduce single-use plastics and promote sustainability.

Asia Pacific is expected to grow at a rapid CAGR in the Reusable Water Bottle Market Size during the forecast period. Asia Pacific is expected to have a 27% market share of the Reusable Water Bottle Market Size. This is because of the rise in awareness regarding environmental protection, along with rising disposable incomes. This is specifically driven by the ban on single-use plastics in countries such as China and India, resulting in the usage of reusable water bottles. A health-conscious population drives the market, which is primarily young. In November 2025, the Indian State of Karnataka made it compulsory to ban the use of plastic water bottles and use either steel, copper, or glass materials and exclusively Nandini products at government gatherings and events.

Europe’s reusable bottle market is expanding steadily owing to the strict government policies regarding the use of single-use plastics, awareness about the environmental impact, and healthy habits adopted by consumers. Government support, sustainability initiatives, and environmental living style habits have made Germany, France, and the UK the most prominent countries in the reusable bottle market. There is a significant availability of quality, BPA-free, and insulated bottles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Reusable Water Bottle Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hydro Flask & Stanley

- Thermos LLC

- CamelBak Products LLC

- Klean Kanteen

- Tupperware Brands Corporation

- Brita GmbH

- A.O. Smith Corporation

- Newell Brands

- Contigo

- Hydaway

- Nalge Nunc International Corp.

- Bulletin Brands LLC

- Aquasana Inc.

- SIGG Switzerland AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Bubba, part of Newell Brands, unveiled a refreshed brand identity and a new generation of reusable water bottles. Known for oversized, high-performance designs, the updated lineup emphasizes style, functionality, and modern consumer lifestyles, combining reliable performance with a design-forward approach for everyday hydration.

- In November 2025, South Korea mandated that beverage producers using over 5,000 tons of PET bottles annually must include at least 10% recycled plastic from 2026. The policy, part of the revised Resource Recycling Act, aims to promote a circular economy and reduce plastic waste nationwide.

- In July 2025, Klean Kanteen enhanced its original reusable water bottle designs with new colors and components, focusing on durability over product expansion. The certified B Corporation continues promoting plastic-free hydration, navigating post-2024 buyout challenges, tariffs affecting small businesses, competition from copycats, and ongoing single-use plastic usage.

- In January 2025, Stasher launched its Stasher Water Bottle, combining a food-grade silicone exterior with double-walled stainless steel for durability and insulation. Leak-proof and dishwasher safe, the stylish bottle promotes sustainable hydration, reduces single-use plastics, and integrates into daily life. Available in Lagoon, it can be purchased solo or in reusable product bundles.

- In April 2023, Nalgene Outdoor announced that, as of January 2023, all lifestyle bottles are now made with 50% certified recycled material. Marked with the Sustain seal, the bottles reduce single-use plastics and repurpose waste, reinforcing Nalgene’s 70-year commitment to sustainability and eco-friendly hydration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Reusable Water Bottle Market Size based on the below-mentioned segments:

Global Reusable Water Bottle Market Size, By Material Type

- Glass

- Metal

- Polymer

- Silicone

Global Reusable Water Bottle Market Size, By Primary Usage

- Everyday

- Sports

- Travel

- Others

Global Reusable Water Bottle Market Size, By Distribution Channel

- Hyper/Supermarkets

- Independent Stores

- Online Sales

- Others

Global Reusable Water Bottle Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Reusable Water Bottle Market Size over the forecast period?The global Reusable Water Bottle Market Size is projected to expand at a CAGR of 4.5% during the forecast period.

-

2. What is the Reusable Water Bottle Market Size?The Reusable Water Bottle Market Size involves manufacturing, selling, and distributing eco-friendly, durable bottles for drinking water, replacing single-use plastics.

-

3. What is the market size of the Reusable Water Bottle Market Size?The global Reusable Water Bottle Market Size is expected to grow from USD 9.31 billion in 2024 to USD 15.11 billion by 2035, at a CAGR of 4.5% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the Reusable Water Bottle Market Size?North America is anticipated to hold the largest share of the Reusable Water Bottle Market Size over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global Reusable Water Bottle Market Size?Hydro Flask & Stanley, Thermos LLC, CamelBak Products LLC, Klean Kanteen, Tupperware Brands Corporation, Brita GmbH, A.O., Smith Corporation, Newell Brands, Contigo, Hydaway, and Others.

-

6. What factors are driving the growth of the Reusable Water Bottle Market Size?The Reusable Water Bottle Market Size is driven by environmental awareness, government plastic bag bans, health consciousness, rising fitness trends, urbanization, disposable income growth, e-commerce expansion, and demand for sustainable, durable, portable bottles.

-

7. What are the market trends in the Reusable Water Bottle Market Size?Key market trends in the Reusable Water Bottle Market Size include sustainability focus, customisation/personalization, smart/tech‑enabled bottles, premium insulation designs, and heightened eco‑friendly packaging demand.

-

8. What are the main challenges restricting wider adoption of the Reusable Water Bottle Market Size?The main challenges restricting the wider adoption of the Reusable Water Bottle Market Size include high upfront costs, the convenience of single-use alternatives, limited public infrastructure for refilling, and hygiene concerns.

Need help to buy this report?