Global Retinal Dystrophy Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Peripheral Dystrophy and Central Dystrophy), By Therapy (Magnetic Therapy, Gene Therapy, and Stem Cell Therapy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Retinal Dystrophy Treatment Market Size Insights Forecasts to 2035

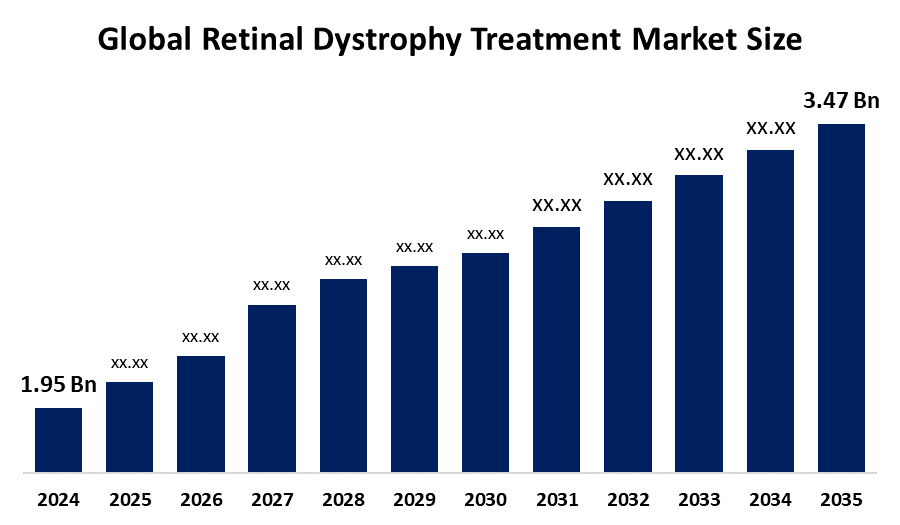

- The Global Retinal Dystrophy Treatment Market Size Was Estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.38% from 2025 to 2035

- The Worldwide Retinal Dystrophy Treatment Market Size is Expected to Reach USD 3.47 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Retinal Dystrophy Treatment Market Size was worth around USD 1.95 Billion in 2024 and is predicted to Grow to around USD 3.47 Billion by 2035 with a compound annual growth rate (CAGR) of 5.38% from 2025 and 2035. The market for retinal dystrophy treatment has a number of opportunities to grow due to the gene therapy innovations for IRDs.

Market Overview

The global retinal dystrophy treatment industry focused on the medical products and therapies used for managing inherited eye disorders causing progressive vision loss. Retinal dystrophy is a rare genetic eye condition causing damage to the retina, the light-sensitive issue at the back of the eye. It represent diverse genetic conditions affecting retina, including rod-cone dystrophies, cone-rod dystrophies, chorioretinal degenerations, and macular dystrophies. More than 270 genes are linked to various retinal dystrophy types, with clinical presentations varying even among family members with the same mutations. The most common retinal dystrophy, retinitis pigmentosa, affects around 1 in 5000 individuals at a global pace. A gene therapy called Luxturna is a new breakthrough in care approved by the U.S. Food and Drug Administration for use in children and adults with retinal disease due to two mutations in the gene RPE65.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships for promoting development and commercializing of gene therapy. For instance, in September 2021, AbbVie and REGENXBIO Inc. announced a partnership to develop and commercialize RGX-314, a potential one-time gene therapy. The incorporation of artificial intelligence and precision therapeutics in the treatment is driving a huge surge in the global retinal dystrophy treatment market.

Report Coverage

This research report categorizes the retinal dystrophy treatment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the retinal dystrophy treatment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the retinal dystrophy treatment market.

Global Retinal Dystrophy Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.38% |

| 2035 Value Projection: | USD 3.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 275 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Type, By Therapy and COVID-19 Impact Analysis |

| Companies covered:: | Spark Therapeutics, Inc., Novartis AG, GSK plc., Beacon Therapeutics, Nanoscope Therapeutics, Inc., SparingVision, jCyte, Inc., Alkeus Pharmaceuticals, Inc., KODIAK SCIENCES INC., ViGeneron GmbH, MeiraGTx Limited, ProQR Therapeutics., Biogen, GenSight Biologics S.A., REGENXBIO Inc., Horama S.A., 4D Molecular Therapeutics, Inc., Editas Medicine, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The retinal dystrophy treatment market is driven by the increased prevalence of inherited retinal diseases which is responsible for adoption and consumption of the gene therapy. Inherited retinal diseases has prevalence of approximately 1:1380 individuals, affecting 5.5 million people globally. The emergence of gene editing technology for providing novel therapeutic strategies in gene therapy is propelling the market growth. Further, ongoing clinical trials for delivering unique scientific and clinical insights, along with the surging investment are anticipated to drive the retinal dystrophy treatment market.

Restraining Factors

The increased cost and complexity related to developing gene therapy is challenging factor, which may be responsible for hampering the market. Further, the associated side effects including eye redness, inflammation, and temporary increase in eye pressure due to injection procedure is restricting the market growth.

Market Segmentation

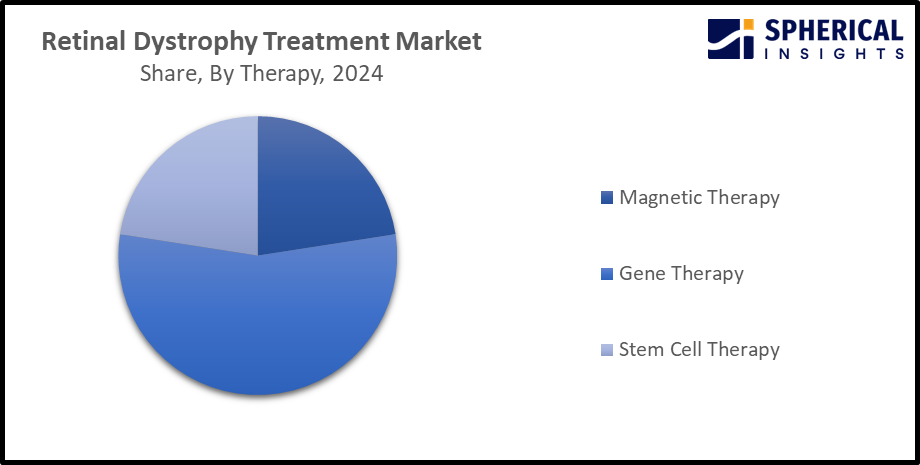

The retinal dystrophy treatment market share is classified into type and therapy.

- The peripheral dystrophy segment dominated the market with the largest share of over 30.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the retinal dystrophy treatment market is divided into peripheral dystrophy and central dystrophy. Among these, the peripheral dystrophy segment dominated the market with the largest share of over 30.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Peripheral retinal dystrophy is classified as intra-retinal degenerations, vitreoretinal degenerations, and chlorioretinal degenerations, on the basis of retinal changes observed on optical coherence tomography. Further, an increasing advancement in diagnostic imaging for examining the peripheral retina, is contributing to propel market growth.

- The gene therapy segment dominated the market with the largest share of about 56.1% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the therapy, the retinal dystrophy treatment market is divided into magnetic therapy, gene therapy, and stem cell therapy. Among these, the gene therapy segment dominated the market with the largest share of about 56.1% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Gene therapy is delivered to target retinal cells via subretinal or intravitreal injection. Further, in gene replacement therapy, a disease causing gene is replaced with a functional copy of gene, for slow down disease progression and restoring visual function. The development of new gene delivery systems including adeno associated virus AAV vectors and combination therapy, along with the trend in gene editing technology is propelling the market growth in the gene therapy segment.

Get more details on this report -

Regional Segment Analysis of the Retinal Dystrophy Treatment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the retinal dystrophy treatment market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 40.2% in the retinal dystrophy treatment market over the predicted timeframe. The market ecosystem in North America is strong, due to groundbreaking advancement in imaging and biomarkers for managing retinal diseases. The demand for retinal dystrophy treatment has been driven by the region's increasing ageing population, and technological advancements in medical treatments. In addition, strategic move towards developing and commercializing innovative therapeutics are promoting the market growth. For instance, in January 2024, Kiora Pharmaceuticals, Inc., a clinical stage biotech company developing treatments for orphan retinal diseases, announced that it has entered a strategic development and commercialization agreement with Théa Open Innovation (TOI), a sister company of the global ophthalmic specialty company Laboratoires Théa (Théa). The U.S. is leading the North America retinal dystrophy treatment market, accounting for approximately 33.1% share, owing to favourable reimbursement scenario for advanced therapies like gene and stem cell therapy.

Asia Pacific is expected to grow at a rapid CAGR in the retinal dystrophy treatment market during the forecast period. The Asia Pacific area has a thriving market for retinal dystrophy treatment due to region’s growing healthcare investments and improvement in genetic testing access. Due to their governments actively supporting the innovation, with an increasing demand for advanced therapies including gene therapies supporting the market growth. For instance, in November 2024, a new stdy showed that Roche’s Vabysmo aids in improving vision in Asian patients with prevalent form of neovascular age-related macular degeneration (nAMD). China accounted for the dominant market share in the Asia Pacific retinal dystrophy treatment market with a 8.5% CAGR value during the projected period, driven by the country’s rapidly ageing population and expanding ophthalmic research capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the retinal dystrophy treatment market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Spark Therapeutics, Inc.

- Novartis AG

- GSK plc.

- Beacon Therapeutics

- Nanoscope Therapeutics, Inc.

- SparingVision

- jCyte, Inc.

- Alkeus Pharmaceuticals, Inc.

- KODIAK SCIENCES INC.

- ViGeneron GmbH

- MeiraGTx Limited

- ProQR Therapeutics.

- Biogen

- GenSight Biologics S.A.

- REGENXBIO Inc.

- Horama S.A.

- 4D Molecular Therapeutics, Inc.

- Editas Medicine

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Ocugen, Inc., a pioneering biotechnology leader in gene therapies for blindness diseases, announced updates to its Retina Scientific Advisory Board (SAB) and Executive Leadership Team.

- In February 2025, Doctors in London cure blindness in children born with a rare genetic condition using pioneering gene therapy. The children had leber congenital amaurosis (LCA), a severe form of retinal dystrophy that causes vision loss due to a defect in the AIPL1 gene. Those affected are legally certified as blind from birth.

- In January 2025, Teva Pharmaceuticals has announced a strategic collaboration with Kinge Biopharma and Formycon for the semi-exclusive commercialization of FYB203, a biosimilar candidate to Eylea (aflibercept), in Europe (excluding Italy) and Israel. This partnership builds upon their successful collaboration on FYB201, a biosimilar for Lucentis.

- In January 2025, ViGeneron GmbH, a next generation clinical stage gene therapy company, announced two important milestones for its novel gene therapy candidate VG901, to treat patients with retinitis pigmentosa (RP) caused by mutations in the CNGA1 gene.

- In October 2024, New research presented at AAO 2024, the 128th annual meeting of the Merican Academy of Ophthalmology, suggested that a new kind of gene therapy can improve vision in people who have lost nearly all sight to retinitis pigmentosa, an inherited condition for which there is no cure and no way to stop it from advancing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the retinal dystrophy treatment market based on the below-mentioned segments:

Global Retinal Dystrophy Treatment Market, By Type

- Peripheral Dystrophy

- Central Dystrophy

Global Retinal Dystrophy Treatment Market, By Therapy

- Magnetic Therapy

- Gene Therapy

- Stem Cell Therapy

Global Retinal Dystrophy Treatment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the retinal dystrophy treatment market?The global retinal dystrophy treatment market size is expected to grow from USD 1.95 Billion in 2024 to USD 3.47 Billion by 2035, at a CAGR of 5.38% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the retinal dystrophy treatment market?North America is anticipated to hold the largest share of the retinal dystrophy treatment market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Retinal Dystrophy Treatment Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.38% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Retinal Dystrophy Treatment Market?Key players include Spark Therapeutics, Inc., Novartis AG, GSK plc., Beacon Therapeutics, Nanoscope Therapeutics, Inc., SparingVision, jCyte, Inc., Alkeus Pharmaceuticals, Inc., KODIAK SCIENCES INC., ViGeneron GmbH, MeiraGTx Limited, ProQR Therapeutics., Biogen, GenSight Biologics S.A., REGENXBIO Inc., Horama S.A., 4D Molecular Therapeutics, Inc., and Editas Medicine.

-

5. Can you provide company profiles for the leading retinal dystrophy treatment manufacturers?Yes. For example, Spark Therapeutics, Inc. is a fully integrated, commercial company committed to discover, develop, and deliver gene therapies, with their approach to investigate treatments that target an inherited diseases at its root by augmenting, replacing or suppressing the function of a mutated gene. Novartis AG is a leading ophthalmology company, with therapies that treat both front and back of the eye disorders, including retina diseases, glaucoma, dry eye and other external eye diseases.

-

6. What are the main drivers of growth in the retinal dystrophy treatment market?increased prevalence of inherited retinal diseases, emergence of gene editing technology, and ongoing clinical trials are major market growth drivers of the retinal dystrophy treatment market.

-

7. What challenges are limiting the retinal dystrophy treatment market?An increased cost and complexity related to developing gene therapy as well as associate side effects related to the therapy remain key restraints in the retinal dystrophy treatment market.

Need help to buy this report?