Global Residual Solvents Market Size, Share, and COVID-19 Impact Analysis, By Type (Class 1, Class 2, and Class 3), By Application (Pharmaceuticals, Food & Beverage, Cosmetics, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Residual Solvents Market Insights Forecasts to 2033

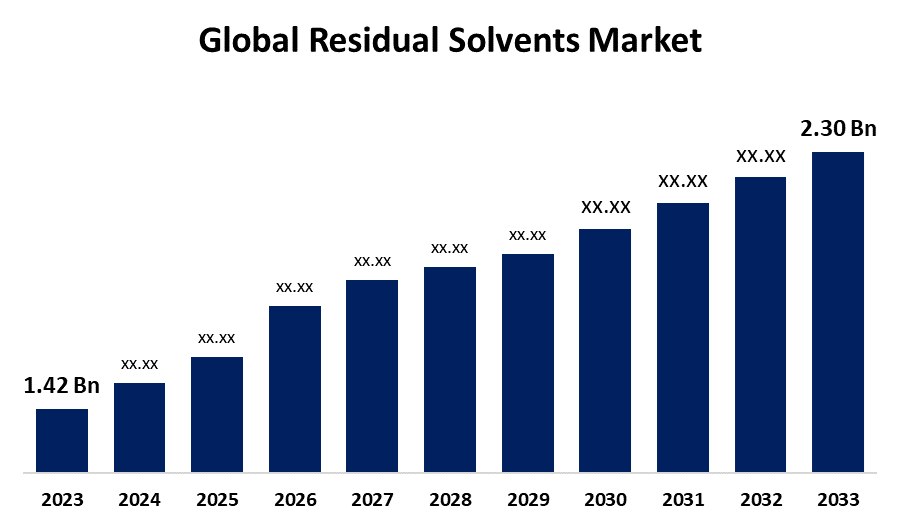

- The Global Residual Solvents Market Size Was Estimated at USD 1.42 Billion in 2023

- The Global Residual Solvents Market Size is Expected to Grow at a CAGR of around 4.94% from 2023 to 2033

- The Worldwide Residual Solvents Market Size is Expected to Reach USD 2.30 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Residual Solvents Market Size is Expected to cross USD 2.30 Billion by 2033, Growing at a CAGR of 4.94% from 2023 to 2033. Technological developments in analytical testing techniques, such real-time monitoring and automation in gas chromatography (GC) and mass spectrometry (GC-MS), which improve accuracy and efficiency, are driving significant opportunities in the residual solvents market.

Market Overview

The sector devoted to identifying, controlling, and eliminating organic volatile compounds that are left over from industrial processes, particularly in the pharmaceutical and food industries, is known as the residual solvents market. These solvents are classified according to their degrees of toxicity and must strictly adhere to safety regulations such as ICH Q3C. The residual solvents market offers regulatory services, solvent recovery, and analytical testing to guarantee product safety. For instance, in May 2021, the International Council for Harmonization (ICH) announced that its guideline, which establishes new allowed daily exposures (PDEs) for three residual solvents, has advanced to Step 4, which means that regulators can now put the guideline into effect. Pharmaceutical production, which uses solvents in the formulation, synthesis, and purification of drugs, is one of the primary factors driving residual solvents market. Food safety laws and quality assurance in cosmetics and personal care products are driving the market's growth and motivating producers to invest in better residual solvent analysis. The necessity for solvent testing to guarantee medication safety and efficacy is driven by the growing manufacturing of biologics, generics, and active pharmaceutical ingredients (APIs).

Report Coverage

This research report categorizes the residual solvents market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the residual solvents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the residual solvents market.

Global Residual Solvents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.42 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.94% |

| 2033 Value Projection: | USD 2.30 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Fuli Instruments, Shimadzu, Beifenruili, Techcomp, Bruker, PerkinElmer, Agilent Technology, LECOFuli Instruments, Thermo Fisher Scientific and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing regulatory scrutiny, as well as the consumer goods and healthcare industries' need for high-purity products, are the main drivers of market growth. The necessity for solvent testing to guarantee medication safety and efficacy is driven by the growing manufacturing of biologics, generics, and active pharmaceutical ingredients (APIs). Further, high-purity solvents with low residual content are required for the biotechnology industry's growth. Concerns about food safety, rising demand for high-purity medications, and strict regulatory requirements are the main factors driving the residual solvents market. Growing consumer consciousness and the development of biotechnology drive market expansion, and guaranteeing adherence to international safety standards and ICH Q3C.

Restraining Factors

High regulatory compliance costs, intricate analytical techniques, and a lack of knowledge in emerging markets are the main obstacles facing the residual solvents business. Adoption rates and industry growth are impacted by strict safety regulations, technological constraints, and environmental concerns, which further restrict the residual solvents market.

Market Segmentation

The residual solvents market share is classified into type and application.

- The class 2 segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the residual solvents market is divided into class 1, class 2, and class 3. Among these, the class 2 segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The class 2 segment is a result of its extensive usage in food processing, cosmetics, and pharmaceuticals, where solvents with moderate toxicity need to be strictly regulated and monitored.

- The pharmaceuticals segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the residual solvents market is divided into pharmaceuticals, food & beverage, cosmetics, and industrial. Among these, the pharmaceuticals segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The widespread use of solvents in the synthesis, purification, and formulation of drugs is the reason for the pharmaceutical segmental growth. The demand for sophisticated analytical methods like gas chromatography (GC) and mass spectrometry (GC-MS) is driven by the strict regulatory criteria established by the FDA, ICH, and EMA, which require severe residual solvent testing to guarantee drug safety and compliance.

Regional Segment Analysis of the Residual Solvents Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the residual solvents market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the residual solvents market over the predicted timeframe. The FDA, USP, and ICH guidelines impose stringent regulatory frameworks that guarantee high safety standards in food, cosmetics, and medicines, which is projected to drive market growth in the North America region. Growth in the residual solvents market is driven by the region's strong biotechnology and pharmaceutical sectors as well as developments in analytical technologies like gas chromatography (GC) and mass spectrometry (GC-MS). The need for high-purity products and growing consumer awareness further increases the necessity of rigorous solvent testing.

Asia Pacific is expected to grow at the fastest CAGR growth of the residual solvents market during the forecast period. The growing food and pharmaceutical sectors, fast industrialization, and tighter regulations in nations like China, India, and Japan are the main drivers of the Asia Pacific residual solvents market. The market is growing as a result of rising investments in biotechnology, medication production, and quality control technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the residual solvents market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fuli Instruments

- Shimadzu

- Beifenruili

- Techcomp

- Bruker

- PerkinElmer

- Agilent Technology

- LECOFuli Instruments

- Thermo Fisher Scientific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, the ICH guideline Q3C (R8) on impurities has been incorporated into Chapter <467> "Residual Solvents" of the United States Pharmacopeia (USP). This version requires revisions to relevant sections and appendices due to the introduction of two Class 2 solvents (cyclopentyl methyl ether and tertiary butyl alcohol) and one Class 3 solvent (2-methyltetrahydrofuran).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the residual solvents market based on the below-mentioned segments:

Global Residual Solvents Market, By Type

- Class 1

- Class 2

- Class 3

Global Residual Solvents Market, By Application

- Pharmaceuticals

- Food & Beverage

- Cosmetics

- Industrial

Global Residual Solvents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the residual solvents market over the forecast period?The residual solvents market is projected to expand at a CAGR of 4.94% during the forecast period.

-

2. What is the market size of the residual solvents market?The Global Residual Solvents Market Size is Expected to Grow from USD 1.42 Billion in 2023 to USD 2.30 Billion by 2033, at a CAGR of 4.94% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the residual solvents market?North America is anticipated to hold the largest share of the residual solvents market over the predicted timeframe.

Need help to buy this report?