Global Respiratory Inhaler Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Dry Powder Inhalers, Metered Dose Inhalers, and Nebulizers), By End User (Hospitals and Clinics, Respiratory Care Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Respiratory Inhaler Devices Market Insights Forecasts to 2035

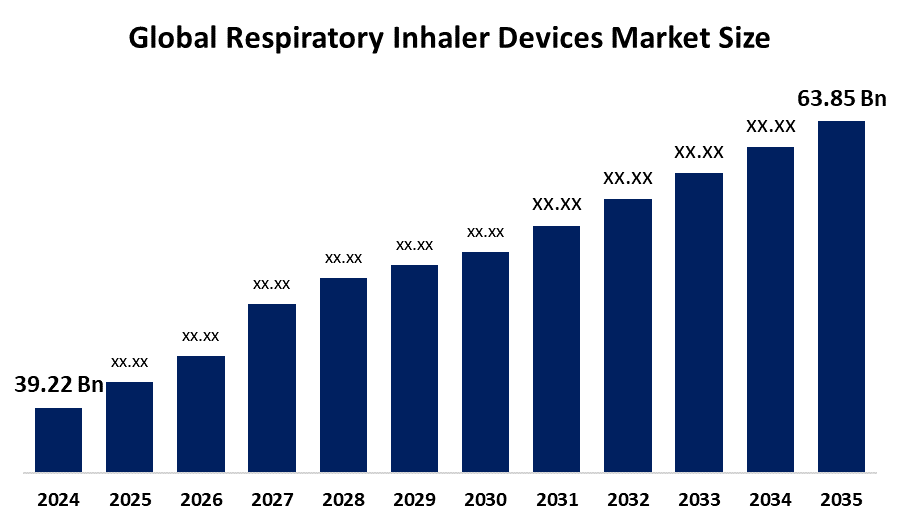

- The Global Respiratory Inhaler Devices Market Size Was Estimated at USD 39.22 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.53 % from 2025 to 2035

- The Worldwide Respiratory Inhaler Devices Market Size is Expected to Reach USD 63.85 billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global respiratory inhaler devices market size was worth around USD 39.22 billion in 2024 and is predicted to grow to around USD 63.85 billion by 2035 with a compound annual growth rate (CAGR) of 4.53 % from 2025 to 2035. The market for respiratory inhaler devices offers prospects for is increase number of respiratory diseases, new technologies, and the very adoption of portable inhalers with the promise of profits in the world's healthcare market.

Market Overview

The development, production, distribution, and sale of medical devices intended to deliver therapeutic medications directly into the respiratory system are all included in the global commercial sector known as the respiratory inhaler devices market. The global ecosystem of portable, handheld medical devices, such as metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers, designed to deliver aerosolized medications directly into the lungs for the treatment of chronic illnesses like allergic rhinitis, asthma, and chronic obstructive pulmonary disease (COPD), is included in the respiratory inhaler devices market. According to GSK’s next-gen low-carbon Ventolin MDI advances in Phase III, AstraZeneca’s Trixeo Aerosphere wins UK approval with near-zero-GWP propellant, and Sanofi accelerates asthma/COPD biologics, signaling rapid innovation across respiratory inhaler-device ecosystems. The market for respiratory inhaler devices is rising incidence of respiratory disorders, such as asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, and other ailments, which all together create an increasing need for inhalers and nebulizers. The main factors driving the respiratory inhaler devices market growth are the increasing pollution levels, smoking population, and the elderly who have lung diseases.

Report Coverage

This research report categorizes the respiratory inhaler devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the respiratory inhaler devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the respiratory inhaler devices market.

Global Respiratory Inhaler Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 39.22 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.53% |

| 2035 Value Projection: | USD 63.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End Use |

| Companies covered:: | AstraZeneca Beximco Pharmaceuticals Ltd. Boehringer Ingelheim GmbH Cipla Ltd. GlaxoSmithKline plc. Koninklijke Philips N.V. Merck & Co., Inc. OMRON Healthcare Europe B.V. PARI Medical Holding Teva Pharmaceutical Industries Ltd. and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for respiratory inhaler devices is anticipated to be driven by advancements in drug compliance technology, inhalation therapy, and home-based healthcare. Furthermore, product development trends are being shaped by regulatory lobbying for sustainable inhaler solutions, hastening the transition to propellant-free inhalers. The growing incidence of COPD and asthma in the elderly population is a major factor behind the growth of the respiratory inhaler devices market. The number of patients in need of maintenance therapy using inhalers is anticipated to increase dramatically as life expectancy rises globally, especially in industrialized and urbanized areas, driving the respiratory inhaler devices market. The market for respiratory inhaler devices is being further fuelled by government-led programs and awareness efforts designed to lessen the burden of chronic respiratory disorders.

Restraining Factors

The market for respiratory inhaler devices is constrained by high treatment and device costs, strict regulations, patient non-compliance, low awareness in developing nations, and difficulties in guaranteeing uniform drug delivery and device usability across a variety of patient populations.

Market Segmentation

The respiratory inhaler devices market share is classified into product and end user.

- The dry powder inhalers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the respiratory inhaler devices market is divided into dry powder inhalers, metered dose inhalers, and nebulizers. Among these, the dry powder inhalers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dry powdered inhalers (DPIs) are more commonly utilized as a recognized medication delivery method for the respiratory system, offering asthma and COPD patients breath-actuated, propellant-free medication delivery. DPIs have better drug deposition and less reliance on coordination than metered dosage inhalers (MDIs), which deliver powdered medication straight into the lung upon patient inspiratory exertion.

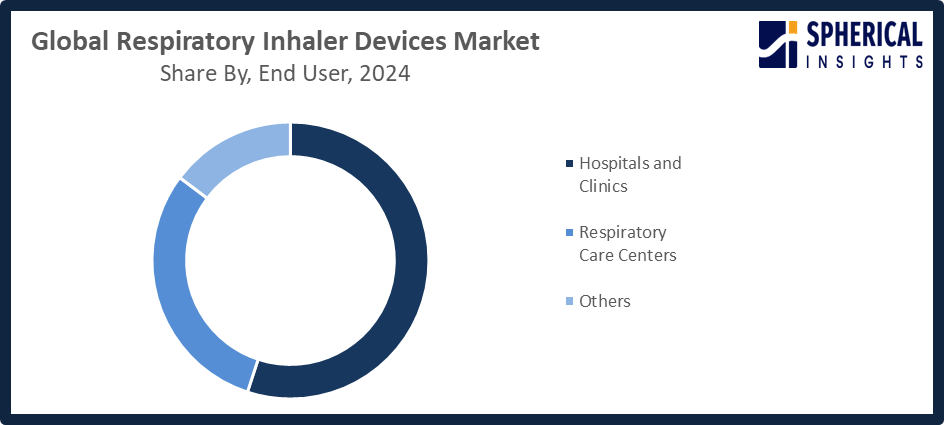

- The hospitals and clinics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the respiratory inhaler devices market is divided into hospitals and clinics, respiratory care centers, and others. Among these, the hospitals and clinics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use of inhaler devices for both acute and chronic respiratory disorders is seen in the hospitals and clinics segment. The availability of cutting-edge medical infrastructure, qualified healthcare workers, and a high patient volume are the main factors driving the segment's supremacy. Additionally, as awareness of inhalation therapy grows and hospitals invest more in contemporary respiratory care equipment.

Get more details on this report -

Regional Segment Analysis of the Respiratory Inhaler Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the respiratory inhaler devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the respiratory inhaler devices market over the predicted timeframe. North America is the market leader for respiratory inhaler devices, largely due to the region's established healthcare infrastructure, increased disease awareness, and current reimbursement systems for treating respiratory conditions. Governmental Guidelines Pharmaceutical businesses are under pressure to invest in propellant-free inhalation systems and environmentally friendly inhaler formulations due to the FDA's trend toward eco-friendly inhalers. The Affordable Inhalers and Nebulizers Act of 2025 was launched by the government of the United States, which limits the maximum monthly out-of-pocket expenses to USD 35, thus making respiratory therapy more accessible to previously neglected communities all over the country.

Asia Pacific is expected to grow at a rapid CAGR in the respiratory inhaler devices market during the forecast period. The Asia-Pacific region has air pollution at very high levels, population growth in megacities is very slow, and the aged population is more aware of respiratory diseases. The respiratory inhaler devices market is participating in the race, which is driven by factors like better healthcare infrastructure, wider accessibility of modern medical technologies, and growth in disposable incomes in countries such as China, India, and Japan. India’s 2025 policy extension boosts local inhaler production with a 15% growth target, while Japan improves nationwide respiratory screening programs through the Ministry of Health initiatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the respiratory inhaler devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Beximco Pharmaceuticals Ltd.

- Boehringer Ingelheim GmbH

- Cipla Ltd.

- GlaxoSmithKline plc.

- Koninklijke Philips N.V.

- Merck & Co., Inc.

- OMRON Healthcare Europe B.V.

- PARI Medical Holding

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, GSK launched positive Phase III results for its next-generation Ventolin MDI, confirming the new low-carbon HFA-152a propellant delivers therapeutic equivalence and safety comparable to the existing HFA-134a formulation, marking progress in sustainable respiratory inhaler devices.

- In July 2023, Viatris Inc. and Kindeva Drug Delivery launched Breyna, the first FDA-approved generic version of Symbicort, offering asthma and COPD patients immediate access to inhalation aerosol therapy in 80/4.5 mcg and 160/4.5 mcg strengths.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the respiratory inhaler devices market based on the below-mentioned segments:

Global Respiratory Inhaler Devices Market, By Product

- Dry Powder Inhalers

- Metered Dose Inhalers

- Nebulizers

Global Respiratory Inhaler Devices Market, By End User

- Hospitals and Clinics

- Respiratory Care Centers

- Others

Global Respiratory Inhaler Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the respiratory inhaler devices market over the forecast period?The global respiratory inhaler devices market is projected to expand at a CAGR of 4.53% during the forecast period.

-

2. What is the market size of the respiratory inhaler devices market?The global respiratory inhaler devices market size is expected to grow from USD 39.22 billion in 2024 to USD 63.85 billion by 2035, at a CAGR of 4.53 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the respiratory inhaler devices market?North America is anticipated to hold the largest share of the respiratory inhaler devices market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global respiratory inhaler devices market?AstraZeneca, Beximco Pharmaceuticals Ltd., Boehringer Ingelheim GmbH, Cipla Ltd., GlaxoSmithKline plc., Koninklijke Philips N.V., Merck & Co., Inc., OMRON Healthcare Europe B.V., PARI Medical Holding, and Teva Pharmaceutical Industries Ltd, and Others.

-

5. What factors are driving the growth of the respiratory inhaler devices market?The respiratory inhaler devices market is driven by rising respiratory disease prevalence, technological advancements, increasing patient awareness, expanding healthcare infrastructure, and growing demand for portable, efficient inhalation therapies globally.

-

6. What are the market trends in the respiratory inhaler devices market?The eco-friendly inhalers, digital and smart inhaler integration, better drug-device combinations, patient-centric designs, and a growing inclination toward home-based respiratory treatment options are some of the market trends

-

7. What are the main challenges restricting the wider adoption of the respiratory inhaler devices market?High device costs, stringent regulations, poor patient adherence, low awareness in underdeveloped nations, and technical difficulties in guaranteeing reliable medication administration and device usability are some of the main challenges.

Need help to buy this report?